As Solana (SOL) Price Reaches Make-or-Break Resistance, Which Way Will It Turn?

The Solana (SOL) price is approaching a crucial resistance at $14.80. Whether it breaks out or gets rejected could determine the future trend. Interestingly, the SOL price increased last week despite negative Solana news.

SOL is the native token of the Solana blockchain platform. The Solana blockchain combines a proof-of-stake (PoS) consensus mechanism with proof-of-history (PoH). The platform was founded by Anatoly Yakovenko and specializes in smart contracts.

Last week’s Solana news was mostly negative. Matrixport continued the trend of projects abandoning Solana and announced that it would remove SOL dual currency products.

However, Bonk coin offers a glimmer of hope. It is the first native Solana dog meme coin and has increased by 130% after its airdrop. With that in mind, the Solana price has increased by 75% since its Dec. 29 lows.

Solana Short-Term Price Prediction: Can Break out Lead to Higher Prices?

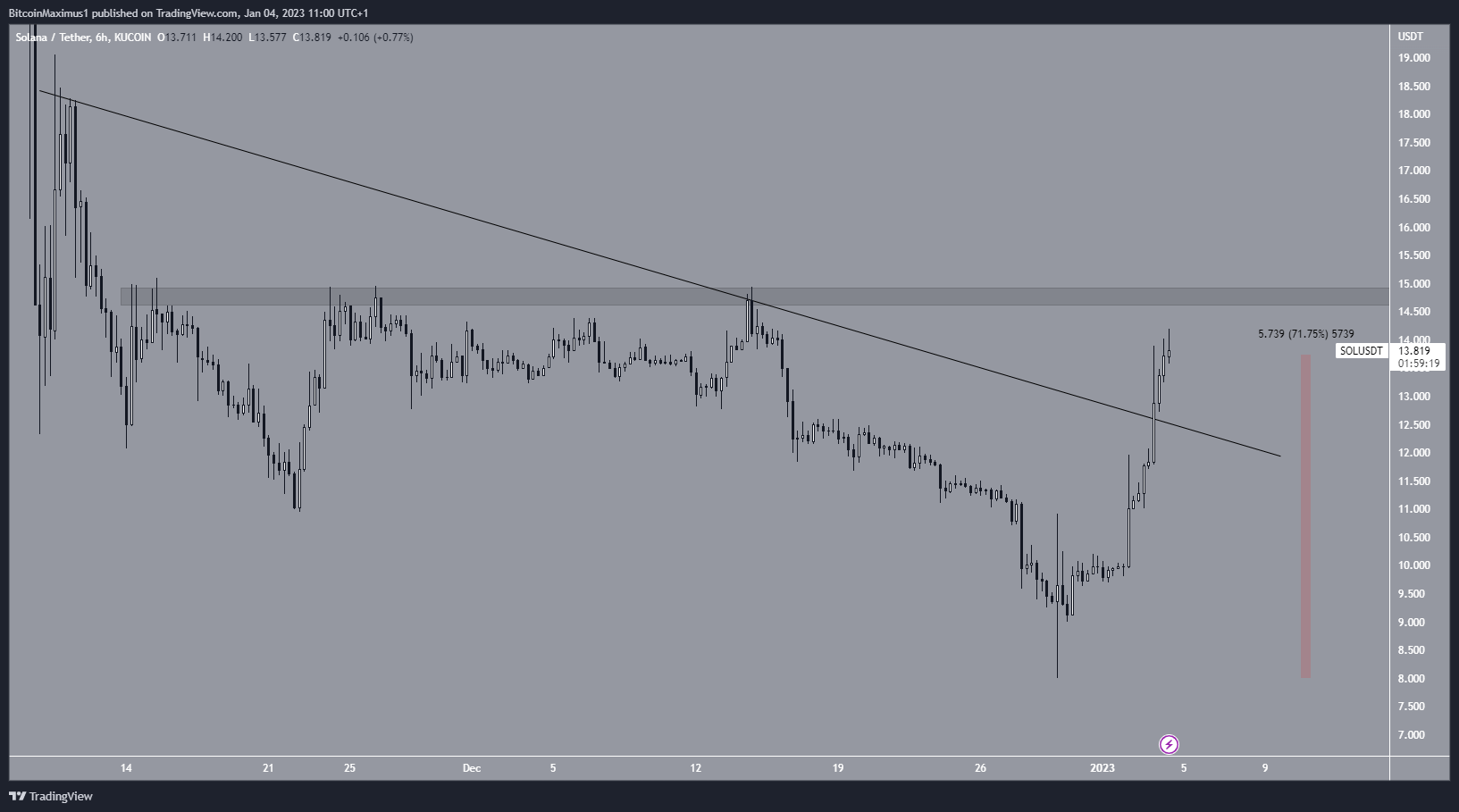

The technical analysis from the six-hour chart shows that Solana had decreased below a descending resistance line since Nov. 9. The downward movement led to a low of $8 on Dec. 29.

Despite the drop, the SOL price began an upward movement almost immediately after the low, creating a long lower wick in the process (green icon). It broke out from the descending resistance line on Jan. 4 and has increased by 72% so far. After the breakout, Solana reached a maximum price of $14.20. The SOL token price is now approaching the $14.80 resistance area.

So, the Solana short-term price prediction hinges on whether the price will break out from the $14.80 resistance area or not. A breakout could accelerate the upward movement toward $20, while a breakdown could lead to a re-test of the resistance line.

SOL/USDT Six-Hour Chart. Source: TradingView

Breakout or Rejection?

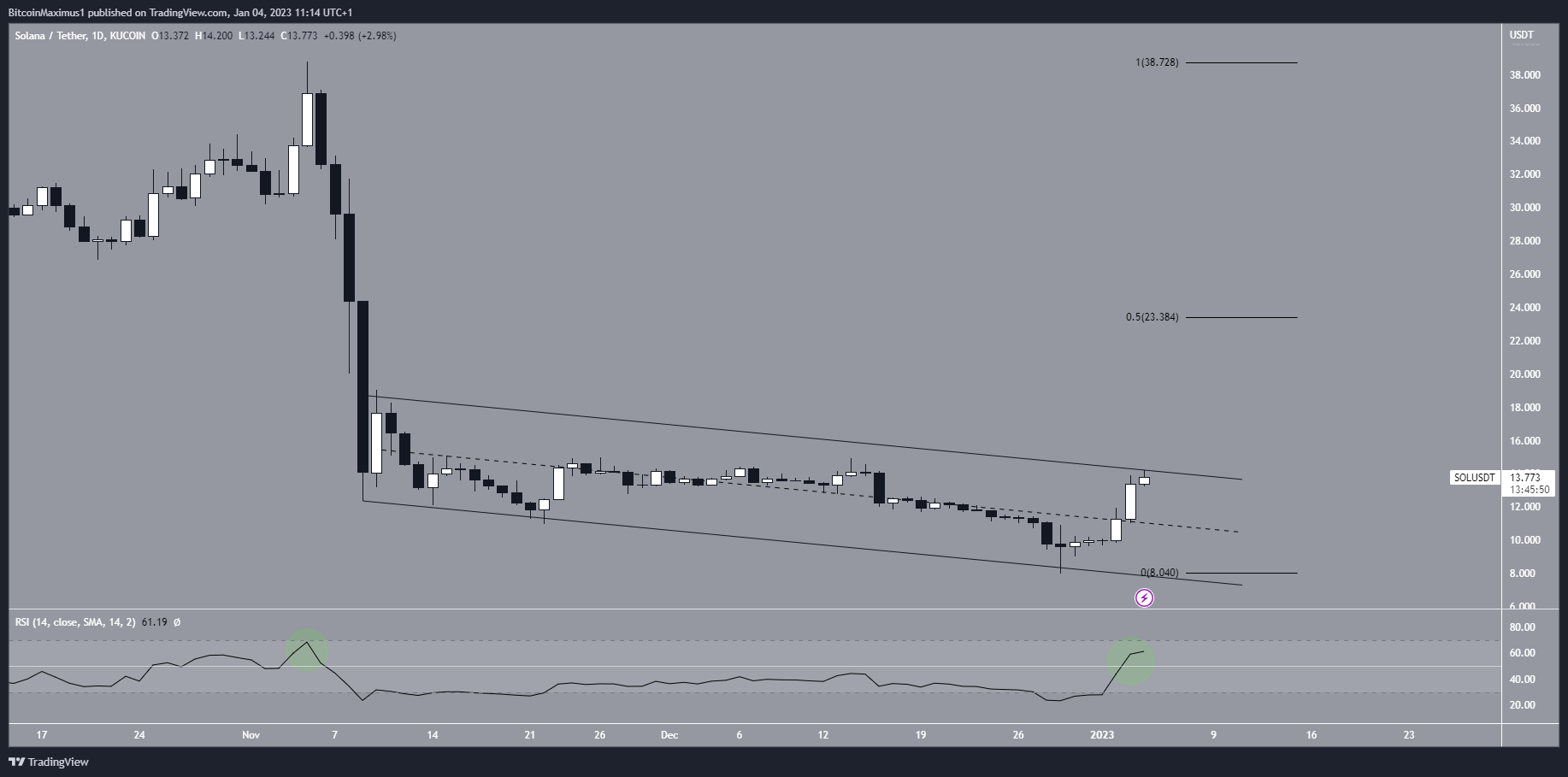

The daily chart reiterates the importance of the $14.80 resistance area. It seems that the Solana price is trading inside a descending parallel channel, and its resistance line coincides with the $14.80 resistance area.

While the descending channel is considered a bullish pattern, the SOL price is still trading below resistance.

While the daily RSI has broken out above 50, it did the same in the beginning of Nov. (green circle) before collapsing. As a result, the indicator reading cannot be considered bullish yet.

A breakout from the channel could take the SOL price to the 0.5 Fib retracement resistance at $23.40. Conversely, a rejection could cause a re-test of the support line at $7.80.

SOL/USDT Daily Chart. Source: TradingView

To conclude, the Solana price analysis for the future is still unclear. A breakout from the $14.80 area and the long-term channel could greatly accelerate the upward movement.

On the other hand, failure to do so could lead to new yearly lows. Negative Solana news could also impact the possibility of a breakout.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  EOS

EOS  KuCoin

KuCoin  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  Hive

Hive  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur