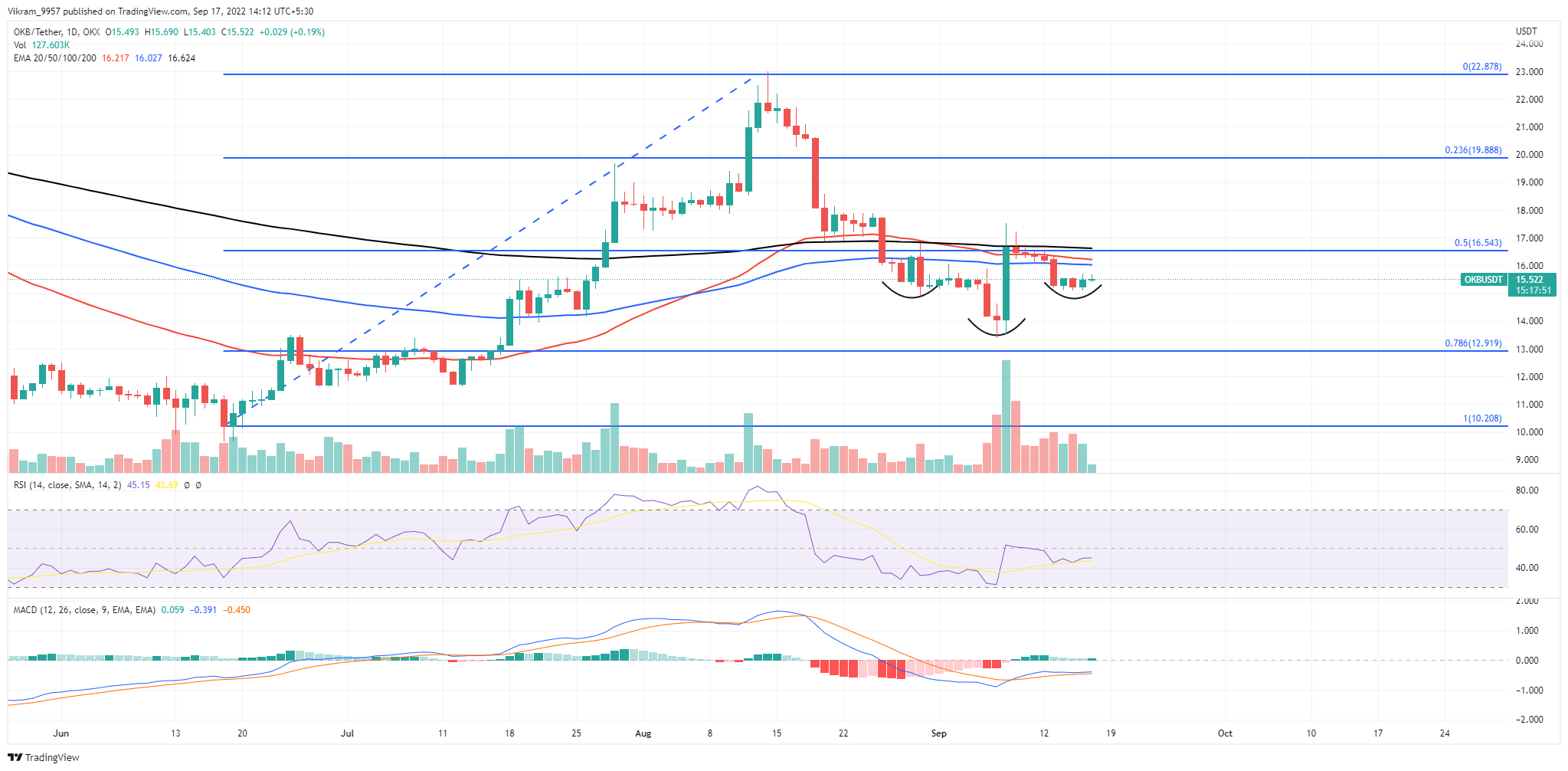

OKB Technical Analysis: Inverted Head And Shoulder Teases Reversal

The OKB price action displays an inverted head and shoulder inchoating in the daily chart with a neckline at the 50% Fibonacci level at $16.54. The OKB price action maintains a trend between $13.5 and $16.5, leading to a bullish pattern reflecting an increase in underlying bullishness. However, as the neckline at $16.5 coincides with the 50% Fibonacci level, the buyers will have difficulty giving a bullish breakout. So, should you consider grabbing the bullish opportunity?

Key Points:

- The OKB prices test the sellers at the $16.5 mark.

- The bullish reversal shows a high likelihood of an uptrend to $20.

- The intraday trading volume in OKB is $18.6 million.

Source — TradingView

OKB Technical Analysis

The OKB price displays a bullish failure to exceed the $16.5 resistance level leading to a base formation at the psychological mark of $15. However, the price action demonstrates the possibility of an inverted head and shoulder, as marked in the technical chart. Currently, the bottom formation at the $15 mark signifies the right shoulder of the bullish pattern, with the neckline at the overhead resistance of $16.5. Furthermore, the neckline overlaps with the 50% Fibonacci level making the neckline an area of high selling pressure. Coming to the daily EMAs, maintaining a lateral trend, the recent reversal from $16.5 increases the bearish crossover chances between the 50 and 100-day EMA. If the OKB price trend completes the bullish pattern, the breakout rally can boost the market price to $20, possibly leading to a golden crossover. However, a reversal in OKB prices from the $16.5 neckline will push the prices back to the $13.5 mark.

Technical Indicators

The RSI slope shows a lateral growth below the halfway line but sustains above the 14-day SMA. Moreover, the MACD and signal lines show a bullish alignment but maintain a lateral shift. As a result, the OKB Technical Analysis takes a neutral standpoint but offers a short-term buying opportunity as the bullish pattern completes. Resistance Levels — $16.5 and $20 Support Levels — $15 and $13.5

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Decred

Decred  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Siacoin

Siacoin  Nano

Nano  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond