3 Reasons Why Stagflation Just Became Your Biggest Worry

The macroeconomic environment is dictating the price movement in the crypto market. Crypto investors and traders are eyeing the Federal Reserve’s every move. Minnesota Fed President and CEO, Neel Kashkari, has given traders something new to worry about. In his recent comments, Kashkari claims that the current economic crisis looks a lot like stagflation.

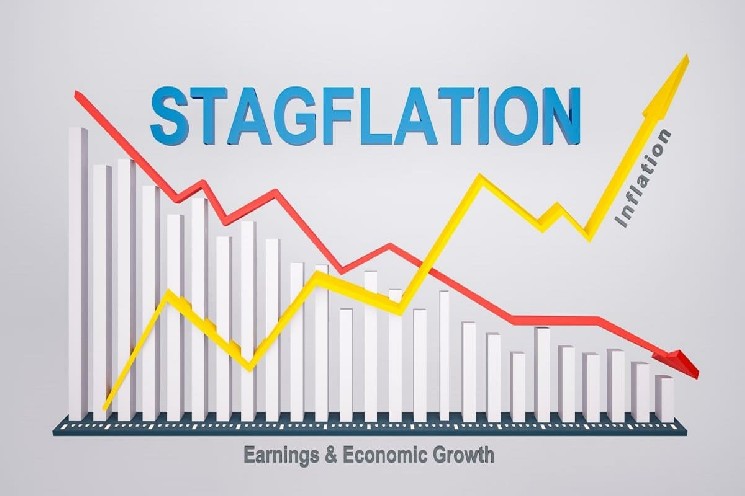

Why Stagflation Can Be Worse Than Recession And Inflation

The current macro economy is unfavorable for the crypto market. Crypto is strongly correlated with the broader market and is currently showing sluggish movement. Soaring inflation levels have caused a massive selloff in the crypto market. Similarly, the Fed’s hawkish response has triggered recession warnings.

However, there are three reasons why stagflation is likely the worst possible outcome of the economic crisis.

- Stagflation combines the bad of both scenarios. It is a period of high inflation levels with slow growth and high unemployment. Key inflation data still points to record-high inflation levels. Similarly, initial jobless claims released today highlight spiking unemployment.

- The central bank cannot come up with a proper solution to deal with stagflation. High inflation requires monetary tightening while slow growth requires quantitative easing. The US Fed is currently engaged in an aggressive tightening while the UK’s ECB has already pivoted.

- Thirdly, the way to tackle stagflation is to proactively avoid it. However, experts believe that stagflation is already here. NYU professor Nouriel Roubini states that stagflation is imminent. Julian Brigden, the co-founder of Macro Intelligence 2, states that the current economic condition is stagflation 101.

Kashkari states that the current economic condition may well be a transition. However, all signs point to soaring prices during recession-like conditions.

How The Fed Can Deal With This Crisis

Neel Kashkari does not believe that the Fed is done with raising interest rates. Despite the slow growth and rising unemployment, the Fed will continue with its aggressive policymaking.

Egon von Greyerz of Matterhorn Asset Management believes that the Fed can either cause a systemic collapse due to tightening or weaken the US dollar by easing.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  Gate

Gate  NEO

NEO  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Siacoin

Siacoin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Qtum

Qtum  Zcash

Zcash  Basic Attention

Basic Attention  Dash

Dash  NEM

NEM  Decred

Decred  Lisk

Lisk  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Augur

Augur  Energi

Energi