XRP Revisits $0.47 – What Can Be Expected For Short-Term Price Movement?

XRP has shown recent gains on its price chart, allowing the altcoin to surpass a significant resistance level. Although the 1% increase over the past 24 hours may not be substantial, it has helped maintain bullish momentum. However, on a weekly chart, XRP has experienced minimal movement.

Despite this, the technical outlook for the coin indicates bullish strength in the market. Buying strength has risen, and both demand and accumulation have turned positive, contributing to this technical outlook. The performance of XRP on its chart may be influenced by the movement of Bitcoin.

If Bitcoin continues to appreciate and reaches the $27,000 range, XRP may attempt to break through its immediate resistance. With buying strength recovering and demand potentially supporting the bulls, their position in the market could strengthen.

However, if the price remains stagnant at its current level, demand might start to decline, causing the bulls to lose momentum. The increase in the altcoin’s market capitalization over the past 24 hours suggests that buyers have gained control over sellers.

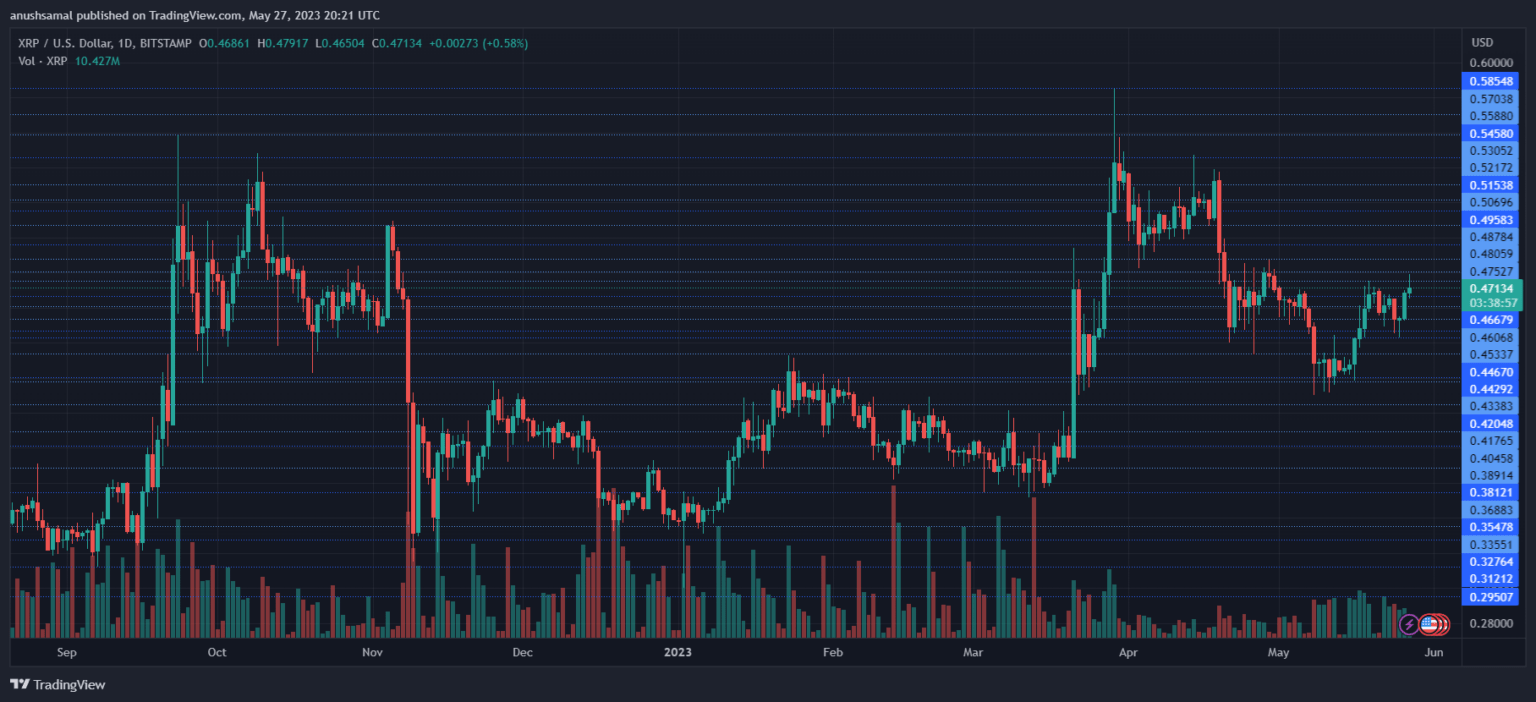

XRP Price Analysis: One-Day Chart

At the time of writing, XRP was trading at $0.47. In recent trading sessions, the altcoin successfully surpassed the resistance level of $0.45. Sustaining this positive momentum, the next resistance level for XRP is expected to be at $0.48.

If this level is cleared, it could fuel a rally towards the $0.50 mark. However, if the price retreats from its current level, it may invite bearish pressure, potentially causing the price to settle around $0.43.

Notably, the volume of XRP traded in the last session was relatively high, indicating a lower selling strength in the market.

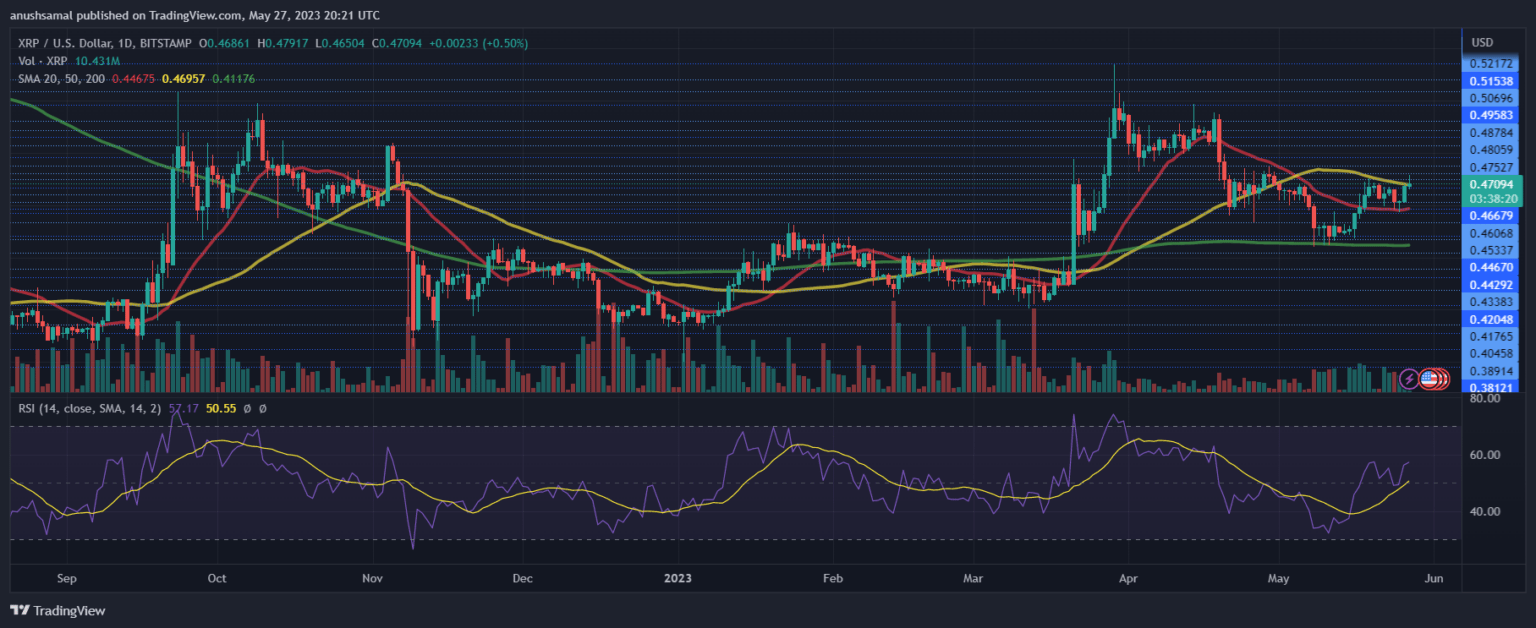

Technical Analysis

During the recent trading sessions, the altcoin not only made progress in its price movement but also saw a notable recovery in buying strength. The Relative Strength Index (RSI) being above the half-line suggests that buyers have taken control of the price action in the market.

Additionally, XRP moved above the 20-Simple Moving Average (SMA) line, indicating that buyers were driving the price momentum. This shift in momentum was supported by an increased demand for XRP in the market.

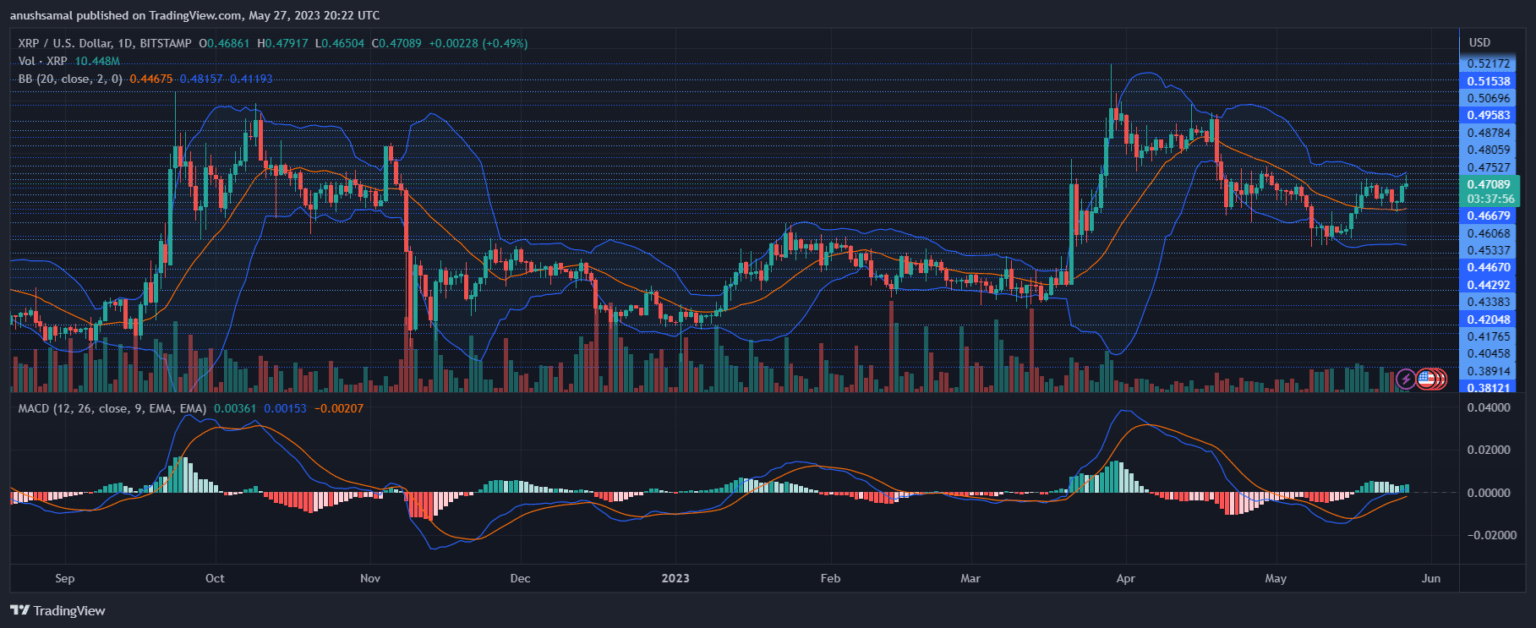

In line with other technical indicators, the altcoin has started to exhibit buy signals on the chart. The Moving Average Convergence Divergence (MACD), a tool used to assess price momentum and potential reversals, displayed green histograms associated with buy signals. This suggests that there is a possibility of the altcoin attempting to break through its overhead resistance level.

Furthermore, the Bollinger Bands, which indicate price volatility and fluctuations, remained parallel and wide. This indicates that the XRP price action is not expected to be constricted or range-bound.

The upper band of the Bollinger Bands intersected at $0.48, highlighting this level as an important resistance level or price ceiling for the altcoin to overcome.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD