Algorithm Known for Outpacing Crypto Markets Goes Fully Risk On, Favoring Ethereum, Polygon and One ETH Rival

A trading robot with a reputation for outperforming the digital asset markets is sharing its newest portfolio allocations amid the ongoing bear market.

Every week, the Real Vision Bot conducts surveys to compile algorithmic portfolio assessments that generate a “hive mind” consensus.

The bot’s latest data reveals that traders have a strong preference for Ethereum (ETH), with the majority of market participants voting to overweight their portfolios with ETH. Second place is king crypto Bitcoin (BTC), followed by Polygon (MATIC), the leading layer-2 ecosystem designed to help scale Ethereum.

After MATIC is Ethereum competitor Avalanche (AVAX) and interoperability blockchain Polkadot (DOT). Those two coins are followed by blockchain ecosystem Cosmos (ATOM).

“Latest results of the free RealVisionExchange crypto survey. Ethereum is still leading, but Bitcoin made it back to rank 2 followed by MATIC and AVAX. USDC isn’t favored anymore, showing participants are ready to retake more risks.”

Source: Real Vision Bot

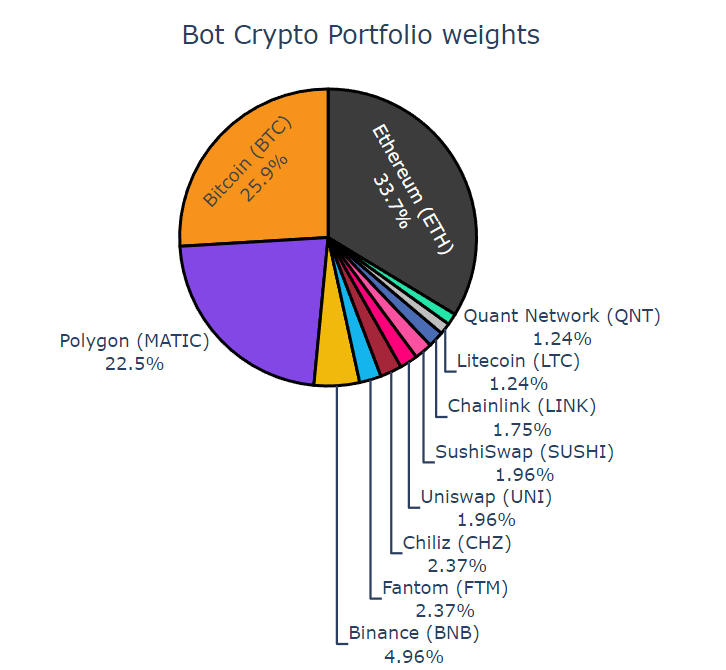

As for the RealVision Bot’s picks, the algorithm is heavily weighed in favor of MATIC and has reduced favor for stablecoins, indicating a higher risk appetite.

“Latest allocation of the free RealVisionExchange crypto portfolio. The top 3 hasn’t changed much, but the survey participants have reduced cash exposure and are now fully risk-on again. The Bot makes a few small bets on trending tokens.”

Source: Real Vision Bot

The Real Vision Bot was co-developed by quant analyst Moritz Seibert and statistician Moritz Heiden.

Real Vision founder and macro guru Raoul Pal has called the bot’s historic performance “astonishing.” The former Goldman Sachs executive says the bot outperforms an aggregated bucket of the top 20 crypto assets on the market by more than 20%.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  Siacoin

Siacoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD