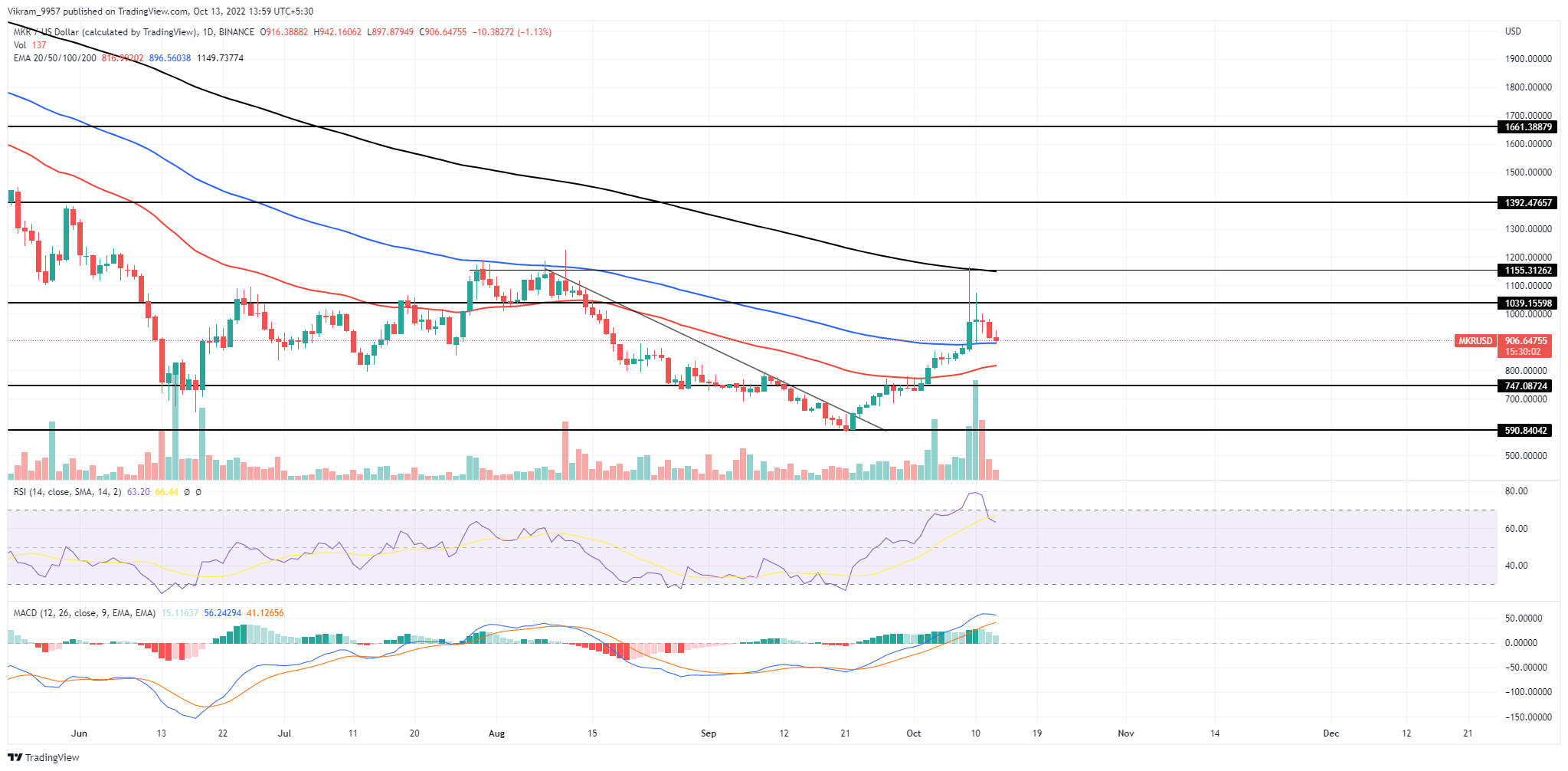

MKR Technical Analysis: Under $1000, Maker Price Hinges At 100 DEMA

The MKR technical analysis displays a bullish failure to cross the $1000 mark leading to a reversal, now struggling at the 100 DEMA to find support. The MKR price action displays a phenomenal bullish recovery of 68% between 21st September and 28th October to reach the $1000 mark. However, the increased supply inflow at the psychological mark led to a bearish reversal within the evening star pattern. Currently, the price action struggles to find support at the 100-Day EMA to avoid further correction.

Key Points:

- A drop below 100 DEMA will propel the Maker market price to the $800 mark.

- The market price struggles to sustain above the $900 mark.

- The intraday trading volume in Maker is $886 Million.

Source-Tradingview

MKR Technical Analysis

The MKR price action gives a bullish breakout of a long-coming resistance trendline as it reverses from the bottom support level of $590. The breakout rally accounts for a 60% price within the month to reach the $1000 mark. The increased supply inflow at the psychological market led to a bearish reversal with an evening star pattern with long wick formation. Additionally, the spike in the intraday trading volume supports the bearish reversal increasing the possibility of a down current to the next support level. Currently, the price action takes support at the 100-day EMA close to the psychological mark of $900. Thus, a daily candle closing below the EMA floor will intensify the selling pressure and plunge the prices 10% down close to the $800 mark. Conversely, if the market sentiment improves, a bullish reversal from the 100 DEMA will offset the bearish thesis. This development could push prices 25% higher to hit the 200 DEMA at $1160.

Technical Indicator

The RSI indicator shows a fall from the oversold zone to cross under the 14-day SMA, reflecting a short breather. Moreover, the declining gap between the MACD and signal lines teases a bearish crossover. Therefore, the MKR technical analysis suggests that traders should wait for a selling opportunity as the technical indicators reflect a surge in selling pressure. Resistance levels- $1000 and $1160 Support levels- $900, $800

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur