Посетители CoinMarketCap прогнозируют скорый рост Ethereum до $2000

Как и весь рынок криптовалют второй по величине рыночной капитализации актив Ethereum (ETH) испытывает повышенную турбулентность, которая усиливается на фоне ожидания обновления Merge. Оно переведёт сеть с алгоритма Proof-of-Work (PoW) на алгоритм Proof-of-Work (PoW).

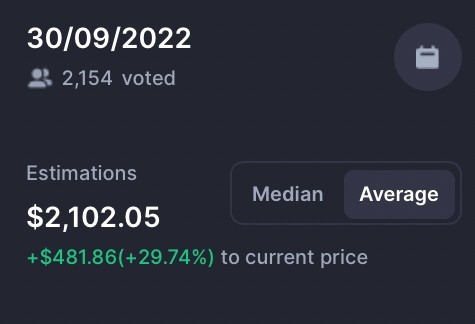

Сейчас криптовалютное сообщество задаётся вопросом, какой будет цена эфира в ближайшее время. Пользователи CoinMarketCap настроены крайне оптимистично, полагая, что к 30 сентября 2022 года ETH будет торговаться выше $ 2000.

Используя инструмент сайта «Прогнозирование цен», сообщество полагает, что к концу сентября Ethereum будет торговаться по $ 2102, или на 29,16% больше текущей цены. За эту версию отдано 2154 голосов.

Прогноз цены Ethereum от криптосообщества. Источник: CoinMarketCap

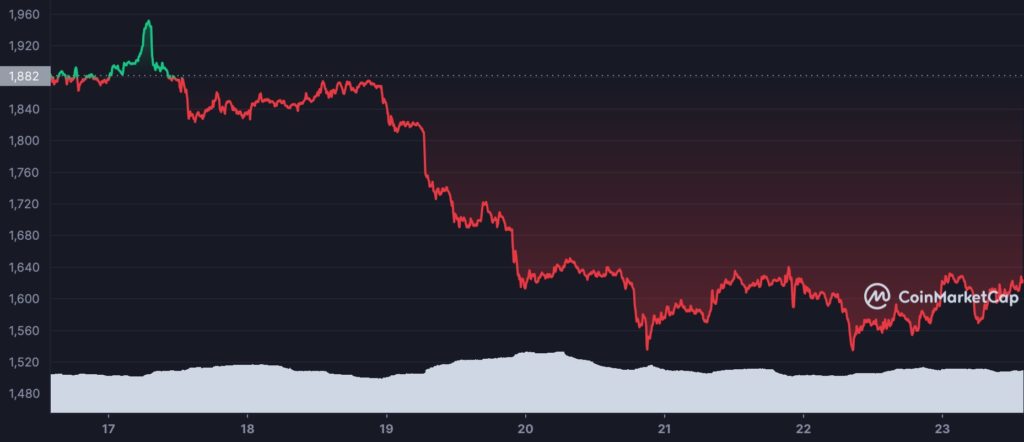

В настоящее время Ethereum торгуется на уровне $ 1642 с дневным ростом 3,3%, сохраняя недельные потери на уровне 13,9%. Общая рыночная капитализация ETH в настоящее время равняется $ 197 млрд.

Криптоаналитик Rekt Capital предположил в своём техническом анализе, что скоро ETH может сформировать нижний максимум, как в 2021 году:

Такое событие не исключено, поскольку ETH не смог повторно протестировать оранжевую область в качестве поддержки. Таким образом, ETH может подняться до оранжевого цвета, чтобы подтвердить его сопротивление.

Потенциальный нижний максимум Ethereum. Источник: Rekt Capital

Интересно, что на фоне турбулентности рынка Ethereum занимает первое место среди проектов с наибольшей активностью разработки за последние 30 дней (по состоянию на 22 августа).

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Monero

Monero  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  Pax Dollar

Pax Dollar  BUSD

BUSD  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Augur

Augur  Bitcoin Gold

Bitcoin Gold  Ren

Ren  HUSD

HUSD