How is artificial intelligence revolutionizing financial services?

1.

What is the role of artificial intelligence in the financial services industry?

AI is proving to be a powerful tool for financial institutions looking to improve their operations, manage risks, and optimize their portfolios more effectively.

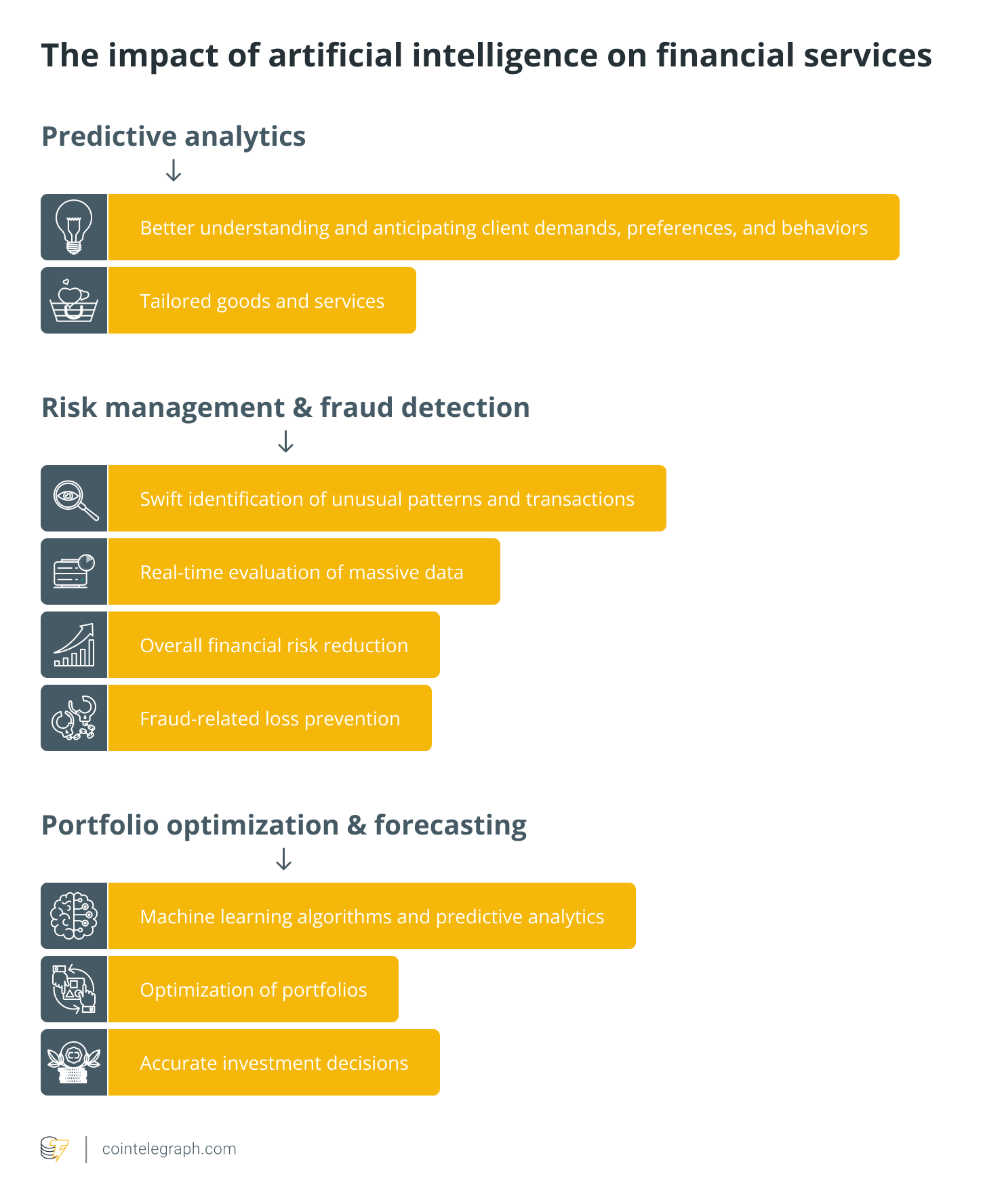

Artificial intelligence (AI) is playing an increasingly vital role in the financial services industry. Predictive analytics, which can assist financial firms in better understanding and anticipating client demands, preferences and behaviors, is one of the most well-known uses of AI. They can then use this information to create goods and services that are more individually tailored.

Moreover, AI is also being utilized to enhance risk management and fraud detection in the financial services industry. AI systems can swiftly identify unusual patterns and transactions that can point to fraud by evaluating massive amounts of data in real-time. This can assist financial organizations in reducing overall financial risk and preventing fraud-related losses.

In addition, AI is being used for portfolio optimization and financial forecasting. By utilizing machine learning algorithms and predictive analytics, financial institutions can optimize their portfolios and make more accurate investment decisions.

2.

How are machine learning, deep learning and natural language processing (NLP) utilized in finance?

Machine learning, deep learning and NLP are helping financial institutions improve their operations, enhance customer experiences, and make more informed decisions. These technologies are expected to play an increasingly significant role in the finance industry in the coming years.

Financial organizations may make better decisions by using machine learning to examine massive volumes of data and find trends. For instance, machine learning can be used to forecast stock prices, credit risk and loan defaulters, among other things.

Deep learning is a subset of machine learning that utilizes neural networks to model and resolve complicated issues. For instance, deep learning is being used in finance to create models for detecting fraud, pricing securities and managing portfolios.

Natural language processing (NLP) is being used in finance to enable computers to understand human language and respond appropriately. NLP is used in financial chatbots, virtual assistants and sentiment analysis tools. It enables financial institutions to improve customer service, automate customer interactions and develop better products and services.

3.

How does AI help in fraud detection and risk management in financial services?

AI is proving to be a powerful tool for financial institutions looking to improve their fraud detection and risk management processes, enabling them to operate more efficiently and effectively while minimizing potential losses.

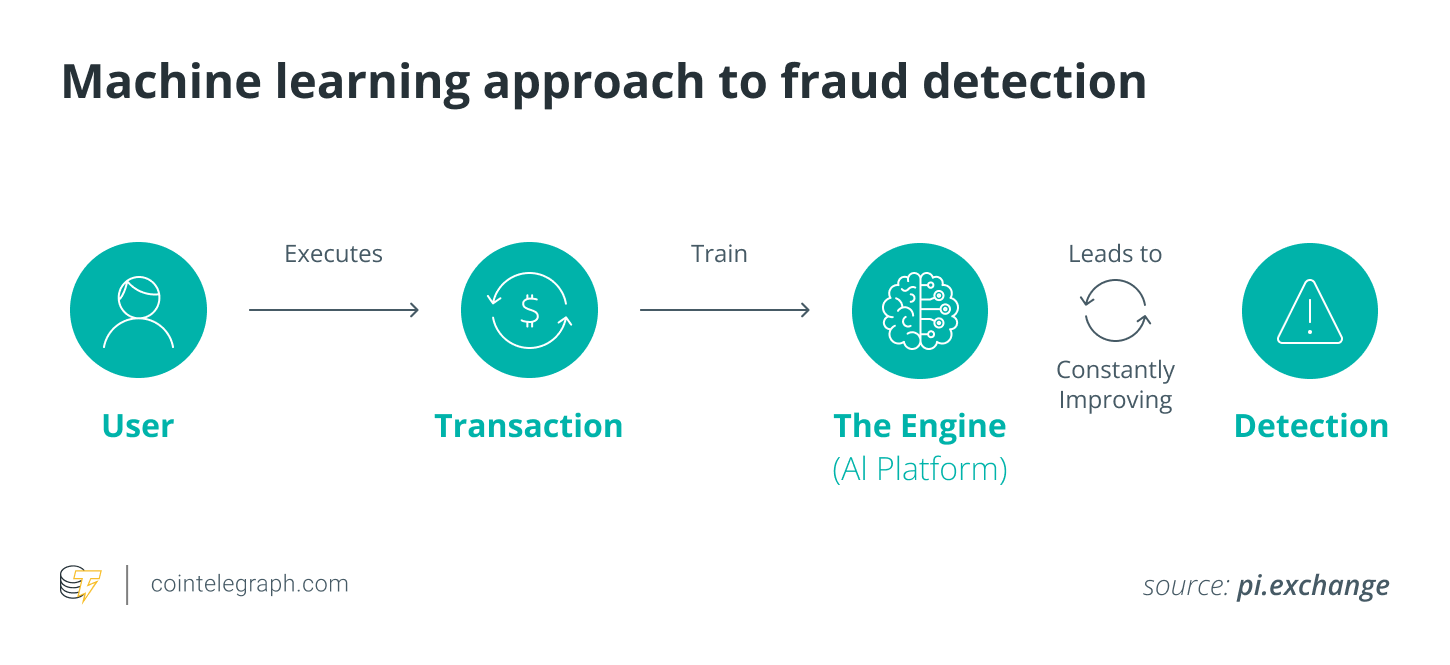

Here are the steps explaining how AI helps in fraud detection and risk management in financial services:

- Data collection: The first step entails gathering data from multiple sources, including market, customer and transactional data. Then, machine learning models are trained using this data.

- Data preprocessing: Once the data has been gathered, they need to be cleaned up to get rid of any errors or inconsistencies. This guarantees the reliability and accuracy of the data.

- Machine learning modeling: To identify potential fraudulent actions or risks, machine learning algorithms are subsequently employed to examine the preprocessed data. Algorithms, for instance, can be trained to spot fraudulent behavior patterns in transaction data or to forecast possible hazards linked with investments.

- Real-time monitoring: AI systems are then used to keep an eye on transactions and spot potential fraud. This makes it possible for financial institutions to act fast and stop losses.

- Compliance: AI can also assist financial organizations in meeting legal standards for risk and fraud management. For instance, AI algorithms can be used to spot potential contraventions of Anti-Money Laundering (AML) laws and pinpoint areas where risk management procedures need to be improved.

- Continuous improvement: AI models need to be updated and enhanced continuously based on fresh information and user input. This guarantees that the models will continue to be reliable and efficient in identifying fraud and controlling risks.

4.

What is the use of chatbots and virtual assistants in the financial industry?

Chatbots and virtual assistants are proving to be valuable tools for financial institutions looking to improve the customer experience, reduce costs and operate more efficiently.

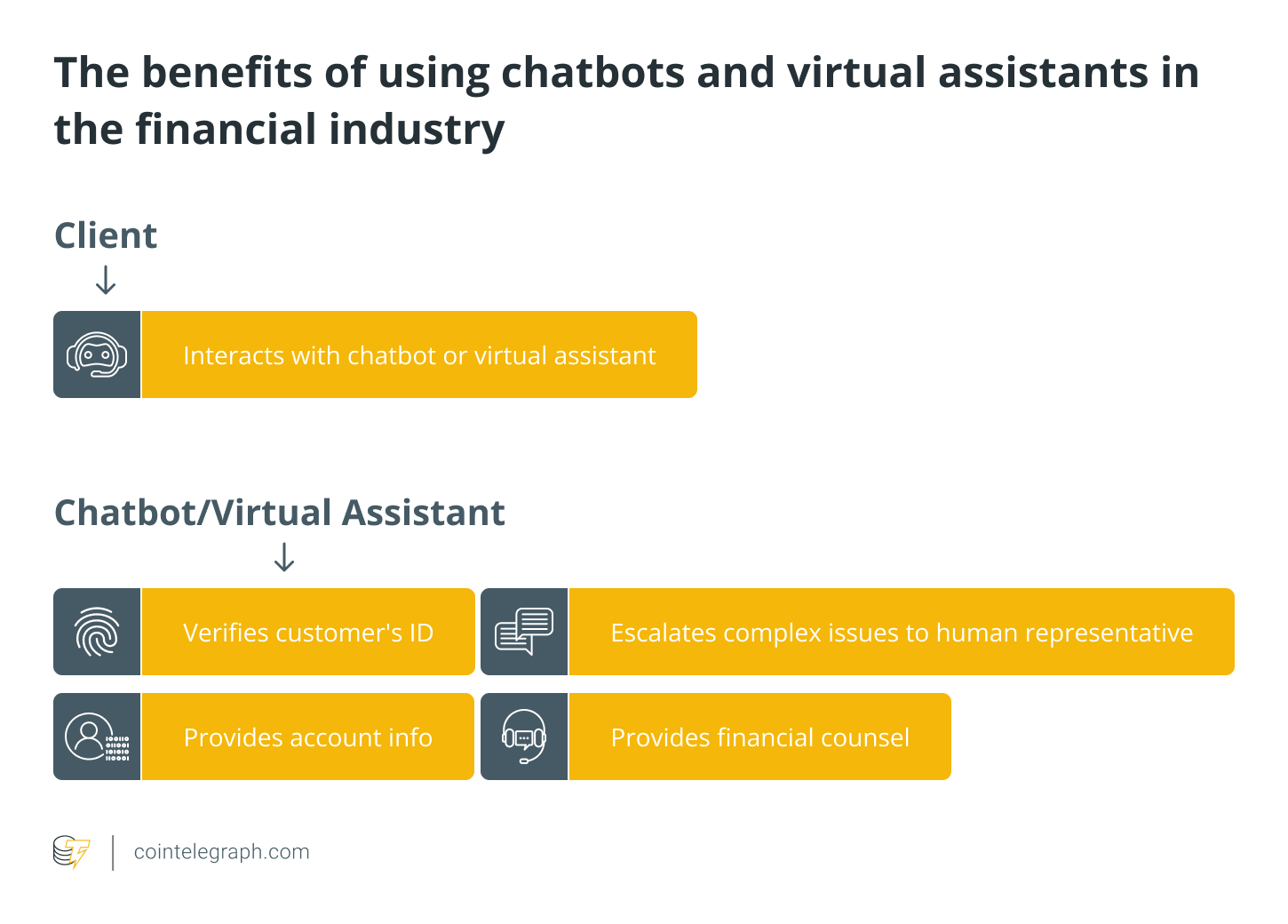

Chatbots and virtual assistants are utilized to provide individualized services and assistance, which enhances the client experience. Customers can communicate with these AI-powered tools in real-time and receive details on their accounts, transactions and other financial services. They can also be used to respond to commonly asked inquiries, offer financial counsel and assist clients with challenging problems.

Suppose a bank customer wanted to check their account balance or ask a question about a recent transaction, but the bank’s customer service center was closed. The customer can make use of the bank’s chatbot or virtual assistant to receive the information they require in real-time rather than having to wait until the following day to speak with a customer support agent.

The virtual assistant or chatbot can verify the customer’s identification and give them access to their account balance or transaction details. If the customer has a more complex issue, the chatbot or virtual assistant can escalate it to a human representative for further assistance. This means that AI-powered chatbots and virtual assistants can provide immediate responses to customer inquiries, reducing wait times and improving customer satisfaction.

Because they are accessible round-the-clock, chatbots and virtual assistants are useful resources for clients who require support outside of conventional office hours. Through the automation of repetitive processes and the elimination of the need for human support, they can also assist financial organizations in cutting expenses.

5.

What are the benefits and potential drawbacks of AI in the financial services industry?

The financial services industry can enjoy several benefits from AI systems, such as automating mundane tasks, improving risk management and swift decision-making. Nevertheless, the drawbacks of AI, such as security risks, potential bias and absence of a human touch, should not be ignored.

Potential advantages of AI in the financial services industry include:

- Improved efficiency: AI can automate routine processes and reduce the need for human intervention, improving efficiency and reducing costs.

- Better risk management: AI can analyze vast amounts of data to identify potential risks and prevent losses.

- Enhanced customer experience: AI can provide personalized services and round-the-clock assistance, improving customer satisfaction.

- Faster decision-making: AI can analyze data and make decisions much faster than humans, enabling financial institutions to respond quickly to changing market conditions.

The possible disadvantages of using AI in the financial services industry consist of:

- Security risks: AI systems can be vulnerable to cyberattacks, posing a security risk to financial institutions and their customers.

- Privacy concerns: The use of AI in financial services can raise concerns about data privacy, as the technology requires access to large volumes of personal and financial data, which must be secured and protected from unauthorized access or use.

- Bias: AI systems can be biased based on the data they are trained on, potentially leading to discriminatory outcomes.

- Regulatory challenges: The use of AI in financial services is subject to regulatory oversight, and compliance with regulations can be challenging.

- Lack of human touch: Customers may prefer interacting with humans for certain financial services, such as complex financial advice or emotional support during difficult financial situations.

- Job displacement: The use of AI in financial services may lead to job displacement as certain tasks become automated.

6.

What is the future of AI in financial services?

The future of AI in finance is exciting, with the potential to improve efficiency, accuracy and customer experience. However, it will be essential for financial institutions to carefully manage the risks and challenges associated with the use of AI.

The use of AI in financial services has the potential to significantly improve the sector. Several facets of finance have already been transformed by AI, including fraud detection, risk management, portfolio optimization and customer service.

Automating financial decision-making is one area where AI is anticipated to have a large impact in the future. This could involve the examination of massive amounts of financial data using machine learning algorithms, followed by the formulation of investment recommendations. With AI, customized investment portfolios might be constructed for clients depending on their risk appetite and financial objectives.

In addition, AI-powered recommendation engines could also be developed to offer customers targeted products and services that meet their needs. This could improve customer experience and satisfaction while also increasing revenue for financial institutions.

However, there are also potential challenges associated with the use of AI in finance. These include data privacy concerns, regulatory compliance issues, and the potential for bias and discrimination in algorithmic decision-making. It will be important for financial institutions to ensure that AI is used in a responsible and ethical way and that appropriate safeguards, such as transparent algorithms and regular audits, are in place to mitigate these risks.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur