Four Potential Catalysts for the Next Crypto Bull Run

Crypto Briefing looks at four potential events that could revive interest in digital assets.

A Fed Pivot Reducing Pressure on Crypto

One of the most widely discussed catalysts that could give crypto and other risk assets a boost is an end to the Federal Reserve’s monetary tightening policies. Currently, the Fed is raising interest rates to help combat inflation. When prices for goods, commodities, and energy reach untenable levels, central banks step in to bring prices down to avoid long-lasting damage to their economies.

In theory, raising interest rates should bring about demand destruction. When the cost of borrowing money and repaying debt becomes too high, it prices out less viable and efficient businesses from the market. In turn, this should reduce demand and lower the prices of essential commodities like oil, wheat, and lumber.

However, while the Fed aims to raise interest rates until its target 2% inflation rate is met, that may be easier said than done. Every time the Fed raises rates, it makes it harder for those holding debt like mortgages to make repayments. If rates go up too high or stay too high for too long, it will eventually result in mortgage holders defaulting on their loans en masse, resulting in a collapse in the housing market similar to the Great Financial Crisis of 2008.

Therefore, the Fed will need to pivot away from its monetary tightening policy before too long. And when it does, it should relieve much of the downward pressure keeping risk assets like cryptocurrencies suppressed. Eventually, the Fed will also start lowering interest rates to spur economic growth, which should also act as a significant tailwind for the crypto market.

When the Fed is likely to pivot is up for debate; however, most pundits agree it will be difficult for the central bank to continue raising rates past the first quarter of 2023.

Fintech Crypto Adoption

Although crypto assets have made huge strides in recent years, their benefits are still fairly inaccessible to the average person. Use cases such as cross-border transfers, blockchain banking, and DeFi are in demand, but the simple, easy-to-use infrastructure to mass onboard users has not yet been developed.

As it stands, using crypto is complex—and a far cry from what most people are used to. Managing private keys, signing transactions, and avoiding scams and hacks might be intuitive for the average crypto degen, but it remains a significant barrier to adoption for more casual users.

There’s a huge gap in the market for onboarding the average person into crypto. If fintech companies start to integrate crypto transfers into their offerings and make it easier for users to put their funds to work on the blockchain, crypto could see a new wave of adoption. As it becomes easier to use crypto infrastructure, more people are likely to recognize its utility and invest in the space, creating a positive feedback loop.

Some companies have already recognized this vision and are working on products that make it easier for anyone to start using crypto. Earlier this year, PayPal integrated deposits and withdrawals of cryptocurrency to personal wallets, marking a significant first step toward broader crypto payment adoption. Last month, Revolut, one of the largest digital banks, was granted registration to offer crypto services in the U.K. by the Financial Conduct Authority.

However, the most significant development may be yet to come. Robinhood, the no-fee trading app that fueled the so-called “meme stock” mania of early 2021 and the subsequent Dogecoin rally, is preparing to launch its own non-custodial wallet. Last month, the wallet’s beta version went out to 10,000 early users, and a full release is scheduled for the end of 2022. The Polygon-based wallet will allow users to trade over 20 cryptocurrencies through decentralized exchange aggregator 0x, without fees. The wallet will also let users connect to DeFi protocols and earn yield on their assets.

At its core, crypto bull runs are fueled by adoption, and products like Robinhood’s new wallet could become the killer app to onboard the next generation of users.

The Bitcoin Halving

Coincidence or not, a new bull rally has historically commenced shortly after the Bitcoin protocol halves its mining rewards every 210,000 blocks. This catalyst has predicted every major bull run since the first Bitcoin halving in late 2012 and will likely continue to do so well into the future.

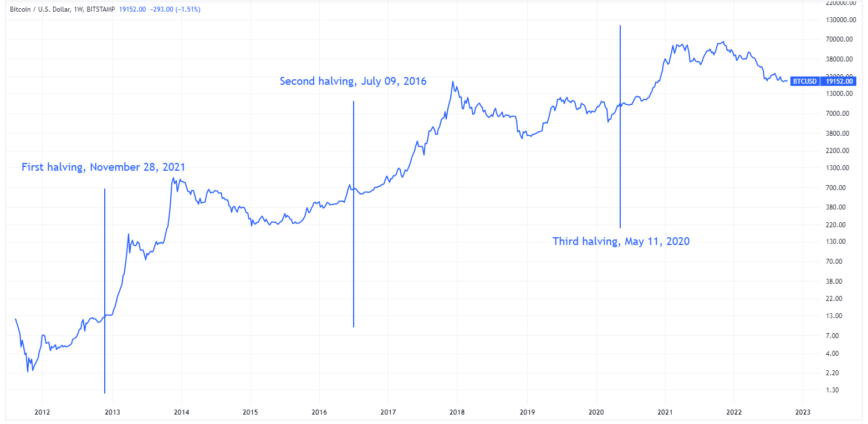

BTC/USD chart with Bitcoin halving dates (Source: TradingView)

Following the first halving on November 28, 2012, Bitcoin soared over 7,000%. The next halving on July 9, 2016, catapulted the top cryptocurrency up around 2,800%, and after the last halving on May 11, 2020, Bitcoin moved up more than 600%.

The most likely explanation for the halving rallies that have taken place roughly every four years is simple supply reduction. Economic theory posits that when the supply of an asset reduces but demand stays the same, its price will increase. Bitcoin miners typically sell a large portion of their Bitcoin rewards to cover the cost of electricity and upkeep of their mining machines. This means that when rewards are halved, this selling pressure is drastically reduced. While this initial supply reduction acts as the ignition, bull rallies often take crypto much higher than can be attributed to just the halving.

At the current rate of block production, the next Bitcoin halving is set to take place sometime in late February 2024. It’s worth noting that for every subsequent halving, the amount Bitcoin rallies diminishes, and the time between the halving and the bull run peak increases. This is likely due to the liquidity in the Bitcoin market increasing, dampening the effect of the supply reduction. However, if history is any precedent, the next halving should propel the top crypto substantially higher than its prior all-time high of $69,044 achieved on November 10, 2021.

One caveat to the halving thesis is that the upcoming 2024 halving could be the first to take place under a bleak macroeconomic backdrop. If the world’s central banks cannot fix the current inflation crisis while maintaining economic growth, it could be tough for risk assets like crypto to rally even with the halving supply reduction.

Loss of Trust in Central Banks

The last potential bull run catalyst is the most speculative of the examples listed in this article, but one that’s definitely worth discussing.

In recent months, the deficiencies in major central bank-run economies have become increasingly apparent. Most world currencies have plummeted against the U.S. dollar, bond yields have appreciated substantially as confidence in national economies decreases, and the central banks of Japan and the U.K. have resorted to buying their own government’s debt to prevent defaults in a policy of Yield Curve Control.

The current debt-based financial system is reliant on constant growth, and when this stops, fiat currencies that aren’t backed by anything suffer a very real risk of hyperinflation. Even before the current spike in inflation due to supply chain issues, an extended period of low interest rates likely caused irreparable damage to the U.S. economy. The cost of living, house prices, and company valuations soared while wages stagnated. Instead of using cheap debt to grow businesses and create real economic value, many borrowed money to purchase real estate or invest in stocks. The result is a massive asset bubble that may not be able to be unwound without collapsing the world economy.

When fiat economies show weakness, gold and other precious metals have often been viewed as safe havens from financial collapse. However, investing in gold-based financial products like gold ETFs is not a viable option for most people. Even those who do may still get caught in the maelstrom if contagion hits the broader financial markets. This leaves Bitcoin and other hard, decentralized cryptocurrencies with fixed supplies as obvious candidates to replace gold as a store value if the public loses trust in national currencies.

Before the current financial crisis, investors had started to recognize Bitcoin as a hard currency due to its fixed supply of 21 million coins, earning the top crypto the title of “digital gold” among adherents. More recently, top hedge fund managers such as Stanley Druckenmiller and Paul Tudor Jones have aired similar views. In a September CNBC interview, Druckenmiller said that crypto could enjoy a “renaissance” if trust in central banks wanes. Similarly, Jones has stated that cryptocurrencies like Bitcoin and Ethereum could go “much higher” in the future due to their limited supply.

Disclosure: At the time of writing this piece, the author owned ETH, BTC, and several other cryptocurrencies.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  TrueUSD

TrueUSD  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD