Why Investors may want to prepare for a discounted MATIC price

- MATIC price fails to break through the upper boundary of the trend channel twice.

- The rejection occurred at a crucial bearish level on the Relative Strength Index after climbing back from oversold territory.

- Invalidation of the bearish thesis is a breach above $0.86

Polygon’s MATIC price hints at a strong bearish influence. The signals may be uncommon to the untrained eye.

MATIC price might become problematic

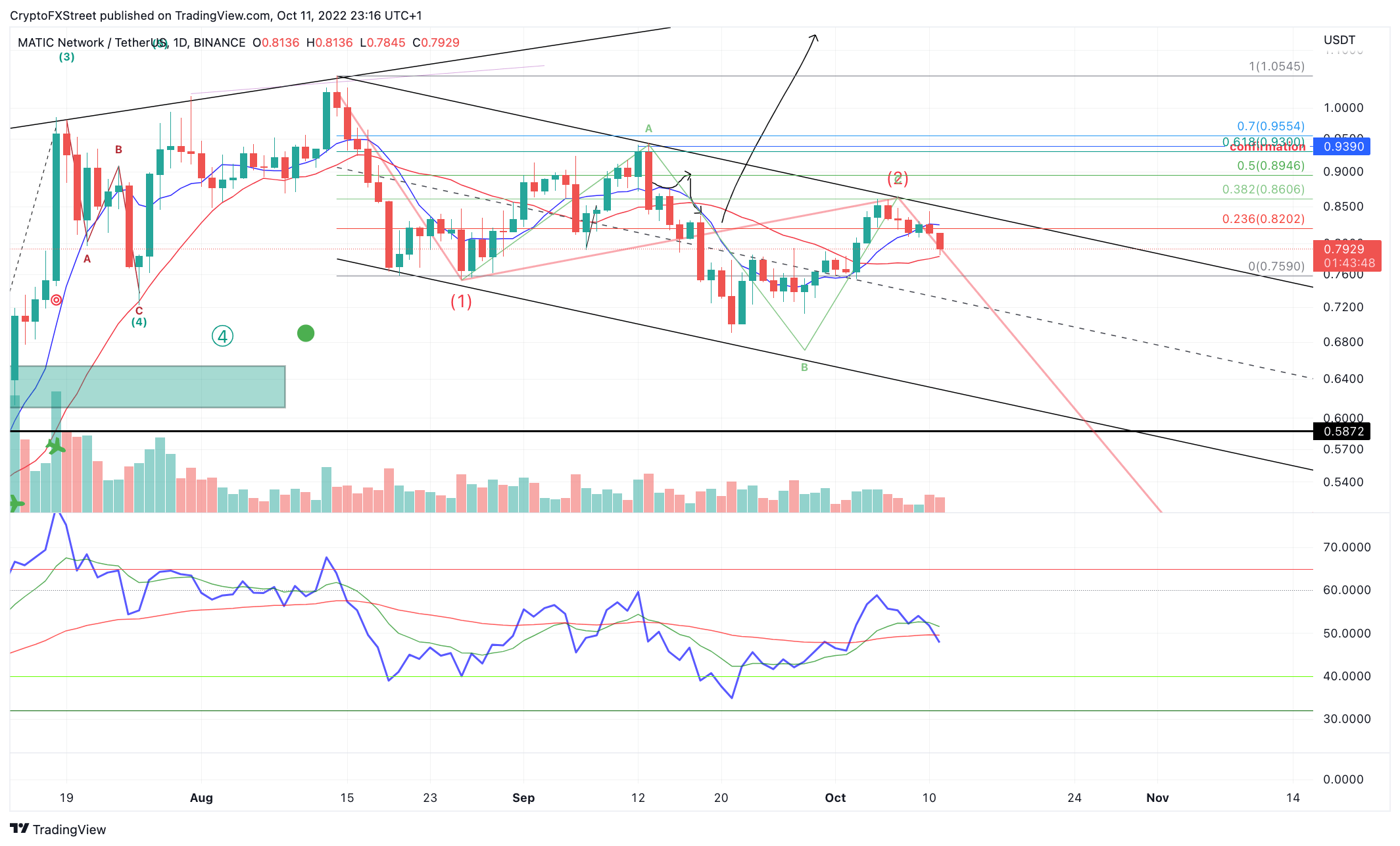

MATIC price is down 7% on the month as the bears have jumped back into the market during the second week of October. The down move was catalyzed near the top of a descending parallel channel that also acted as strong resistance in September when the smart contract token auctioned near $0.90. The consecutive rejections near the descending barrier could be the early imprint of a much stronger influence on the MATIC price than meets the eye.

MATIC price currently auctions at $0.79 as the bulls have lost ground from the 8-day exponential moving average. The Polygon Network token is now testing the 21-day simple moving average as the next level of support. If the indicator does not hold, the downtrend move targeting the lower end of the descending channel near $0.62 will likely be solidified.

The Relative Strength Index confounds a strong beamish presence as The recent rejection from near the upper bounds of the descending trend channel occurred simultaneously at a key bearish. It is worth noting that the bulls climbed into the resistance barrier after falling into extremely oversold territory on higher time frames.

MATIC/USDT 1-Day Chart

The scenario underway for Polygon could be problematic when tying it all together. The RSI indicator may suggest that the same bears who descended price into oversold levels are now back in the market and will be aiming to establish new lows again.

Still, technical analysis is always subject to interpretation and is never a set guarantee. Invalidation of the bearish thesis is a breach above the recent swing high at $0.86. If the bulls can hurdle the barrier, an additional rally toward the $1.20 liquidity levels could occur. Such a move would result in a 50% incline crease from the current MATIC price.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  0x Protocol

0x Protocol  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur