Can Bitcoin (BTC) Price Bounce Back Over $30,000? This Indicator Suggests it Could

The Bitcoin (BTC) price has fallen since a long-term horizontal resistance area rejected it. It now trades in a short-term bearish pattern.

A breakdown from the neckline of this pattern could catalyze a sharp fall. Additionally, it will confirm the validity of the long-term rejection.

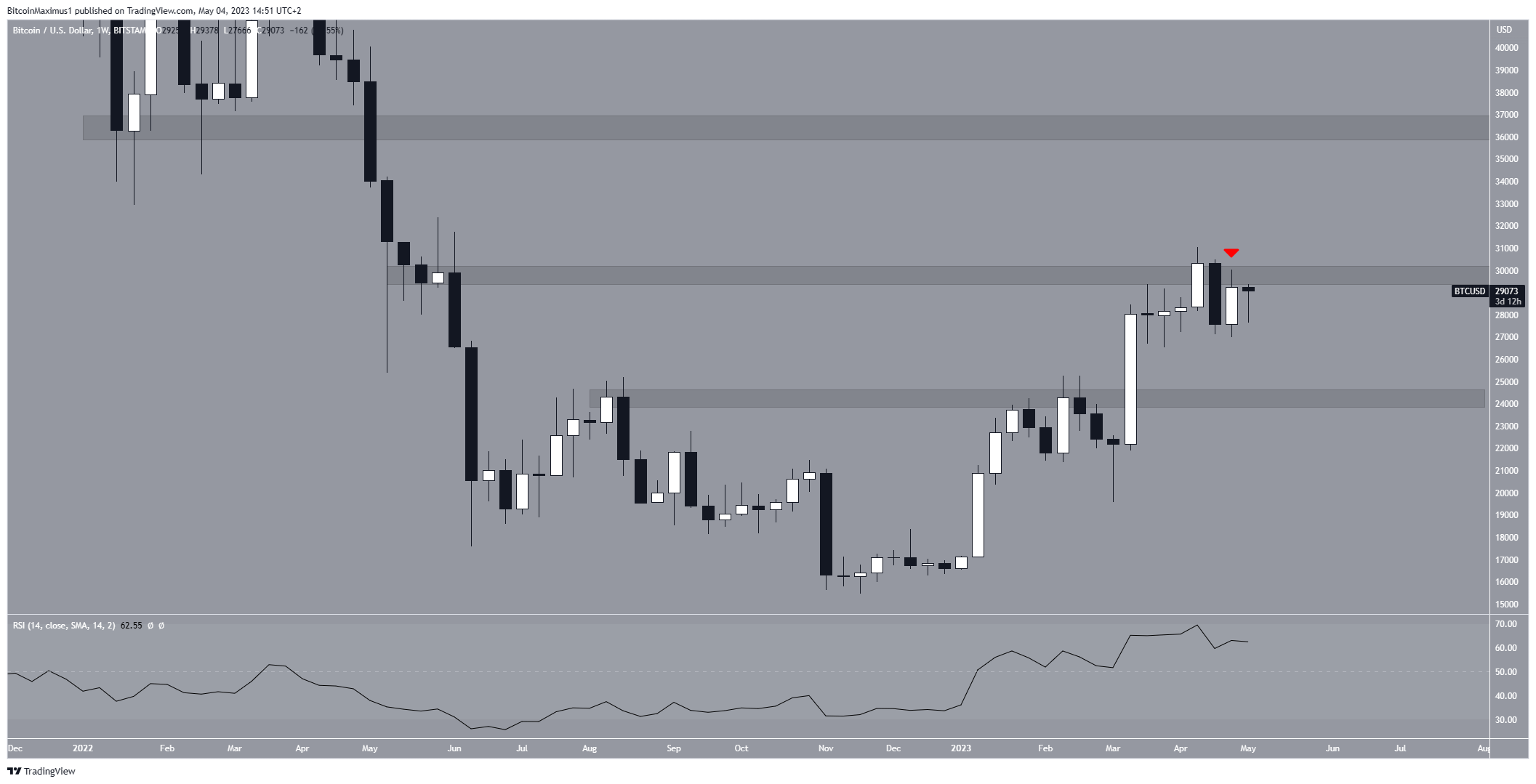

BTC Price Deviates and Gets Rejected

The BTC price decreased significantly after forming a bearish engulfing candlestick pattern during the week of April 17-24. This type of pattern occurs when the entire gains from the previous period are wiped out in the next one. It indicates a bearish sentiment.

While the price tried to increase next week, it was stopped by the $29,800 resistance zone (red icon). Therefore, the movement over the past three weeks resembles a failed breakout and validation of that area as resistance (red icon).

These are all bearish signs that usually lead to downward movements.

BTC/USD Weekly Chart. Source: TradingView

Despite these bearish signs, the weekly Relative Strength Index (RSI) remains positive, as it is above 50 and rising. Traders use the RSI to assess whether a market is overbought or oversold and decide whether to buy or sell an asset.

The bulls are in control if the RSI is above 50 and trending upwards. However, the opposite is true if the RSI falls below 50. It is worth noting that the number of average transactions hit a new record high last week.

The next closest resistance area is at $36,500, while the closest support is at an average price of $24,000.

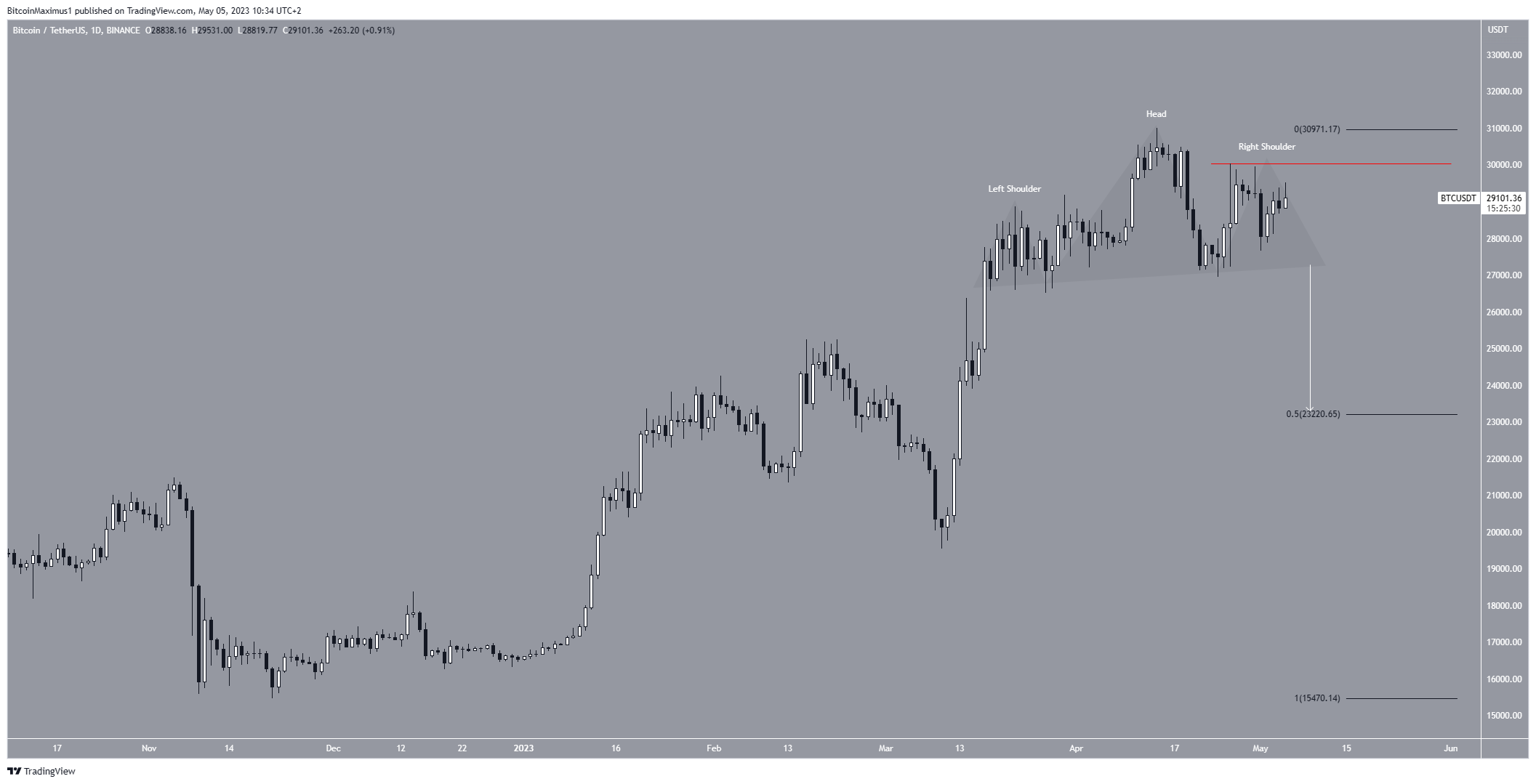

Bitcoin Price Prediction: Does a Correction Await?

The technical analysis from the daily time frame provides a bearish Bitcoin price prediction. The main reason for this is that the price has created a head and shoulders, which is considered a bearish pattern.

The pattern consists of a peak that is higher than the ones preceding and succeeding it. Once the second one is finished, the price typically drops quickly, breaking the neckline.

If the potential price breakdown spans the entire pattern’s height (white), it will result in the digital asset dropping to $23,400. This aligns with the 0.5 Fib retracement support level (black).

According to the Fibonacci retracement levels principle, following a significant price change in one direction, the price is expected to partially retrace or go back to a previous price level before resuming in its original direction.

BTC/USDT Daily Chart. Source: TradingView

Despite this bearish Bitcoin price prediction, a movement above the right shoulder (red line) at $30,000 will mean that the trend is not bearish.

Rather, it could lead to an increase toward the next long-term resistance at $36,500.

For BeInCrypto’s latest crypto market analysis, click here.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  LEO Token

LEO Token  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Monero

Monero  Dai

Dai  OKB

OKB  Gate

Gate  Ethereum Classic

Ethereum Classic  Cronos

Cronos  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Maker

Maker  Tether Gold

Tether Gold  IOTA

IOTA  Theta Network

Theta Network  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Dash

Dash  Zilliqa

Zilliqa  Synthetix Network

Synthetix Network  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Siacoin

Siacoin  Holo

Holo  Ravencoin

Ravencoin  NEM

NEM  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Nano

Nano  Hive

Hive  Waves

Waves  Lisk

Lisk  Status

Status  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  HUSD

HUSD  Bytom

Bytom