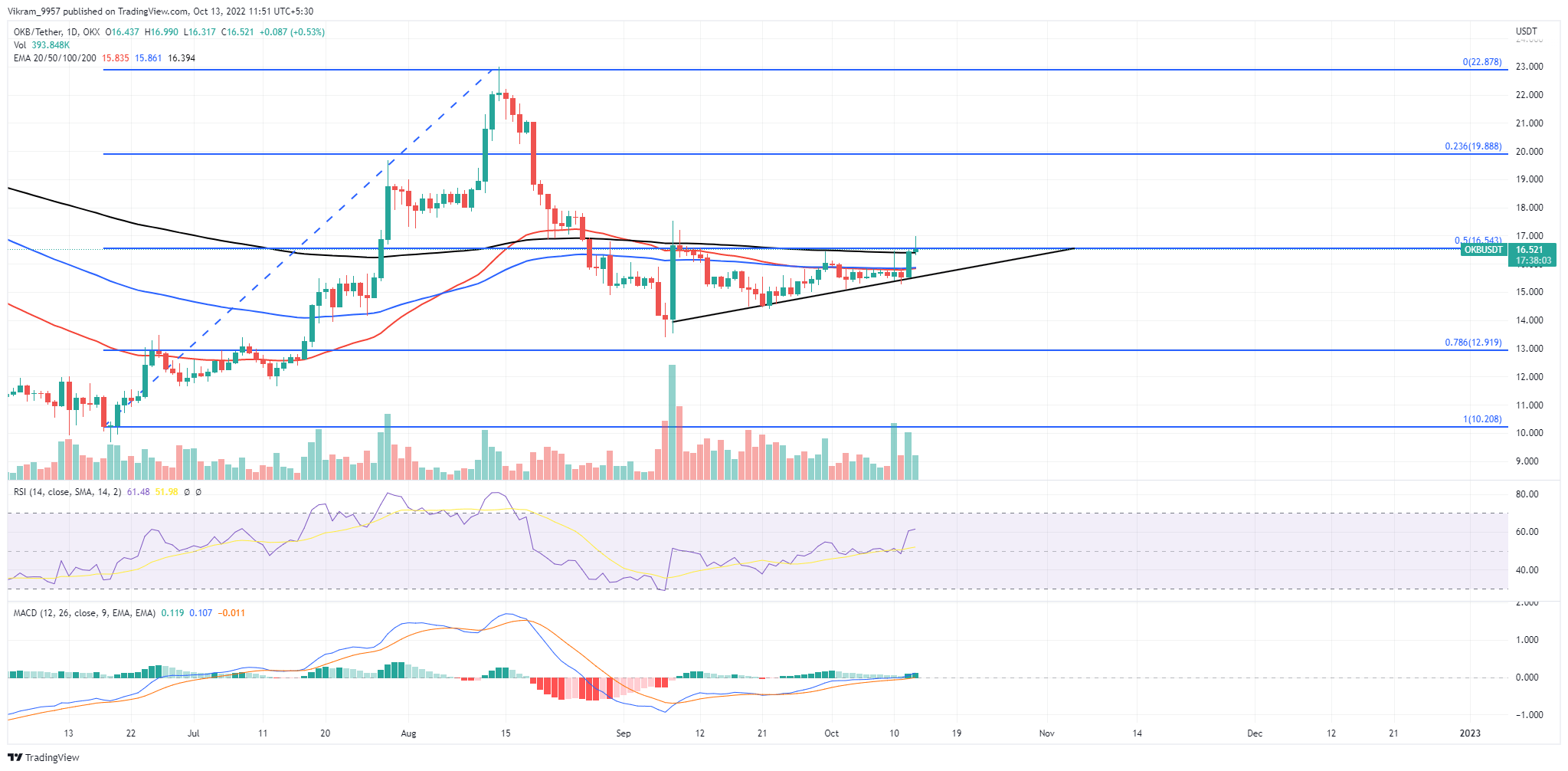

OKB Technical Analysis: Uptrend Teases 50% Fibonacci Breakout

The OKB technical analysis offers a breakout entry opportunity if the buyers beat the overhead resistance of 50% Fibonacci level at $16.5. The OKB price action displays a rising trend within an ascending triangle pattern with an overhead resistance of $16.5. Furthermore, the resistance level coincides with the 50% Fibonacci level, which will signal a strong buying signal upon breakout. On the other hand, the higher price rejection in the daily candle warns of another bear cycle. Would you wait to buy at the support trendline?

Key Points:

- The 200-day EMA coincides with the $16.50 resistance level, increasing the bearish influence.

- A bullish breakout will launch the trapped momentum to reach the $20 mark.

- The intraday trading volume in Okex is $27.79 Million.

Source-Tradingview

OKB Technical Analysis

On 28 September, the OKB price action completed the morning Star pattern accounting for an 18.5% jump to challenge the overhead resistance confluence. The resistance confluence consisted of 200-day EMA, a $16.5 psychological mark, and the 50% Fibonacci level. However, the bullish attempt for a breakout rally failed, resulting in an ascending triangle pattern in the daily chart. The recent bull cycle on the 12th of October accounts for a 5.8% jump and challenges the bearish overhead ceiling. Additionally, the daily candle shows a bullish follow-through, but the higher price rejection warns of another bear cycle. So, if the buying pressure grows to undermine the higher price rejection, the daily candle closing above the $16.5 mark will signal a buying opportunity. The breakout rally will potentially launch the OKB market value to the 23.60% Fibonacci level close to $20, accounting for a 20% jump. On a contrary note, if the market sentiment turns bearish or starts a profit-booking phase, a bearish turnaround will test the rising support trendline. This will further prolong the resonance within the triangle.

Technical Indicator

The RSI indicator shows a spike above the halfway line and crosses above the 60% level, reflecting an improvement in the underlying sentiments. Moreover, the rising trend of MACD and signal lines increase the bullish gap with a boom in bullish histograms. Therefore, the OKB technical analysis offers a buying opportunity if the daily candle closes above the resistance confluence. Resistance levels- $16.5 and $19.88 Support levels- $15.5, $14.5

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD