What Are Decentralized Stablecoins, and Why Might We Need Them?

Stablecoins are an essential part of the modern crypto scene: from newbie traders and holders with diamond hands to experienced DeFi fans («degens») and GameFi enthusiasts, everyone needs them. Being a censorship-resistant and easy-to-use alternative to fiat money, they have already established themselves as a medium of exchange and store of value.

However, the largest stablecoins (USDT, USDT, BUSD) are not aligned with a decentralization ethos and are vulnerable to the same threats that fiat banking systems are. As such, fully decentralized stablecoins are set to replace them. What have we achieved so far?

What are stablecoins?

Stablecoins are cryptocurrency assets with prices pegged to fiat currencies or precious metals. As such, they are issued, stored and transferred on blockchains (decentralized registers) between accounts (wallets). Largely, stablecoins are pegged to major world currencies: the U.S. Dollar, Euro, Chinese Yuan and Gold (XAU).

The first (and now-defunct) stablecoin, BitUSD, was launched in 2014 on BitShares (BTS) blockchain. Its design was proposed by IOG founder Charles Hoskinson and Block.one’s Daniel Larimer. As per the statistics of the largest crypto assets tracker CoinMarketCap, there are 75 stablecoins on the crypto scene as of early Q2, 2022.

What are centralized stablecoins?

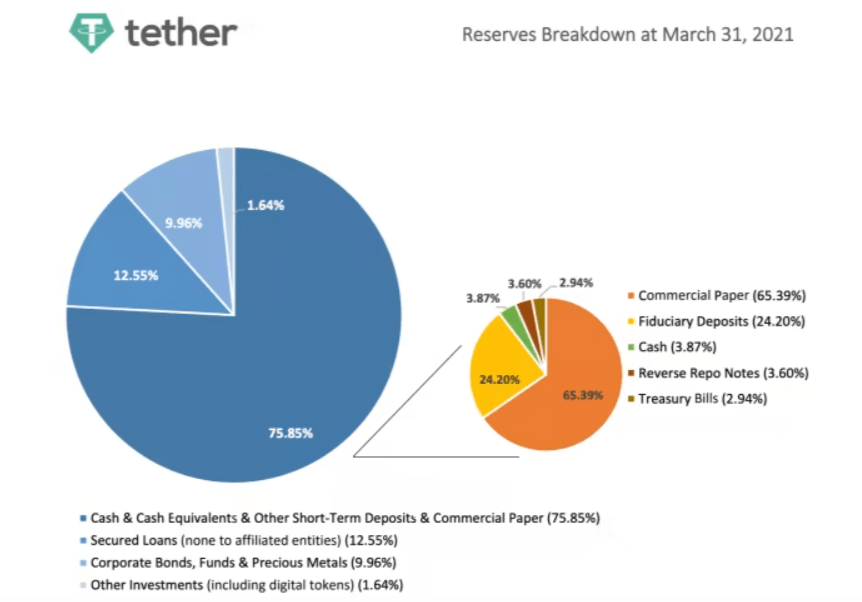

All of the largest stablecoins are centralized: their reserves are guaranteed by this or that financial entity, e.g., if a corporation issues 1 USD-pegged stablecoin on a blockchain, it guarantees that it is backed by 1 USD in value from its reserves.

In turn, the issuer of the stablecoin can store its reserves in fiat money (cash), stocks, treasury bills, corporate bonds, precious metals and so on.

The stablecoin segment is dominated by the three largest centralized stablecoins, i.e., USD Tether (USDT) by Tether Limited, USD Coin (USDC) by Circle Inc. and Binance USD (BUSD) by world-leading centralized crypto ecosystem Binance.

Combined, they are responsible for $151 billion out of $182 billion of capitalization of the entire stablecoin segment, or 82.9%.

What are decentralized stablecoins?

Decentralized stablecoins are not, by definition, issued by centralized banking entities. Its peg to the underlying currency is guaranteed by a hierarchy of smart contracts as well as by a reserve pool of collateral assets.

Decentralized stablecoins implemented sophisticated strategies to ensure the sustainability of their equilibrium. The strategies of «elastic supply» and «collateralized-debt-position» (CDP) are the two most popular in this field.

«Elastic supply» stablecoins like Nu are supported with increased APY for holding them when the price dips below $1. Their monetary design reduces the supply when interest in the token rises and restricts supply.

In collateral-based systems, users can get a certain amount of stablecoins by locking the collateral into smart contracts. Some stablecoin ecosystems are over-collateralized, while the others are under-collateralized: it depends on the loan/collateral ratio.

Pros and cons of decentralized stablecoins

Decentralized stablecoins are far more censorship resistant: for instance, Tether and Circle can «freeze» USDT and USDC in geo-restricted jurisdictions or by government body request.

Also, mainstream media outlets frequently publish reports about a lack of transparency in the reserve systems of major centralized stablecoins. We do not know whether they actually have sufficient amounts of assets in reserve. The peg of decentralized stablecoins is guaranteed by algorithms, so they cannot be controlled by teams or third parties.

At the same time, during periods of extreme market volatility or as a result of FUD, the prices of decentralized stablecoins can lose their peg: their algorithms simply cannot cope with rocketing or plummeting demand.

For instance, DAI dropped to $0.89 on Black Thursday in Crypto in 2020, while Neutrino Dollar (USDN) fluctuated below $0.69 and $1.20 amid the recent Waves v. Alameda Research conflict.

Top decentralized stablecoins in 2022

To address the most dangerous flaws of centralized stablecoins, leading DeFi teams have proposed their unique designs for decentralized USD-pegged assets.

Dai (DAI)

Name: Dai (DAI)

Blockchain: Ethereum

Team: Maker

Market Cap: $6.4 billion

Dai (DAI) is a pioneering decentralized stablecoin by Ethereum veteran Maker. Its design accepts MKR crypto as collateral. The average Maker loan is overcollateralized with a collateral-to-debt ratio of 150%.

For a long time, DAI was the dominant stablecoin of the Ethereum-based DeFi ecosystem.

Magic Internet Money (MIM)

Name: Magic Internet Money (MIM)

Blockchain: Ethereum, Avalanche, Arbitrum, BNB Chain, Polygon

Team: Abracadabra Money

Market Cap: $223 million

Magic Internet Money (MIM) is developed and maintained by the Abracadabra Money team. It can be obtained by the collateralization of vYFI, yvUSDT, yvUSDC, xSUSHI and other interest-bearing assets.

Among all decentralized stablecoins, MIM offers the widest range of blockchains for its operations.

Frax (FRAX)

Name: Frax (FRAX)

Blockchain: Ethereum

Team: Frax Finance

Market Cap: $1.5 billion

Frax (FRAX) promotes itself as the world’s first fractional-algorithmic stablecoin: it is partially backed by collateral and partially backed by algorithms. FXS is used as the main collateral asset for the FRAX ecosystem. By press time, the lion’s share of its reserves is backed by liquidity on Curve (CRV).

USDD (USDD)

Name: USDD (USDD)

Blockchain: Tron

Team: Tron DAO

Market Cap: $724 million

USDD by Tron’s ecosystem is a DAO-managed over-collateralized stablecoin pegged to the U.S. Dollar. H.E. Justin Sun, a founder of Tron (TRX) and CEO of Bittorrent (BTT), launched USDD in April 2022. Tron DAO attracted liquidity to the USDD ecosystem with a breathtaking 30-40% APY on Tron’s DeFis for USDD-based pairs.

Disappointing decentralized stablecoins of 2022

Typically, managing a decentralized stablecoin (its 1:1 peg to the underlying asset, the health of the collateral portfolio, the supply/demand balance and so on) is not an easy task. That is why, in periods of increased volatility, these assets can easily collapse.

TerraUSD (UST)

Name: TerraUSD (UST)

Blockchain: Terra

Team: Terraform Labs

Collapsed: May 2022; imbalance in Anchor Protocol (ANC) caused by unsustainable APYs on UST-based yield farming.

Fei (FEI)

Name: Fei (FEI)

Blockchain: Ethereum

Team: Fei Labs

Shut down: August 2022; Hacker attack on Rari Protocol, regulatory scrutiny, irrelevant product design.

Bottom line

Decentralized stablecoins should be considered a type of stablecoin whose peg to the underlying asset is guaranteed either by some algorithm or collateral structures. This sphere is fast-growing; despite having some issues in terms of stability, it remains the most transparent and DeFi-native type of stablecoin.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  TrueUSD

TrueUSD  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Numeraire

Numeraire  Siacoin

Siacoin  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  BUSD

BUSD  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD