MATIC On The Upper Side Of The Consolidated Range, Breakthrough Incoming?

MATIC has been on the rise for the past week now. Over the last 24 hours, MATIC increased 2%, and the coin gained close to 14% in the past week. The altcoin was moving within a range but was not precisely rangebound as it approached the immediate resistance mark.

The technical outlook of the altcoin pointed towards the bulls, depicting strength. The accumulation of MATIC increased, which also means that demand for the coin shot up. If demand increased slightly, the altcoin would move past the local resistance over the subsequent trading sessions.

As the king coin consolidates, Bitcoin will need to show some strength and move above the $23,000 mark. Many altcoins have been struggling to break past their immediate resistance mark.

As buying strength for MATIC noted an uptick, it also signified that the coin would soon move toward the overbought region. The range within which MATIC was moving fell between $1.16 and $1.28. Currently, Polygon (MATIC) is trading 57% below its all-time high secured in 2021.

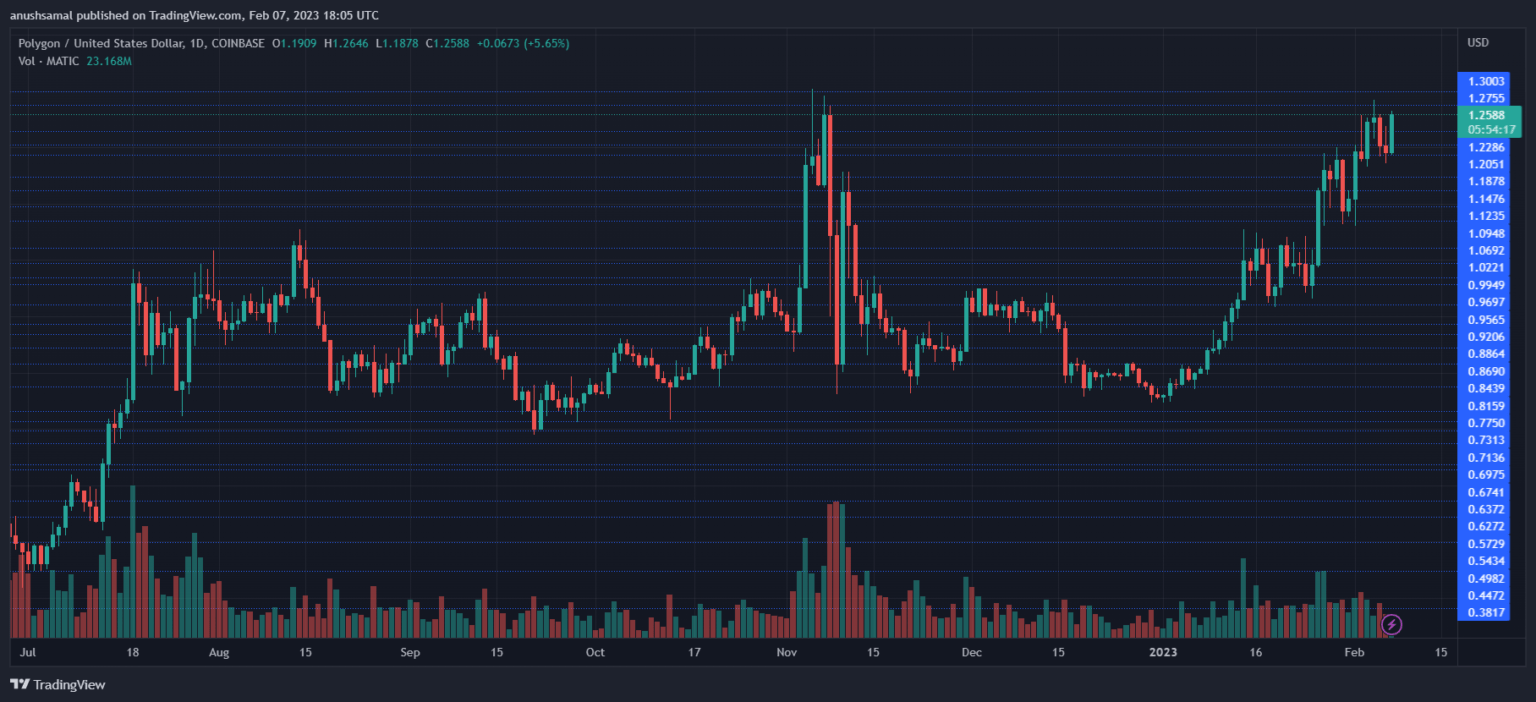

MATIC Price Analysis: One-Day Chart

The altcoin was trading at $1.24 at the time of writing. Over the last week, the coin broke past important resistance levels; for instance, the $1.18 level acted as a strong barrier. After MATIC crossed that level, the coin moved up more quickly until it touched the $1.25 level.

The level above had weakened the bulls briefly. At the moment, a buying force will take the coin above the $1.27 level, causing it to reach $1.30.

On the flip side, if the altcoin starts to retrace, the first stop is at $1.20, and another drag by the bears will make it land below $1.18, causing the coin to fall further. The amount of MATIC traded in the last session was green, which indicated that the coin was under buying pressure.

Technical Analysis

Polygon (MATIC) had hovered around the overbought zone for the past few weeks, and the coin was overvalued at the moment. The Relative Strength Index noted a sharp uptick and moved above the 60-mark, which meant that the coin was planning to move further north.

On a similar note, MATIC’s price moved above the 20-Simple Moving Average line as buyers drove the price momentum in the market. The coin also shot past the 50-SMA and 200-SMA lines, which suggested a further rally for MATIC.

Other technical indicators also showed that the bulls were in command, as there were buy signals for investors. The Moving Average Convergence Divergence (MACD) underwent a bullish crossover and formed green signal bars, indicating a buy signal.

This implied a further increase in price for MATIC. MACD indicates price momentum and reversals. The Chaikin Money Flow points towards capital inflows and outflows; the indicator was above the half-line, meaning capital inflows were higher than outflows.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Enjin Coin

Enjin Coin  Ontology

Ontology  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren