XRP on the Verge of Closing a Second Green Weekly Candle, What’s Next? (Ripple Price Analysis)

Ripple is on the verge of closing its second green weekly candle. However, there is a horizontal obstacle on the way to higher levels, which will be discussed further below.

Technical Analysis

By Grizzly

The Daily Chart:

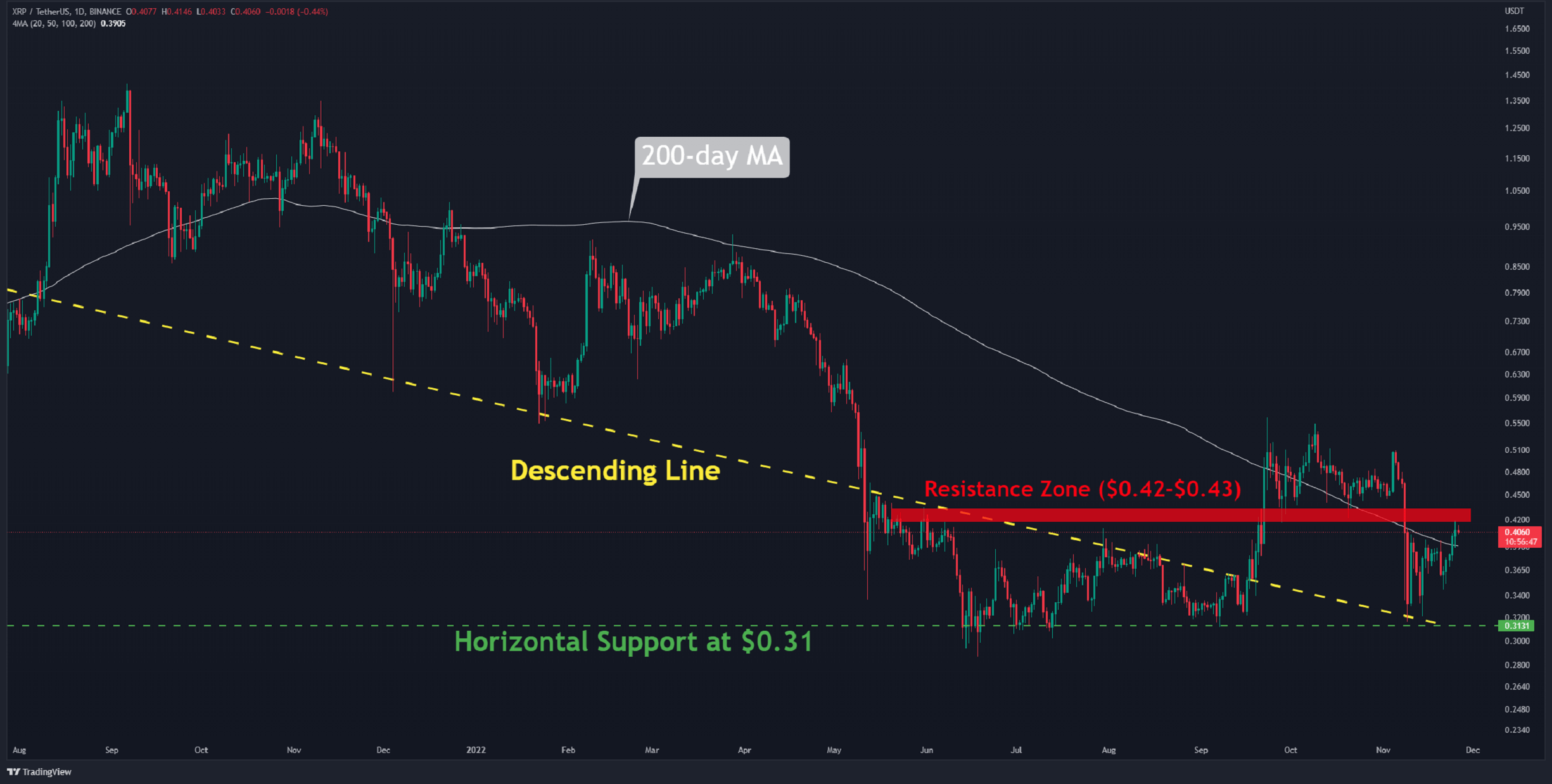

XRP managed to recapture the 200-day moving average line (in white) on the daily chart after struggling since mid-November. Technically, this pattern denotes a positive psychological momentum in the market.

Although the bullish sentiment is observable on the chart, the horizontal resistance in the $0.42 to $0.43 region (in red) should be regarded as a strong obstacle. After the May collapse, XRP remained below this level for a few months.

Suppose that the asset will overcome this obstacle. In this case, an upward trend with a target of $0.55 is likely. This level prevented further price growth in September and October.

A brief pullback to $0.37, on the other hand, is also considered healthy. As long as XRP trades above this level, it can always retest the highlighted overhead resistance.

Moving Averages:

MA20: $0.38

MA50: $0.44

MA100: $0.41

MA200: $0.39

The XRP/BTC Chart:

The chart shows an early indication of an end to the negative trend. In the latest correction, no candle closed below 2000 SATs, emphasizing the need to keep an eye on this level as critical support. The pair has recovered from the 61.8% Fib level (in yellow) and is presently hitting the 23.6% level at 2500 SATs (in blue). If the price can break over this resistance, it will be poised to retest the 2800 SATs.

In this chart, the primary support is at 2200 SATs (in green). The optimistic outlook remains strong in the short term as long as the pair maintains above it.

Key Support Levels: 2200 SATS, 2000 SATs

Key Resistance Levels: 2500 SATs, 2800 SATs

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur