Bitcoin Price and Ethereum — Why Could BTC Go After $20,500?

On October 14, the cryptocurrency market is on the rise with the total market capitalization of all cryptocurrencies increasing by 2.79% to $944.24 billion. The total volume of the cryptocurrency market has increased by 93.62% in the last 24 hours, to $2.79 billion.

DeFi’s total volume was $5.17 billion, or 6.04% of the cryptocurrency market’s total 24-hour volume. In the last 24 hours, the total volume of stablecoins was $78.95 billion, accounting for 92.21% of the total cryptocurrency market volume.

Bitcoin, the leading cryptocurrency, rebounded from the $18,248.46 triple bottom support level and gained 3.79% to trade at $19,807.93. Similarly, Ethereum is experiencing a sharp reversal, trading above $1,300 (the psychological level), after increasing by nearly 3.28% in the last 24 hours.

Top Altcoin Gainers and Losers

Ethereum Name Service (ENS), TerraClassicUSD (USTC), and Lido DAO (LDO) remained the top performers. Ethereum Name Service price has risen by more than 17% to $19.87, while TerraClassicUSD price has soared by 12.42% to $0.0509. Likewise, LDO rose 12.84% to $1.37.

Cryptocurrency Market Heatmap | Source: Coin360

Convex Finance’s price has remained bearish, falling 4.38% in the last 24 hours to $5.49.

Despite stronger-than-expected US CPI figures, the market appears to be trading risk-on. Investors appear to be selling cryptos on rumors and buying the fact (assuming higher US inflation figures).

As a result, we have a good opportunity to enter positions, especially given the market’s bullish reversal.

US Inflation Hits 40-Year High

The United States experienced annualized consumer price inflation of less than 9% in September 2022 for the third month in a row. The rate was lower than the 8.1% predicted by the market, but it was still higher than the low point seen in February.

For the second time in three months, the core CPI rose by 0.6% from the previous month. Increases of 0.4% from the previous month and 8.2% from the previous year were seen in the Consumer Price Index (CPI).

US Inflation — Source: US Bureau of Labor Statistics

In addition, the annual rate remained well above the 2% target set by the US Federal Reserve, suggesting that policymakers will keep their hawkish rhetoric and rapidly increase interest rates.

In September, the Consumer Price Index in the United States was 296.808, up from 296.171 in August and above the market expectation of 296.43 points.

US Dollar Index — Source: Tradingview

Even though the US dollar initially rose in response to a hotter-than-expected US inflation report, it retreated against most other major currencies on Thursday as investors decided the market’s initial reaction to the data was over the top.

The focus will remain on the preliminary UoM Consumer Sentiment and Retail Sales data from the United States later today. It may contribute to increased volatility and price action in the cryptocurrency market.

Bitcoin Price

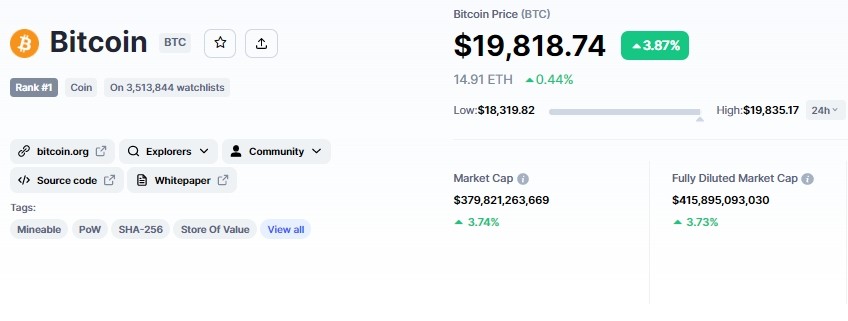

The current Bitcoin price is $19,804.53, and the 24-hour trading volume is $48.62 billion. Bitcoin has increased by 3.73% in the last 24 hours. CoinMarketCap currently ranks first, with a live market cap of $379 billion.

Bitcoin Price & Tokenomics — Source: Coinmarketcap

On the technical front, the triple bottom pattern has extended major support near $18,250. Bitcoin has experienced a massive reversal since the US dollar took a bearish turn, owing to triple bottom support and a weaker dollar.

On the 4-hour timeframe, Bitcoin has surpassed the 50-day moving average at $19,450, indicating the possibility of a bullish trend continuation. Similarly, oscillator indicators such as RSI and MACD are in a buying zone, indicating a bullish trend.

Bitcoin Price Chart — Source: Tradingview

Having said that, Bitcoin appears to be on the verge of breaking through the $20,450 barrier. A bullish break above the $20,450 level could push the Bitcoin price up to the $21,240 level.

Ethereum Price

The current price of Ethereum is $1,331.35, with a 24-hour trading volume of $19.24 billion. In the last 24 hours, Ethereum has gained 3.40%. CoinMarketCap currently ranks #2, with a live market cap of $163.47 billion. It has a circulating supply of 122,785,631 ETH coins and no maximum supply.

Ethereum Price & Tokenomics — Source: Coinmarketcap

On the technical front, Ethereum is encountering significant resistance at $1,340, which is extended by a downward trendline. The other technical indicators, on the other hand, point to an uptrend.

Ethereum Price Chart — Source: Tradingview

For instance, the ETH/USD pair has surpassed the 50-day moving average, which is now acting as a support near $1,315. The RSI and MACD are pointing to a bullish trend, and the recent bullish engulfing candle may add to that.

All that remains is for ETH to break above $1,340, at which point it will be able to target the $1,400 or $1,445 resistance levels.

Alternative Crypto — Tamadoge & IMPT

Tamadoge, a meme coin, has risen more than 3.07% in the last 24 hours to $0.04112. OpenSea is now selling ultra-rare Tamadoge NFTs for 1 WETH. If you’re looking for a place to buy Tamadoge right now, the top cryptocurrency exchanges are OKX, MEXC, XT.COM, BKEX, and BitMart.

In addition to Tamadoge, a new project called IMPT is still in the spotlight.

The IMPT token, the project’s native currency, has already raised more than $4.2 million after only 10 days of the presale, with 237 million tokens sold.

Despite the fact that the blockchain-based carbon credit marketplace held its auction during a bear market in cryptocurrency, demand for the marketplace token remained high.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  Gate

Gate  NEO

NEO  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Siacoin

Siacoin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Lisk

Lisk  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Nano

Nano  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD