Where To Now For Cosmos As ATOM 2.0 Proposal Rejected

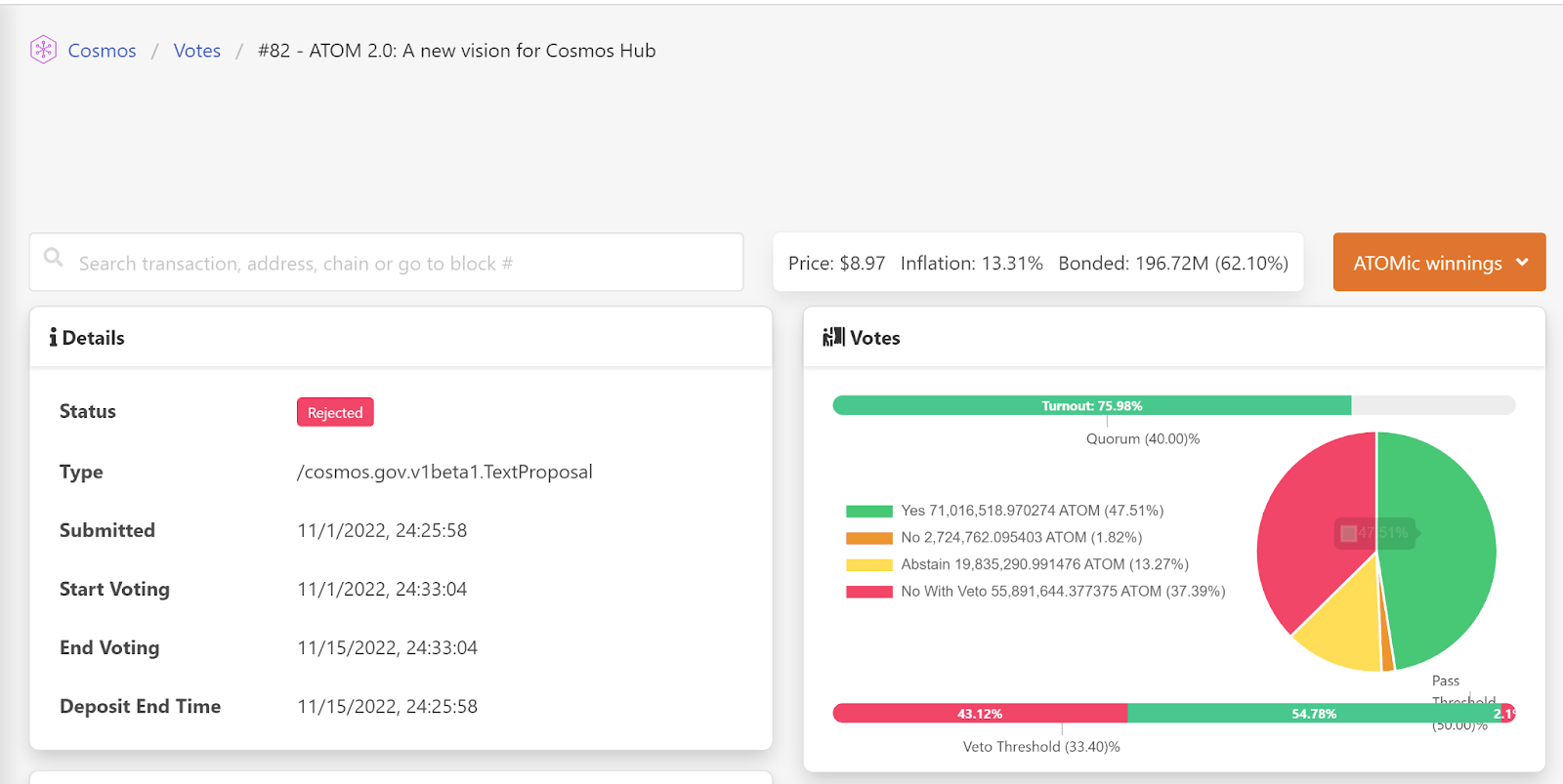

After a tightly contested proposal vote, the Cosmos community has decided to reject a new tokenomics model outlined in the ATOM 2.0 whitepaper. The proposal was rejected on November 15th, 2022.

Source: https://atomscan.com/votes/82

Cosmos (ATOM) is a decentralized network of parallel, independent blockchains, each powered by a Proof-of-Stake Byzantine fault-tolerant consensus model (like Tendermint) designed by Cosmos. It is an ecosystem of blockchains with features that allow them to scale and interoperably communicate with each other.

“Not sure why people are not talking about Cosmos,” tweeted Qiao Wang, a contributor to AllianceDAO and former trader at Tower Research. Wang calls Cosmos “the most used non-speculative DeFi protocol there is” and the best “de-facto cross-chain bet.”

After months of discussions and a two-week voting period, the Cosmos community voted against implementing proposal #82- “ATOM 2.0: A new vision for Cosmos Hub.” The vote asked whether the ideas outlined in a recently written whitepaper should be integrated and fundamentally change the nature of the Cosmos hub ecosystems and the platform’s native token ATOM.

What is ATOM 2.0?

ATOM 2.0 is a vision piece and counterpart to the original 2017 Cosmos whitepaper that articulates a new, integrated vision and direction for the Cosmos Hub. The new whitepaper had 10 different contributors from groups including Interchain GmbH, Informal Systems, Galileo, Hypha Worker Co-op, Inclusion, and Strangelove.

ATOM 2.0 was introduced in a whitepaper that was released at the Cosmoverse conference in late September. It proposes a major expansion to Cosmos Hub, the core blockchain that sits at the centre of the Cosmos ecosystem. It is an app-chain built for facilitating the connectivity between other app-chains within Cosmos. The Cosmos Hub is secured using the ATOM token. Presently, interconnectivity is driven through the use of IBC and transfers between various Cosmos app-chains.

The 2.0 whitepaper expanded the role of the Cosmos Hub and created a new interchain security outline that would allow other chains built on Cosmos to leverage the existing security of the Cosmos Hub. It made suggestions that would have significantly changed the tokenomics of ATOM and outlined building two new tools within Cosmos, the Interchain Allocator, and the Interchain Scheduler.

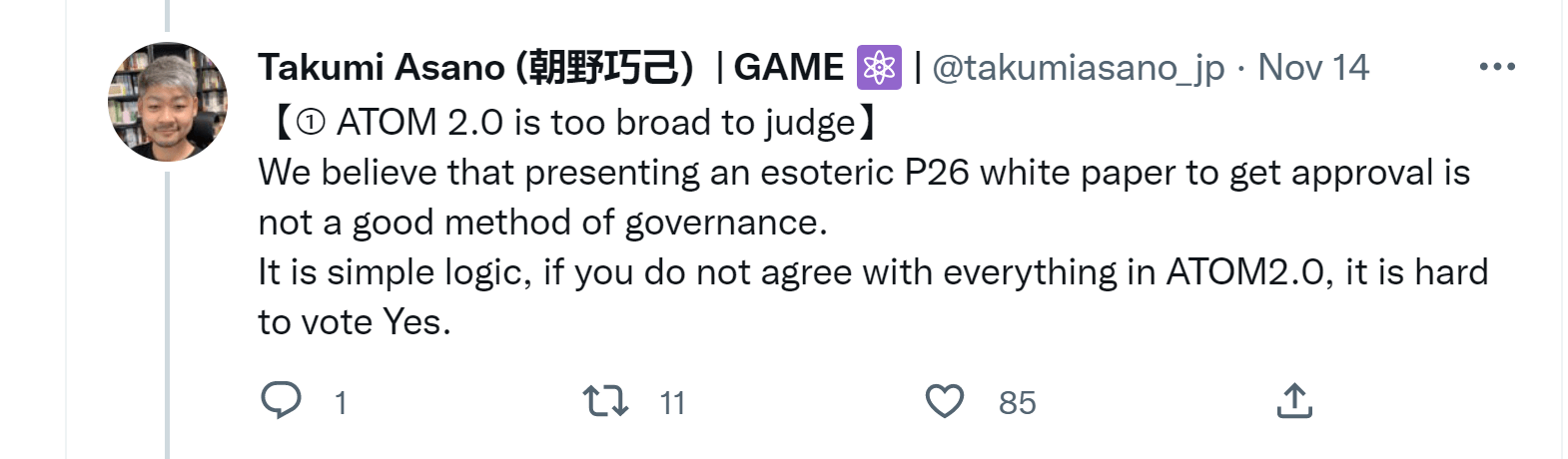

There is a sense that the whitepaper was rejected because there was too much built into it. The Interchain Allocator was designed to allow for mutual stakeholding across Cosmos Interconnected Blockchains. The Interchain Scheduler, for example, aims to be an on-chain MEV marketplace. Interchain security also may have felt like an isolated issue. These are two very different, radical changes to the way Cosmos functions and while the community may have liked some aspects of the whitepaper, others may have required more discussion and assessment.

Source: Cosmos Governance Forum

Source: Twitter

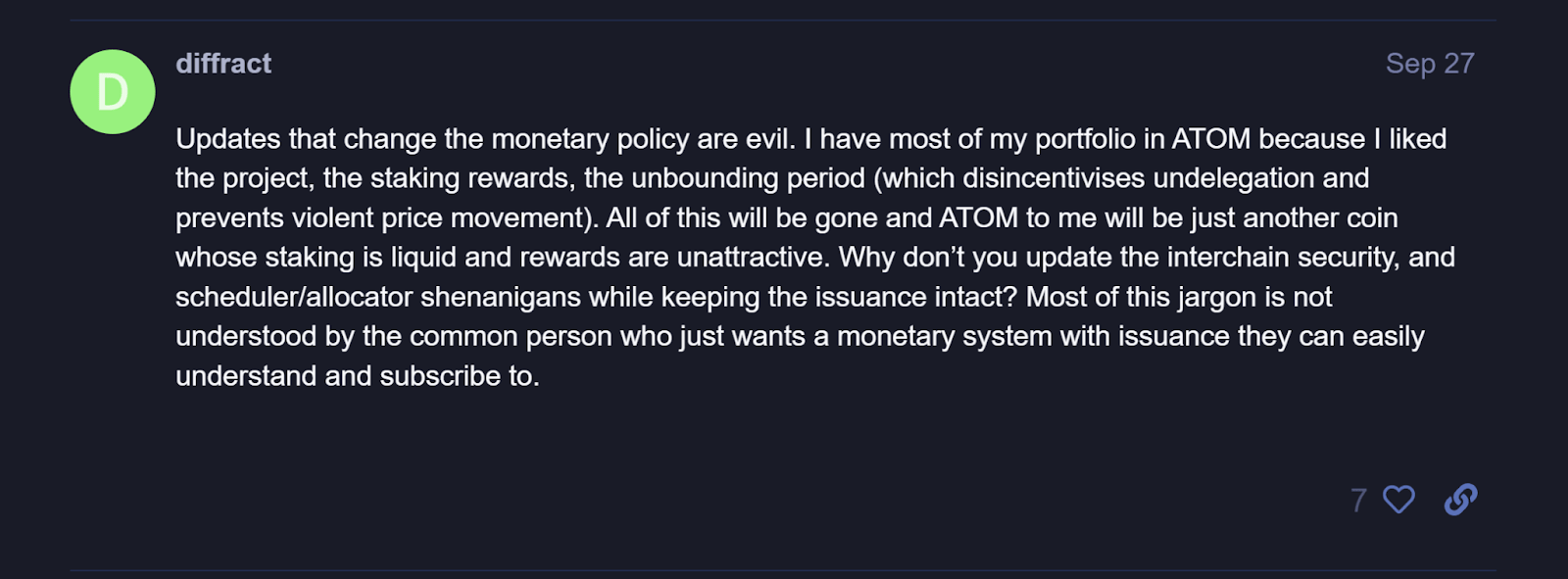

Another major point of contention within the whitepaper was the revamped tokenomics for ATOM. The whitepaper explained a plan to ramp up the issuance of ATOM tokens during a transition to subsidize the hub before the emission schedule slows three years later. “At the beginning of the transition phase 10,000,000 ATOM are issued per month. This issuance decreases at a declining rate until it reaches steady state issuance 36 months later.”

This shift was disputed for a number of reasons, some voters said a drastic shift in the monetary policy wasn’t necessary. Other concerns included whether there would be enough revenue from other sources to replace the ATOM subsidy after 36 months and the lack of details on how the accumulated ATOM would be used. The newly issued ATOM was to be allocated to the Cosmos Hub treasury and not ATOM stakers, another point of contention amongst ATOM governance token holders.

Source: Cosmos Governance Forum

Source: Cosmos Governance Forum

Proposal #82 had an unusually high rate of participation rate. 75.99% of all ATOMs were staked for voting. The vote was close with a large number of ‘Yes’ votes, 47.59% — more than any other option.

The vote didn’t pass because of a unique Cosmos governance mechanic. if more than 33.4% of voters opt for “NoWithVeto”, then a proposal cannot pass within Cosmos. ‘NowithVeto’ indicates stronger opposition to the proposal than simply voting ‘No’. Just a third of votes allocated to this option is enough for proposal rejection. 37.39% of voters picked this option, along with 13.27% who voted for ‘abstain’ and the 1.82% who voted ‘No’.

In a tweet thread one of the authors of the Whitepaper, Cosmos co-founder, Ethan Buckman acknowledged NowithVeto’s perspective and stated “the proposal in its current form is untenable. Even if it passed, amendments would be necessary!”

One of the authors of the paper, Jelena Djuric of Informal Systems (who is also a core contributor to Cosmos) told Brave New Coin “This proposal is a high-level direction for the ecosystem, not a roadmap for execution.” The development team brought together is set to continue working on some of the key features outlined in the Whitepaper like Interchain security.

While tokenomics and the far-reaching nature of the Cosmos hub were rejected. The wider goals are to create more value for the ATOM token and drive more interconnectivity throughout the Cosmos ecosystem. Durkic also told BNC “One of the main objectives behind ATOM 2.0 is creating incentive alignment between the Hub and the rest of the IBC economy. This means getting ATOM in the hands of as many promising projects as possible through services such as security and liquidity. The reason we believe this is achievable boils down to the Scheduler, the Allocator, and the flywheel that exists between them.”

Cosmos’s most notable use case is its Application-Specific Blockchain (‘App-chain’) framework. Projects like the Binance-Chain and Thorchain have been built on top of Cosmos as App-chains use the built-for-purpose use case-specific solutions Cosmos offers.

Initially, the App chains built on top of Cosmos were separate and ran independently, however, with the launch of Inter-Blockchain-Communication (‘IBC’) in 2021, this changed. IBC enabled the independent blockchains on Cosmos to connect, transact and exchange tokens and other data fluidly for the first time — and this has led to the ecosystem growing in scale and utility.

At the center of the Cosmos ecosystem is the Cosmos Hub. This is an app-chain built for facilitating connectivity between other app-chains within Cosmos. The Cosmos Hub is secured using the ATOM token. Presently, interconnectivity is driven through the use of IBC and transfers between various Cosmos App-chains.

Currently there are two key drivers of value for ATOM holders. One is transaction fees generated through IBC transactions and the other is inflation rewards earned through ATOM new token issuance. This is set to be expanded if some of the ideas discussed in the ATOM 2.0 Whitepaper are ultimately deployed.

Where To Now For ATOM?

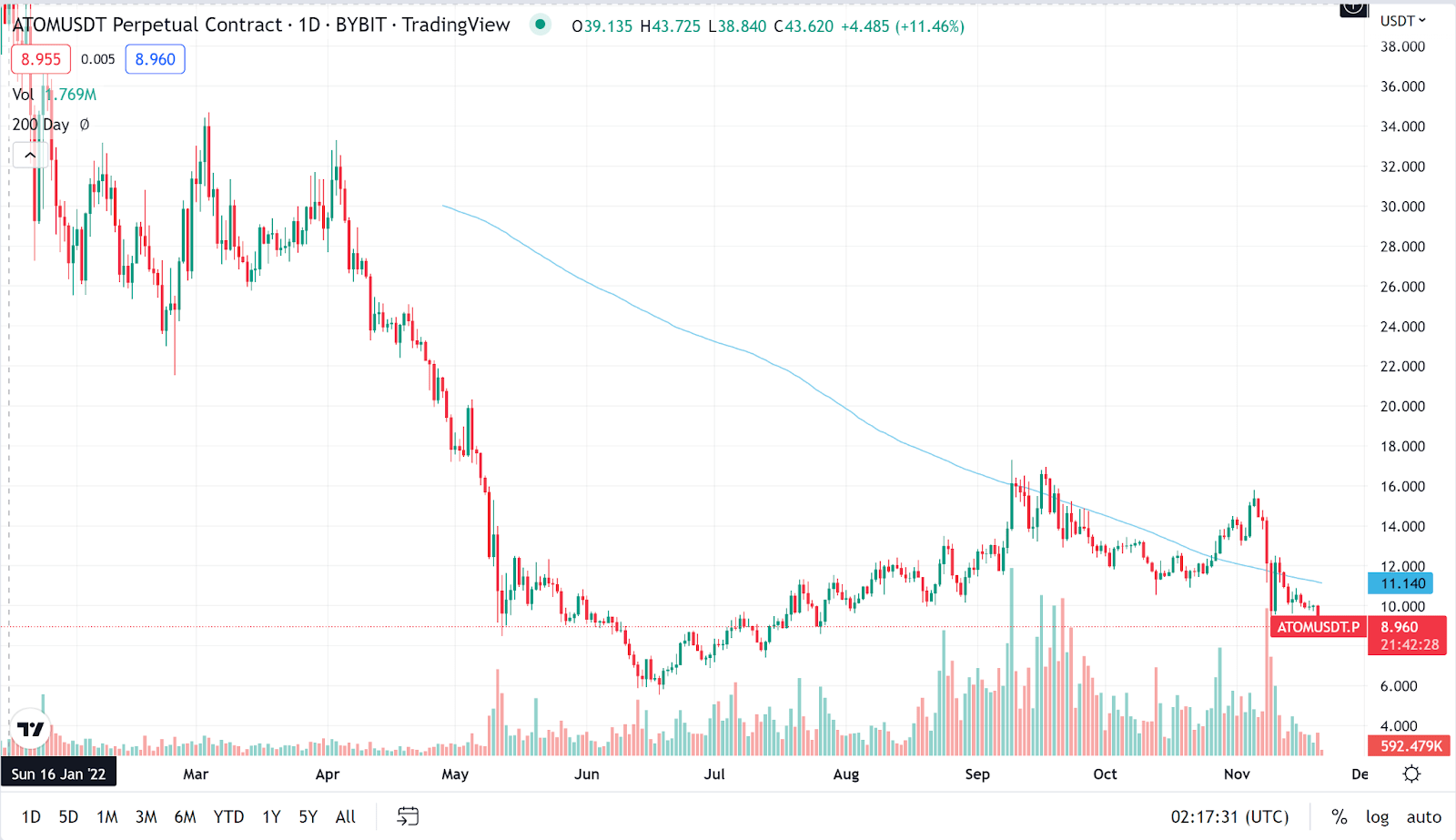

Recent months have been a rollercoaster for Cosmos stakeholders. ATOM enjoyed a recent period of strong price momentum, that has now been derailed. Following the Ethereum Merge on September 15th, traders were looking for exciting assets with some kind of upcoming catalyst in an otherwise quiet market. ATOM ticked this box and enjoyed a strong period of price momentum between October 13th and the 6th of November where its price rose from US$11.30 to US$15.49.

The chart above evidences how in mid-October, ATOM had clearly broken above its 200-day moving average after struggling to break past it in September. Following the breakout, ATOM looked as though it may continue its price momentum, however, the FTX black swan event derailed this momentum and canceled out any bullishness. ATOM, like most assets across the crypto space, was pulled into the FTX whirlpool with its price falling by 41.7% from US$15.40 to US$8.98 after the collapse.

The Ethereum Merge was years in the making and created new fundamental value for the Ether token when it was completed in September. At that time was a sense of ‘over to you’ to other assets in the platform blockchain space. Platforms like Cosmos, Solana, and Fantom had an opportunity to be the post-merge trade during Ethereum’s cool-off period. Cosmos and the release of the ATOM 2.0 whitepaper was a key fundamental update that drove investors as momentum from the Ethereum Merge slowed.

Although the ATOM 2.0 proposal was rejected by its community, progress on the protocol continues and there was actually significant value and learning to be had from the voting process. The high rate of participation in the ATOM 2.0 proposal is encouraging. It suggests a token-holding community that is actively invested in the future of the protocol. Additionally, the positive, unfettered reaction from the Whitepaper’s authors to its criticisms suggests more updates and development are coming for the Cosmos ecosystem.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond