Cardano Shows Red Flags and Only One Bullish Signal

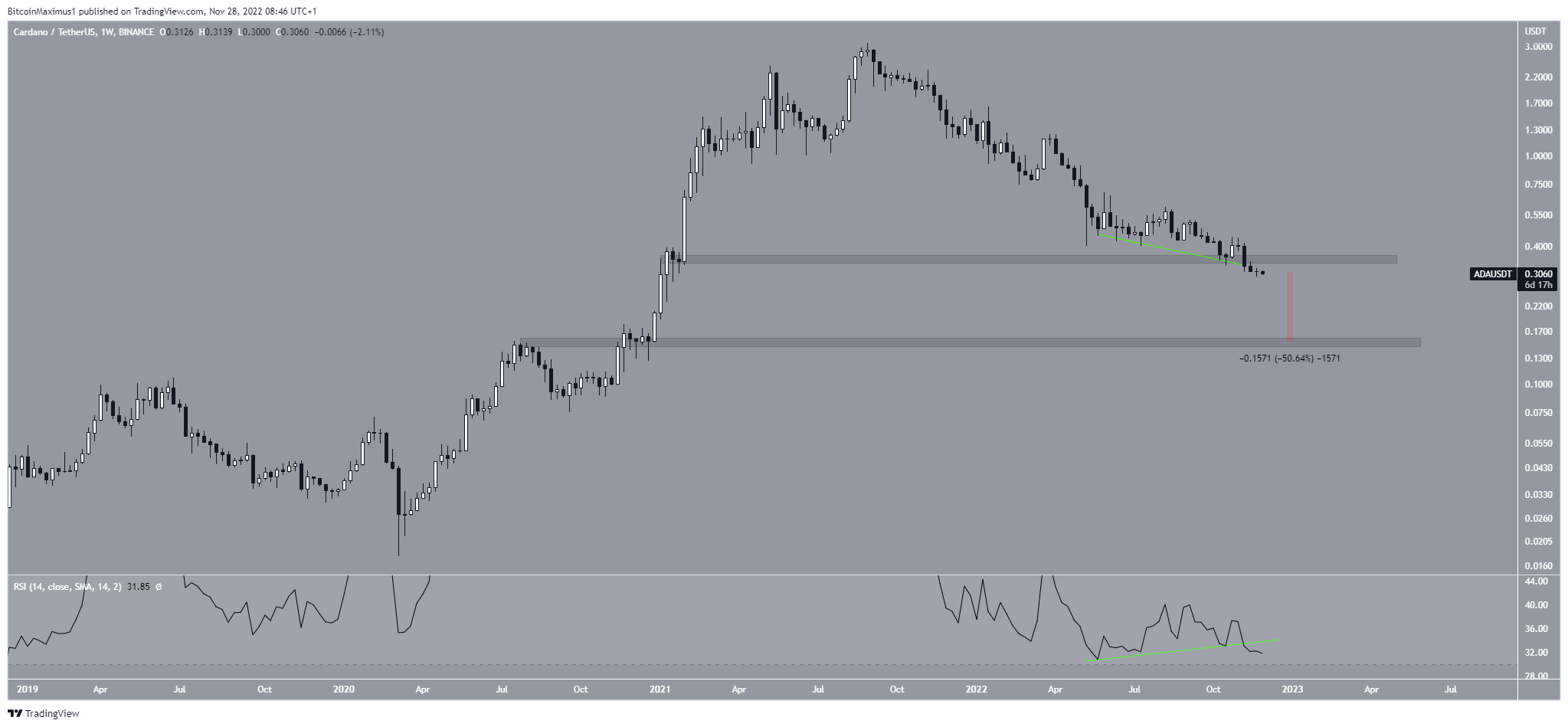

The Cardano (ADA) price shows mixed signs on different time frames. Whether it bounces or breaks down from the $0.30 level could determine the future price trend.

The Cardano blockchain platform is a proof-of-stake platform created by Charles Hoskinson. The Cardano price has been falling since reaching an all-time high of $3.10 on Aug. 2021. The drop led to a low of $0.29 in Nov. 2021.

This caused a breakdown from the long-term $0.35 horizontal support area. The drop accelerated during November 2022, a fall seen throughout the crypto market.

Moreover, the decrease invalidated a bullish divergence in the weekly RSI (green line). This is another sign of the continuation of the decline

If the downward movement continues, the next closest support area would be at $0.15, a 50% drop from the current level.

As a result, the weekly time frame indicates that the Cardano price prediction is bearish.

ADA/USDT Chart By TradingView

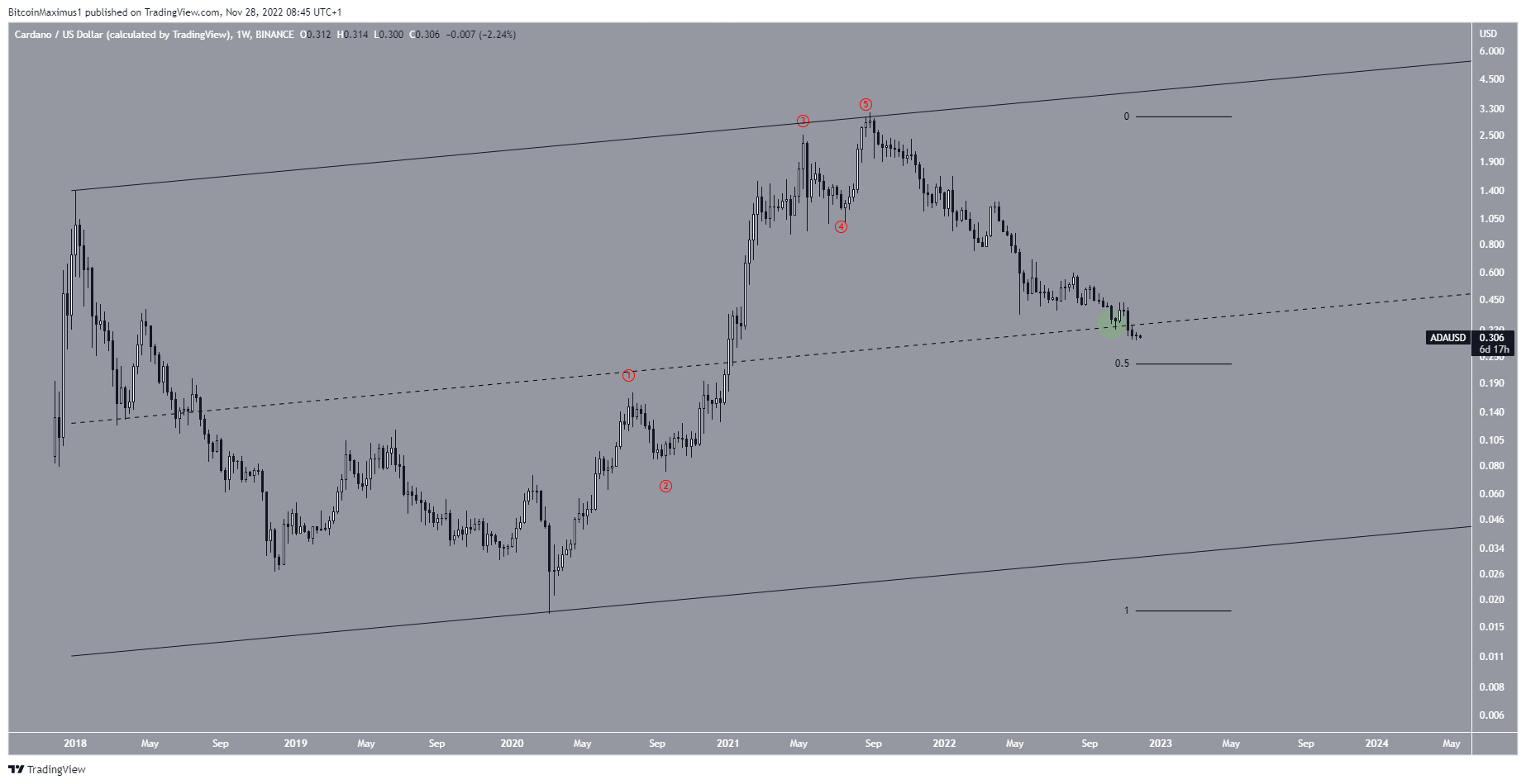

Another bearish outline is revealed by drawing an ascending parallel channel to connect the 2017 high with the all-time high. Doing so shows that the ADA price has broken down from the middle of this channel (green circle).

However, it also provides a closer support area at $0.22, created by the 0.5 Fib retracement support level. This may act as a bottom for the future price.

ADA/USD Chart By TradingView

Will Cardano Price Bounce?

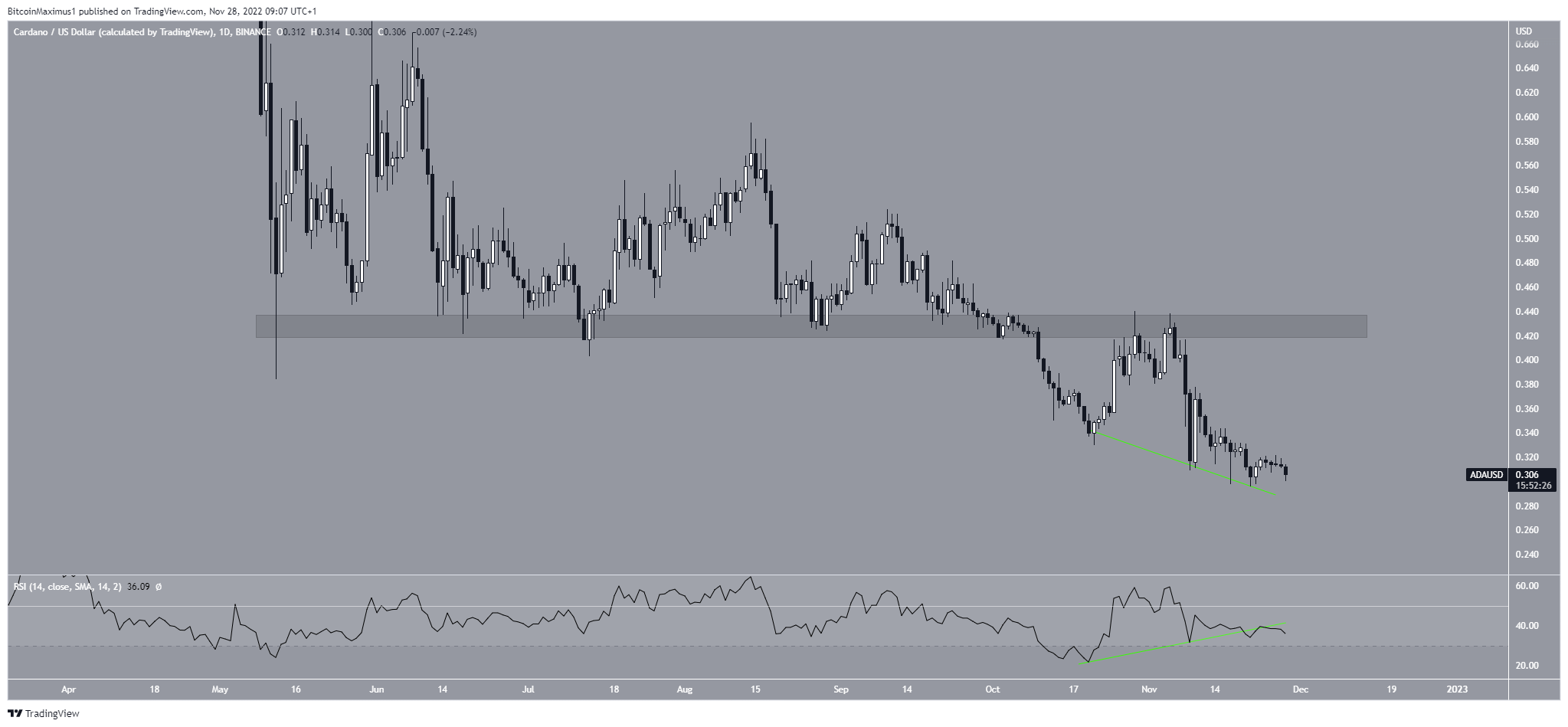

The technical analysis from the daily chart shows that the ADA price was rejected by the $0.43 horizontal resistance area at the beginning of Nov. It has been falling since. It reached a maximum price of $0.44 before the rejection.

While the daily RSI has generated bullish divergence (green line), its trend line seems to have been invalidated. As a result, it is not certain if the divergence will lead to a bounce.

ADA/USD Chart By TradingView

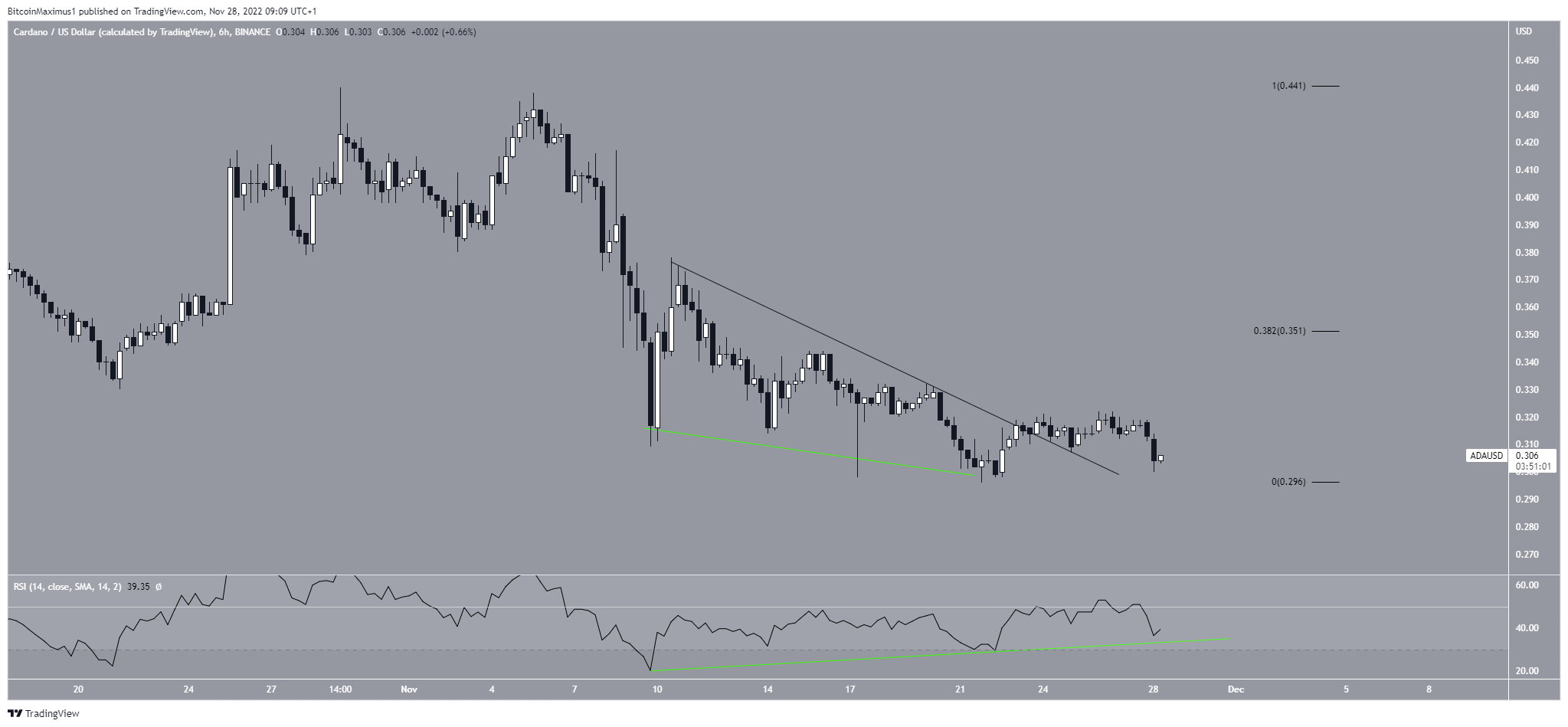

However, the six-hour time frame shows a breakout from a short-term descending resistance line.

Additionally, it shows that the bullish divergence trend line (green) is still intact. While the ADA price decreased over the next 24 hours, it could validate the line as support.

Therefore, the ADA price prediction from short-term time frames is not clear.

ADA/USD Chart By TradingView

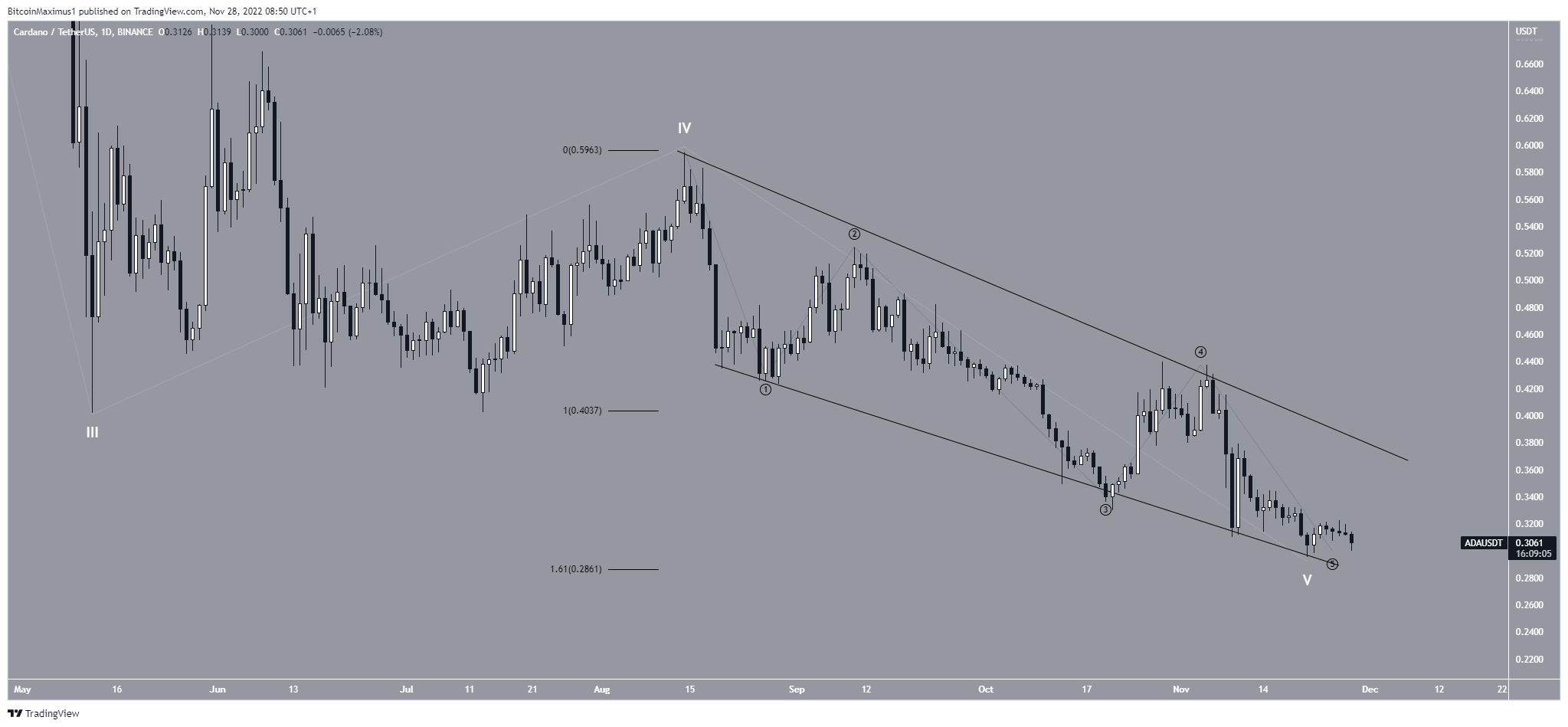

Cardano Wave count: Two Possibilities for Bottom

Finally, the wave count provides two possibilities for the bottom. Both suggest that the ADA price is in the fifth and final wave of a long-term downward movement (white).

The first count suggests that the ADA price is completing the fifth wave in the form of an ending diagonal. The sub-wave count is in black. It suggests that the bottom is very close.

ADA/USDT Chart By TradingView

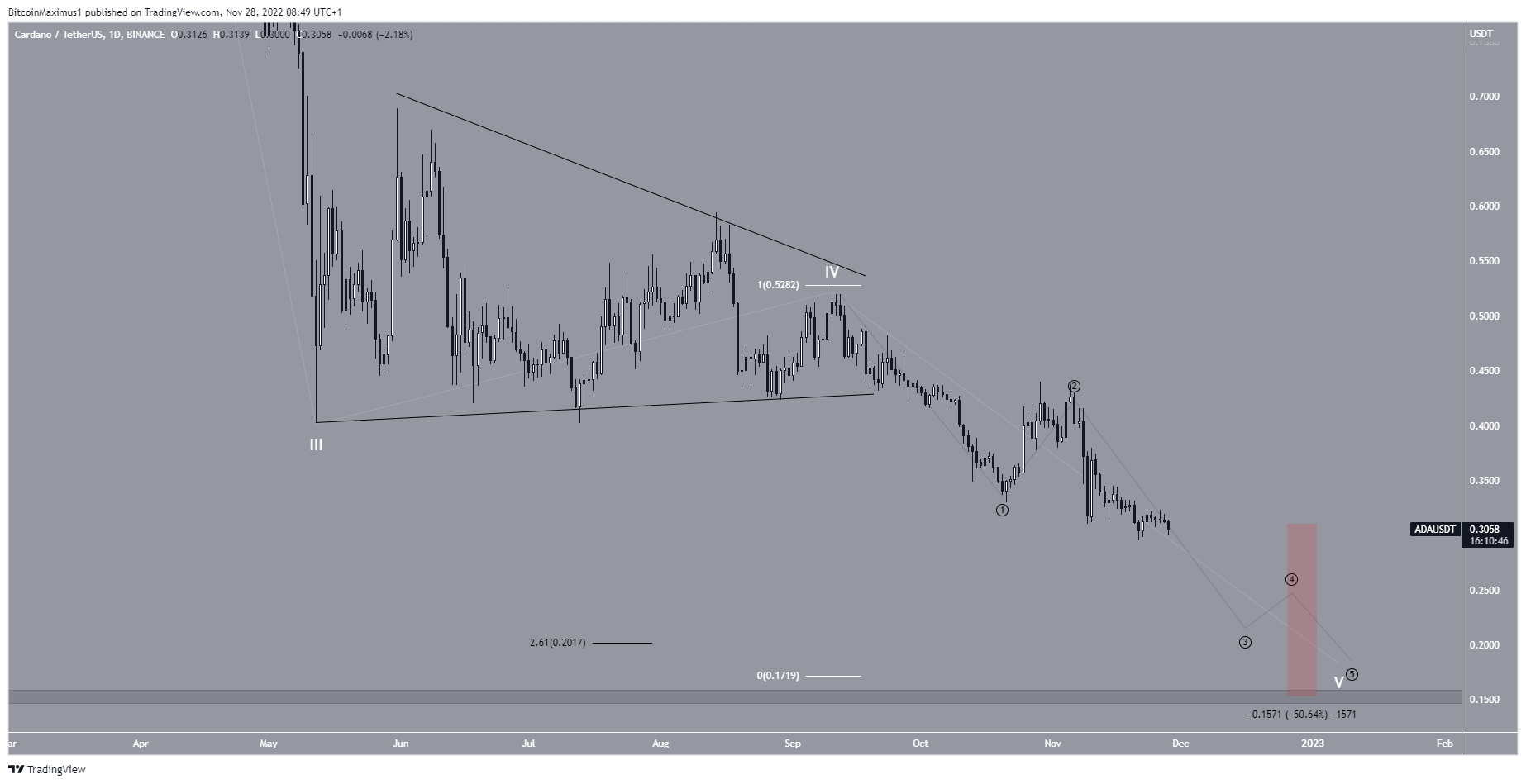

The more bearish count indicates that the Cardano price has completed only the first portion of the decrease, and the downward movement will resume towards $0.15.

Therefore, whether the Cardano price breaks down below $0.30 or bounces will likely determine the future Cardano price forecast.

ADA/USDT Chart By TradingView

Disclaimer: BeInCrypto strives to provide accurate and up-to-date news and information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Status

Status  Ontology

Ontology  BUSD

BUSD  Hive

Hive  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren