BSV Price Analysis: Token faces strong resistance at the 50 EMA

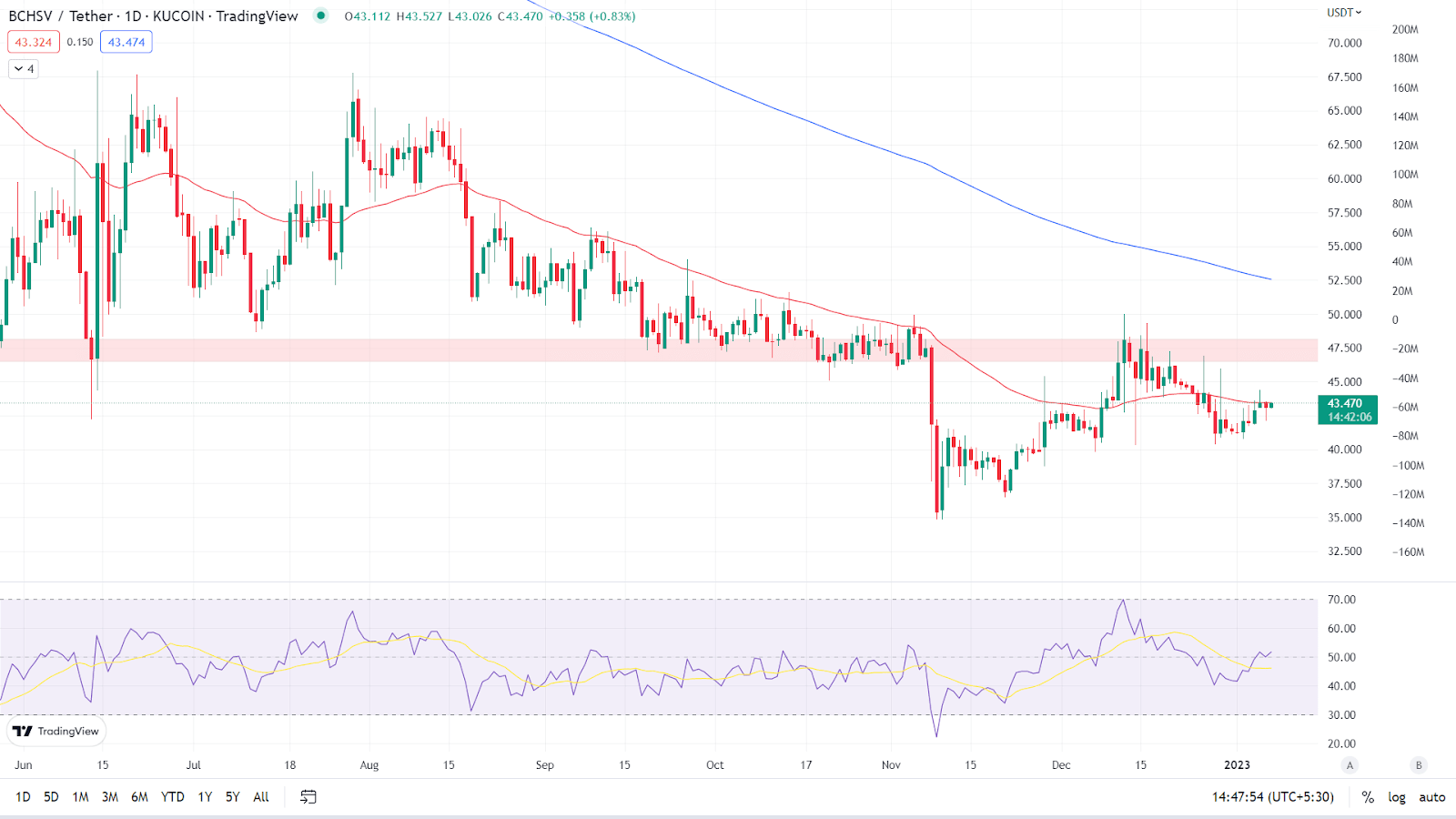

- The BSV token price is trading below the demand zone on a daily time frame.

- The pair of BSV/USDT is trading at the price level of $43.470 with a gain of 0.60% in the past 24 hours.

So far, 2022 has been a difficult year for cryptocurrency, and bitcoin sv (BSV) has battled alongside the market. After reaching $125.23 on January 2nd, the overall direction of movement was downhill. Things worsened in May with the depegging of the UST stablecoin, the collapse of the related LUNA cryptocurrency, and the following market crash.

BSV on the daily chart

Source: TradingView

The token’s overall outlook is bearish, with price forming lower highs and lower lows. As can be seen, BSV is presently trading at $43.470, up 0.60% in the last 24 hours. It is now trading below its key Moving Averages of 50 and 200. (Red line is 50 EMA and the blue line is 200 EMA). Token is encountering strong resistance at the 50 EMA; it tried to cross the 50 EMA but was unable to hold above it. On a daily time frame, the token is trading below the demand zone.

Relative Strength Index: The asset’s RSI curve is now at 51.61. The value of the RSI curve dropped as the token retraced to its demand zone and began declining from there. The RSI curve has crossed above the 14 SMA. As the indicator gains momentum, we may see the token cross over the 50 EMA. once more.

Analyst view & Expectations

Token is trading below the demand zone and is continually facing strong resistance at the 50-day moving average. The token’s price rose, but it was just a pullback till the demand zone, after which the token’s downhill path continued. Investors should avoid buying now and instead wait for the token to trade above the demand zone. Intraday traders, on the other hand, have a good opportunity to go short if the token trades below $40.5 and can achieve the target of $37.

According to our current Bitcoin SV(BSV) price prediction, the value of Bitcoin SV(BSV) is expected to rise by 13.60% in the next few days, reaching $ 49.03. Our technical indicators indicate that the current sentiment is Neutral, with the Fear & Greed Index reading 25. (Extreme Fear). Over the previous 30 days, Bitcoin SV(BSV) has 15/30 (50%) green days and 4.07% price volatility. According to our Bitcoin SV(BSV) forecast, if Bitcoin SV goes above the demand zone, it’s a good time to buy.

Technical Levels

Major support: $40.5

Major resistance: $48

Conclusion

On a daily time frame, the BSV token price has fallen below the demand zone. The BSV token price is forming a bearish chart pattern based on the price action. Investors should wait for a clear indication before acting.

Disclaimer: The views and opinions stated by the author, or any people named in this article, are for informational ideas only, and they do not establish the financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Bitcoin Gold

Bitcoin Gold  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Pax Dollar

Pax Dollar  Status

Status  Numeraire

Numeraire  Nano

Nano  Steem

Steem  Hive

Hive  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur