Cryptocurrencies to watch for the week of February 13, 2023

As the cryptocurrency market enters the week of February 13, all eyes are on the digital assets that are poised to make the most significant moves. Although the market momentum has stalled in 2023, primarily due to renewed regulatory scrutiny, there are still cryptocurrencies that hold the potential to rally.

Finbold, therefore, takes a look at the top cryptocurrencies to watch in the coming week based on their current popularity, the narrative they drive, and their potential to outperform the market.

SingularityNET (AGIX)

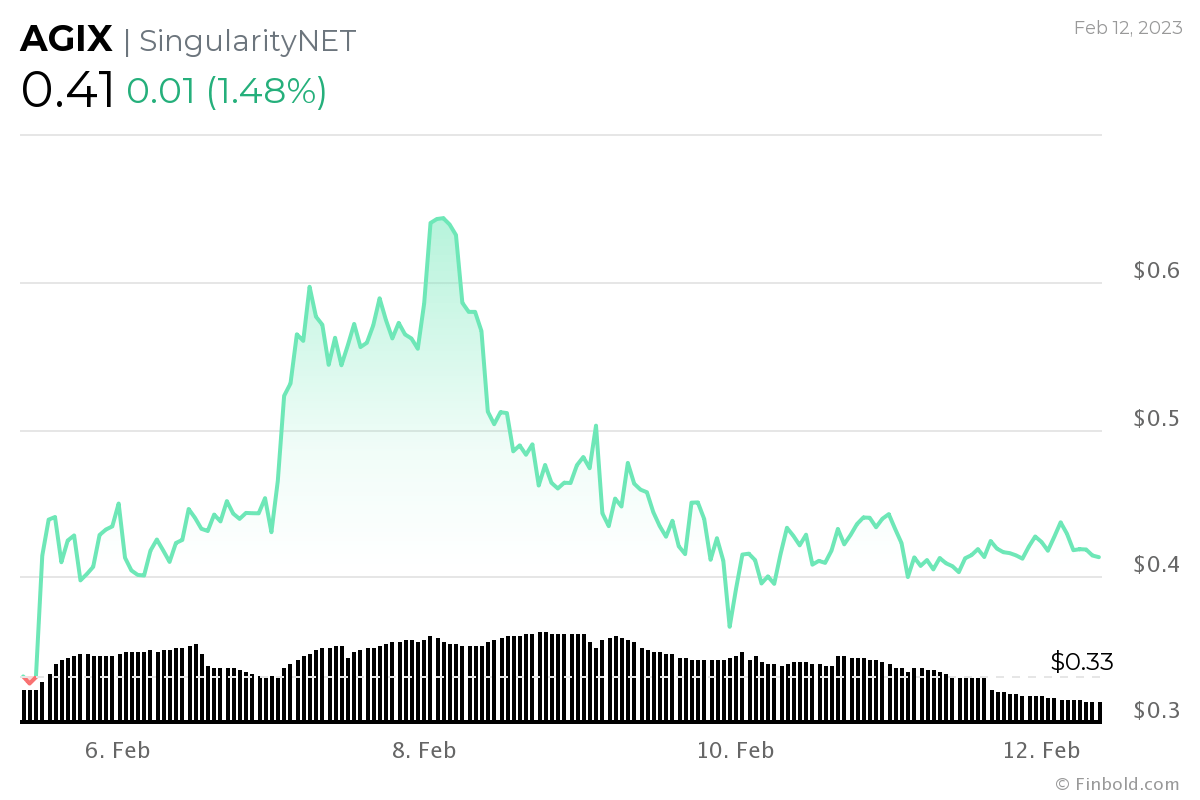

SingularityNET (AGIX), a decentralized artificial intelligence (AI)-focused crypto ecosystem, has recently seen an aggressive pullback. The cryptocurrency has been on an uptrend since the start of the year, driven by the hype of AI-related products such as the text-based ChatGPT that has recorded significant success in its initial stages. The token’s growth was highlighted by a Finbold report on February 6 that indicated AGIX surged by about 900% in 2023 alone.

Notably, SingularityNET allows users to easily “create, share, and monetize” AI services, and its globally-accessible AI marketplace is also making waves by inking key partnerships. In particular, the platform recently announced a collaboration with Cardano (ADA).

The partnership is part of SingularityNET’s exploration to bolster a high-use case for all of its developers leveraging MeTTa, a smart contract development environment on the Cardano ecosystem.

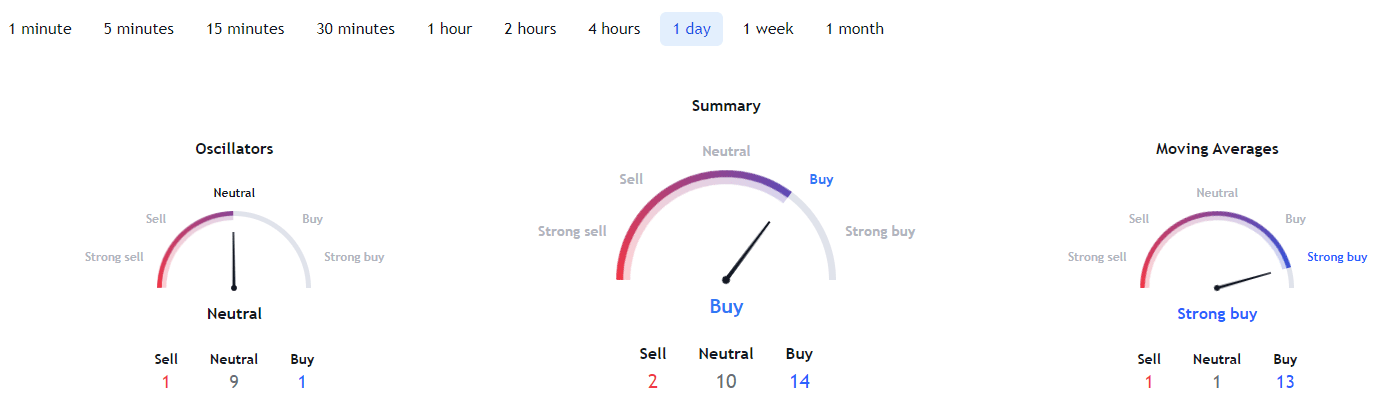

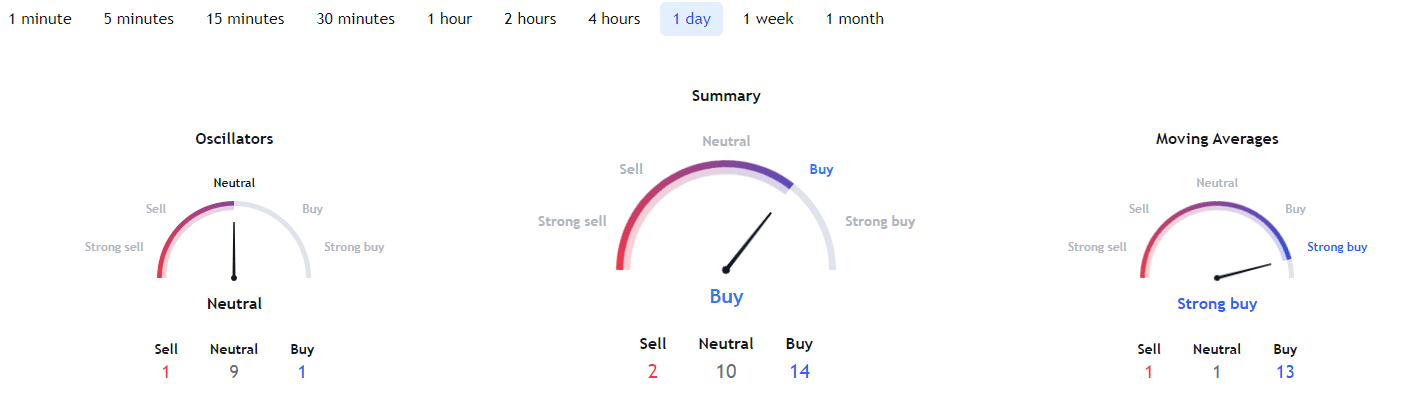

From a technical analysis perspective, AGIX is dominated by bullish sentiment. A summary of one-day gauges is ‘buy’ at 14, while moving averages are for the ‘strong buy’ sentiment at 13. Oscillators are ‘neutral’ at 9.

Ethereum (ETH)

The second-ranked cryptocurrency by market cap has entered 2023 with a host of lined-up network upgrades aiming to complement the Merge update that shifted the blockchain to the proof-of-stake (PoS) protocol. In particular, investors are gearing up to start withdrawing their staked ETH from March once the Shanghai upgrade goes live. In the meantime, investors are simulating the withdrawal process through the Zhejiang testnet.

Currently, developers on the blockchain announced February 28 as the date for the Sepolia testnet as part of the route toward initiating the Shanghai upgrade. Notably, after Sepolia, the next update will be Goerli, the final testnet to get the Shanghai upgrade.

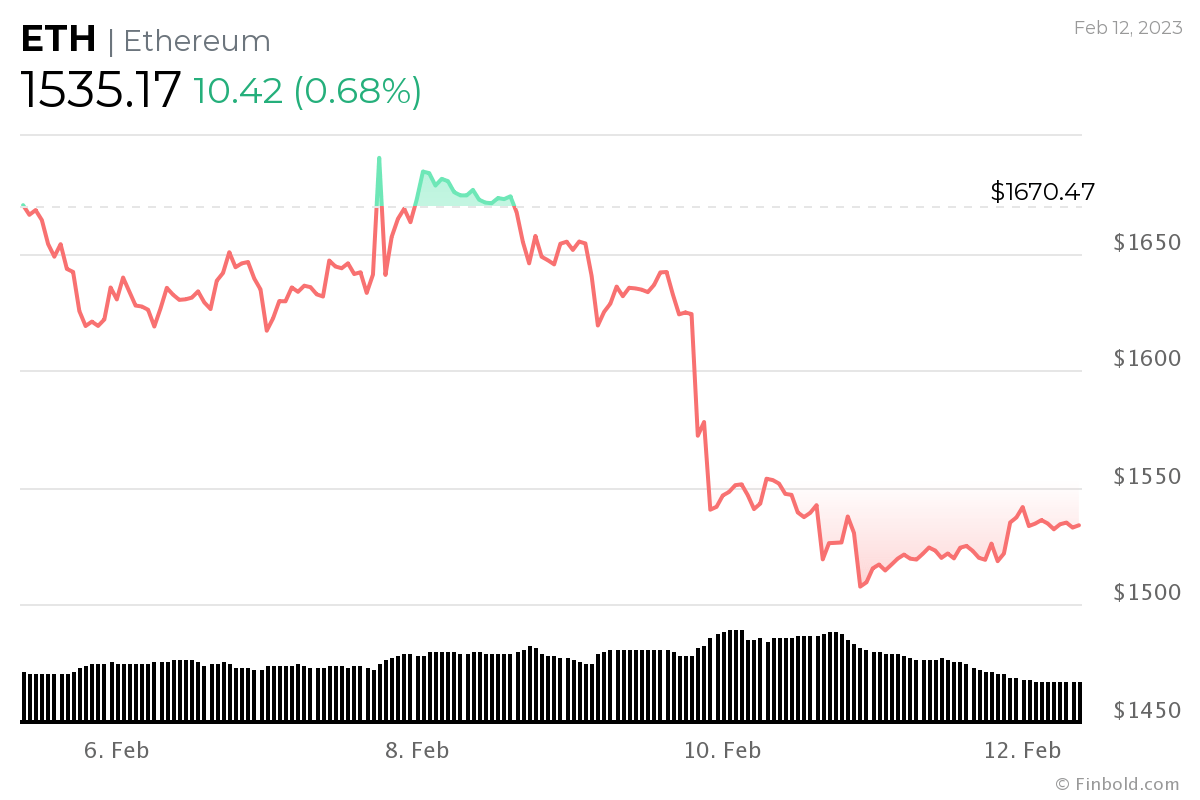

Although the upgrades are likely to influence the price of Ethereum positively, the asset remains on the lookout following the renewed regulatory crackdown on staking by United States regulators. In this regard, the Securities Exchange Commission (SEC) reached a deal with the Kraken crypto exchange that will see the trading platform halt its staking services. Therefore, the fallout from the SEC’s move will likely play a role in determining ETH’s price trajectory.

Interestingly, Charles Hoskinson, the founder of Cardano, had termed Ethereum staking problematic, a factor he notes could hurt the whole industry due to centralization fears. Overall, the SEC’s crackdown on staking has been met with criticism from the crypto space.

Ethereum is currently changing hands at $1,535 with weekly losses of almost 10%.

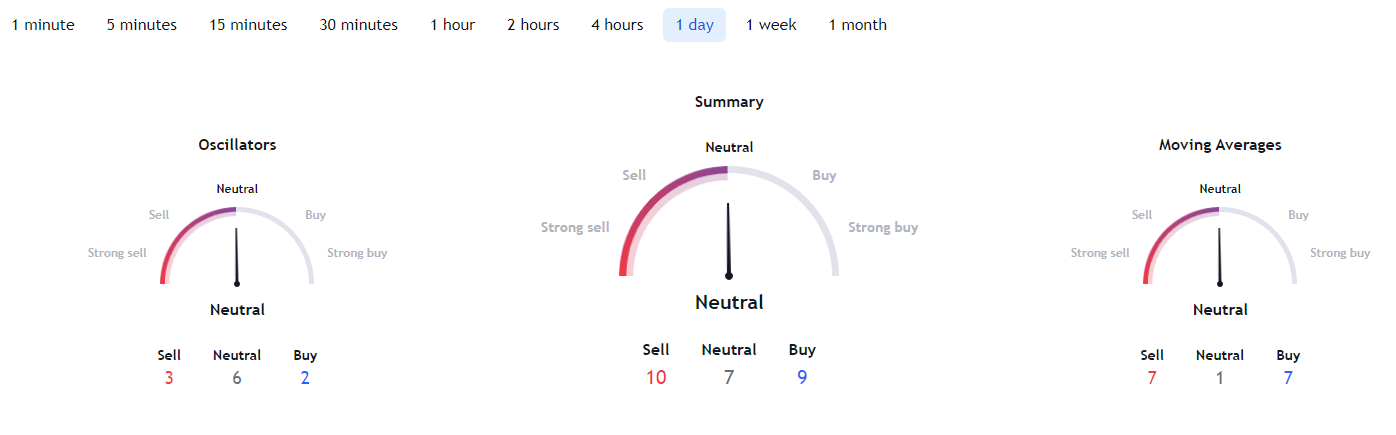

On the other hand, Ethereum’s technical analysis is dominated by neutrality. A summary of the one-day gauges, moving averages, and oscillators are all neutral at 7, 1, and 6, respectively.

The Graph (GRT)

The GRT token has rallied mainly due to consistent growth in its vital on-chain metrics. It is worth noting that The Graph (GRT) is an indexing protocol for querying networks like Ethereum, and a recent report showed that several metrics accounted for steady quarterly growth.

The report indicated that there were 618 active subgraphs on The Graph mainnet as of December 2022, a 25% QoQ increase and a 151% YoY increase, thanks to improved developer accessibility to on-chain data. Furthermore, the report also indicates that there was a QoQ growth of 33% for Indexers, 9% for Delegators, and 2% for Curators on The Graph’s network. Indexers process and store data, Curators identify valuable subgraphs, and Delegators earn rewards by delegating GRT.

At the same time, the platform’s revenue from query fees on The Graph saw a 66% QoQ increase in Q4 2022, with a 6,228% YoY increase. The report also predicts continued growth in query fees with the migration of more subgraphs to the mainnet in the upcoming quarters.

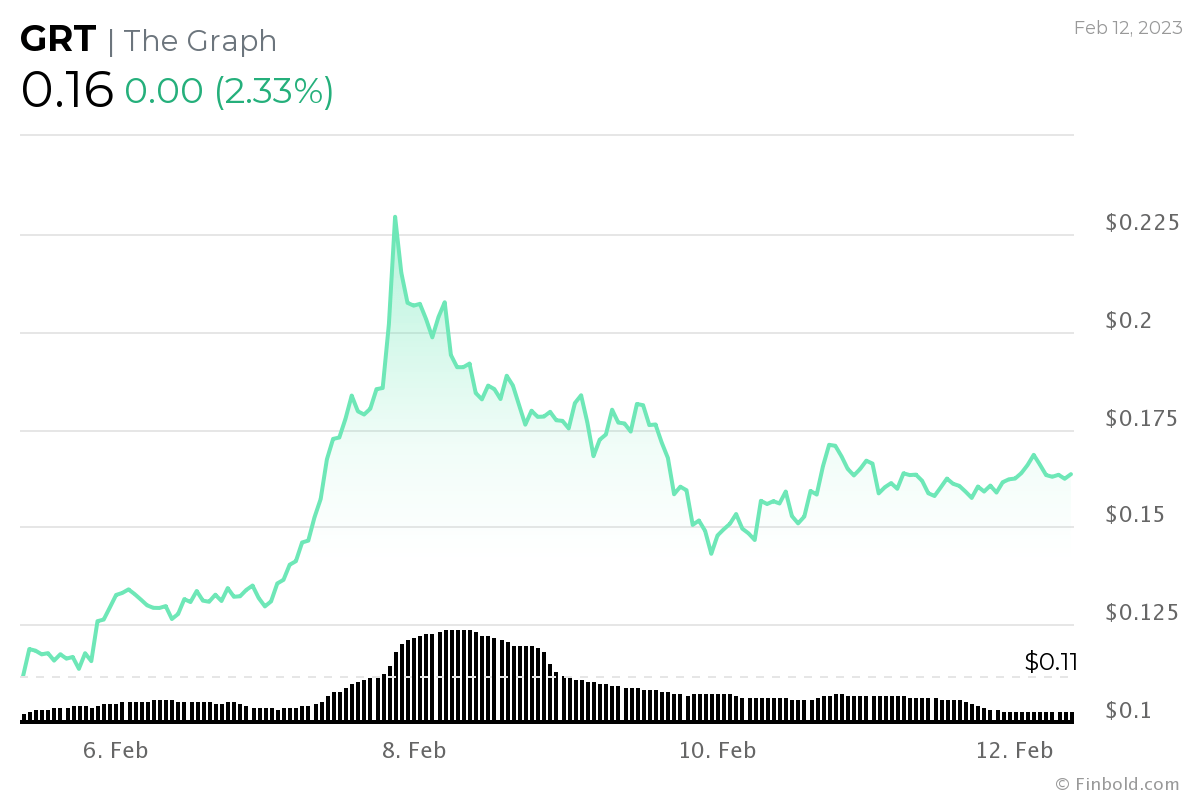

Indeed, the token has ranked among the biggest gainers in 2023 at almost 190%. Although the asset is still attempting to establish itself in the crypto space, its price momentum is of interest, especially on selling and buying pressure trends. Notably, the asset’s price will be under threat of correcting, especially if investors start taking profits. By press time, GRT was trading at $0.16, with gains of over 2% in the last 24 hours.

For the technical analysis, a summary of the daily gauges on TradingView is for ‘buy’ at 14, while moving averages recommend a ‘strong buy’ at 13.

Cardano (ADA)

The Cardano (ADA) ecosystem is dominated by sustained development activities that have accelerated in recent months. Notably, the activities have been touted to help the network’s native token ADA, to rally in the future. Some of the growth saw Cardano hit 5,000 smart contracts as of February 2 since incorporating the functionality in September 2021.

Elsewhere, Cardano emerged in second place among leading smart contract crypto projects by staking market capitalization at $10.4 billion. The network also ranks high in GitHub development activity, with 701 events.

It is worth noting that the focus turns on how Cardano’s price will play out, especially with regulatory concerns around staking. In this line, founder Hoskinson has proposed the contingent staking model as a means of navigating regulatory concerns.

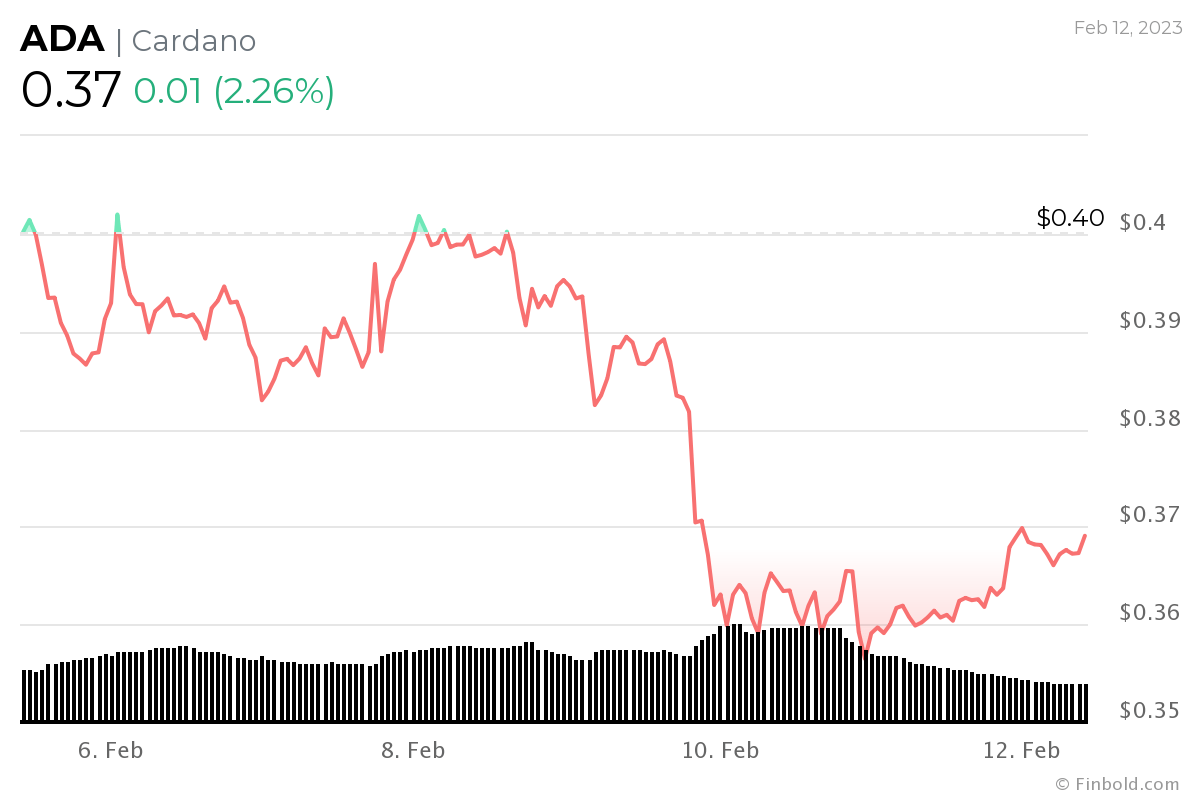

Per the proposal, the participants in the staking will adhere to strong know-your-customer practices. Therefore, the continued fallout from the staking controversy will likely influence ADA’s price in the coming week. By press time, ADA was trading at $ 0.37 with daily gains of over 2%.

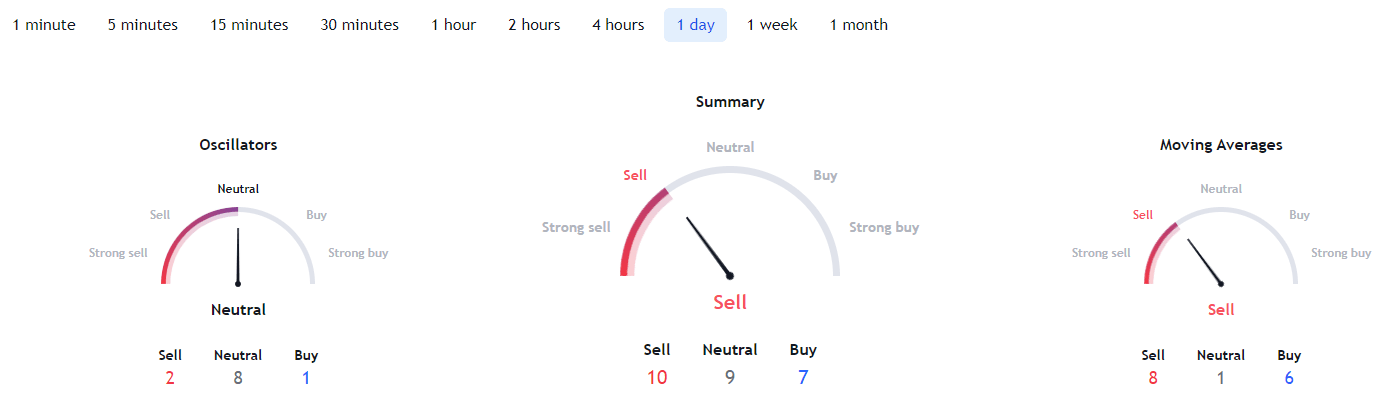

At the same time, ADA’s technical analysis has turned bearish. The one-day gauges on TradingView are summarized by the ‘sell’ sentiment at 10, similar to moving averages at 8.

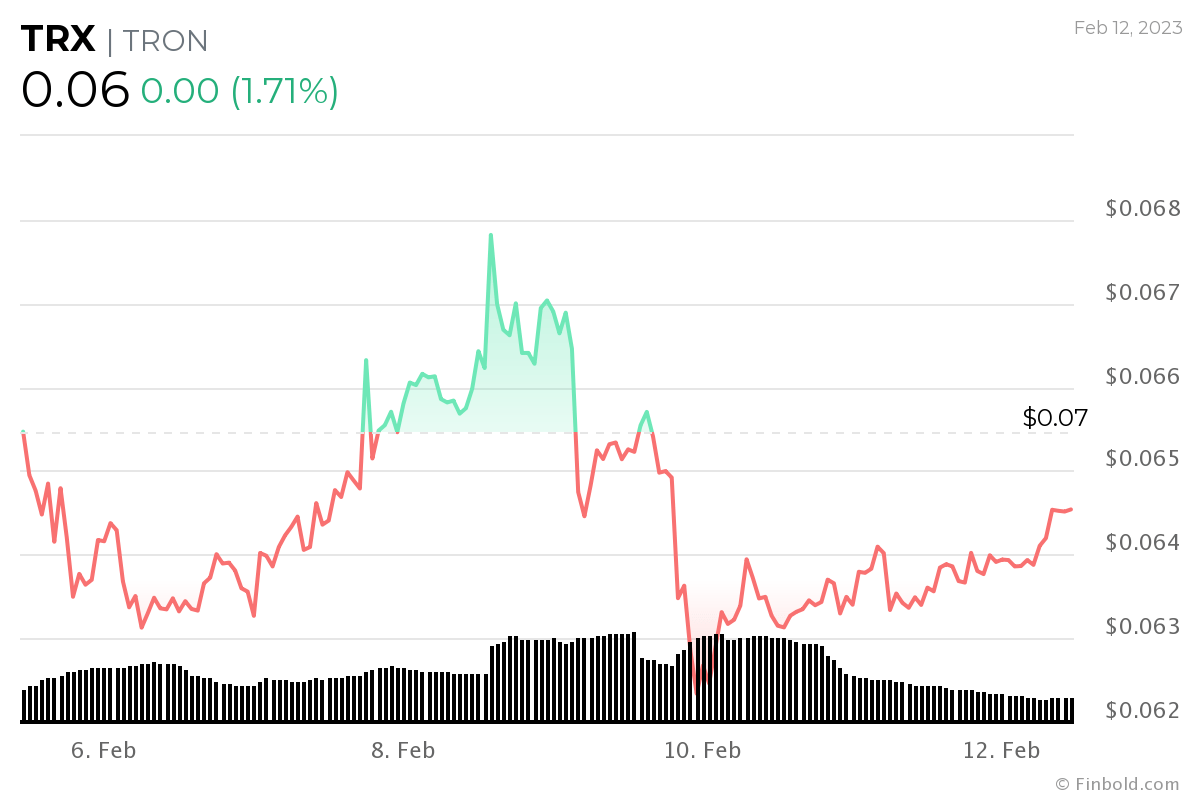

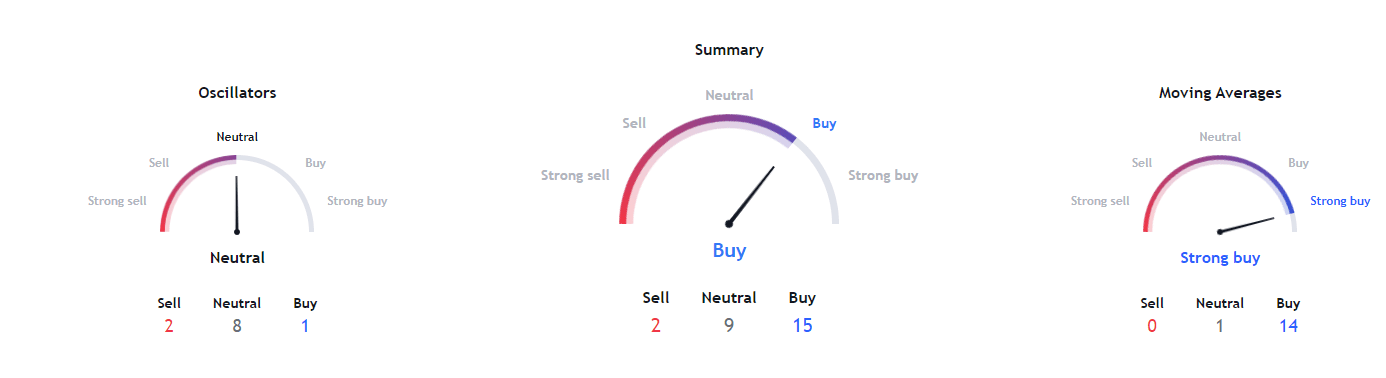

TRON (TRX)

Thanks to sustained network developments and proposed partnerships, TRON (TRX) ranks among the cryptocurrencies to watch. For instance, TRON is making inroads into the AI world, with founder Justin Sun recently announcing the launch of a new decentralized payment framework for AI systems.

According to Sun, the framework will work for AI research company OpenAI and its flagship project, ChatGPT, which is revolutionizing the text-based AI sector.

Additionally, TRON has received support from entities such as crypto exchange Binance. According to the trading platform, it had reset the withdrawal limits on the TRON network to their previous levels, a move that aligns with the community feedback. In this line, Sun revealed that he is working with Binance to reduce withdrawal fees.

Although TRX’s price remains worth watching mainly due to network development activities and partnerships, the platform might face a few hurdles in the coming days. Notably, a recent report by crypto analysis platform Santiment indicated that TRX’s volume had plunged significantly, a fact which can impact the protocol’s future. The metric suggests that fewer people are actively trading TRX, which can impact the token’s liquidity.

By press time, TRON was trading at $0.06, gaining almost 2% on the daily chart.

Elsewhere, from a technical analysis perspective, TRON remains bullish. A summary of the one-day gauges on TradingView recommends ‘buy’ at 15, while moving averages are for ‘strong buy’ at 14.

As the cryptocurrency market faces renewed regulatory scrutiny, the potential for market momentum remains uncertain. However, the selected cryptocurrencies are showing signs of influencing the general market. However, despite their potential, it is worth noting that the cryptocurrency market is volatile and subject to rapid fluctuations.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  TrueUSD

TrueUSD  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD