These 5 Altcoins Posted the Highest Rate of Increase Last Week

BeInCrypto looks at five altcoins that increased the most in this week’s crypto market, specifically from March 24 to 31.

The term altcoin refers to cryptocurrencies other than Bitcoin (BTC). These altcoins have stolen the crypto news and cryptocurrency market spotlight:

- Ripple XRP price increased by 23.68%

- Stellar (XLM) price increased by 20.35%

- Conflux (CFX) price increased by 12.24%

- Hedera (HBAR) price increased by 11.79%

- Flare (FLR) price increased by 11.30%

Ripple XRP Price Leads Altcoin Gainers

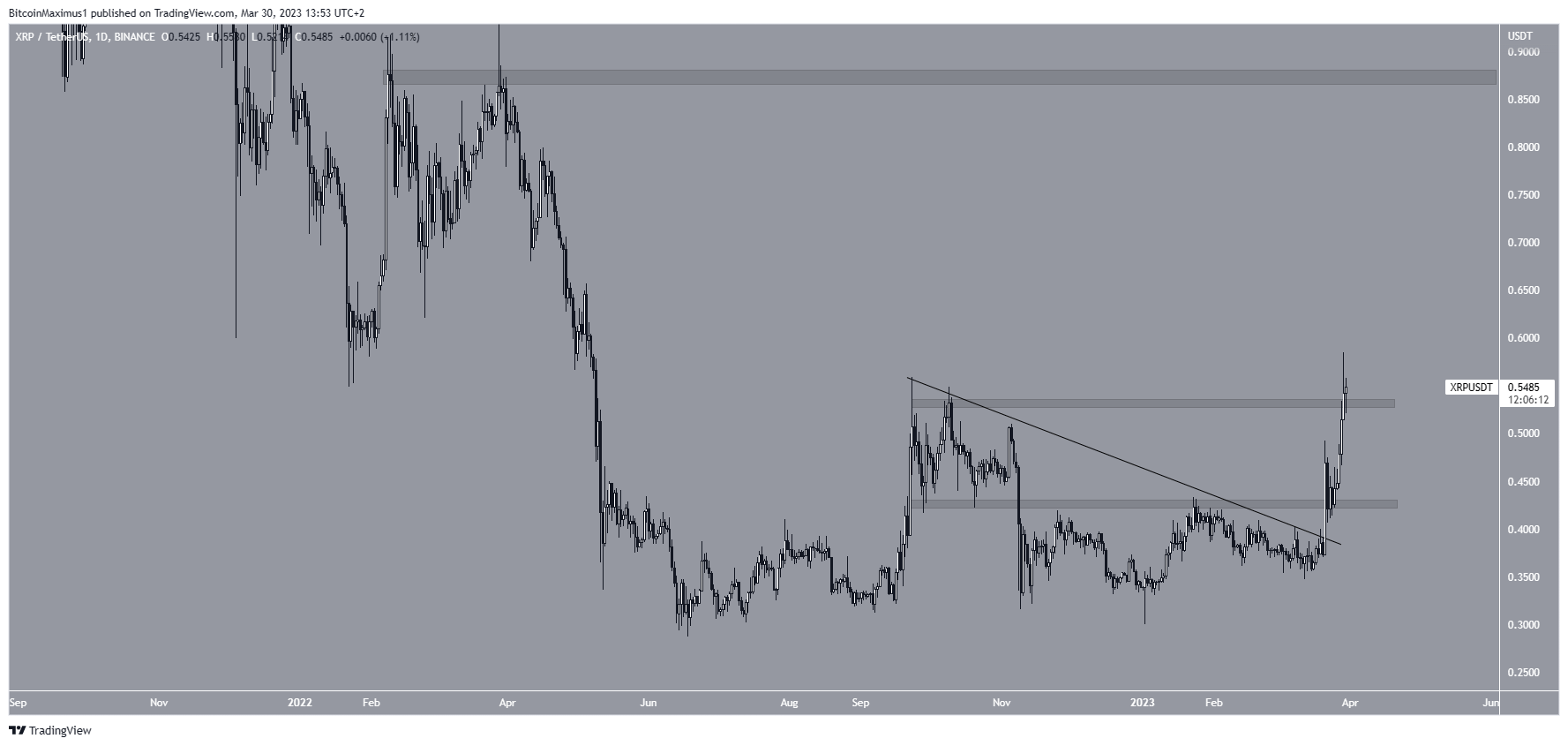

The XRP price broke out from a descending resistance line on March 21 and reached a new yearly high of $0.585 on March 29. This was the highest price since September 2022. Currently, the price is attempting to validate the $0.530 horizontal area as support.

If successful, the price could increase to the next major resistance at $0.870.

However, if the digital currency closes below $0.530, it would put the entire bullish structure at risk and could cause a drop to the $0.425 support.

XRP/USDT Daily Chart. Source: TradingView

Stellar (XLM) Price Clears Major Resistance

The XLM price has increased since bouncing at an ascending support line on March 10 (green icon). On March 28, it broke out from a horizontal resistance area at $0.095, leading to a new yearly high of $0.107 the next day. The $0.095 area is now expected to provide support.

During this price action, the daily RSI also broke out from its bearish divergence trend line (green).

If the increase continues, the digital asset could move to the next resistance at $0.115. However, if the price closes below the $0.095 support area, it will invalidate the bullish structure and could cause a drop to the ascending support line at $0.080.

XLM/USDT Daily Chart. Source: TradingView

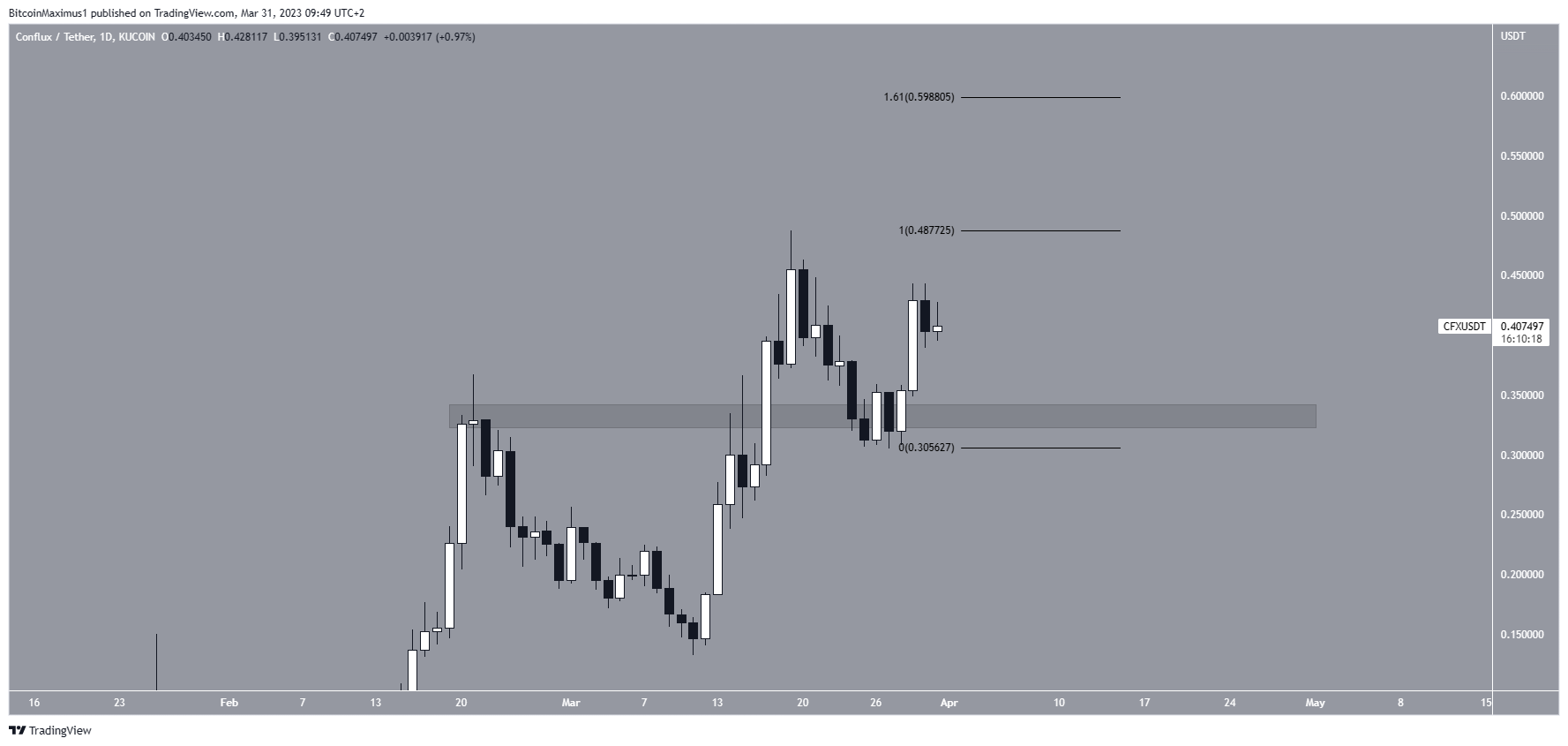

Conflux (CFX) Altcoin Price Creates Lower High

The Conflux price has increased since validating the $0.330 horizontal area as support on March 26. The increase led to a high of $0.443 on March 30. This is a lower high relative to the price on March 19.

If the increase continues, CFX could increase to a high of $0.600, created by the 1.61 external Fib retracement of the recent drop.

However, if the rally loses momentum, the CFX price could retest the $0.330 support area again.

CFX/USDT Daily Chart. Source: TradingView

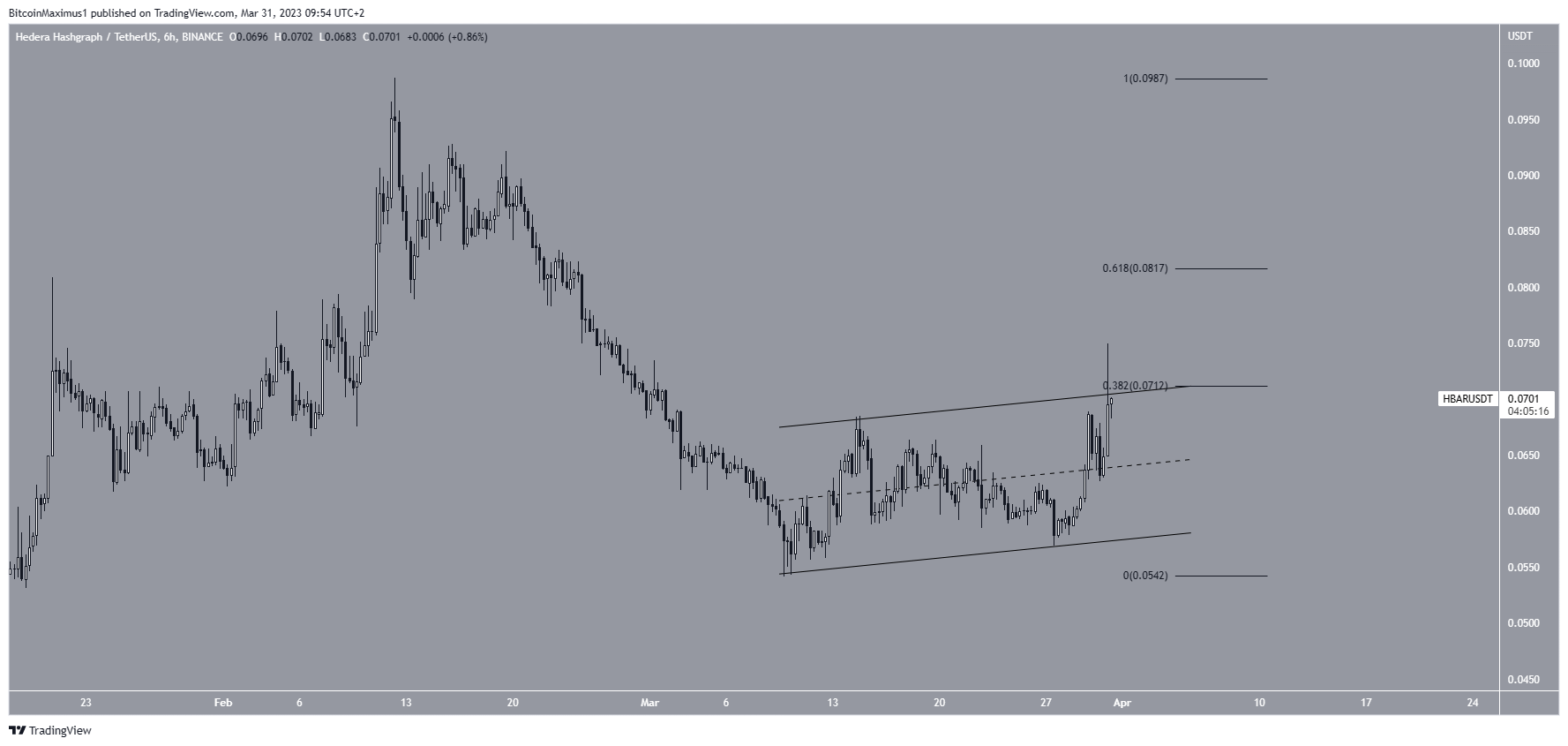

Hedera Hashgraph (HBAR) Trades in Corrective Pattern

The HBAR price has increased inside an ascending parallel channel since March 11. Such channels usually contain corrective movements, meaning that an eventual breakdown from it is expected.

On March 31, the HBAR price was rejected by both the channel’s resistance line and the 0.382 Fib retracement resistance level at $0.071.

If a breakout from the channel occurs, the crypto token could move to the 0.618 Fib retracement resistance at $0.081. However, if the price breaks down, a drop toward $0.045 is likely.

HBAR/USDT Six-Hour Chart. Source: TradingView

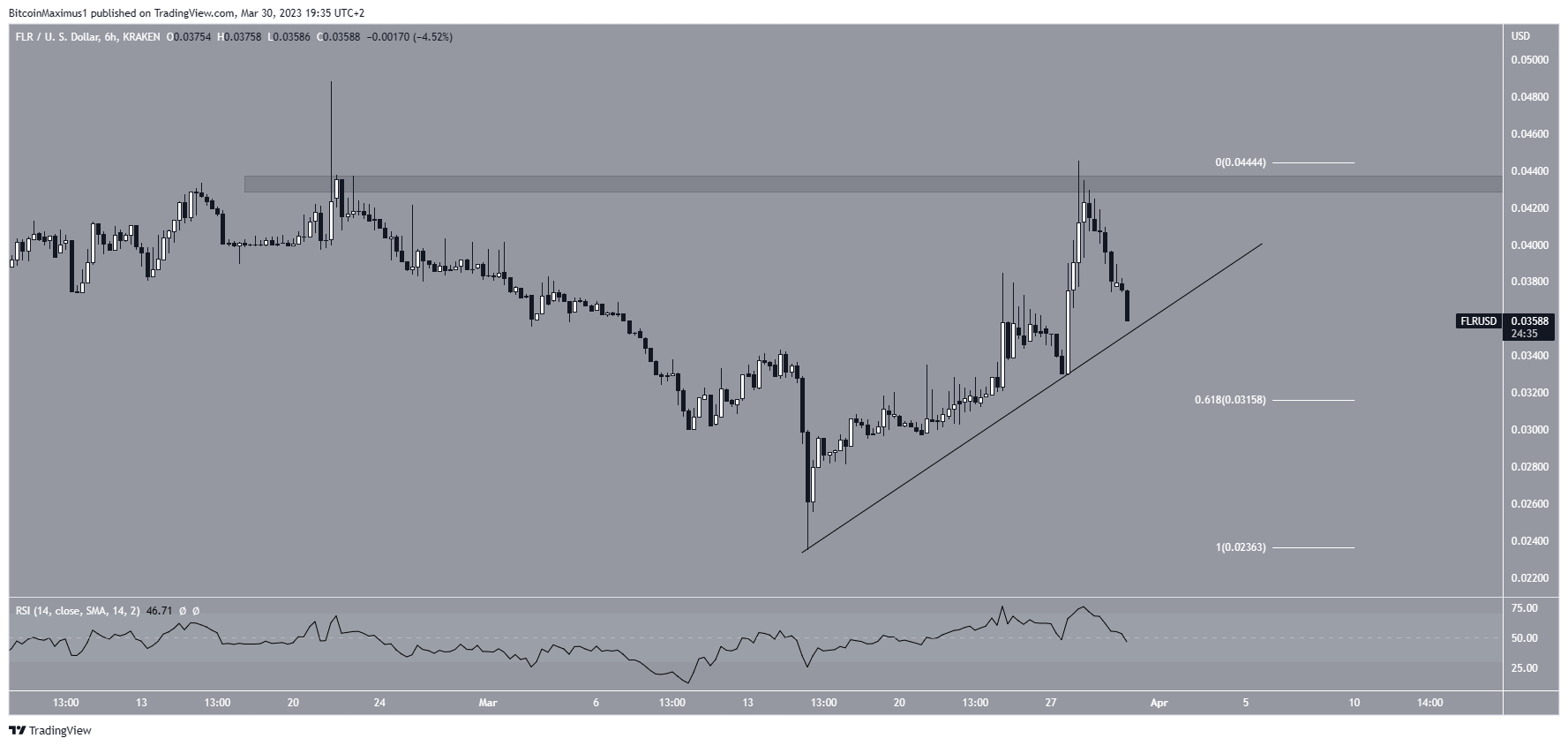

Flare (FLR) Price Attempts to Find Support

The FLR price has increased since reaching a low of $0.023 on March 15. The upward movement led to a high of $0.044 on March 28. Despite the considerable increase, the price failed to break out above the $0.043 resistance area. It is currently attempting to find support above an ascending support line.

If FLR bounces, it could make another attempt at reaching the $0.043 resistance area. However, if it breaks down, FLR could fall to the 0.618 Fib retracement support level at $0.031.

FLR/USD Six-Hour Chart. Source: TradingView

For BeInCrypto’s latest crypto market analysis, click here.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Numeraire

Numeraire  Siacoin

Siacoin  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Pax Dollar

Pax Dollar  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Augur

Augur  Bitcoin Gold

Bitcoin Gold  Ren

Ren