Total crypto market cap drops to $850B as data suggests further downside

The total cryptocurrency market capitalization dropped by 24% between Nov. 8 and Nov. 10, reaching a $770 billion low. However, after the initial panic was subdued and forced future contracts liquidations were no longer pressuring asset prices, a sharp 16% recovery followed.

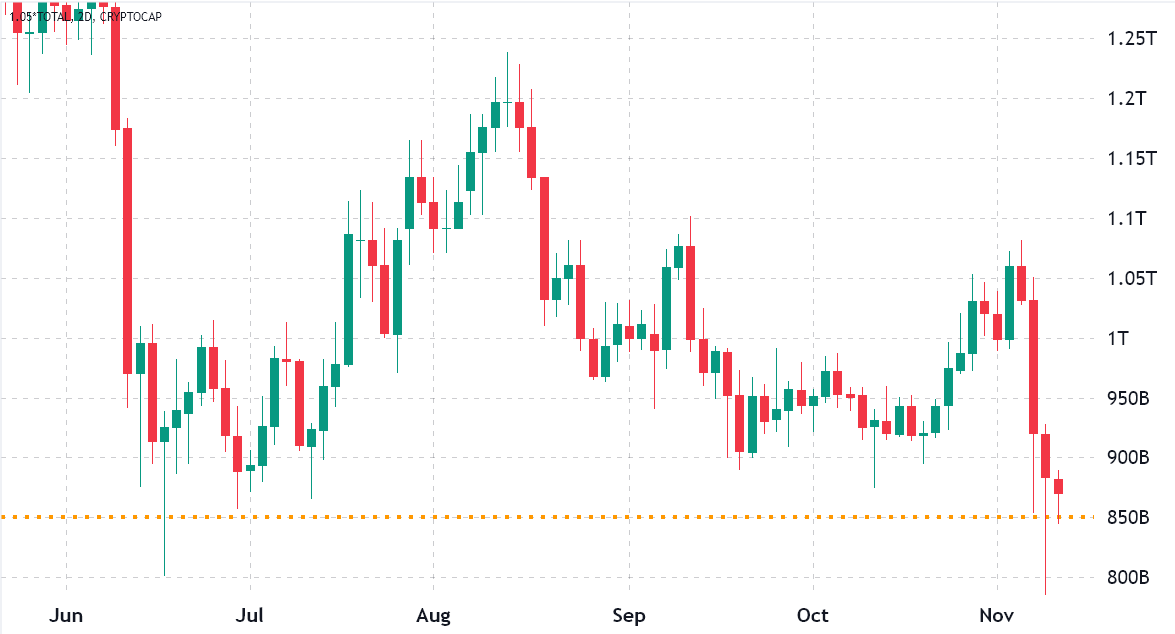

Total crypto market cap in USD, 2-days. Source: TradingView

This week’s dip was not the market’s first rodeo below the $850 billion market capitalization level, and a similar pattern emerged in June and July. In both cases, the support displayed strength, but the $770 billion intraday bottom on Nov. 9 was the lowest since December 2020.

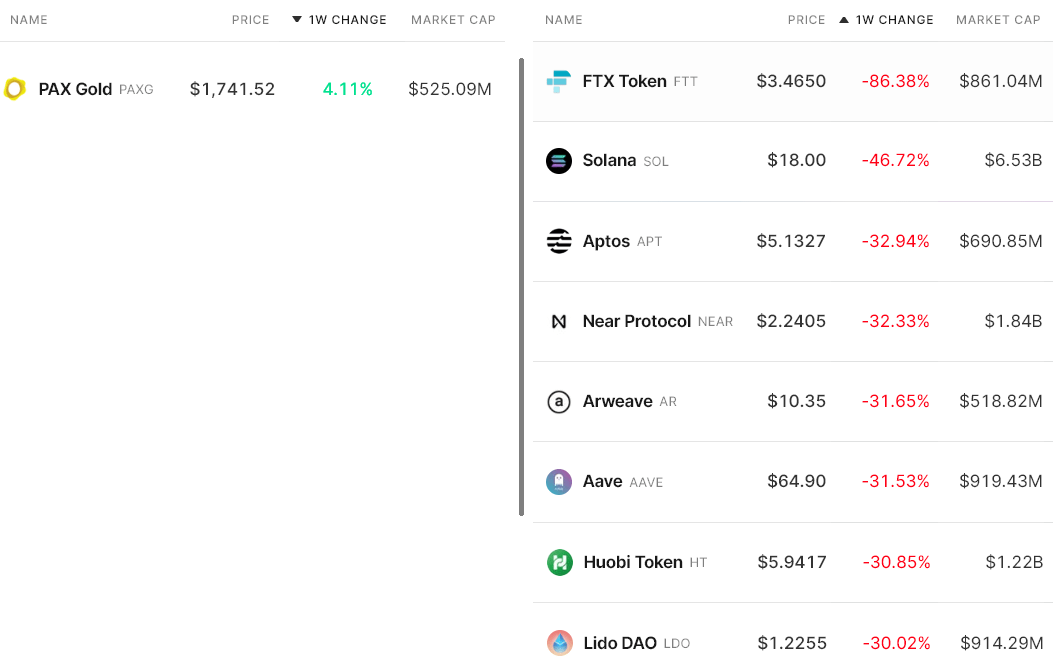

The 17.6% weekly drop in total market capitalization was mostly impacted by Bitcoin’s (BTC) 18.3% loss and Ether’s (ETH) 22.6% negative price move. Still, the price impact was more severe on altcoins, with 8 of the top 80 coins losing 30% or more in the period.

Weekly winners and losers among the top 80 coins. Source: Nomics

FTX Token (FTT) and Solana (SOL) were severely impacted by liquidations following the insolvency of FTX exchange and Alameda Research.

Aptos (APT) dropped 33% despite denying rumors that Aptos Labs or Aptos Foundation treasuries were held by FTX.

Stablecoin demand remained neutral in Asia

The USD Coin (USDC) premium is a good gauge of China-based crypto retail trader demand. It measures the difference between China-based peer-to-peer trades and the United States dollar.

Excessive buying demand tends to pressure the indicator above fair value at 100% and during bearish markets, the stablecoin’s market offer is flooded, causing a 4% or higher discount.

USDC peer-to-peer vs. USD/CNY. Source: OKX

Currently, the USDC premium stands at 100.8%, flat versus the previous week. Therefore, despite the 24% drop in total cryptocurrency market capitalization, no panic selling came from Asian retail investors.

However, this data should not be considered bullish, as the USDC buying pressure indicates traders seek shelter in stablecoins.

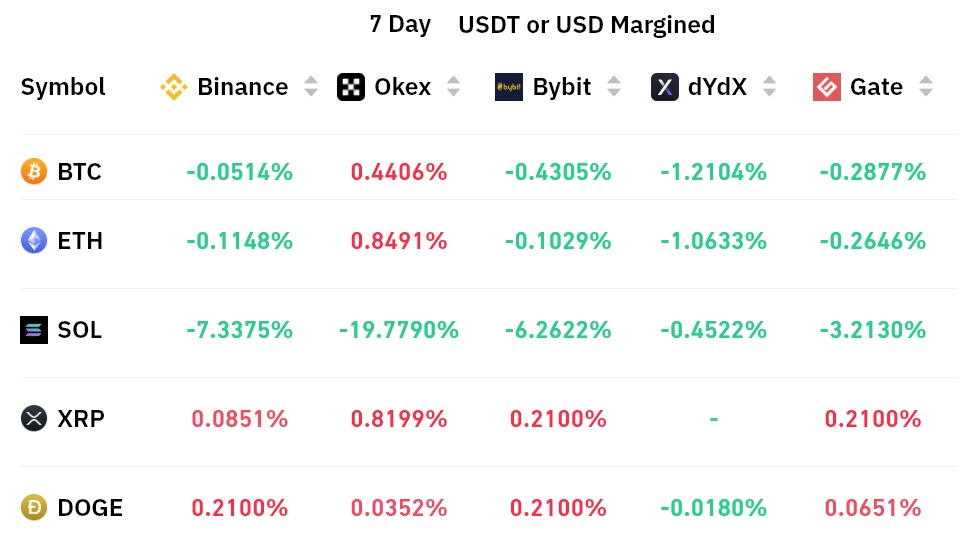

Few leverage buyers are using futures markets

Perpetual contracts, also known as inverse swaps, have an embedded rate usually charged every eight hours. Exchanges use this fee to avoid exchange risk imbalances.

A positive funding rate indicates that longs (buyers) demand more leverage. However, the opposite situation occurs when shorts (sellers) require additional leverage, causing the funding rate to turn negative.

Perpetual futures 7-day funding rate on Nov. 11. Source: Coinglass

As depicted above, the 7-day funding rate is slightly negative for the two largest cryptocurrencies and the data points to an excessive demand for shorts (sellers). Even though there is a 0.40% weekly cost to maintain open positions, it is not worrisome.

Traders should also analyze the options markets to understand whether whales and arbitrage desks have placed higher bets on bullish or bearish strategies.

The options put/call ratio points to worsening sentiment

Traders can gauge the overall sentiment of the market by measuring whether more activity is going through call (buy) options or put (sell) options. Generally speaking, call options are used for bullish strategies, whereas put options are for bearish ones.

A 0.70 put-to-call ratio indicates that put options open interest lag the more bullish calls by 30% and is therefore bullish. In contrast, a 1.20 indicator favors put options by 20%, which can be deemed bearish.

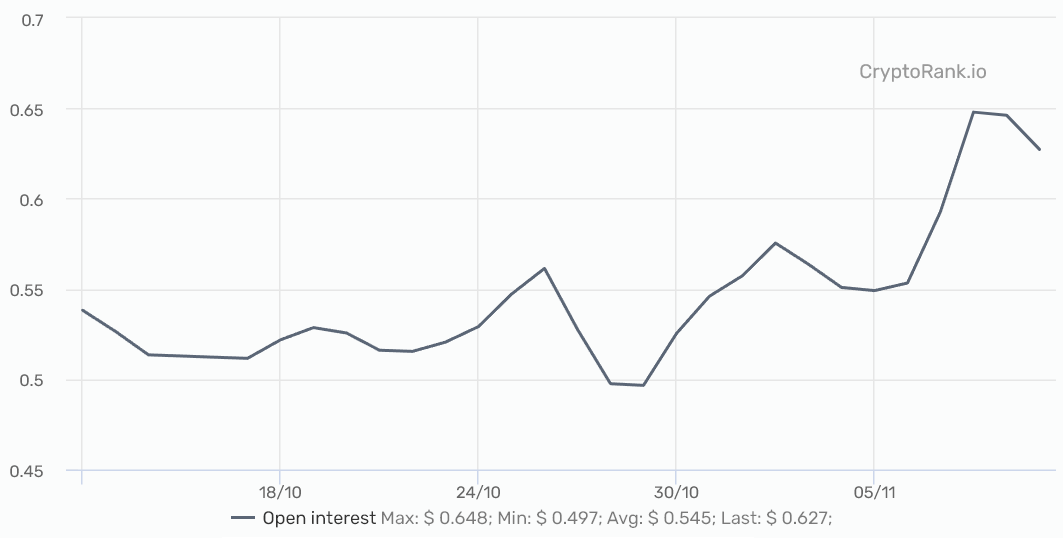

BTC options put-to-call ratio. Source: Cryptorank.io

As Bitcoin price broke below $18,500 on Nov. 8, investors rushed to seek downside protection. As a result, the put-to-call ratio subsequently increased to 0.65. Still, the Bitcoin options market remains more strongly populated by neutral-to-bearish strategies, as the current 0.63 level indicates.

Combining the absence of stablecoin demand in Asia and negatively skewed perpetual contract premiums, it becomes evident that traders are not comfortable that the $850 billion market capitalization support will hold in the near term.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond