Why Algorand price could continue to pack on negative returns in December

- Algorand price shows rejection from a critical barrier, which could entice a sweep of 2020 liquidity levels.

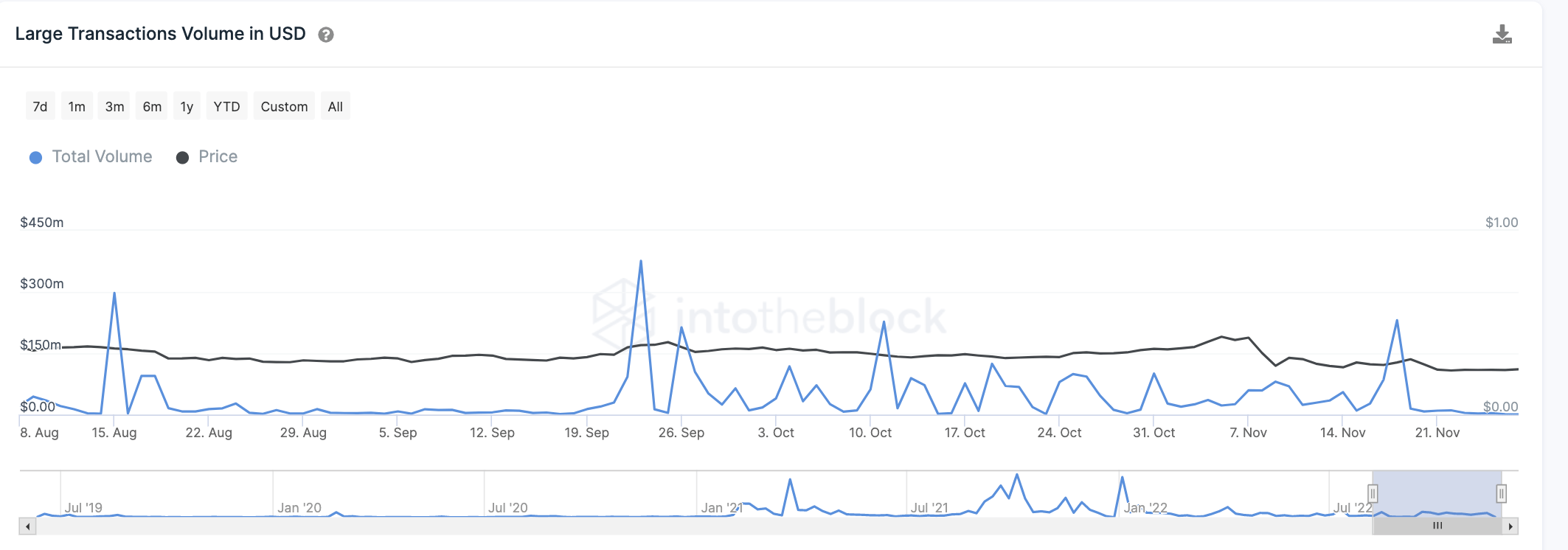

- ALGO shows an uptick in large transactions, which has resulted in significant selloffs this year.

- A flip of the 8-day exponential moving average into support could invalidate the bearish stronghold

Algorand price continues to pack on negative returns for November. As the final days of the month approach, knife-catching bulls are skimming through all digital assets looking for a last-minute opportunity. Unfortunately, the ALGO price may not be a top pick to bounce anytime soon, as the technicals show confounding evidence of bearish control.

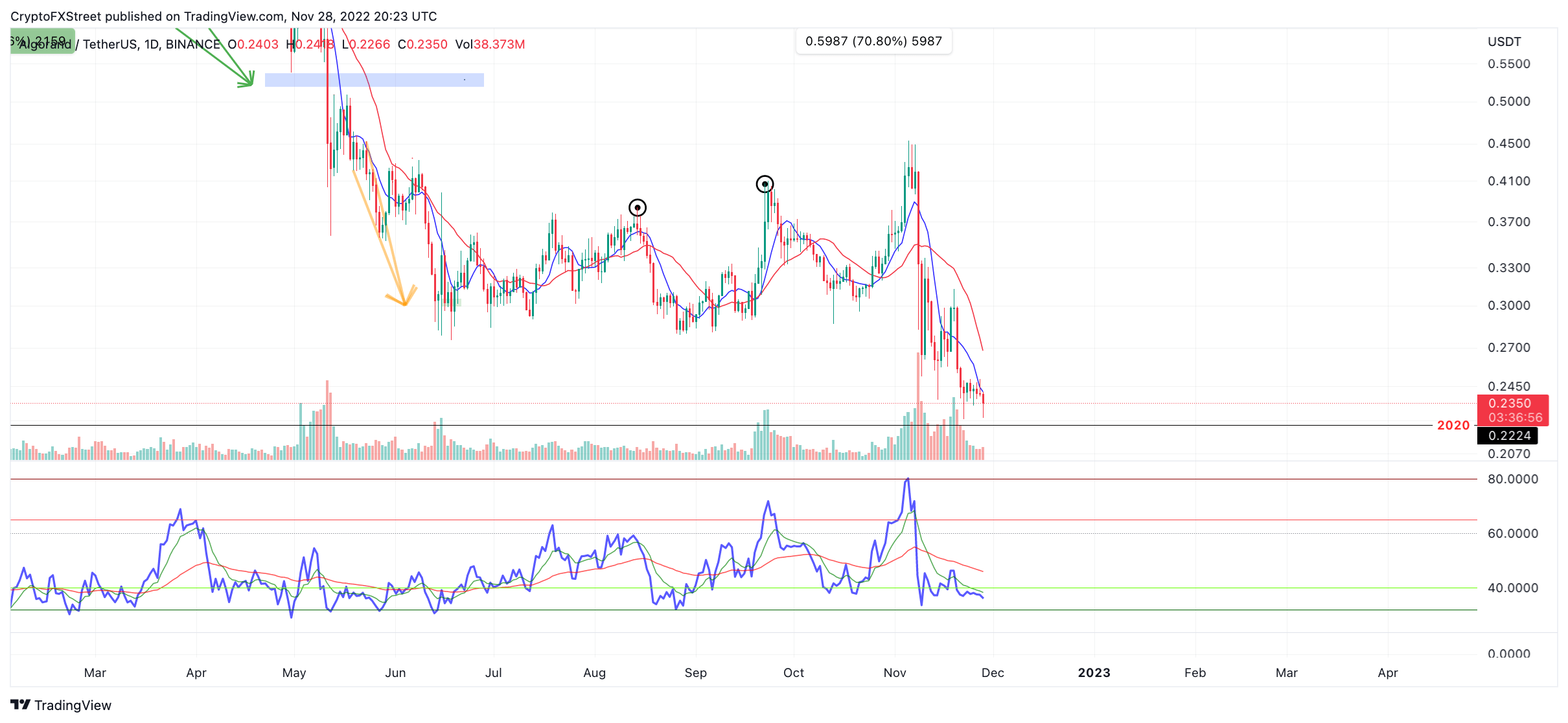

Algorand price looks problematic

Algorand price has endured a 47% decline since the beginning of the month. As the selloff progresses, the price action has become congested near $0.20 as the bulls and bears have grappled over a trading range over a week.

On November 23, the bulls printed a morning star pattern, signaling for sidelined bulls to enter the market. Classical price action traders likely placed their stop under the monthly low at $0.225 in hopes of a retaliation rally against the bearish onslaught.

On November 27, the bulls bolstered their first attempt at reconquering the 8-day exponential moving average (EMA), but unfortunately, the price was rejected and has been trading beneath the indicator ever since.

Algorand price currently auctions at $0.233 and has yet to invalidate the bullish signal. However, on-chain metrics hint that the move south could be coming soon. According to Into-the-Blocks’ Large Transactions by Volume Indicator,

The indicator had a similar reading on August 15 and September 23 at $375.8 and $297.4 million dollars. Interestingly enough, the Algorsand price fell by 23% and 27% in less than a week after indicators’ influx spikes were displayed.

Intotheblock’s Large Transactions Indicator

Algorand price is already down 20% since the indicator’s reading but can continue to fall as the rejection of the 8-day EMA could provoke the breach of the newfound monthly low at $0.237. A breach of the low would likely promote further downtrend price action targeting the 2020 liquidity at $0.224 for an additional 8% dip in market value.

ALGO/USDT 1-day chart

The bulls will need to conquer the 8-day EMA to secure the confidence amongst bulls and invalidate the bearish thesis. A breach above the moving average could promote a rally towards the 21-day simple moving average of $0.270, resulting in a 17% increase from the current Algorand price.

Here’s how Bitcoin price moves could affect Algorand price

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren