Binance Coin (BNB) Price Bounces on News of Voyager Acquisition

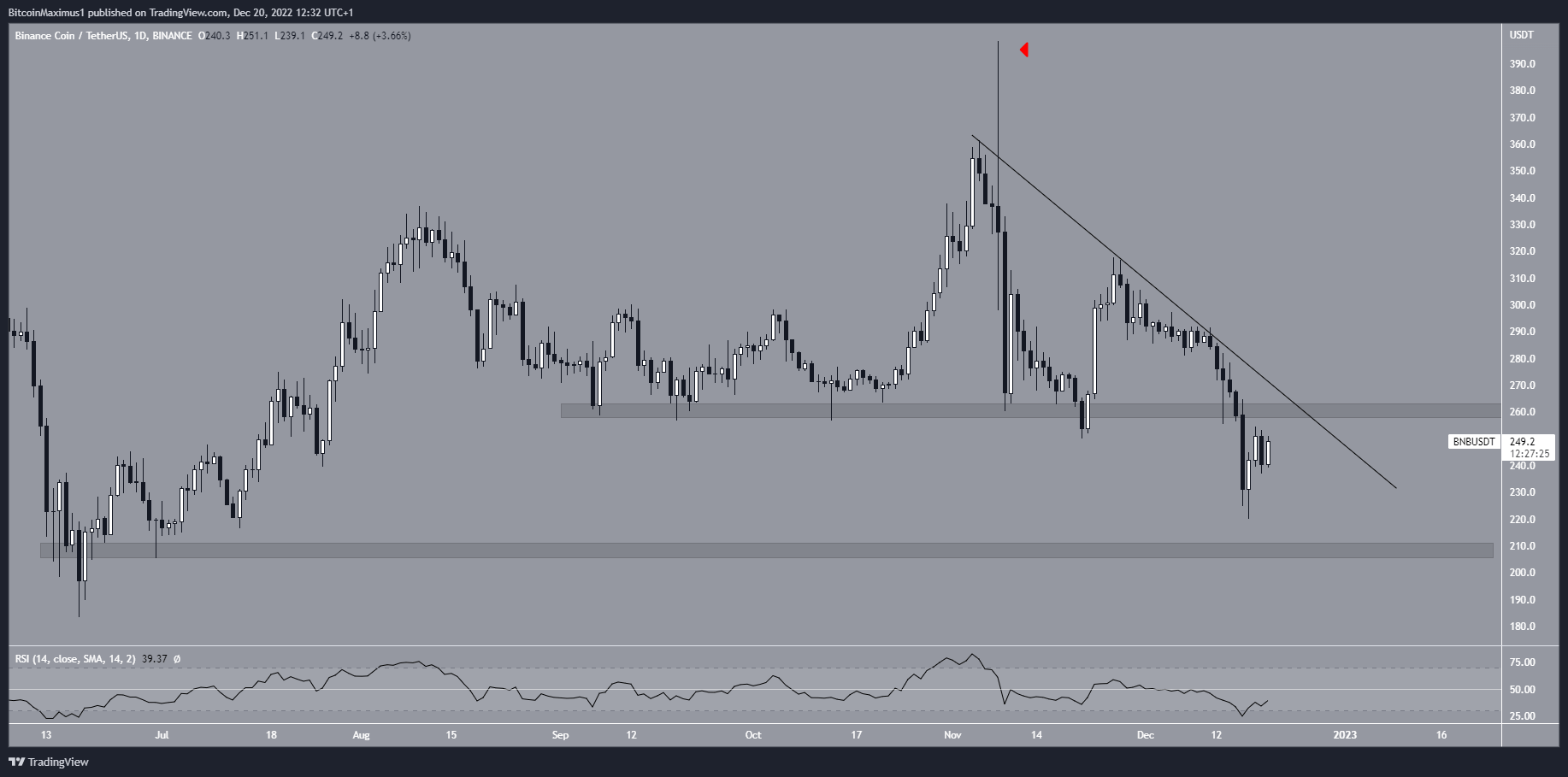

The Binance Coin (BNB) price broke down from the $260 horizontal support area. It is gearing up for an attempt at reclaiming it.

BNB Bounces After Voyager Acquisition

BNB is the native token of the Binance exchange and the Binance Smart Chain. The BNB price has decreased underneath a descending resistance line since reaching a high of $398.30 on Nov. 3. The same day, it created a massively long upper wick (red icon). The downward movement led to a low of $220 on Dec. 17 and caused a breakdown from the $260 horizontal support area.

The BNB price has increased since. The recent acquisition of Indonesian exchange Tokocrypto and the assets of bankrupt crypto lender Voyager Digital could have aided the increase. Voyager announced that it selected Binance.US as the highest bidder for its assets, in a bid amounting to $1.022 billion.

In order for the trend to be considered bullish, the Binance Coin price has to reclaim the $260 resistance area and break out from the descending resistance line. If it fails to do so, it could fall toward the next support area at $207.

While the daily RSI is below 50, it just moved outside of its oversold territory. As a result, the readings from the daily time frame are insufficient to determine the future trend’s direction.

Interestingly, opinions of various crypto experts on whether Binance will suffer the same fate as FTX are also divided.

BNB/USDT Daily Chart. Source: TradingView

Wave Count Supports More Downside

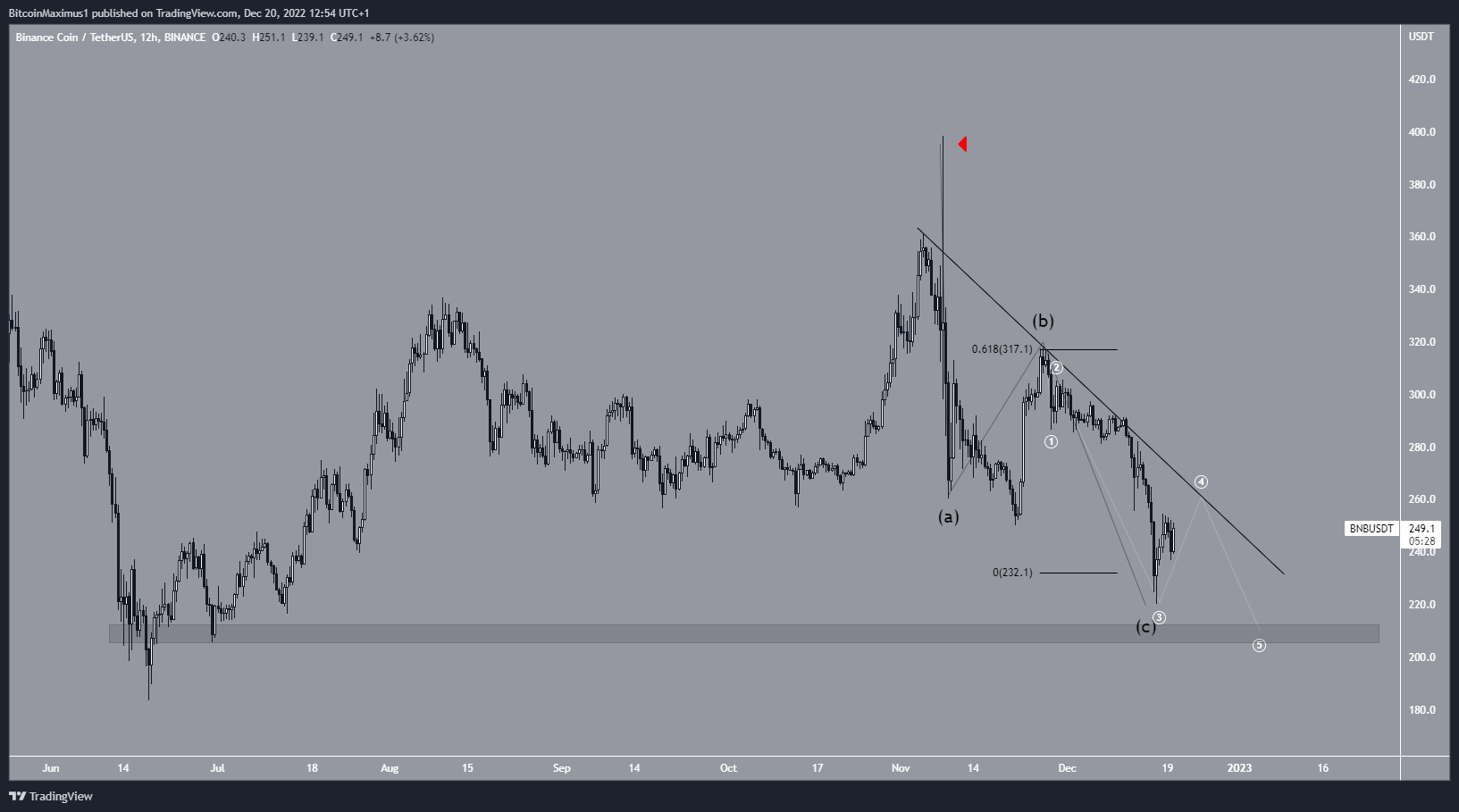

While the daily time frame does not offer a decisive direction for the trend, the wave count suggests that the BNB price faces more downside.

Since the aforementioned Nov. high, the Binance Coin price has been mired in an A-B-C corrective structure (black). Currently, waves A:C have a 1:0.618 ratio, which is relatively common in such structures. However, the sub-wave count (white) indicates that another drop is expected.

If the count is correct, the BNB price will complete sub-wave four at the resistance line before falling toward $207. Breaking out from the resistance line would invalidate this bearish BNB price projection.

BNB/USDT 12-Hour Chart. Source: TradingView

To conclude, the most likely price forecast for BNB is a re-test of the resistance line and a drop toward $207. Breaking out from the resistance line would indicate that a bullish reversal has begun.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Zcash

Zcash  Decred

Decred  Dash

Dash  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  HUSD

HUSD  Augur

Augur