Solana (SOL) Enters Local Uptrend: Crypto Market Review

The cryptocurrency market has once again entered a downtrend after the cold shower delivered by SEC Chair Jerome Powell, who made it clear that the regulator will continue its series of rate hikes until the desired inflation target is reached. After that, Bitcoin tumbled to $17,000, ETH fell back to $1,200 and alternative currencies lost the gains they achieved throughout the week.

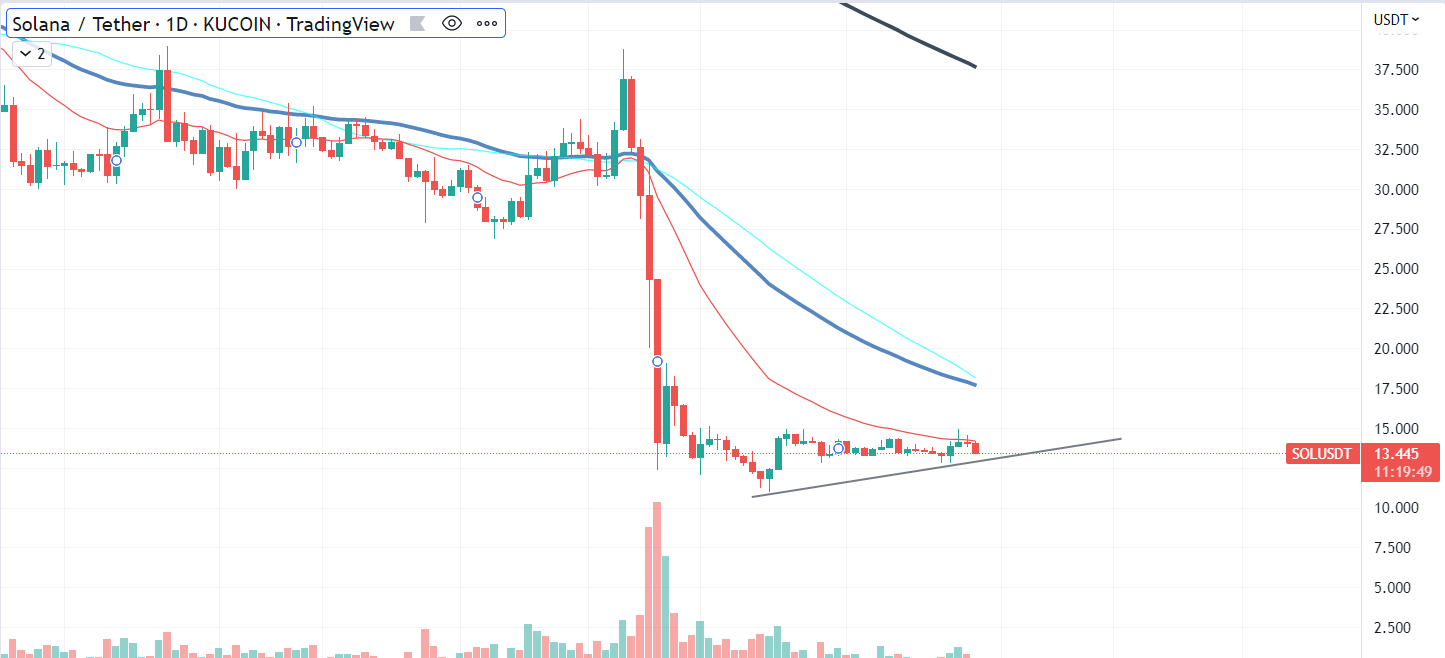

Solana’s uptrend is in danger

Despite the massive breakdown we witnessed in November, Solana has been gradually moving upward and even entering a local uptrend, despite dangerously high selling pressure. However, it is too early to celebrate a reversal; SOL’s uptrend entry could be a part of a rising wedge, which is a part of a downtrend continuation.

The most common reason behind Solana’s successful reversal highlighted by analysts is the extent to which SOL is oversold now. The SBF-endorsed cryptocurrency and go-to network for NFT projects in 2021 has been the most actively sold asset on the market during the implosion of the exchange.

Unfortunately, up to 100 million of SOL could be held in the wallets of stakers who withdrew their assets from staking contracts in a panic after it became clear that SOL was the main, if not the only, source of liquidity for FTX.

The future for what used to be an Ethereum killer remains foggy as it is unclear how much SOL stakers are going to unleash on the market once the volatility and liquidity of the crypto industry returns to a normal level.

Shiba Inu’s transaction count plummets

The number of transactions on the meme token’s network has reached a multi-week low after the price per SHIB token dropped to $0.000008 for the first time since November. The recovery of the burn rate of Shiba Inu did not help the price to bounce off of the local price levels.

The reason behind the drop has nothing to do with Shiba Inu itself, as there were no major happenings around the project or its token. The aforementioned 50 bp rate hike fueled yet another correction on the market that affected alternative coins like Shiba Inu.

SHIB has always been dependent on the performance of the market in general. Meme tokens and coins are practically the most volatile assets on the market, and their growth usually acts like a signal for a recovered risk demand.

In the case of today’s market, the lack of action on meme assets is an additional confirmation of the practically nonexistent demand for risks. Investors are not willing to gain exposure to assets that tend to swing from one side to another and lose their value faster than more stable assets like Bitcoin or even Ethereum.

Generally, the cryptocurrency market is still experiencing a massive migration of funds from exchange to self-custody. By the end of this cycle, we might see the beginning of a proper accumulation that would become a foundation for the future recovery rally that we have been waiting for since the middle of 2022.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur