MATIC Technical Analysis: Is This A Must Buy Opportunity For Polygon?

The Polygon(MATIC) prices sustain above the 100-day SMA after a successful retest, teasing a potential rise to the $1 mark. Key technical points:

- The MATIC prices jumped by 0.11% in the last 24 hours.

- The market value of polygon sustains above the 100-day SMA.

- The 24-hour trading volume of Polygon is $1.25 Billion, indicating a drop of 26%.

Past Performance of MATIC

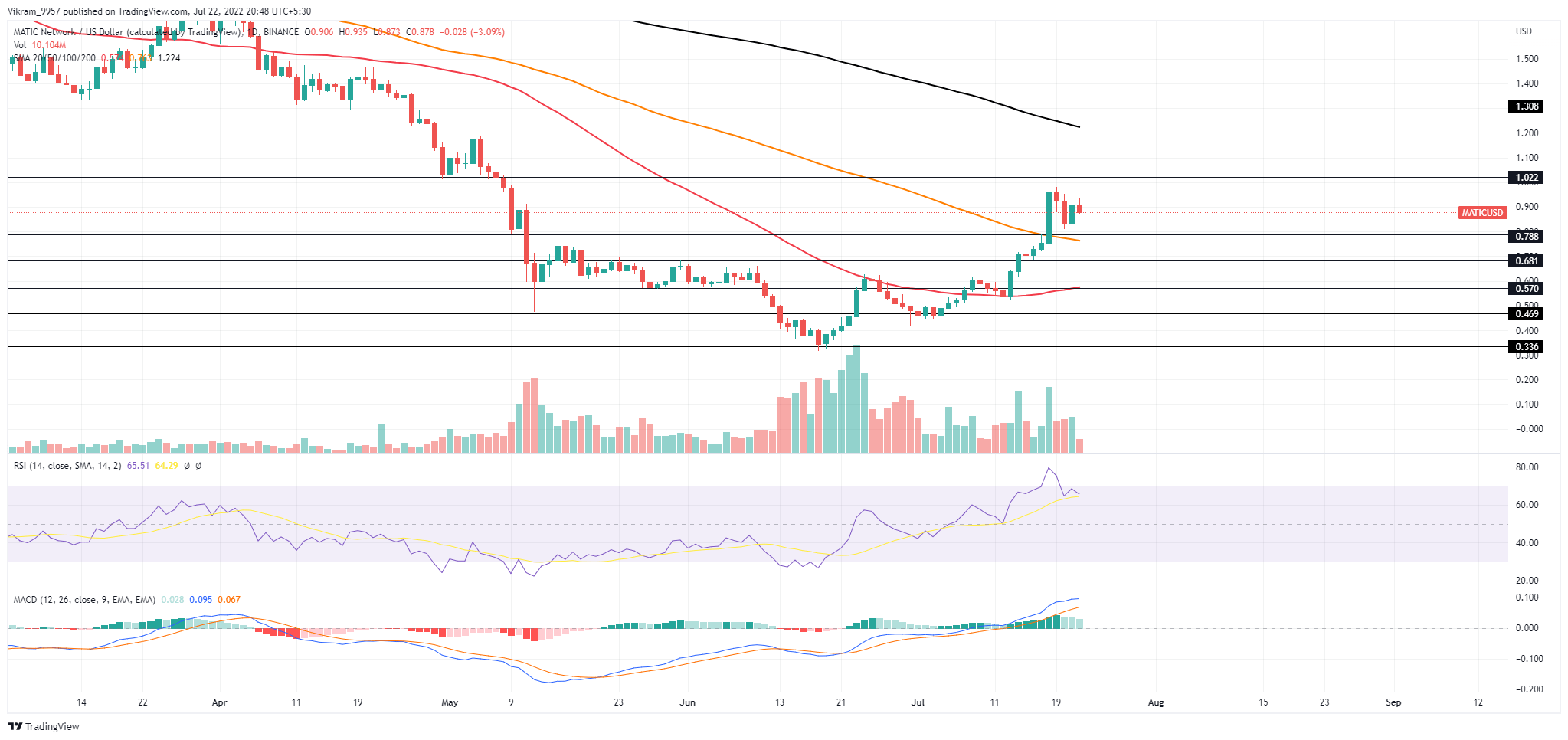

Amid the recent recovery, the Polygon(MATIC) price has last breached the 100-day EMA and $0.75 resistance, providing a higher footing to carry forward this rally. However, in response to profit-booking from short-term trades, the price witnessed an 18.8% pullback, retesting the 100-day EMA.

Source- Tradingview

MATIC Technical Analysis

Even though the MATIC price rebounded from the 100 EMA support with an inside candle, the buyers struggled to follow up this bull run, which displayed high-wick rejection and a 3% intraday loss. The RSI indicator shows a gradual increase in the underlying bullishness, with the RSI slope rising higher with the 14-day SMA. Hence, the technical indicator suggests a potential-jump above the psychological mark of $1. Furthermore, as the bullish histograms decline, the MACD indicator displays a spread loss between the fast and slow lines. Hence, the possibility of a bearish crossover in the MACD and signal lines increases. In a nutshell, the MATIC technical analysis projects weakness in the underlying bullishness, but the price action suggests otherwise.

Upcoming Trend

If the selling pressure persists, the coin price may experience a deeper retracement, possibly to the $0.75 to $0.62 mark. However, the expected pullback may provide a dip opportunity to acquire a MATIC again at a discounted price. The replenished momentum may continue the prevailing recovery, indicating a high possibility for Polygon price to break above the $1 psychological resistance. Resistance Levels: $1 and $1.30 Support Levels: $0.78 and $0.68

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond