Bitcoin, Ether Retrace Weekend Losses As Bears See $183M in Short Liquidations

Bitcoin (BTC) and ether (ETH) surged 10% in the past 24 hours to retrace all weekend losses after crypto markets plunged following troubles at Silicon Valley Bank (SVB) on Friday night.

Bitcoin inched just over $22,500 in Asian morning hours on Monday while ether regained the $1,600 level, as per Coingecko. The move came as USD Coin (USDC)-issuer Circle said Sunday it would cover all shortfall in reserves, while Federal regulators said SVB depositors will have access to all funds on Monday morning after the U.S. open.

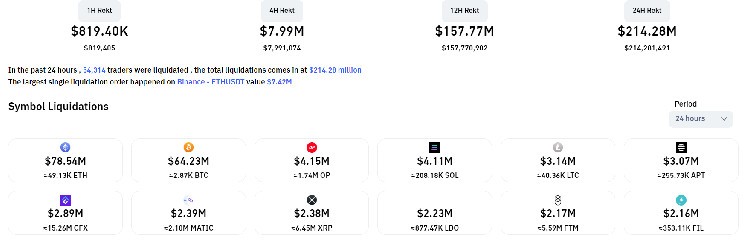

Traders betting on a market-wide decline were caught off guard as a broader market recovery in the past 24 hours saw $183 million in shorts, or bets against price rises, getting liquidated.

Short traders made nearly 85% of all liquidations in the past 24 hours, Coinglass data shows.

Liquidation refers to when an exchange forcefully closes a trader’s leveraged position due to a partial or total loss of the trader’s initial margin. It happens when a trader is unable to meet the margin requirements for a leveraged position (fails to have sufficient funds to keep the trade open).

Large liquidations can signal the local top or bottom of a steep price move – which may allow traders to position themselves accordingly.

Liquidations on ether futures crossed $78 million, the most among all crypto futures, followed by bitcoin futures at $68 million. Such activity may have contributed to an overall market surge as shorts capitulated their positions.

Futures of other major tokens saw relatively lesser losses, suggesting movement was spot driven. Optimism (OP) and solana (SOL) took on $4 million in losses each, followed by litecoin (LTC) and aptos (APT) futures at $3 million.

Binance saw $75 million in short liquidations, the most among exchanges, followed by OKX at $47 million.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond