The Basic Difference Between Ethereum And Polkadot In Staking Mechanism

Staking mechanism

Ethereum adopts the proof-of-stake (PoS) mechanism, and each validator needs to hold 32 ETH for staking. Validators run a main beacon chain node and multiple validator clients with 32 ETH each. These validators are assigned to “committees,” which are randomly selected groups that validate shards in the network.

Ethereum 2.0 relies on a large validator set to provide availability and validity guarantees: each shard requires at least 111 validators to run the network, and each shard requires 256 validators to finalize in an epoch All shards. With 64 shards, that would require 16384 validators.

Polkadot adopts the Nominated Proof of Stake (NPoS) mechanism, in which there are two roles – the “validator,” who runs the node, and the “nominator,” who nominates the validator. The nominator does not need to run the machine himself but can also get rewards from the system. Nominators can also join the nominator pool to further lower the participation threshold and simplify the operation process. NPoS allows Polkadot to require a smaller set of verifiers.

Each parachain requires about 10 verifiers. If there are 100 parachains, only 1000 verifiers are required. The Polkadot network currently has 297 validators, and it is expected that 1,000 validators will be needed in the mature stage of the network. To this end, Polkadot has launched the “Thousand Validator Plan” to increase the number of validators.

Current staking data

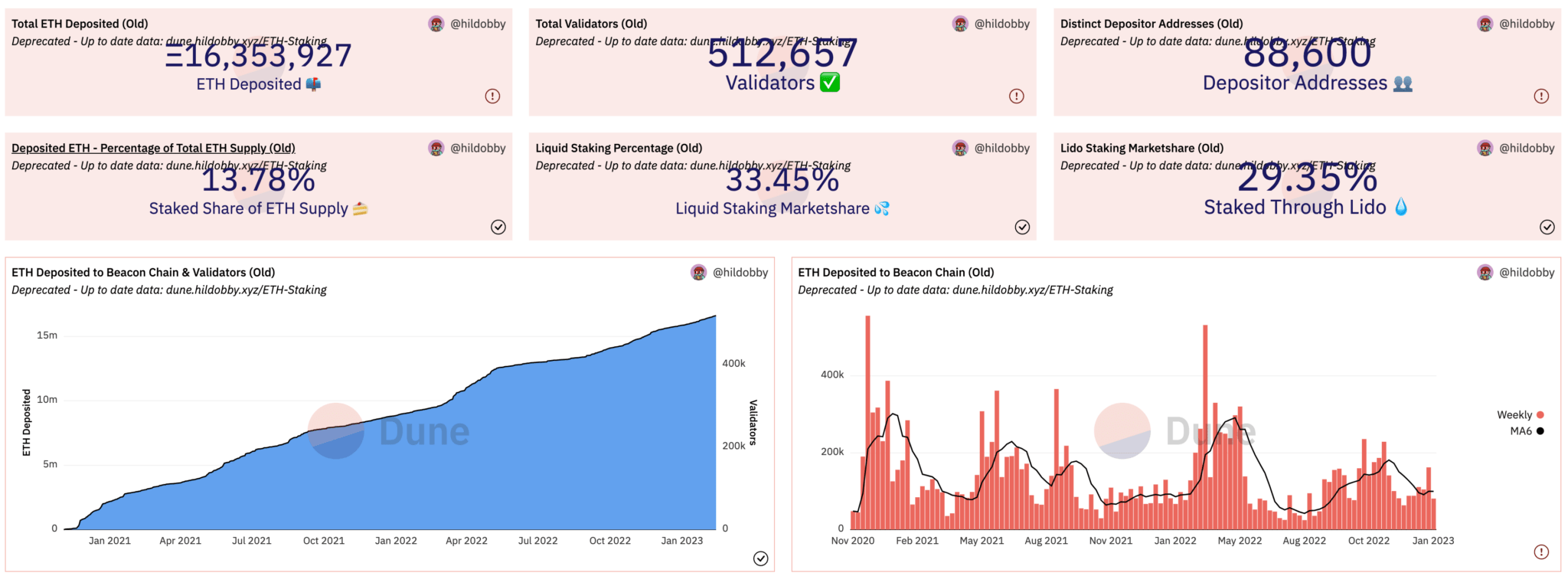

At the time of this article, Ethereum has 16.35 million ETH in staking, the staking rate is 13.78%, 512,600 validators, the staking rate of return is 4.21%, and the rate of return after calculating inflation is 4.65%; Polkadot has 592 million in the DOT staking, the staking rate is 46.4%, the number of nominators is 455,000, the historical staking rate of return is 15.39%, and the rate of return after deducting inflation is 8.26%.

ETH staking data. Source: Dune

For the PoS chain, the more people participate in the staking, the higher the staking rate and the more secure the network will be. The current staking rate of Ethereum is relatively low compared to Polkadot and other PoS chains, which may be because the staked ETH cannot be withdrawn under the current version, so. The upgrade of Ethereum “Shanghai” is expected to be completed in March.

At that time, the withdrawal of staked ETH will be supported, and the staking rate may be greatly improved. The ideal staking rate of Polkadot is 50%, and the actual staking rate is maintained between 40% and 60% most of the time.

Note: The staking rate refers to the ratio of tokens in staking to the total supply of tokens. The above data comes from the February 13, 2023 data from the Ethereum official website, Polkadot staking panel, and Staking Rewards.

Lock-up period

At present, the ETH staked in Ethereum cannot be withdrawn. After the “Shanghai” upgrade is completed, users can withdraw the staked ETH. After the withdrawal function is enabled, the staking lock-up period of ETH is 27 hours, that is, the staked ETH can be withdrawn 27 hours after unstacking.

Polkadot’s staking lock-up period is 28 days, that is, the staked DOT can be withdrawn 28 days after unstacking. A longer lockup period increases the security of the protocol but also makes it less attractive to stakers due to lower flexibility and higher opportunity cost.

Staking threshold

Ethereum only supports one native way of staking, which is to run validators itself. Each validator needs to deposit 32 ETH into the ETH 2.0 deposit contract, and also needs a dedicated computer connected to the Internet throughout the year, and understands some technical operations.

Although the Ethereum protocol itself does not support staking delegation, there are also some third parties on the market that provide node hosting services, that is, outsourcing the work of node operations to service providers. This method still needs to deposit 32 ETH, which is suitable for people who have coins but do not understand the technology and requires a certain degree of trust in the custodian.

The Polkadot protocol natively supports four staking methods. According to the funding threshold from high to low, they are running verifiers, direct nominations, running nomination pools, and joining nomination pools. A minimum of 1 DOT is required to participate in the staking. Polkadot also provides a “staking panel” website (staking.polkadot.network), which is convenient for users to perform staking operations.

Running a validator: Requires a dedicated computer connected to the Internet 24/7 and knowledge of related technical operations. In addition, the number of staked DOTs needs to rank higher to be eligible to enter the active validator set. These DOTs can be staked by themselves or by nominators. The number of DOTs required to become an active validator is dynamically changing and currently requires at least about 1.6 million DOTs.

Direct nomination: Nominators need to “nominate” (up to 16) verifiers they trust, that is, stake their DOTs under the verifiers. Nominators and validators share equal network rewards and need to pay a certain commission to validators (the current average commission is 4.04%).

If the nominated verifier has malicious behavior, such as disconnection, the nominator will also be fined. If you want to get nomination rewards, you need to reach the minimum binding amount, which is also dynamically changing, and currently requires about 264 DOT.

Run the nomination pool: The nomination pool is a new function launched recently, with the purpose of further lowering the nomination threshold. Multiple small nominators can form a nomination pool, staking DOTs to the nomination pool, and then the pool as a whole nominates the selected validator set as a nominator, and the pool members share the rewards and punishments equally according to the staked shares. To run a nomination pool, you need to select a validator. Currently, 200 DOT is required to run a nomination pool.

Join the nomination pool: Joining the nomination pool is the easiest way to staking. You don’t need to worry about which validators to choose, and you only need 1 DOT to join the nomination pool to get the staking reward.

From the point of view of the staking threshold, compared with Ethereum, Polkadot provides more native staking options, with a minimum of 1 DOT to participate in the staking, and some staking methods do not need to understand technology, so no matter in terms of capital requirements or technical requirements on the one hand, Polkadot’s staking participation threshold is lower, which is conducive to attracting more people to participate in staking, and improving the degree of decentralization and security of the network.

Liquidity staking

Since the staking has a certain lock-up period, the locked funds cannot be used, and liquidity staking came into being. Liquid Staking Derivatives (LSD) allow users to obtain staking rewards while maintaining the liquidity of funds, thereby improving the utilization rate of funds.

Users are staking tokens to the liquidity staking protocol to generate corresponding liquidity derivative tokens. These derivatives have similar uses to the original tokens. For example, they can be used to participate in DeFi while obtaining staking rewards.

The existence of liquid staking can stimulate the economic activity of the PoS chain because it makes the two channels of staking and participation in DeFi no longer conflict but can kill two birds with one stone. Therefore, liquid staking is a very important track.

It may be due to the fact that Ethereum’s native staked funds cannot be withdrawn at present, and the liquid staking rate of Ethereum is very high. In the first quarter of 2023, 44% of all staked ETHs are made through liquid staking.

The liquidity-staking TVL of Ethereum has reached $10 billion, which is a very large market. Among them, Lido occupies an absolutely dominant position in the Ethereum liquidity staking market, with a market share of 73.42%, and the second-ranked Coinbase has a market share of 15.76%.

Unlike Lido, which is the only one in Ethereum’s liquidity staking, the TVL of Polkadot’s liquidity staking products is relatively average. The TVL of Lido on Moonbeam is $16.71 million, the TVL of Acala’s liquidity staking is 14.14 million, the TVL of Bifrost is $12.10 million, and the TVL of Parallel liquidity staking is $7.49 million. The combined TVL of these four liquidity staking protocols is only $50.44 million, and there are currently 592 million DOTs being staked.

Compared with the situation of Ethereum, Polkadot’s liquidity staking penetration rate is quite low, and the growth potential of Polkadot’s ecological liquidity staking market is still very large. In addition, liquid staking products developed based on Polkadot parachains have some unique advantages, such as easy cross-chain integration.

In general, in terms of liquidity staking, the penetration rate of Ethereum’s liquidity staking is quite high, while the popularity rate of Polkadot ecological liquidity staking is relatively low. Lido is the only one in the Ethereum liquidity staking market, while Polkadot is ecological There is no liquid staking product with particularly obvious advantages.

Conclusion

In general, the staking rate of Polkadot is higher than that of Ethereum. Polkadot provides more native staking options, and the threshold for participating in staking is lower, while the development of Ethereum’s liquidity staking market is considerable. With the upcoming upgrade of Ethereum Shanghai and the further popularization of Polkadot’s ecological liquidity staking, the pattern of the two may have relatively large changes.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Monero

Monero  Dai

Dai  OKB

OKB  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Gate

Gate  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Tether Gold

Tether Gold  Theta Network

Theta Network  Zcash

Zcash  IOTA

IOTA  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Ravencoin

Ravencoin  Decred

Decred  Dash

Dash  Zilliqa

Zilliqa  Qtum

Qtum  Synthetix Network

Synthetix Network  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Siacoin

Siacoin  Holo

Holo  Status

Status  DigiByte

DigiByte  Nano

Nano  Enjin Coin

Enjin Coin  Ontology

Ontology  Waves

Waves  Hive

Hive  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  NEM

NEM  Numeraire

Numeraire  BUSD

BUSD  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Augur

Augur  HUSD

HUSD  Bitcoin Diamond

Bitcoin Diamond