Will Bulls Correct the Aptos Market After a Two-Day Price Fall?

Apto’s (APT) price has been falling since yesterday, and bears are currently in control of the APT market. The bear market intervention altered the direction of the APT price trend. APT found support at $3.58 and resistance at $3.922 when the bears took control of the market.

The price of APT has decreased by 0.35% over the past day and is now trading at $3.18. The market capitalization has declined by 0.40% to $413,362,301. The trade volume, on the other hand, increased 5.18% to $66,204,213, indicating a negative outlook.

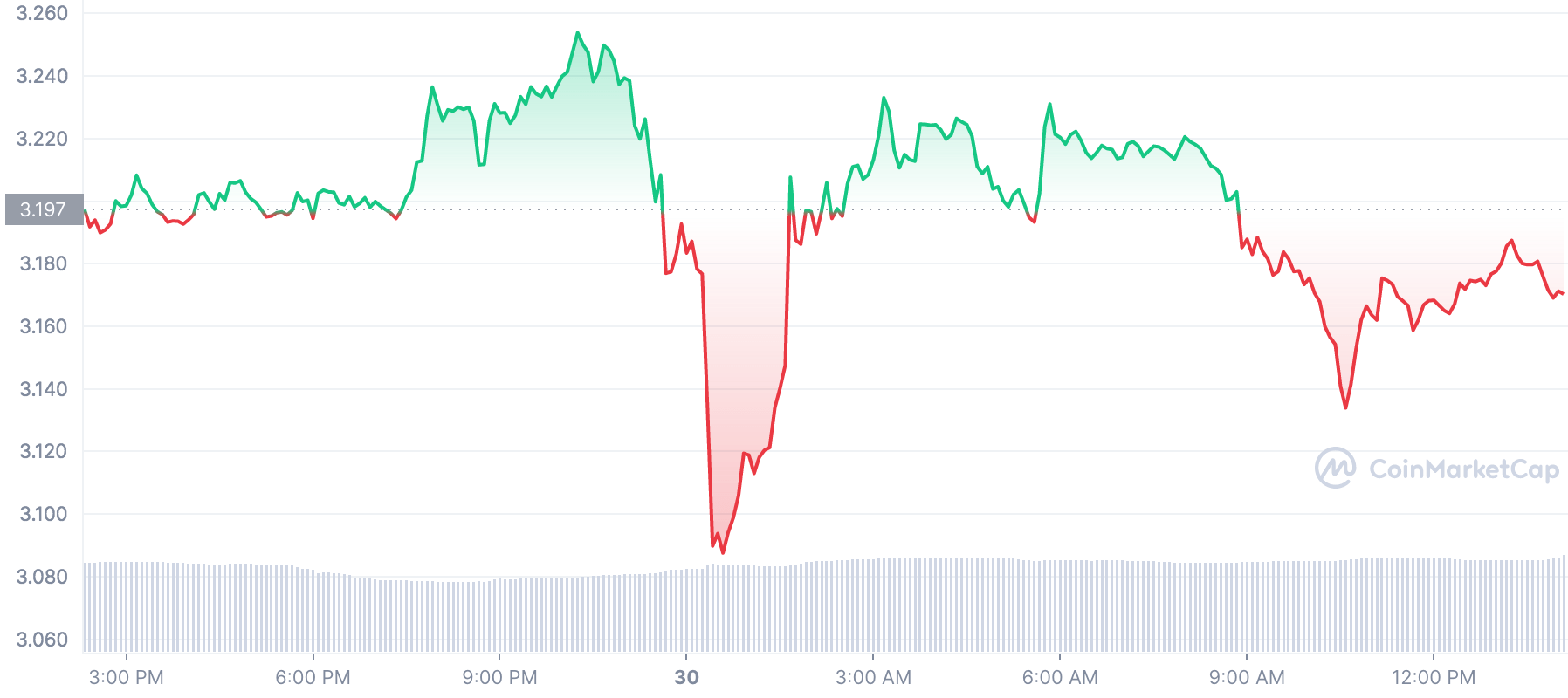

APT/USDT 1-Day Trading Chart (Source: Coinmarketcap)

The upper and lower bands of the Bollinger Bands touched 3.0876 and 3.259, respectively, indicating an increase in selling pressure in the APT market. This downward trend is supported by the bearish engulfing candlestick pattern.

APT began trading at an intraday low of $3.18, per the price analysis of the daily chart and has since sunk sideways, forming a descending triangle pattern. The 200 and 100 SMA curves are holding the price steady, pointing to a long-term negative trend.

The histogram’s position in the negative region is another element bolstering this bearish trend. This motion supports the idea that the bear trend in the APT market will last for some time.

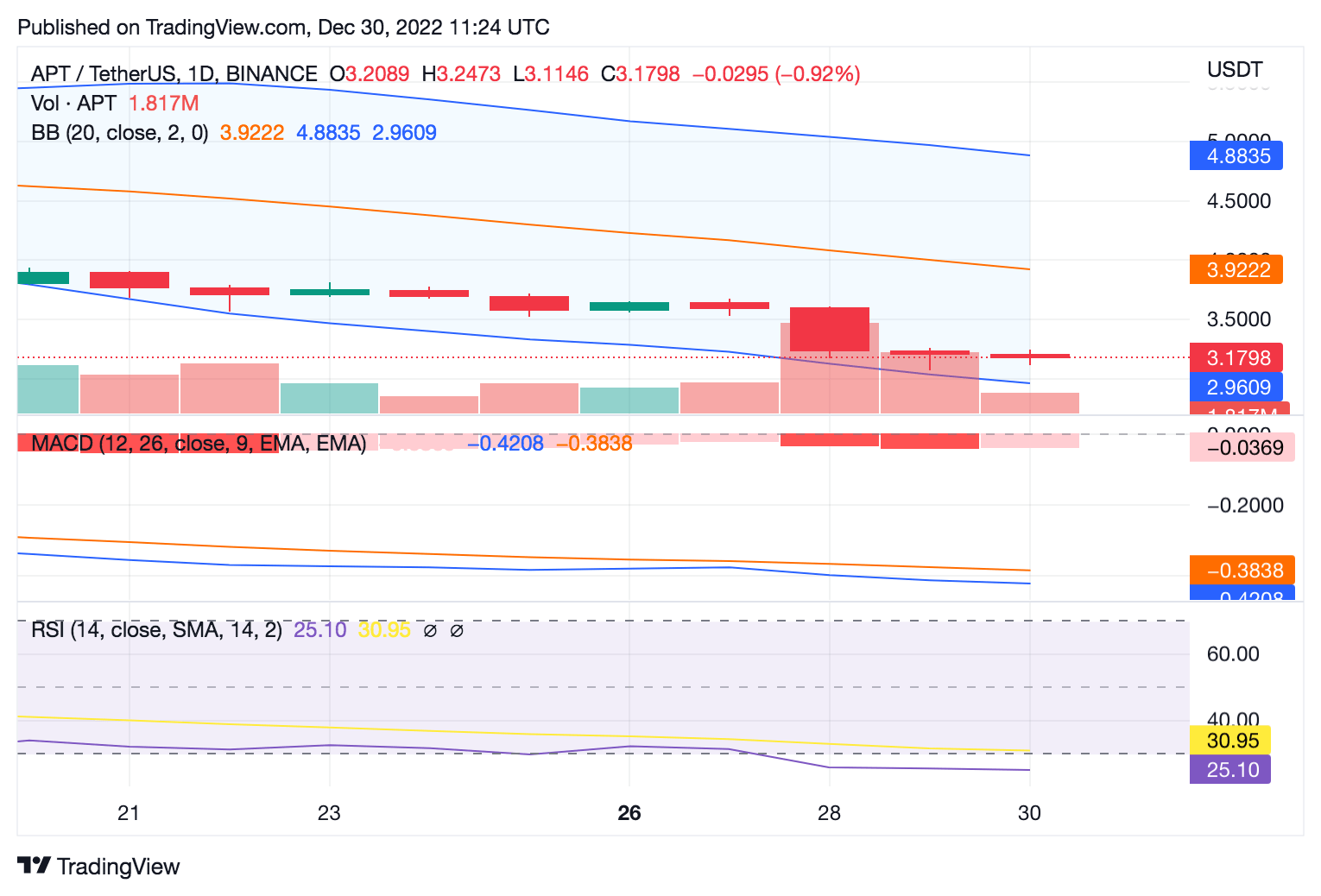

APT/USDT 1-Day Trading Chart (Source: Trading view)

Prices have been progressively sliding into the lower band, which indicates that bear vigor will likely prevail and is another sign that the current market pattern may continue.

According to the Relative Strength Index (RSI) line, which is currently at 25.10, the market’s current bearish trend may continue. Investors are worried about the likelihood of a bearish persistence because the most recent dip below its SMA line is extending the current negative trend.

The 9-day and 20-day EMA lines, as well as the daily RSI indicator, all showed negative indications at the time of publication. The daily RSI line has crossed below the daily RSI SMA line and is currently sloping down towards the oversold area. Currently, the 20-day EMA line is higher than the 9-day EMA line. These two indicators suggest that Aptos’ charts are under a strong bearish influence.

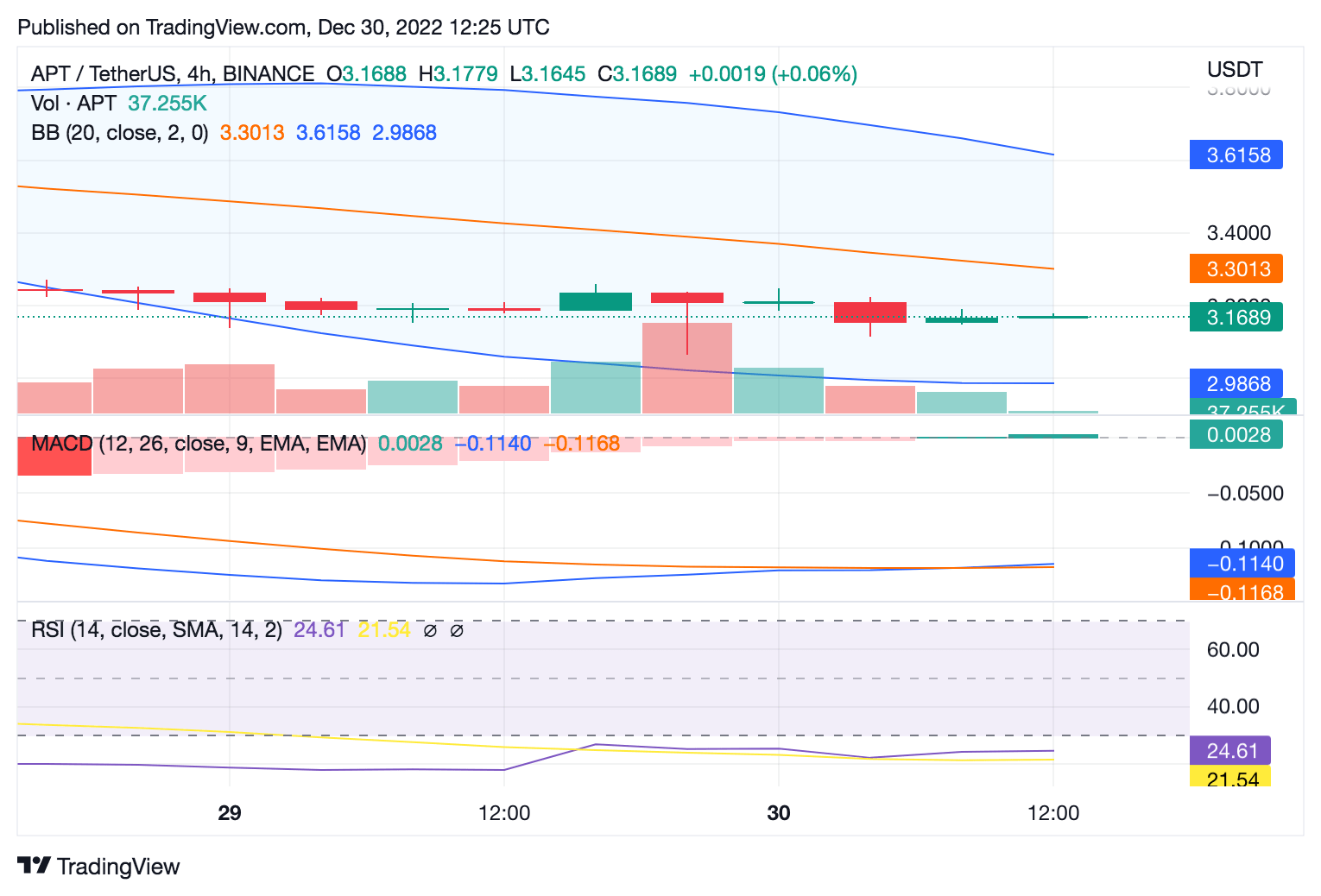

APT/USDT 1-Day Trading Chart (Source: Trading View)

The bulls have started to show positive signs of a market reversal to a bullish trend on the four-hour chart. They have pushed the price up to $3.16 in the near term and would make APT surge past the current resistance level at $3.2071.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur