Will the Fed Shift Monetary Policy Amid a Banking Crisis?

On March 22, the Federal Reserve will announce its next interest rate move at the Federal Open Market Committee (FOMC) meeting. Now that such deliberations are enveloped in the US banking uncertainty, is the overall monetary policy at a turning point?

Navigating through the Fed’s Boom and Bust Cycles

There is no shortage of comparisons between the present US banking crisis and the Great Financial Crisis (GFC) of 2008. And for a good reason. In 2008, Seattle’s Washington Mutual went bust as the largest bankruptcy in US history, holding $307 billion worth of assets.

Over the last month, Silicon Valley Bank and Signature Bank failed, holding $327 billion combined. In September 2008, the Federal Deposit Insurance Corporation (FDIC) seized Washington Mutual and sold it to JPMorgan Chase for $1.9 billion.

In response to the evolving crisis, the FOMC lowered its federal funds rate from 4.5% at the end of 2007 to 2% in September 2008. So, what led Washington Mutual to fail in the first place? Although there are multiple contributing factors, the biggest one is the federal funds rate, the Federal Reserve’s primary tool to set the cost of capital:

- In response to the weakened economy, following the Dot-com bubble burst in 2001, the federal funds rate decreased from the 2000s’ 6.24% to 2004’s average rate of 1.83%.

- In turn, the Fed began to fuel a new bubble – the housing market bubble. The sharp rise in home prices led to more subprime mortgages, including to borrowers who couldn’t afford them.

- Repackaged into derivatives via collateralized debt obligations (CDOs) and credit default swaps (CDSs), subprime mortgages injected risk into the entire financial system.

And just like the Federal Reserve started to lower the federal funds rate after the Dot-com bubble, the central bank increased it up until September 2007’s 5.25%, bursting the housing market bubble.

To speed up economic recovery, the following decade resulted in near-zero interest rates (0.25%) up until 2016. But following “implications of global developments for the economic outlook as well as muted inflation pressures,” rate cuts again came into play in July 2019.

The Federal Reserve manages economic conditions through the federal funds rate, resulting in manufactured bearish and bullish cycles. Image credit: StLouisfed.org

However, from 2019 to 2020, monetary policy took an unprecedented turn.

2019 Repo Crisis as Stimulatory Precursor

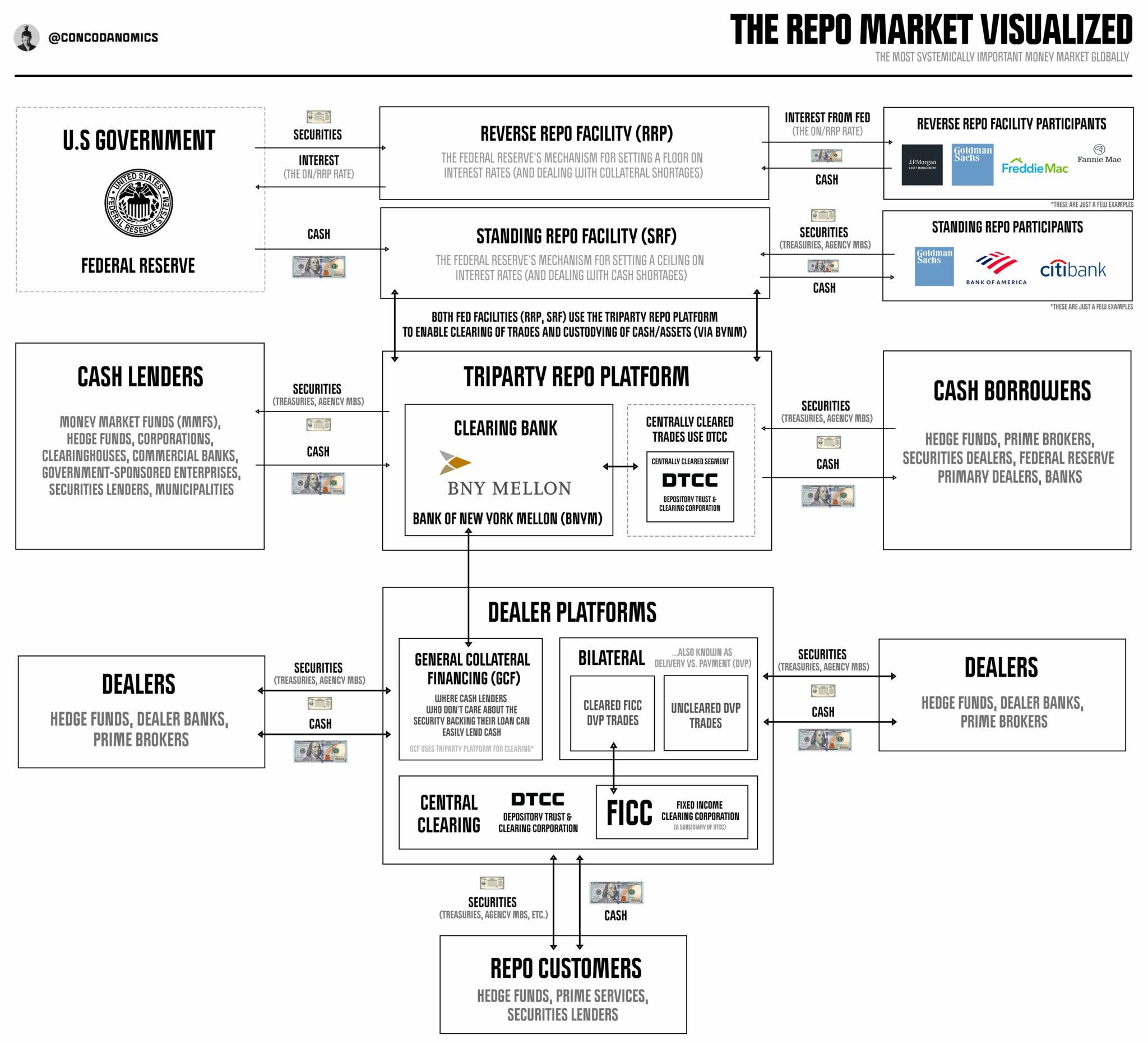

In September 2019, a repo crisis was emerging, disrupting the money markets. Short for repurchase agreements (repos), these are short-term borrowing contracts creating a money market in which one party sells securities to another party, following a buyback at a later date at a slightly higher price.

The repo market as the underpinning of the US banking system. Image credit: @concodanomics

The repo market is critical for the financial system, as banks need short-term funding to facilitate daily operations. However, a cash shortage led to a high demand for overnight funds in the repo market.

A pileup of outstanding US Treasury securities caused this. These are financial instruments by which the government borrows money from investors in return, giving them a fixed interest rate. Therefore, they are backed by the full faith and credit of the US government.

The increased amount of US Treasuries created a demand for this haven asset, leading to higher prices and lower yields. In the repo market, this manifested as a shortage of available collateral. After all, repo market participants typically use US Treasuries as collateral for their transactions.

Since post-2008 regulations prohibited banks from holding excess reserves, the banking sector relied highly on the repo market. Fast forward to September 2019, and rising repo rates created a liquidity crunch. The Federal Reserve stepped in by injecting billions of dollars, expanding its balance sheet by buying Treasury bills.

From Repo Crisis to Lockdowns

Half a year later, the Federal Reserve took an unprecedented turn on the back of a stabilized repo crisis. Following the lockdowns in March 2020, the central bank increased the M2 money supply by an outstanding 39% until February 2023.

The Fed balance sheet once again sprung following the Bank Term Funding Program (BTFP) to stabilize the banking sector. Image credit: Bloomberg

M2 money supply accounts for all cash, checking deposits, savings deposits, money market securities, serving as the broader measure of money supply. Of course, given this unprecedented money flood, one of the expected outcomes was inflationary pressure.

In addition to inflation, the excess M2 supply buildup in the near-zero interest regime led to excessive borrowing and lending. This created asset bubbles, from stocks and cryptos to real estate, surpassing their fundamental values.

Initially, lockdowns culled consumer demand and delayed inflation. But it eventually went from “transitory” to rampant, peaking at 40-year ATH at 9.1% in June 2022, measured as CPI. The Fed had to mirror the rampant inflation with an equally rapid hiking cycle, the fastest in 40 years.

Also, predictably, this deflated the aforementioned asset bubbles. On-risk assets like Bitcoin took a heavier toll as the failure of overleveraged crypto companies reflected on this decentralized ‘sound money’ network.

The performance of S&P 500 and Bitcoin since the first Fed hike in March 2022. Image credit: Trading View

But now, with the banking confidence eroding, and as customer deposits are more precisely viewed as unsecured loans to banks, Bitcoin is again testing its raison d’etre. When all considered, where is the Fed’s monetary policy to go now?

The Fed’s Confines

The Federal Reserve’s dual mandate is to keep the prices stable and unemployment low. One could say the central bank broke that mandate by increasing the money supply, thus destabilizing prices. On a path of inflation correction, Fed Chair Jerome Powell also pointed out multiple times that unemployment would have to go up to cut consumer demand. This would then eventually lead to the targeted 2% inflation rate.

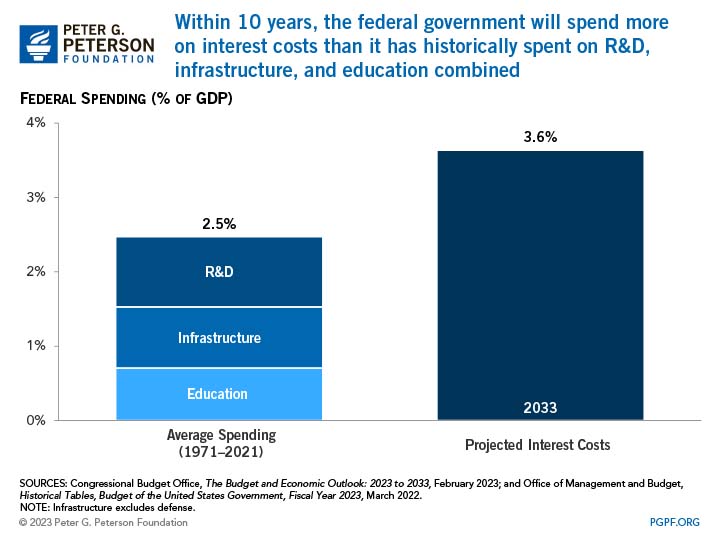

The US national debt also comes into play, now at $31.6 trillion, as it needs to be serviced. By increasing rates, the Fed would also have to raise interest payments. The Congressional Budget Office (CBO) projects that the federal debt held by the public will grow to 195% of GDP by 2053.

Image credit PGPF.org

Powell openly admitted that the country is on a path to unsustainable debt but still within the confines of sustainable debt.

? Fed. Chair Jerome Powell Says the U.S. is Heading Towards a Big Problem w/ Our Economy

«The problem is that we are on a path where the debt is growing substantially faster than the economy and that’s, by definition in the long run, unsustainable» pic.twitter.com/ijIj96707l

— Chief Nerd (@TheChiefNerd) March 7, 2023

Therefore, this would be a signal against increasing interest rates. Moreover, in light of the recent erosion of confidence in the US banking sector, it is clear that the Fed destabilizes commercial banks’ balance sheets, particularly if they hold significant US Treasuries as safe-haven assets. After all, this is how SVB collapsed without hedging for such exposure risk.

The banking crisis also worsened financial conditions, the tightest since March 2020.

Bloomberg’s Financial Conditions Index gives the Fed a green light as financial conditions have sufficiently worsened to pre-March stimulus binge. Image credit: Bloomberg Finance

This is another signal for the Fed to either pause, slow, or even cut rates down the line. The market consensus is at 86.4% for the previously expected 25 bps hike on March 22, elevating the fed target rate to the 4.75 – 5.00% range. Only 13.6% expect zero hikes.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Enjin Coin

Enjin Coin  Waves

Waves  Ontology

Ontology  Status

Status  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur