Inconsistent Metrics Indicate Further Struggle For SUSHI – Colder Winter Ahead?

SUSHI is having a hard time gaining some ground as the market declines again. Today, SUSHI has lost more than 5% of its value, following the trend of other major cryptocurrencies such as Bitcoin and Ethereum.

Here’s a quick glance at how SUSHI is performing:

- Optimism manifested itself as an acceleration in development activity and an increase in whale demand for SUSHI

- Technicals and metrics imply significant bearishness

- SUSHI could wrap up 2022 in a bumpy ride

Related Reading: How Litecoin (LTC) Outperforms Other Top Cryptocurrencies In This Department

The token’s dismal showing is in contrast to some positive trends, such as rising developer engagement (as reported by Santiment) and rising whale interest (as reported by WhaleStats). Metrics and technicals, however, suggest that SUSHI may close out the year with negative numbers.

JUST IN: $SUSHI @sushiswap now on top 10 purchased tokens among 100 biggest #ETH whales in the last 24hrs ?

We’ve also got $MOH, $QRDO, $QWLA, $aDAI & $BOBA on the list ?

Whale leaderboard: https://t.co/N5qqsCAH8j#SUSHI #whalestats #babywhale #BBW pic.twitter.com/TWNaSe2p5T

— WhaleStats (tracking crypto whales) (@WhaleStats) December 10, 2022

SUSHI Technicals Not Looking Great

The coin has found support at $1.013 and is presently trading at $1.119. The price is at a red candle, supporting a further drop in the near future. Money Flow Index verifies the decline that has started despite RSI readings near neutral levels.

This pessimism is bolstered by the gloomy data from CryptoQuant. Exchange reserve data have grown over the past few days, despite increased development activity and whale interest being incredibly favorable indicators.

The oversold level of SUSHI’s stochastic relative strength index (RSI) may serve as a catalyst for a pullback, notwithstanding the stock’s bearish sentiment.

The Bollinger band is in a position that is close to neutral, but its moving average acts as resistance at $1.263. However, the present price action is persistently pushing the bottom half of the range, which could result in a negative outcome for the token.

Drastic Measures Required?

Currently, the price is attempting to settle near $1.114, which could indicate that bulls and bears will remain in a prolonged deadlock. CMF data for SUSHI may suggest a turnaround.

Messari’s revealing of a major decline in SUSHI’s volatility could help investors and traders gain some momentume. Sharpe’s ratio indicates that the token’s performance indicates very low returns relative to its volatility.

The current state of the crypto may be the result of recent reports that the DEX’s finances are not in good shape, and its CEO Jared Grey is considering severe measures to remedy the situation.

With DeFiLlama observing repeated reductions in TVL for SUSHI, investors and dealers of the token may have a colder winter this year.

Related Reading: Yearn Finance: What The Final Quarter Of 2022 Has In Store For YFI Price

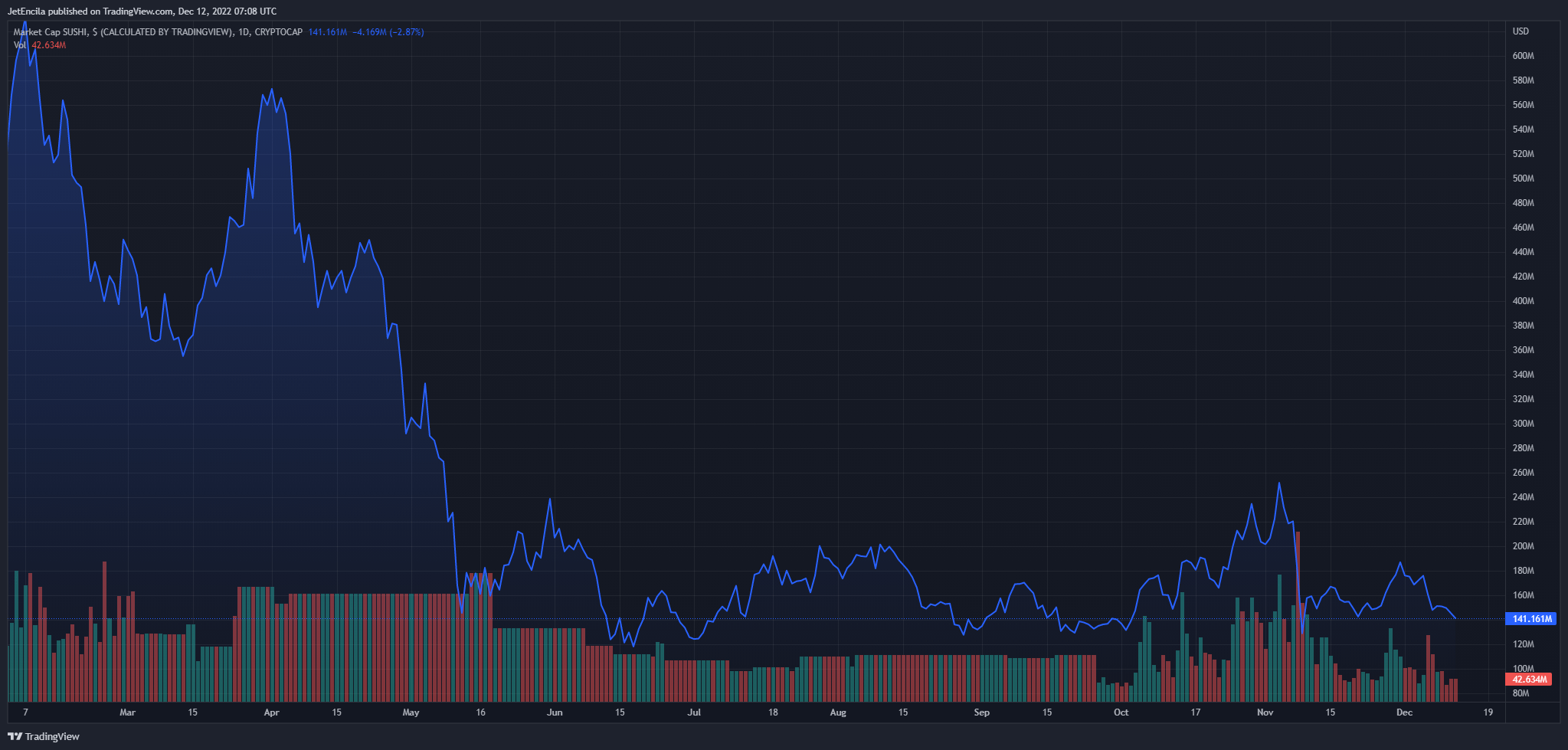

SUSHI total market cap at $141 million on the daily chart | Featured image: Mahmoud Fawzy — Unsplash, Chart: TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Monero

Monero  Litecoin

Litecoin  Zcash

Zcash  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Pax Dollar

Pax Dollar  BUSD

BUSD  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Augur

Augur  Bitcoin Gold

Bitcoin Gold  Ren

Ren