Bitcoin, Ethereum and Altcoins Are About To Outperform Most Major Asset Classes, According to Bloomberg Analysts

Commodity analysts from Bloomberg say that crypto assets are gearing up to outperform the rest of the financial markets.

In the latest Bloomberg Intelligence: Crypto Outlook report, analysts Mike McGlone and Jamie Douglas Coutts argue that Bitcoin (BTC), Ethereum (ETH), and altcoins within the Bloomberg Galaxy Crypto Index (BGCI) are ready to outshine everything else when financial markets turn bullish again.

The Bloomberg analysts say digital asset markets could come to life on the narrative of Bitcoin becoming a risk-off asset rather than being tightly correlated with stock markets.

“That the lone major asset class to rally in 1H – commodities – may have logged an enduring peak has implications for a bottom in Bitcoin. When the ebbing economic tide turns, we see the propensity resuming for Bitcoin, Ethereum and the Bloomberg Galaxy Crypto Index to outperform most major assets. Rate hikes by more central banks than ever is a strong headwind.

But it’s the potential for the benchmark crypto to shift toward becoming a risk-off asset like gold and US Treasurys, that may play out in 2H. Since 2014, October has been the best month for Bitcoin, averaging gains of about 20%, and in 3Q the BGCI advanced about 16% vs. 5% declines for the Nasdaq 100 and S&P 500. Ethereum’s transition to proof of stake may be helping it build a base above $1,000 and Bitcoin about $20,000.”

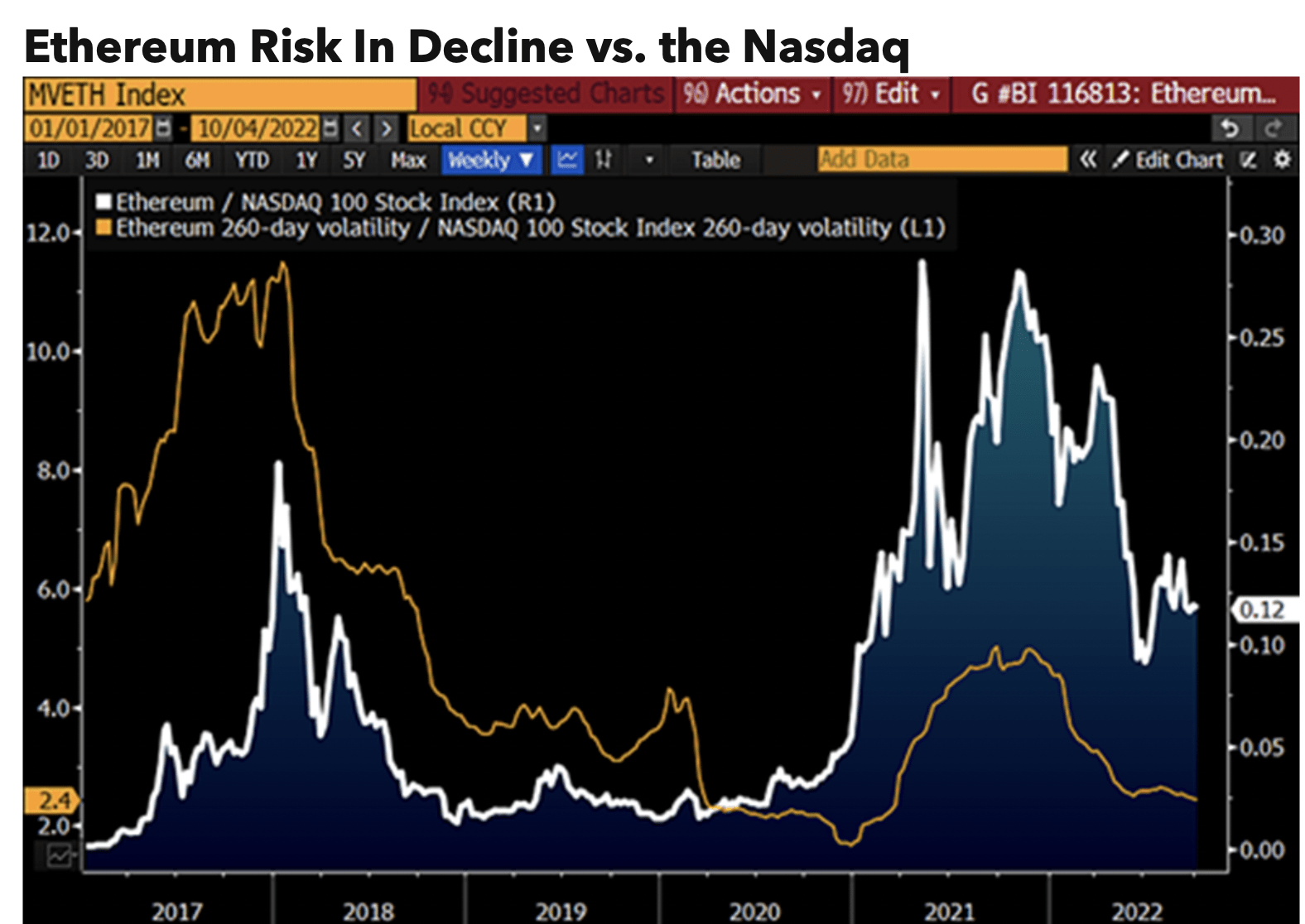

Looking at Ethereum, the Bloomberg analysts say that the second largest blockchain by market cap’s recent successful merge to proof-of-stake helped it enter a new chapter. According to the strategists, ETH may be at a point where it becomes more stable than traditional financial instruments during macro bear markets.

“Ethereum took a leap forward with the merge to proof of stake in September, with implications for its price

performance. The No. 2 crypto has a tendency to respect support and resistance at major round numbers, and $1,000-$2,000 has been its cage.

About $1,000 is key support and our graphic shows Ethereum outperforming the Nasdaq 100 Index in 3Q. The nascent technology and more volatile No. 2 crypto has a tendency to outperform the stock index on the way up, but the merge may mark an inflection point of Ethereum also beating the Nasdaq 100 when it declines.”

Source: Bloomberg Intelligence:Crypto Outlook

The Bloomberg analysts are also bullish on the fact that USD-pegged stablecoins, the most widely traded type of crypto assets, primarily rely on the Ethereum network to operate.

“The most widely traded digital assets are crypto dollars, which are tokens tracking the greenback, made possible mostly by Ethereum. We like to ask what stops the tokenization of most assets and it may simply be a matter of time.”

Featured Image: Shutterstock/Illus_man

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  Siacoin

Siacoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD