Bitcoin slips as memecoins lead loses; GBTC discount to NAV widens

Cryptocurrency prices slipped across the board, even as the sector buzzes about the future of AI and big data tokens.

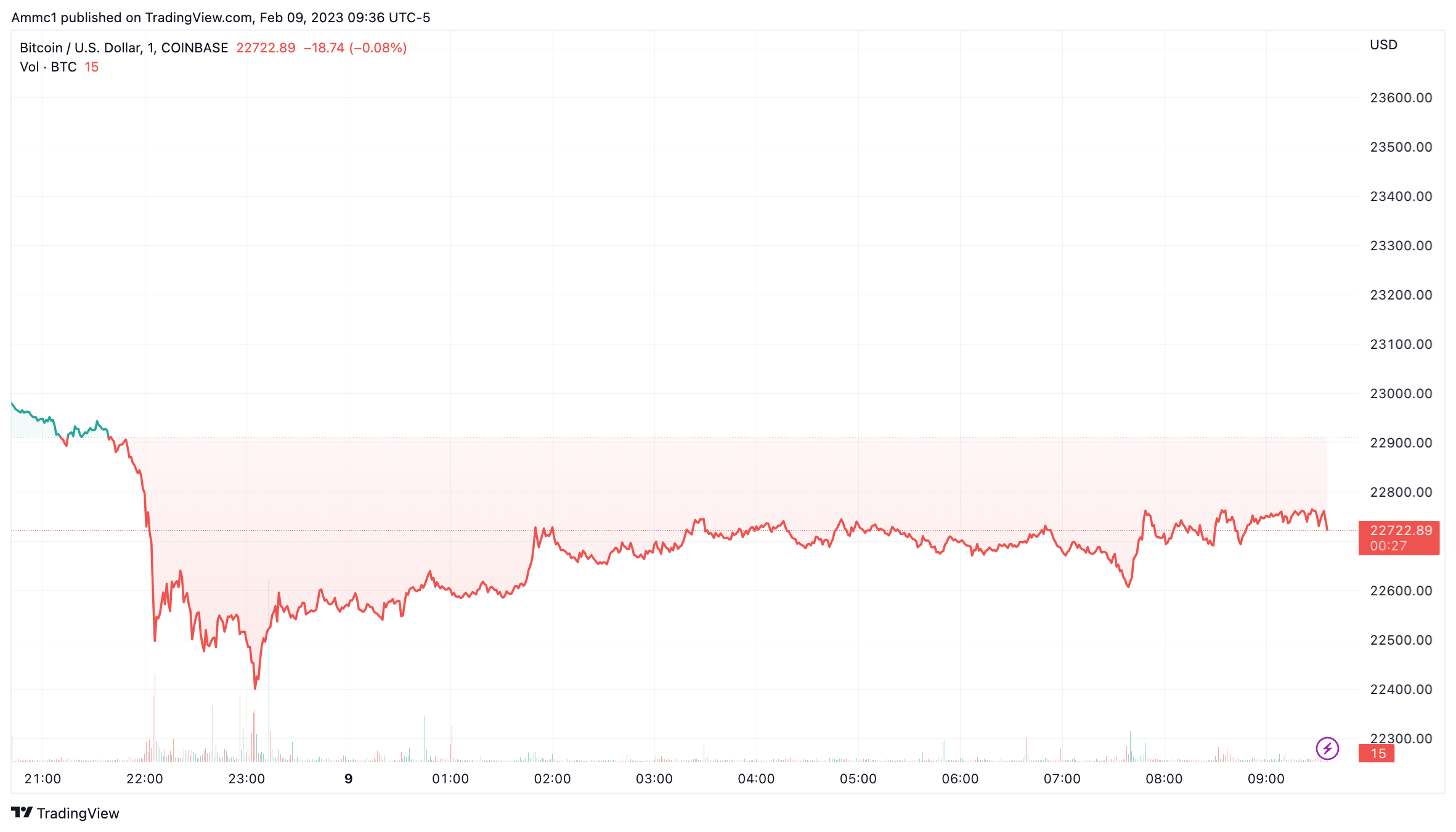

Bitcoin was trading at $22,722 by 9:35 a.m. EST, down 1.5% over the past day, according to TradingView data.

BTCUSD chart by TradingView

Ether fell 1.6% over the past 24 hours, trading at about $1,645. Binance’s BNB dropped 3%, while Cardano’s ADA fell 2.8%. Dog-themed memecoins experienced sharper sell-offs, with dogecoin down 3.1% and shiba inu losing 5.2%.

Structured products

Grayscale’s bitcoin trust, GBTC, has been trading down throughout the week, having reached a high of $12.93 last week. The fund’s discount to net asset value has also widened to 43.5%, the widest gap since early January, according to The Block data.

AI and big data x blockchain

Artificial intelligence and big data tokens have rallied recently on the back of a sudden fascination with AI chatbots, but the move has split opinions, with Fantom’s Lead Developer Andre Cronje saying AI and blockchain aren’t complimentary.

The convergence between machine learning and blockchain data could be a «killer use case,» according to 21Shares Director of Research Eli Ndgina, who stated that «blockchain data is a dark and complex forest with mechanisms that varies across ecosystems like Ethereum and Solana.»

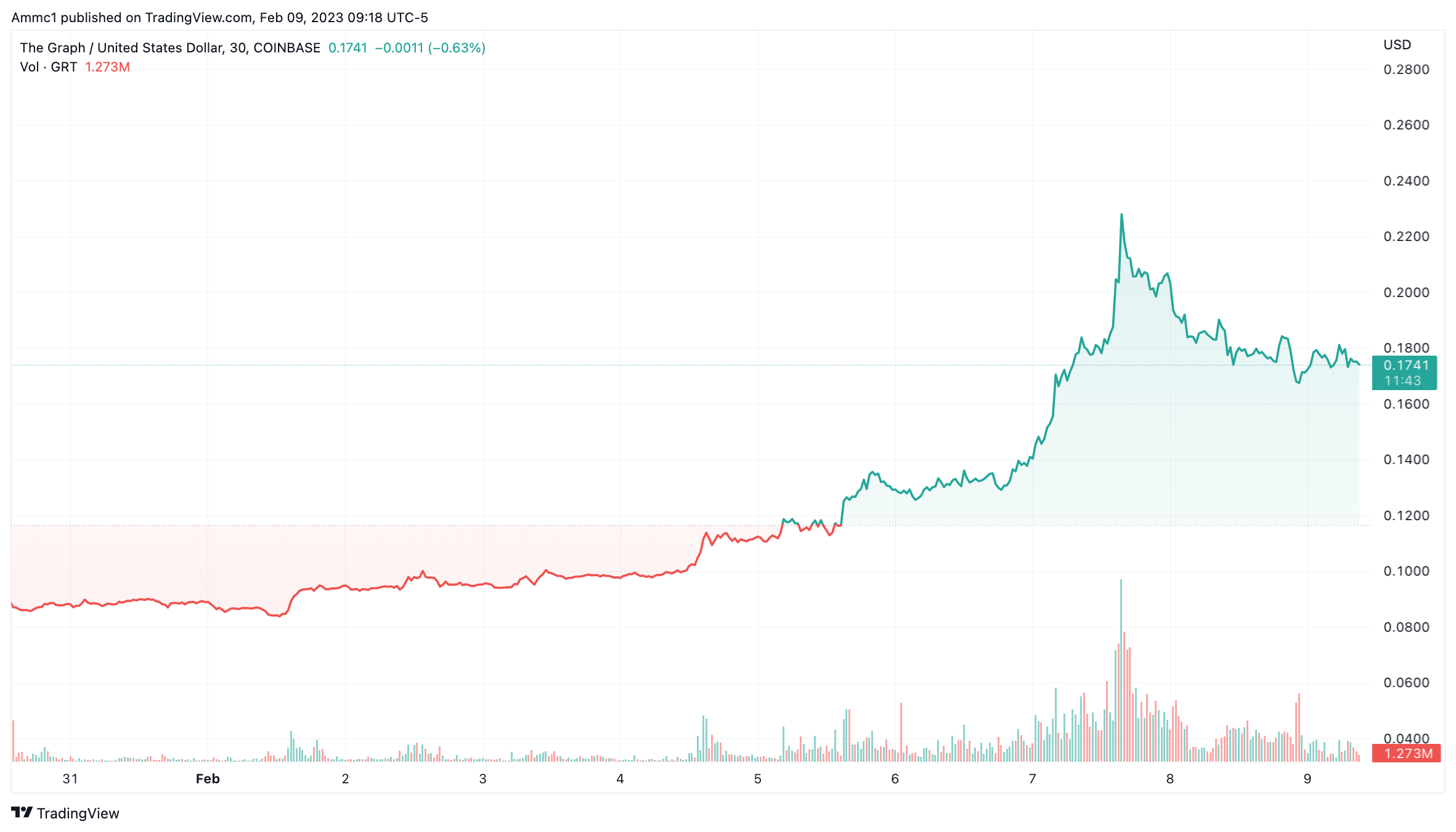

«The Graph (GRT), up 147% in 30 days, built a global API to index blockchain data across dozens of ecosystems to retrieve for example, token prices on decentralized exchanges without the need to download a full node,» he added.

GRTUSD chart by TradingView

Ndinga said the tokenization of assets and more use cases will dominate crypto, giving blockchain infrastructure players like The Graph an important role in accessing blockchain data such as using AI to label wallets and spot patterns of certain wallets. This will also create applications for investors and law enforcement.

«A concrete example is retrieving lost funds in the aftermath of a hack or after debacles like FTX,» he said.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Bitcoin Gold

Bitcoin Gold  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Pax Dollar

Pax Dollar  Status

Status  Numeraire

Numeraire  Nano

Nano  Steem

Steem  Hive

Hive  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur