FTX Contagion Spreads, Will ETHE And Grayscale Bitcoin Trust Share Same Fate As FTT?

The sudden decline of FTX has created a devasting effect on the entire Bitcoin and crypto market. Panic shorting of digital assets is the order of the day, with Solana taking a massive hit as many investors dumped the coin.

FTT, the native crypto asset of FTX, has lost almost all its investor value. Most investors had withdrawn their tokens in large amounts till the exchanged halted withdrawals and filed for bankruptcy.

Bitcoin, like most altcoins, still felt the effects of this sudden market sentiment. Most centralized exchanges recorded all-time high withdrawals as investors withdrew their assets to personal wallets.

Crypto exchanges like Binance have gone the extra mile to reassure users of their strength; and transparent financial status. However, the shake-up shows no signs of slowing down, with crypto brokerage firm Genesis trading under financial strain.

Genesis will seek to enlighten the public with a call at 8 AM EST tomorrow. This call will unravel the current situation at Genesis and its relationship with Alameda Research. On November 11, FTX group and Alameda filed for bankruptcy under the voluntary chapter 11 bankruptcy code – in the US.

The CEO of the FTX exchange Sam Bankman-Fried resigned and handed over to John J. Ray III. The consequent revelations of financial misappropriations on a grand scale have led investors to scrutinize most centralized exchanges.

Grayscale’s Bitcoin Trust And ETHE Under fire?

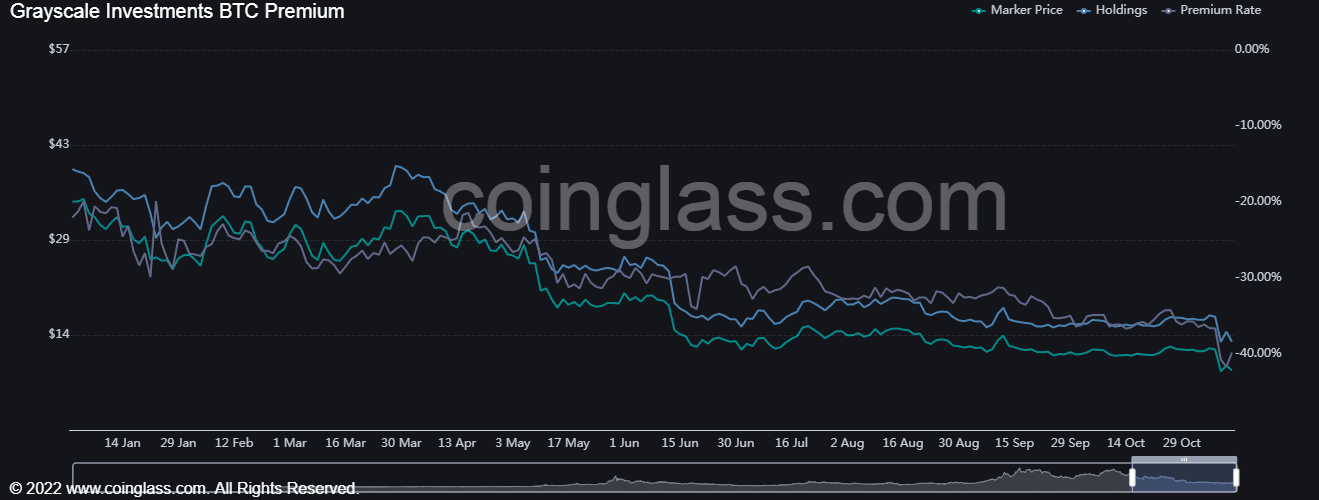

Grayscale’s asset of value – the GBTC was on a 41% discount due to the FTX meltdown. Coinglass data pegs GBTC’s total holdings at 633.64BTC; these holdings; are worth above $10 billion.

Grayscale Bitcoin Trust

Ark Invest had recently acquired the Grayscale Bitcoin Trust shares at a total value of 2.8 million. GBTC premium is now at -37.08%, with ETHE on a record-breaking low of -34.47% in the wake of the FTX crisis. The effect of this crash has created doubts about the durability of cryptocurrencies.

Grayscale To Crack Next?

FTX’s devastating collapse alongside Alameda research has created a domino effect in several crypto exchanges. As a result, some companies are unraveling plans to seek bankruptcy protection.

According to rumors in the crypto space, Genesis is also battling financial troubles. According to Autism Capital, the implication is the likely dissolution of ETHE and GBTC to repay lenders. Genesis interim CEO Derar will host client calls tomorrow to clarify the turn of the crypto markets and their lending status.

Autism capital had tweeted earlier that Grayscale held power over GBTC and ETHE trusts, not Genesis. Despite the support of Digital Currency Group: Genesis and Grayscale’s parent company, the situation might remain bad. Digital Currency Group might ultimately dissolve the GBTC and ETHE to balance their financial books.

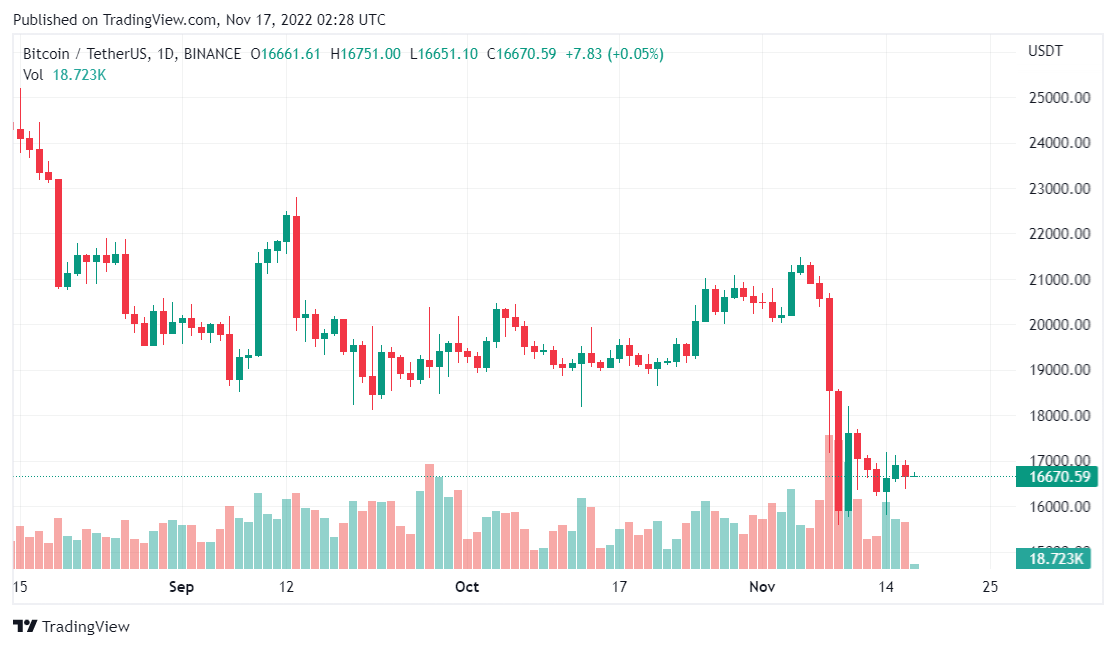

Bitcoin price fails to cross the $17k boundary l BTCUSDT on Tradingview.com

To create transparency, Genesis trading reported $175 million of their funds locked in an FTX trading account. However, they insist on no exposure to the FTX on their part. DCG, in reaction, provided $140 million as an equity infusion to Genesis. It is not yet certain; how the relationship between FTX and Genesis will ultimately come into play in proceedings.

Featured image from Pixabay, chart from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Decred

Decred  Zcash

Zcash  Dash

Dash  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Nano

Nano  Numeraire

Numeraire  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur