Polkadot Drops Significantly as It Can Hold above $5.98 Support

The price of Polkadot (DOT) is in a downtrend and has fallen to the lower price level of $5.98. This support is the historical price level from July 13 and has not been broken yet.

Long-term analysis of the Polkadot price: bearish

The cryptocurrency has fallen into the oversold zone of the market. Further downward movement of prices is unlikely. If the sellers break the $6.00 support, the altcoin will fall to a low of $4.00. However, Polkadot will resume its uptrend if the current support holds. On July 13, the cryptocurrency rallied from the $5.98 support and reached the high of $9.64 on August 10. Today, Polkadot is trading at $6.29 at the time of writing.

Analysis of Polkadot indicators

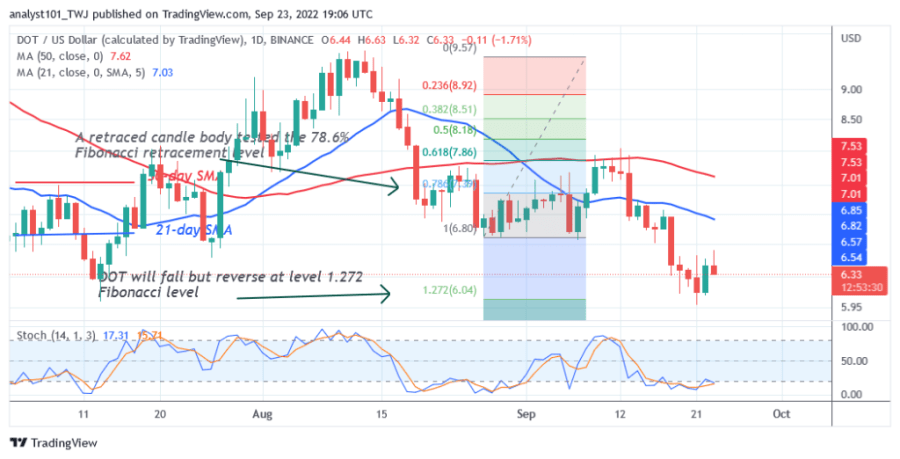

Polkadot is at level 36 of the Relative Strength Index for the period 14. DOT The price is in the downward zone, as buyers appear in the oversold region. DOT Polkadot’s price bars have fallen well below the moving average lines, indicating a further decline in the altcoin. The cryptocurrency is below the 20% range of the daily stochastic. This confirms that the market has reached the oversold zone.

Technical Indicators

Key resistance zones: $10, $12, $14

Major support zones: $8.00, $6.00, $4.00

What is the next direction for Polkadot?

Polkadot has retraced to the previous low of July 13. The downtrend has reached its bearish exhaustion. Meanwhile, the downtrend tested the 78.6% Fibonacci retracement level through a candlestick on August 27. The retracement suggests that DOT will fall but will reverse at the Fibonacci level of 1.272 or $6.04. Based on the price action, the market has fallen to the low of $6.31 at the time of writing.

Disclaimer. This analysis and forecast are the personal opinions of the author and are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol. Readers should do their research before investing in funds.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Qtum

Qtum  Synthetix

Synthetix  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur