Binance Coin (BNB) Price Soars Above $300, Is Next Stop $400?

The Binance Coin (BNB) price has broken out from a short-term resistance level and could soon move above a long-term one.

Binance CEO Changpeng Zhao said that the exchange has no exposure to the Silicon Valley Bank. But, shortly afterward, he stated that the cryptocurrency exchange would convert what remains of its $1 billion industry recovery fund to assets such as Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB). However, not all Binance news was positive. Payments provider Skrill ended its relationship with Binance, forcing the latter to suspend its GBP transactions starting from May 22.

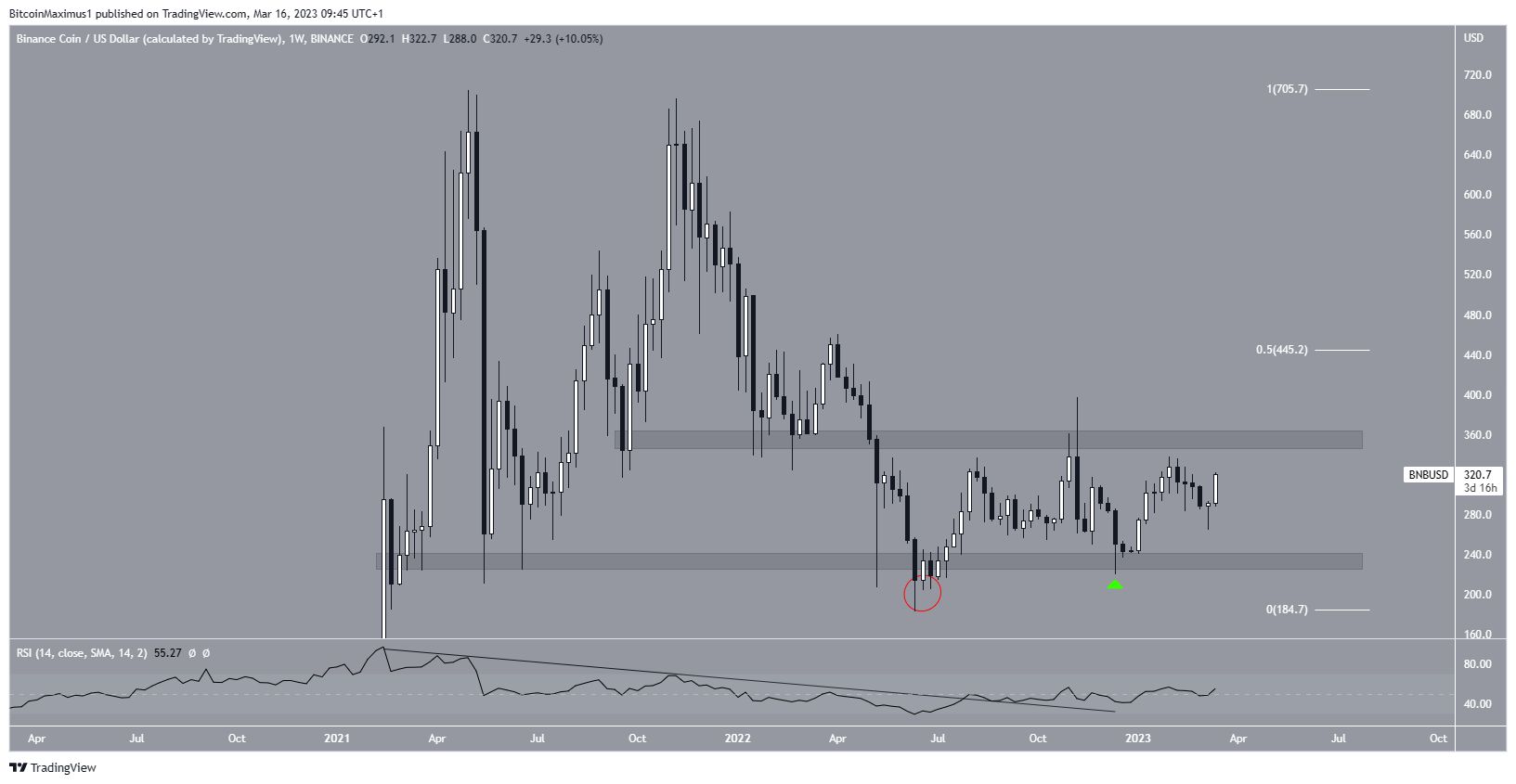

Binance Coin (BNB) Price Trades in Long-Term Range

The weekly time frame technical analysis shows a long-term range between $240 and $360. Excluding a deviation in May 2022 (red circle), the BNB token price has traded inside this area since April 2022.

The price has increased since the deviation but has not managed to break out from the top of the range. Rather, it validated the range bottom in December (green icon), created a higher low, and has increased since. Last week, the price created another bullish candlestick.

Despite the failure to break out, technical indicators are bullish. This is especially visible in the weekly RSI. The indicator broke out from a long-term descending resistance line and is now above 50. So, a breakout is the most likely scenario.

If the Binance Coin price breaks out above $360, it could increase to the next resistance at $445, created by the 0.5 Fib retracement resistance level (white). However, a drop to the $240 support area could follow if the rally loses momentum.

BNB/USD Weekly Chart. Source: TradingView

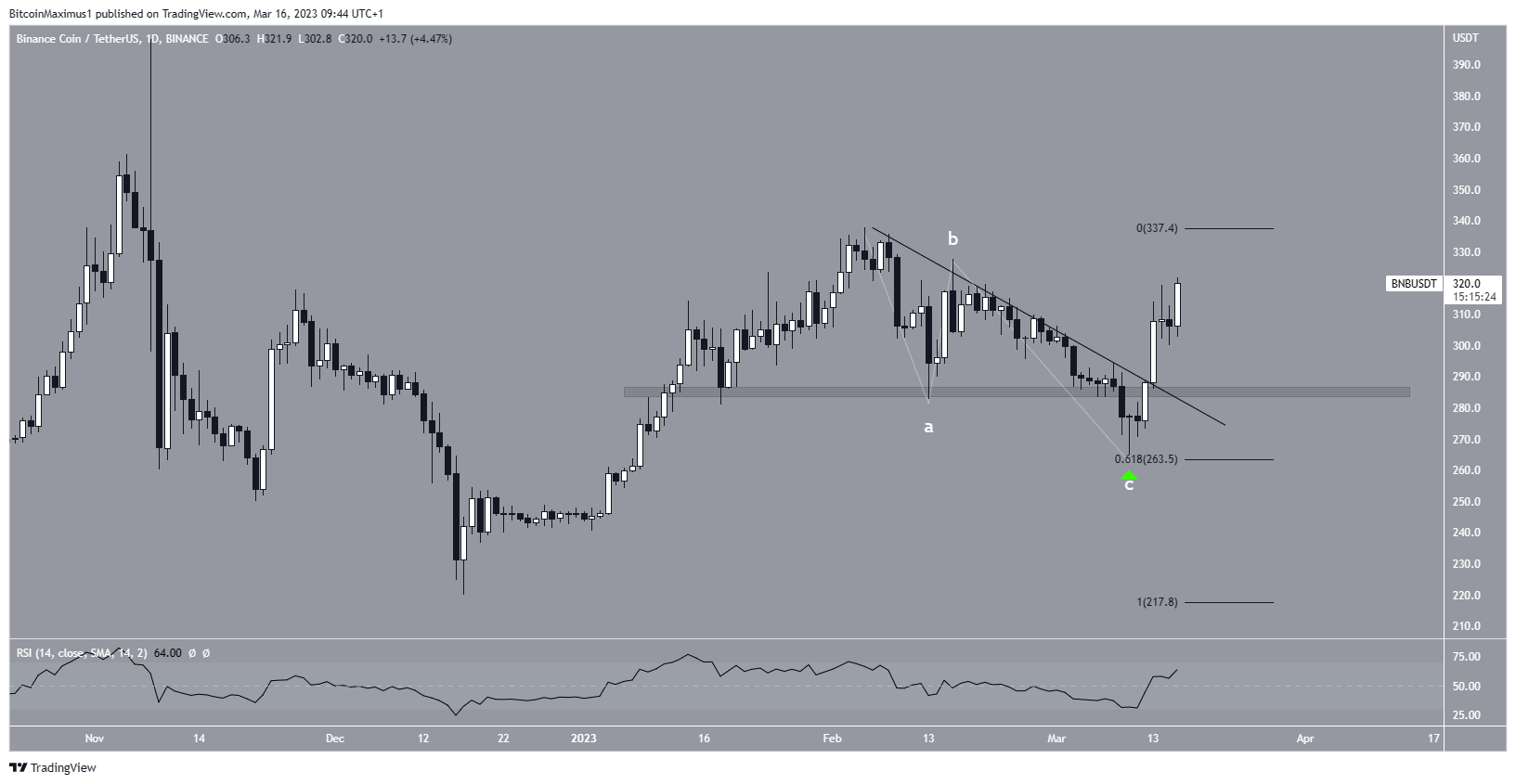

Binance Coin (BNB) Price Short-Term Breakout Could Precede Long-Term One

The daily chart provides a more bullish outlook. There are several reasons for this. Firstly, the price broke out from a descending resistance line that had been in place since the beginning of February. This is a sign that an upward movement has begun.

Next, the price completed an A-B-C corrective structure, which was confirmed by the breakout from the resistance line.

Then, the daily RSI moved above 50. Finally, the BNB price reclaimed the minor $285 horizontal area, which is now expected to provide support. These are bullish signs suggesting that the increase is expected to continue.

Therefore, the BNB price is likely to reach the top of the range at $360. However, the signs are insufficient to determine if it will break out.

BNB/USDT Daily Chart. Source: TradingView

To conclude, the most likely BNB price forecast is an increase toward the range top at $360. Whether it breaks out or gets rejected could determine the future trend. On the other hand, if the BNB price fall below $290, it would invalidate the bullish structure and could catalyze a decrease toward $200.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  Cosmos Hub

Cosmos Hub  Stacks

Stacks  OKB

OKB  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Synthetix Network

Synthetix Network  Zcash

Zcash  Tether Gold

Tether Gold  Dash

Dash  TrueUSD

TrueUSD  Holo

Holo  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Siacoin

Siacoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Huobi

Huobi  Status

Status  Waves

Waves  Lisk

Lisk  Numeraire

Numeraire  Hive

Hive  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom