Markets trade down after Fed chair’s comments, Grayscale recovers amid hearing

Crypto markets whipsawed throughout the day after U.S. Federal Reserve Chair Jerome Powell’s delivered testimony to Congress.

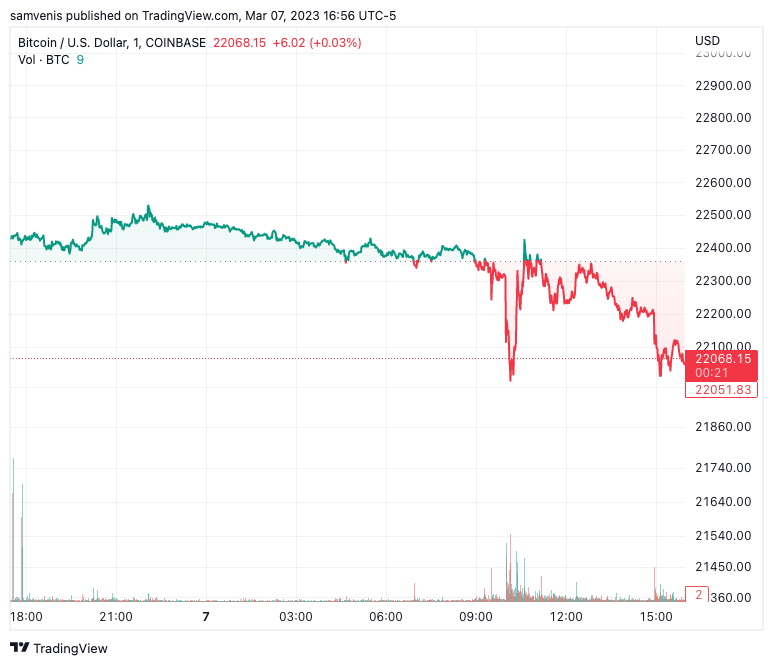

Bitcoin was trading around $22,070 by 4:55 p.m. EST, down about 1.5%, according to TradingView data. Earlier in the day, it fell as low as $21,900.

BTCUSD chart by TradingView

The U.S. central bank is «prepared to increase the pace of rate hikes,» Powell said during his testimony, adding that because the latest economic data had come in stronger than expected, the ultimate level of interest rates is «likely to be higher than previously anticipated.»

Markets dropped immediately following the comments, recovering slightly throughout the day.

Ether was trading at $1,550 by 4:55 p.m. EST, down 0.9% on the day, while altcoins fell slightly. Binance’s BNB fell 0.3%, Ripple’s XRP was up 3% and Cardano’s ADA down 1.1%.

CoinFLEX’s token was up 8.7%, after the company released a statement saying a court in the Seychelles had approved its restructuring plans.

Crypto stocks and structured products

After months of delay, Grayscale finally had its day in court, bringing a case against the U.S. Securities and Exchange Commission for rejecting its proposal to convert its flagship fund, GBTC, into a spot bitcoin ETF in June.

As GoldenTree’s head of digital asset trading Avi Felman noted on Twitter, oral arguments were «going well,» and the judges were «questioning the validity of the SEC’s arguments against spot ETF.»

GBTC traded up throughout the day, gaining around 9.6% to $12.90 at the close, according to TradingView data. The asset manager’s ether product, ETHE, jumped about 2.8% to about $7.12.

Other crypto stocks traded relatively flat, with slight declines. Silvergate was down 3.7% to $5.20, Coinbase was down 1.4% to around $62. Block lost 3.4% to trade around $78 and MicroStrategy declined by 6% to $231.44.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur