Axie Infinity (AXS) Price Prediction: When Will the Bearish Tide Subside?

Axie Infinity (AXS) entered a bearish trend after a 5% negative performance in February.

The steady decline in whale transactions and price volatility suggests that the bears may remain in firm control in the coming weeks.

AXS Whales Are Missing in Action

Axie Infinity is one of the top 10 ranking GameFi projects globally. In February, its native AXS token delivered an unimpressive 5% price decline. And tellingly, the activity of large investors has diminished significantly on the blockchain gaming network over the past 30 days, signaling an extended price slump.

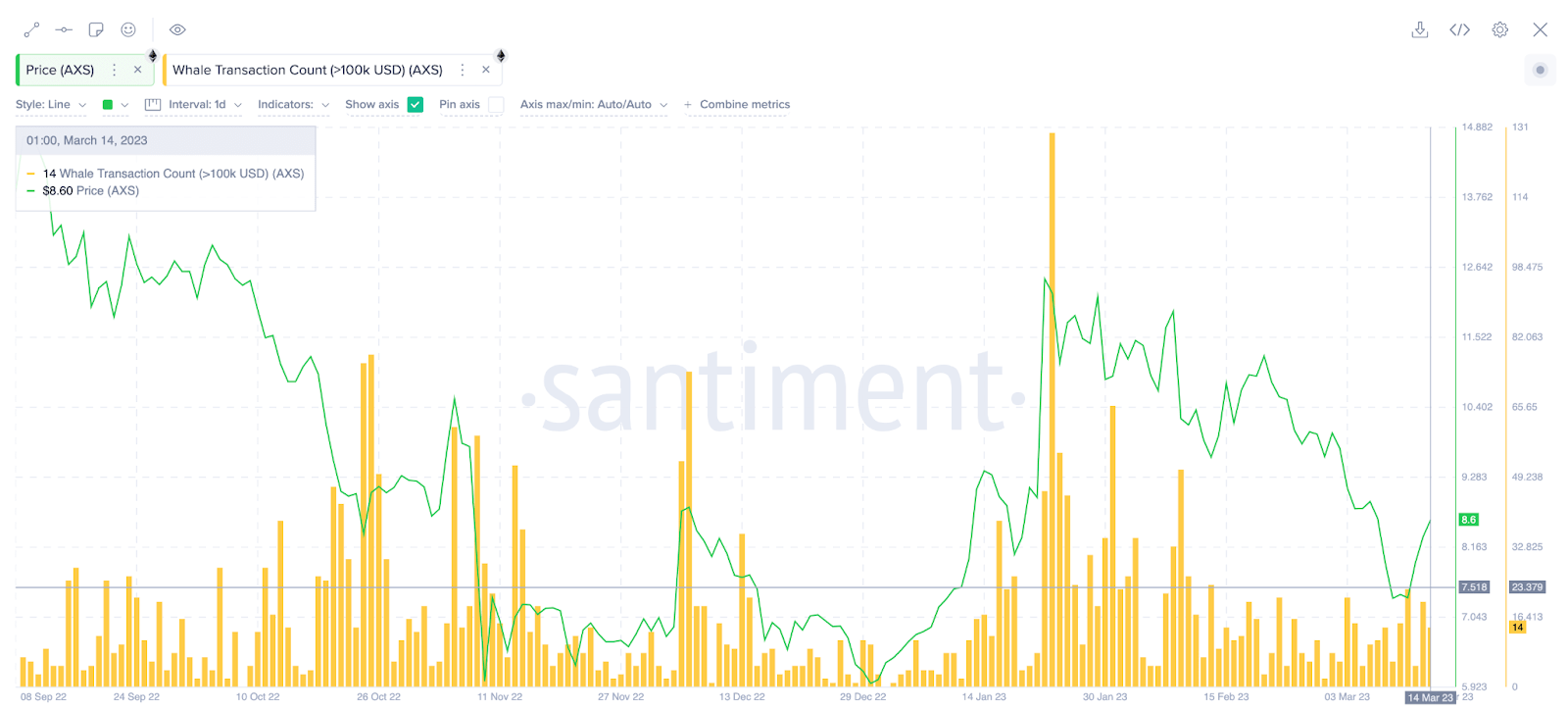

According to the renowned on-chain market intelligence platform, Santiment, the number of whale transactions recorded on the Axie Infinity network has dropped by nearly 80% since the start of February.

Previous AXS price slumps have frequently been accompanied by a comparable fall in the volume of large transactions.

AXS Whales Transaction Count, March 2023. Source: Santiment.

Santiment recorded 66 AXS transactions worth over $100,000 at the close of Jan. 31, and by the recent count on March 14, the figure has dropped to 14.

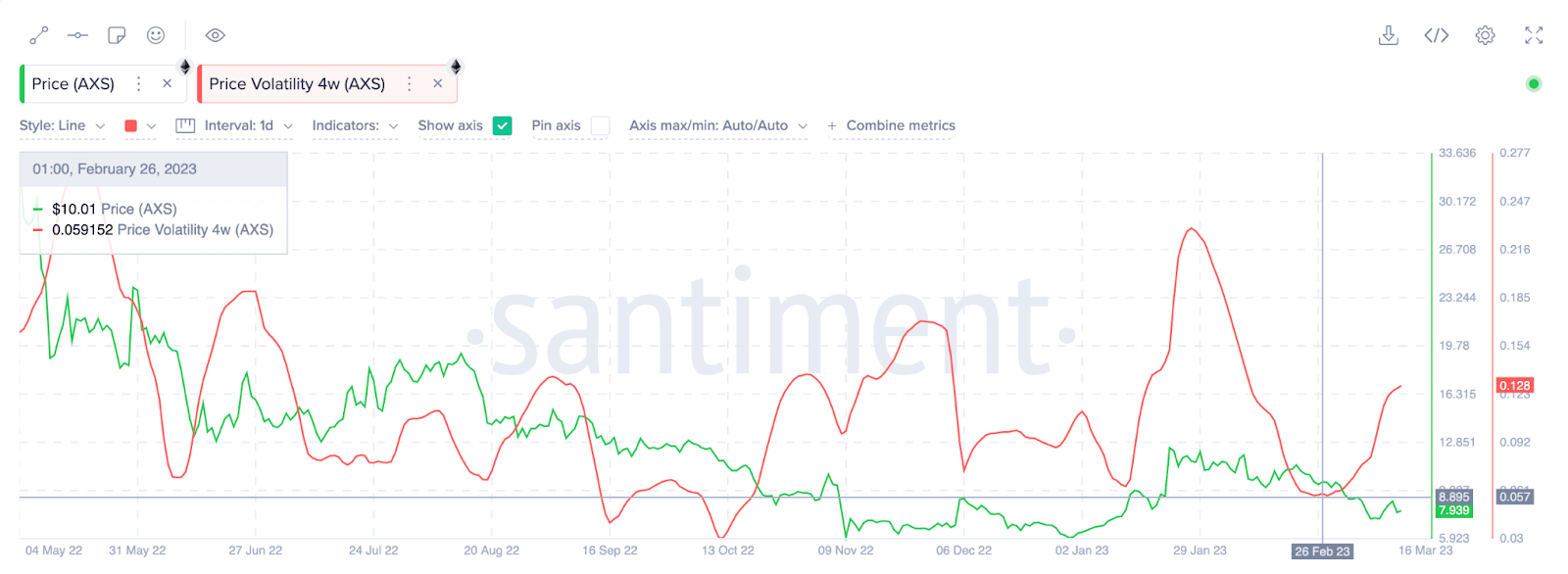

Also, a closer look at the on-chain data trail of the Axie Infinity network shows that price volatility has become less intense.

AXS price volatility ratio, measured at four-week intervals, reached a 3-month low as trading drew to a close in February.

AXS Price Volatility, March 2023. Source: Santiment

From 0.20 recorded on Feb 1, AXS price volatility ratio hovered around 0.12 as of March 14. In the past, when volatility diminished, it often coincided with price slumps on the GameFi network.

Furthermore, crypto investors often seek high-volatility assets because they move more quickly and have larger price changes. Hence, the declining volatility on the AXS network may likely trigger short-term traders to sell off their tokens as they seek to avoid a stagnant price action in the coming weeks.

Axie Infinity Price Prediction: Drop Below $6?

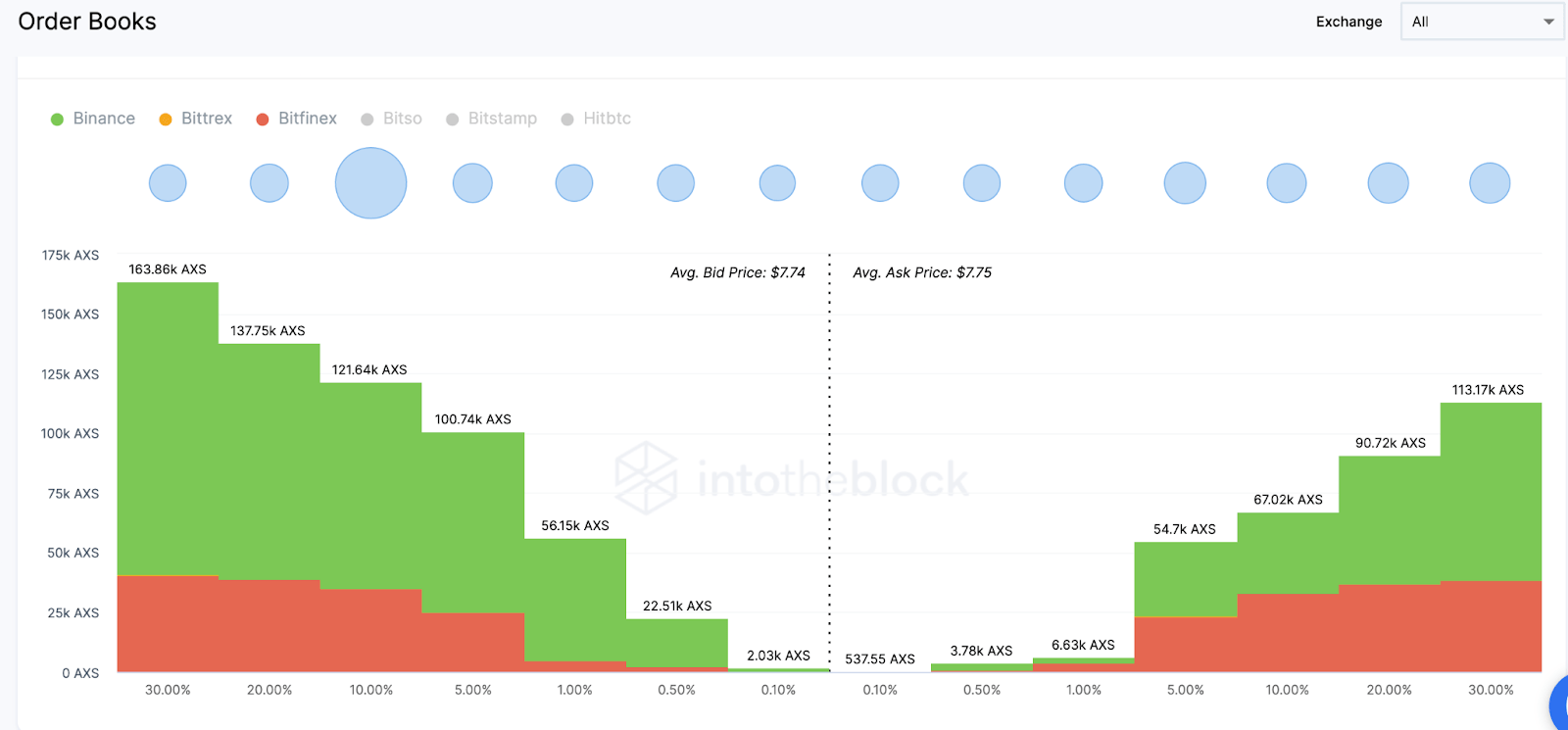

IntoTheBlock’s Exchange Market Depth chart provides a>

Axie Infinity (AXS) Exchange Market Depth, March 2023. Source: IntoTheBlock

In contrast, if the trend turns bullish, $9.72 is a key resistance point, as the aggregate order books of exchanges currently show 91,000 sell orders of nearly 1.5 million AXS tokens.

But, if Axie Infinity scales this resistance point, the 113,000 sell orders of 1.3 million AXS tokens at $12 will be the next cluster to beat.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  EOS

EOS  KuCoin

KuCoin  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur