Ontology (ONT) Bounces After Falling to All-Time Low

Ontology (ONT) is in the process of breaking out from a horizontal and diagonal resistance levels. If successful, the rate of increase could accelerate greatly.

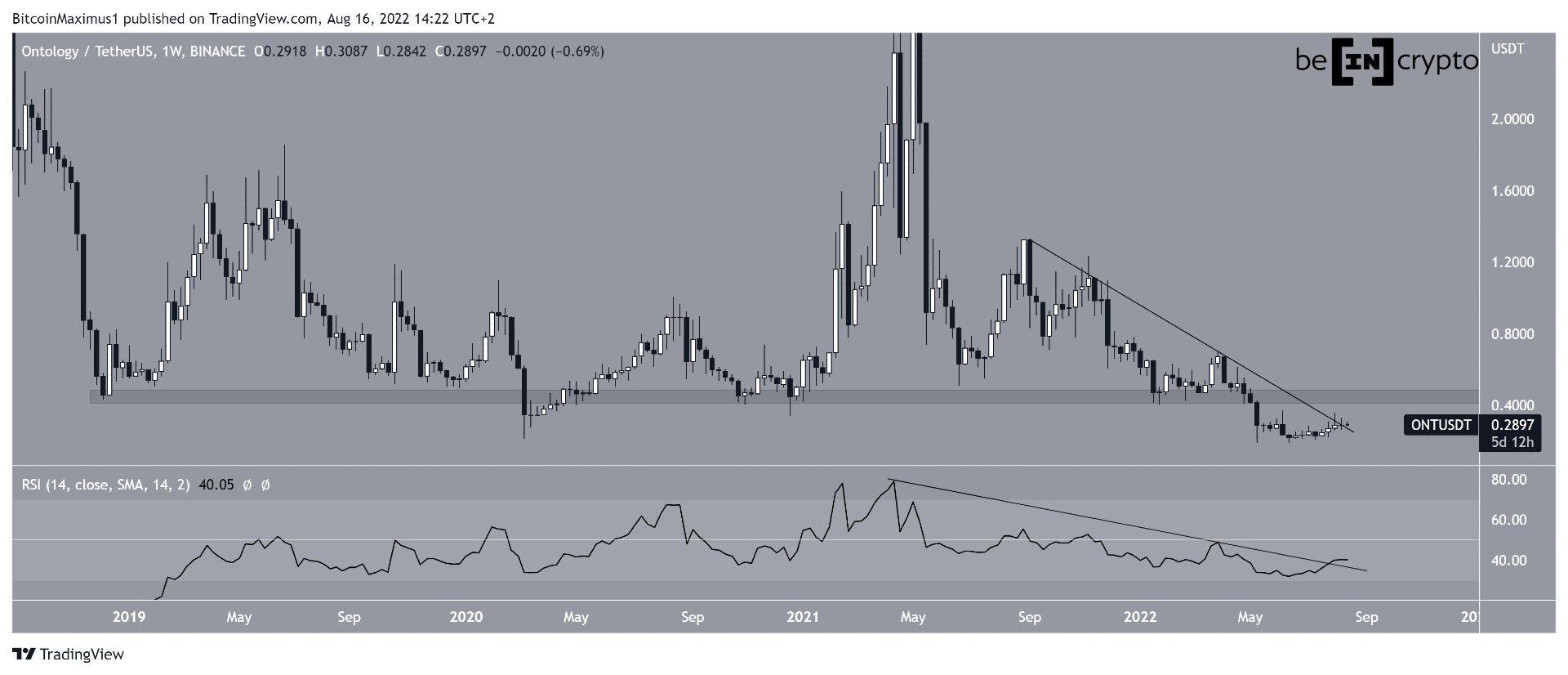

ONT has been decreasing since reaching an all-time high of $2.95 in May 2021. Since Sept, it has been following a descending resistance line, which led to an all-time low price of $0.19 in June.

While Ontology is still following a descending resistance line, the weekly RSI has already broken out from its resistance. Such breakouts in the RSI often precede breakouts in the price.

If the price manages to break out, the $0.45 area would be expected to provide resistance. This is a crucial area since it had previously provided support since $0.45.

ONT/USDT Chart By TradingView

Cryptocurrency trader @Coinqts tweeted a chart of ONT, stating that it could double in price soon.

Source: Twitter

If the price manages to break out, it would likely reach the $0.45 area, which is nearly double the current price.

Short-term movement

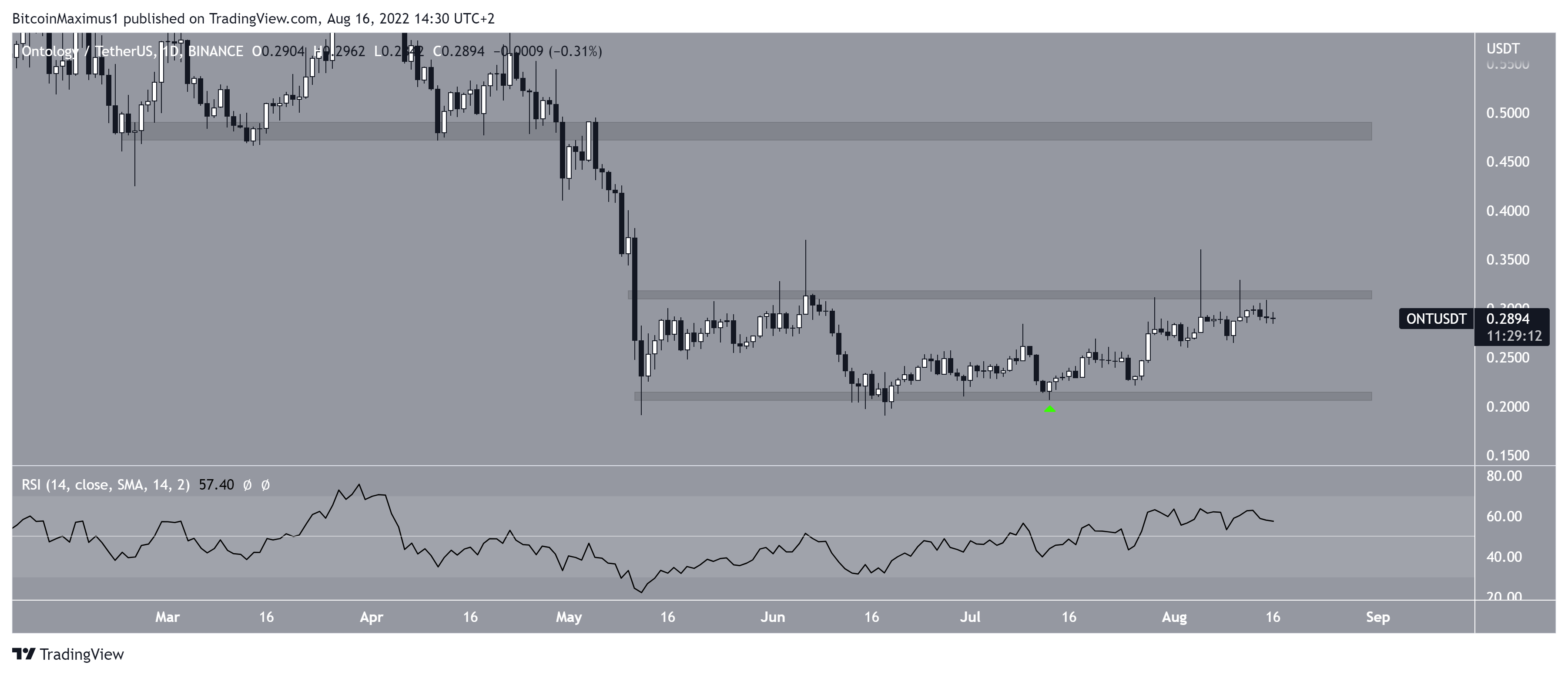

The daily chart shows that ONT has been trading inside a range between $0.21 and $0.315 since May. More recently, it bounced at the support of the range on and has been increasing since July (green icon). It is currently making an attempt at breaking out.

The daily chart indicates that the most likely scenario is an eventual breakout. The two reasons for this are the fact that the RSI has moved above 50 and that the price has already made several attempts at breaking out.

If a breakout occurs, the closest resistance in the daily timeframe is at $0.48, aligning with the previously outlined long-term resistance.

ONT/USDT Chart By TradingView

ONT/BTC

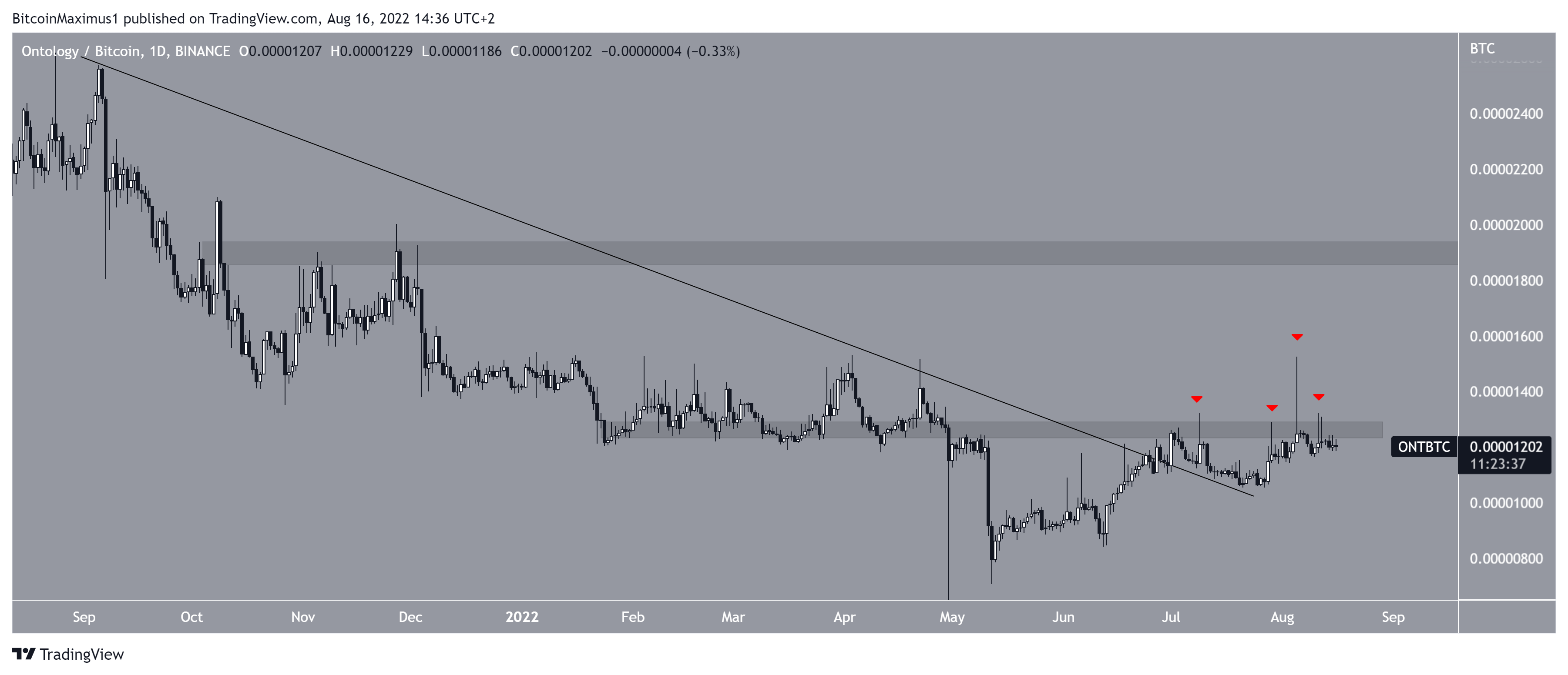

The chart for ONT/BTC is more bullish than the USD counterpart, since the price has already broken out from a descending resistance line. It has currently made four attempts at breaking out from the 1,260 satoshi horizontal resistance area.

If it is successful in breaking out, it could increase rapidly towards 1,900 satoshis.

ONT/BTC Chart By TradingView

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Lisk

Lisk  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD