Bitcoin & Ethereum Funding Rates Signal Continued Bullishness Despite Recent Selloff

Funding rates in the market for bitcoin (BTC) and ethereum (ETH) perpetual futures contracts reveal that most crypto derivatives traders continue to lean bullish, despite falling spot prices over the past 24 hours.

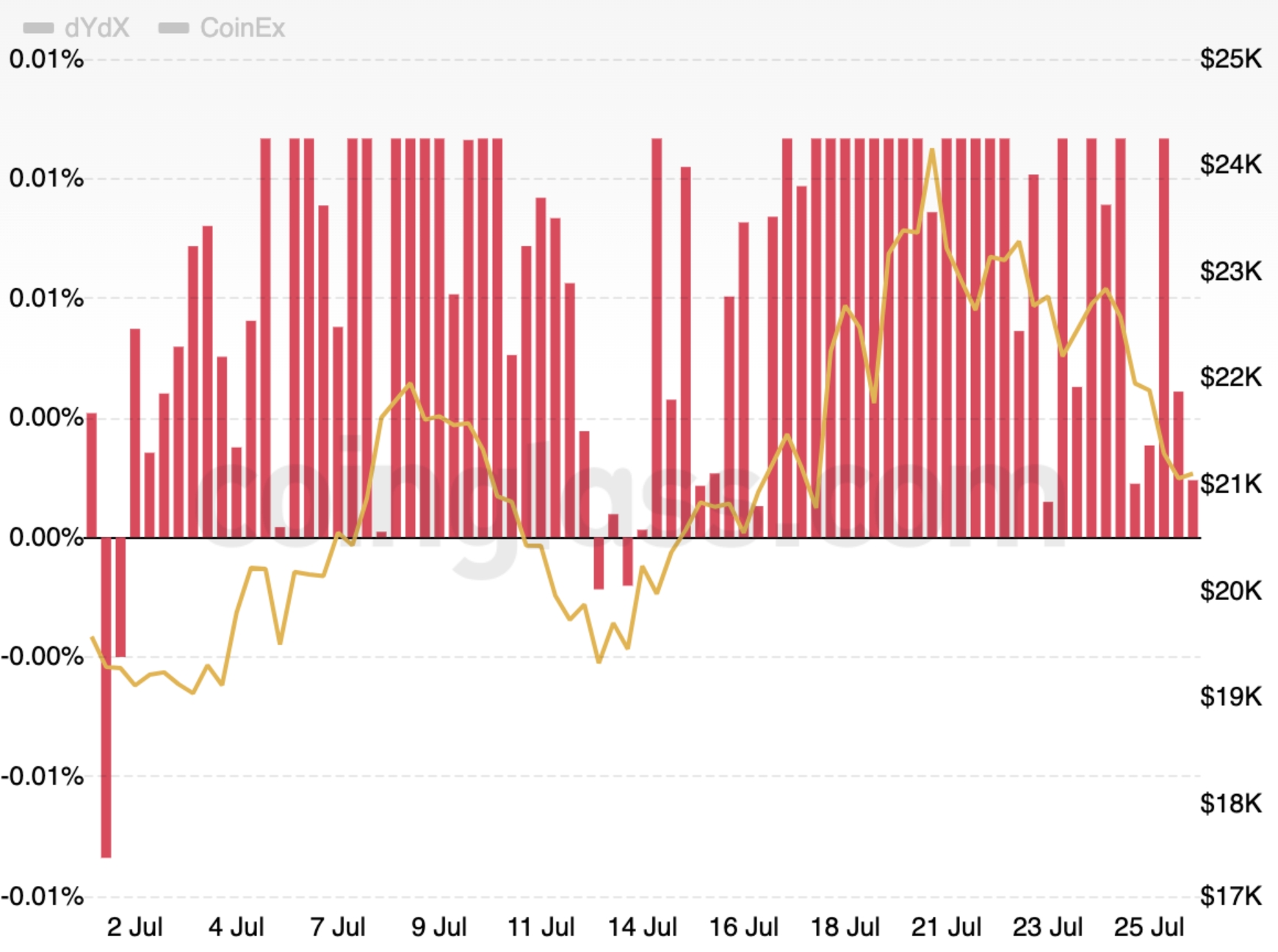

Judging from data by Coinglass, funding rates on the BTC/USDT perpetual contract on the major crypto exchange Binance have largely remained positive throughout July, despite stagnating and falling prices seen since July 19.

Binance BTC/USDT funding rates in July:

Source: Coinglass

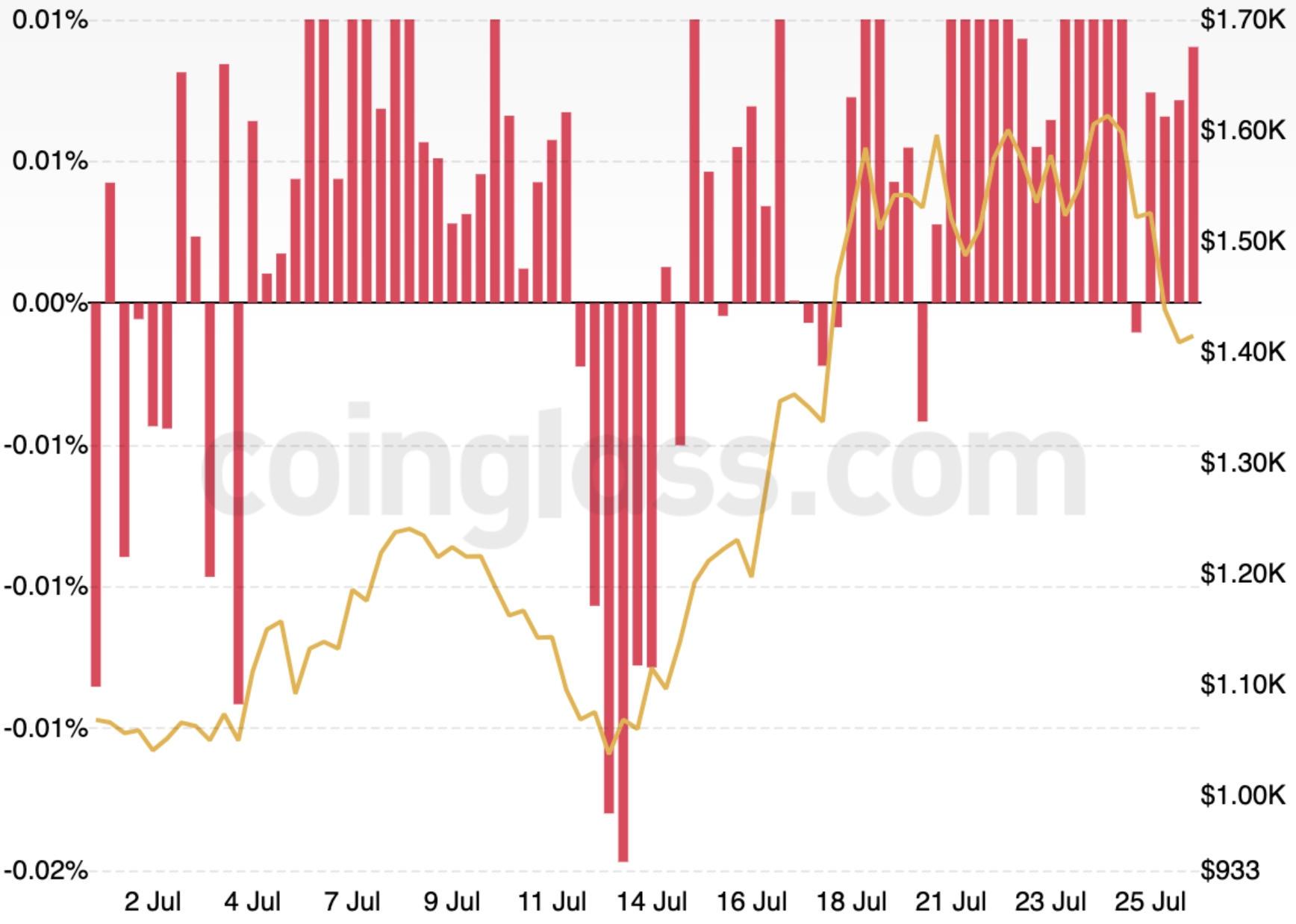

The same has mostly also been the case for the ETH/USDT perpetual contract. The funding rate has remained positive even as ETH fell sharply on Monday this week, dropping from USD 1,600 to well below the key USD 1,500 level.

Binance ETH/USDT funding rates in July:

Source: Coinglass

A positive funding rate means that traders who are long need to pay a funding fee to those who are short, while a negative funding rate results in the opposite situation. Funding rates on perpetual futures are generally positive during bullish market conditions and negative during bearish conditions.

Binance usually ranks as the largest exchange by open interest in bitcoin perpetual futures. The exchange updates its perpetual funding rates every 8 hours.

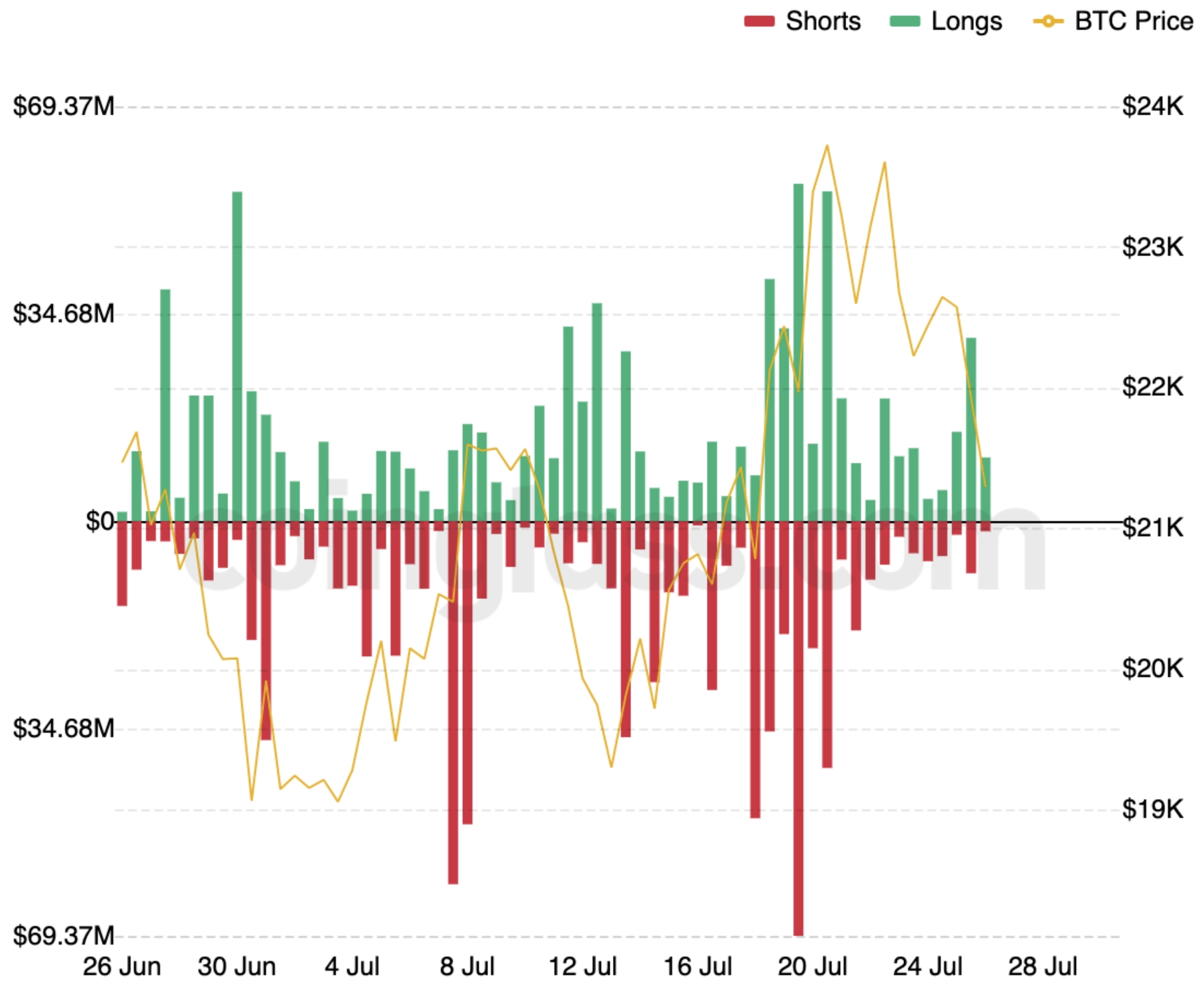

Meanwhile, liquidations of leveraged bitcoin long positions reached USD 30.6m in the 12 hours from noon to midnight UTC on Monday. The event marked the highest level of liquidations since July 20, when over USD 55m of bitcoin longs were liquidated as bitcoin crashed from the USD 24,000 level.

BTC liquidations:

Source: Coinglass

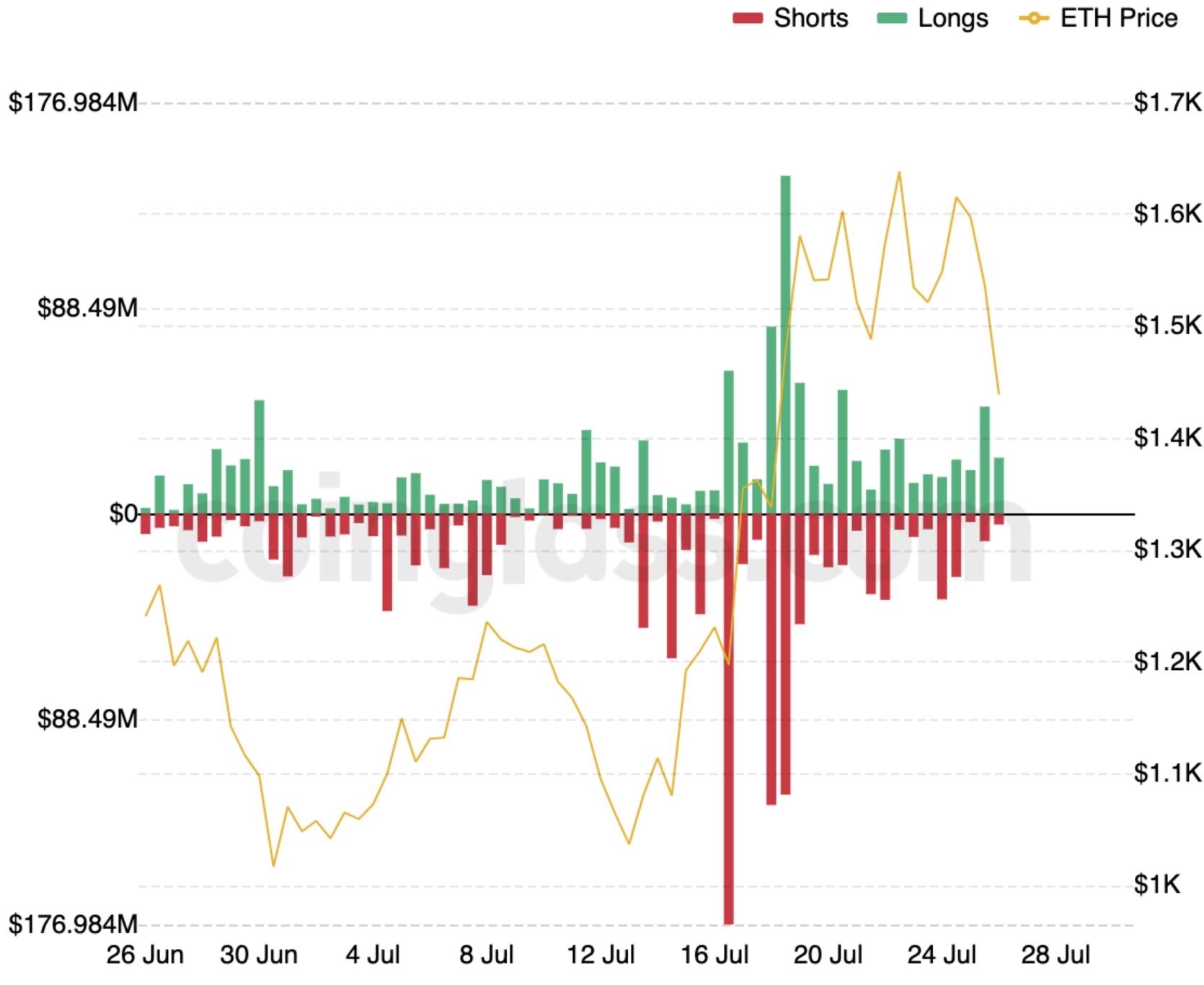

Similarly, ETH also saw a relatively high level of liquidations on Monday, with USD 46m in ETH longs liquidated in the 12 hours from noon to midnight. As with bitcoin, the liquidations on Monday marked the highest level of ETH liquidations since the crypto sell-off on July 20.

ETH liquidations:

Source: Coinglass

The long liquidations in the ETH market came despite increased bullishness on the asset in recent days, fueled partly by a sense that the Merge – Ethereum’s transition from the proof-of-work (PoW) to the proof-of-stake (PoS) consensus mechanism – is nearing. Ethereum developer Tim Beiko earlier in July proposed September 19 as the tentative date for the Merge.

The news is thought to be at least partly responsible for a surge in the price of ETH from the USD 1,200 level to close to USD 1,600 between July 16 and July 18 as a massive amount of leveraged shorts were liquidated.

Commenting on the surging price at the time, a blog post published by the crypto derivatives exchange Deribit said that it “seems to be caused by a gamma squeeze,” or large-scale buying of short-dated call options. However, the post also warned that the price increase “lacks sufficient support.”

Sure enough, ETH fell sharply on Monday this week, with the sell-off continuing on Tuesday, seen by many other cryptoassets as well.

At 12:34 UTC on Tuesday, BTC was down 3.7% for the past 24 hours and 5.7% for the week to a price of USD 21,113. At the same time, ETH stood at USD 1,402, down 8.3% for the day and 10.6% for the week.

____

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  EOS

EOS  KuCoin

KuCoin  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Dash

Dash  Ontology

Ontology  Zcash

Zcash  Decred

Decred  NEM

NEM  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur