IOTA Price Analysis : Will IOTA breakdown yearly low at $0.1938 ?

- IOTA formed bullish hammer candle near yearly low, with a higher volume

- RSI approaching oversold zone whereas MACD may generate negative crossover

IOTA prices had trading near to yearly lows with mild bearish cues. In the previous session IOTA formed a bullish hammer candle and up by 0.89% but in the last few hours bulls lost the previous gains and down by -2.54%.The last 24 hours volume up by 102% and volume to market cap ratio stood at $0.0311

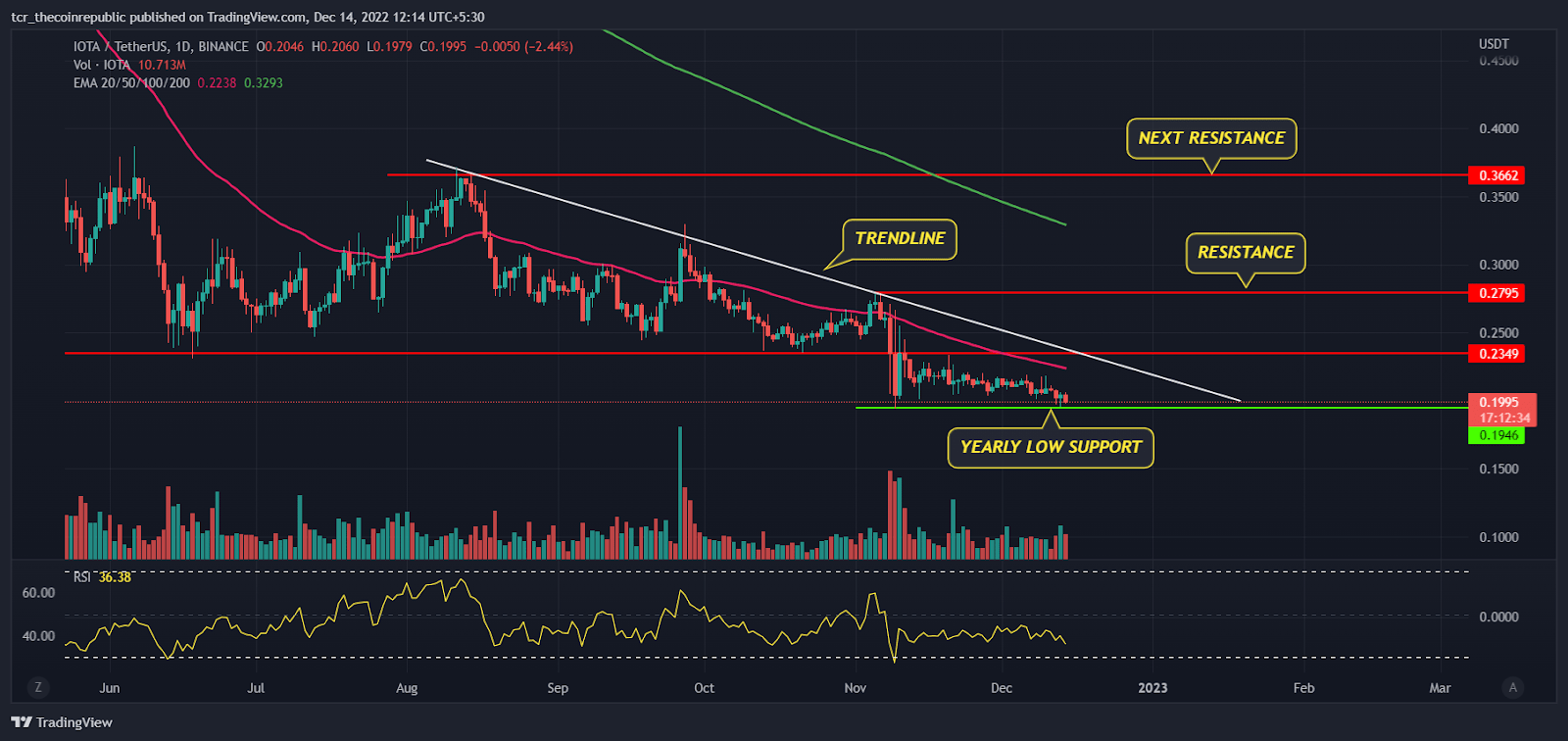

Higher time frame narrative

Source : IOTA/USDT daily chart by Tradingview

On a higher time frame, IOTA prices had been quite volatile and trading in the range between $0.2349 to $0.3662 from the past couple of months. In June prices picked up some positive momentum but faced resistance in the higher zone at $0.3662, later in the mid August, selling pressure got triggered and IOTA bulls lost all the previous gains.

Recently, due to an unfavorable scenario in the crypto market IOTA slipped below its lower range and created a new yearly low at $ $0.1938, after a little bit consolidation in a tight range, prices again attempting recent lows and forming a bullish hammer candle.

The 200 day ema(green) sloping downwards indicates a positional trend to remain weak in coming months. The 50 day ema (pink) at $.2238 will act as an immediate hurdle for bulls followed by the next hurdle will be a falling trendline and breakdown level $0.2349 and $0.2795.

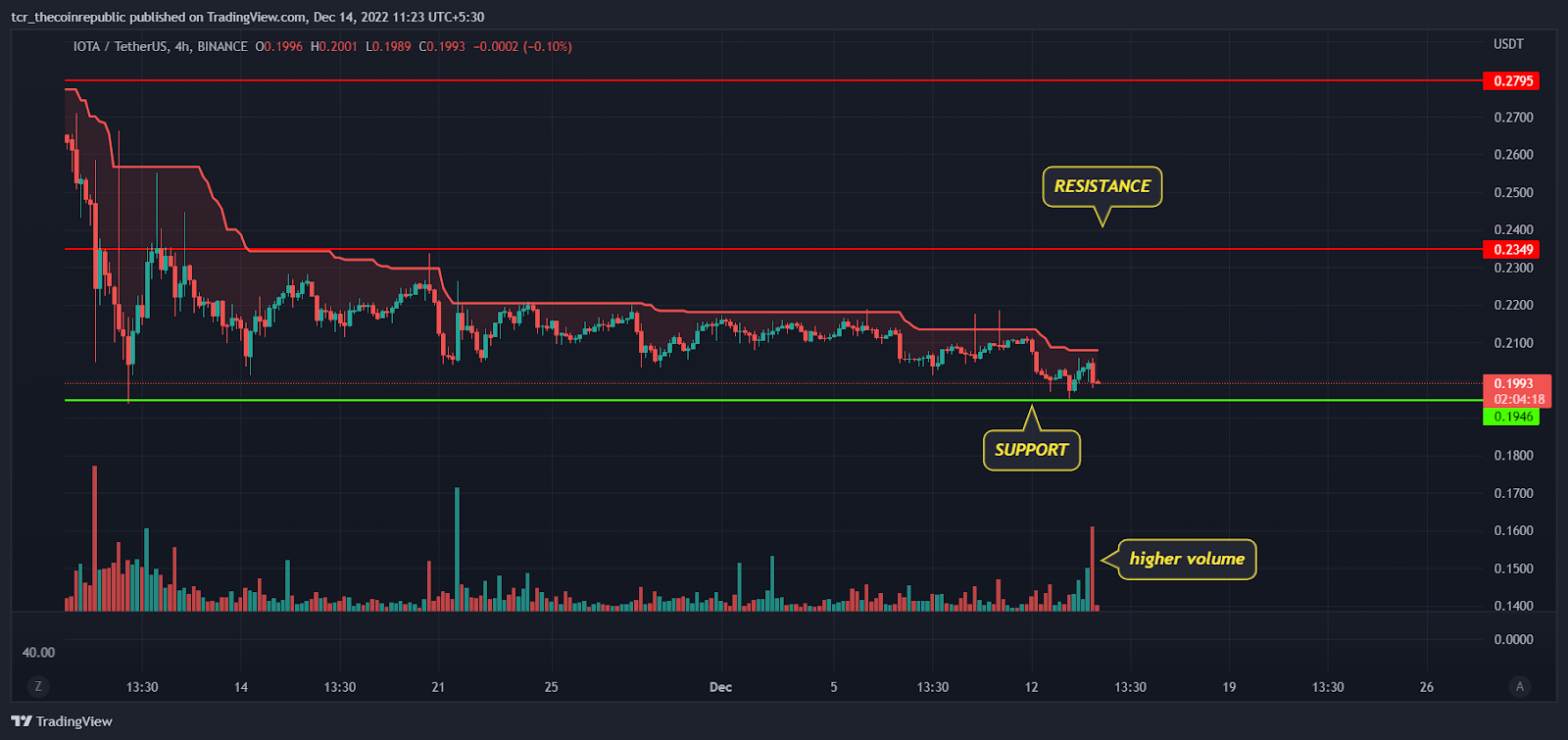

Smaller time frame narrative

Source : IOTA/USDT daily chart by Tradingview

On a lower time frame, IOTA prices look stable and trading in the tight range between $0.1946 to $0.2349 which is likely to break either side in coming days. Super trend indicator generated sell signal and continuing trailing down, which indicates short term trend is still on bear grip.

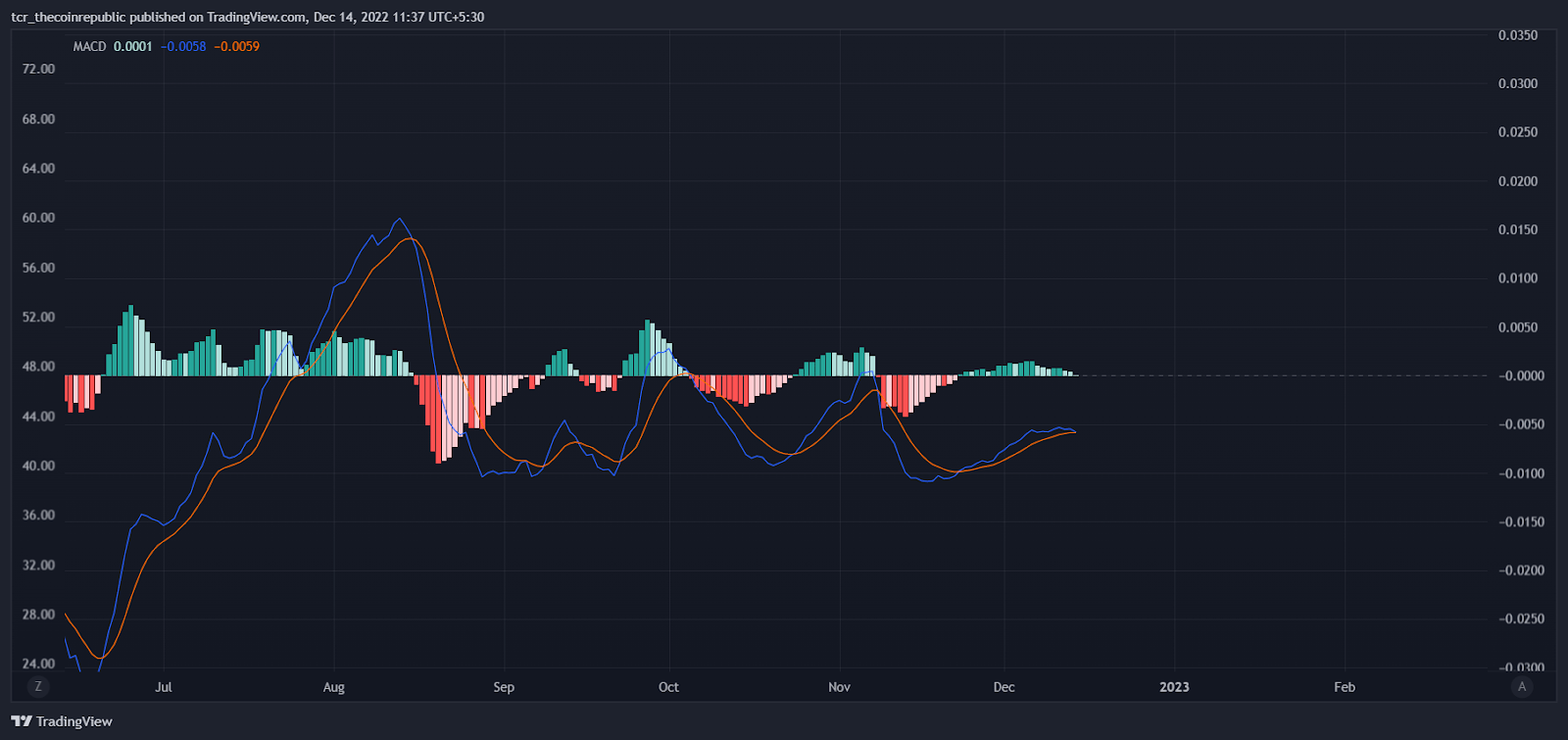

MACD

Source : IOTA/USDT daily chart by Tradingview

The MACD indicator had shown some strong recovery in the past couple of months but later in mid August it generated negative crossover and slipped below zero line. Since then bulls had tried multiple times to trade above zero line but were unable to sustain higher levels. Currently, MACD is again on a way to generate negative crossover.

Summary

IOTA has been in a strong downtrend for quite a long time and bulls are struggling to defend the yearly lows. As of now, price analysis does not indicate any trend reversal but if prices sustain above $0.1946 we may see some relief rally in coming days. The aggressive traders and investors both should avoid creating any buying positions in the lower levels.

Technical levels

Resistance levels : $0.2795 and $0.3662

Support levels : $0.1946 – $0.1500

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only, and they do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond