Bullish FTM Price Rise Meets Resistance Amid Market Slowdown

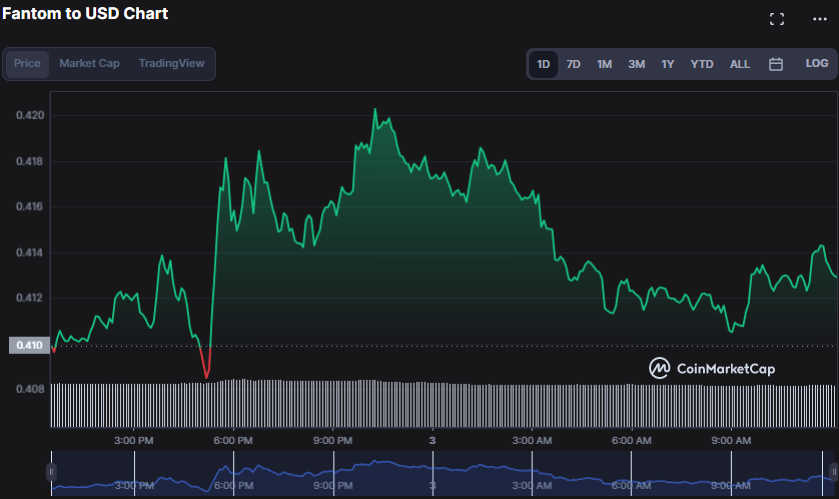

Fantom (FTM) has been under bullish control in the last day, with a bearish effort to grab control thwarted when support was established at $0.4083.

The bullish rise, however, ran into resistance around the 24-hour high of $0.4203. Despite the resistance, bullish dominance was still present, as evidenced by the 0.76% increase to $0.4127 as of press time.

During the rise, the market capitalization increased by 0.66% to $1,150,480,606, but the 24-hour trading volume decreased by 5.42% to $86,391,567. This disparity may indicate a slowdown in market activity as investors become less active even as the market cap rises.

FTM/USD 24-hour price chart (source: CoinMarketCap)

The Keltner Channel bands are moving linearly on the 1-hour FTMUSD price chart, indicating a period of market consolidation in which neither bulls nor bears have a clear edge. The top, middle, and bottom bars all read $0.4194, $0.4136, and $0.4079, respectively, indicating this shift.

The price action’s movement generates red candlesticks below the middle band, indicating that the bears seek to drive the price down. Nonetheless, the lack of a strong breakout suggests that the bulls are fighting back and preventing a significant price drop.

The bullish momentum in FTM may fade now that the Relative Strength Index has fallen below its signal line at 46.65. However, it is not yet cause for concern because the RSI is still above the oversold level of 30, indicating that the bulls have room to regain control.

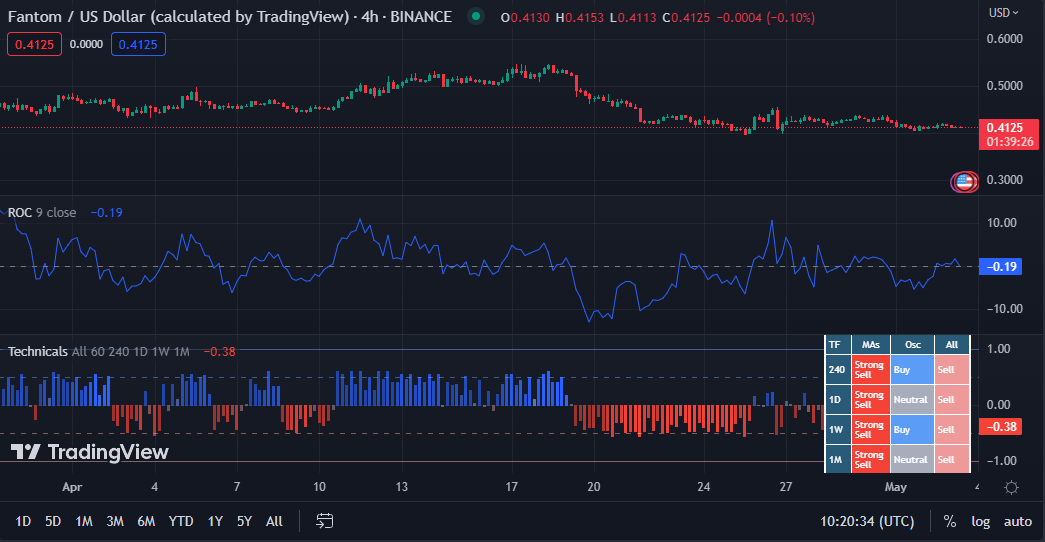

FTM/USD chart (source: TradingView)

The latest Rate of Change (ROC) plunge below the “0” line with a reading of -0.19 indicates that the bullish momentum in FTM is fading, and a probable shift to negative momentum is on the horizon.

If the ROC continues to fall and crosses below -0.5, it may imply a greater negative trend and alert traders to consider selling their holdings.

Despite being bullish, the technical rating indicator displays a “strong sell,” warning traders to place stop-loss orders to limit potential losses if the trend continues to deteriorate.

FTM/USD chart (source: TradingView)

In conclusion, while FTM’s bullish momentum may be fading, investors should closely monitor the ROC and RSI for any potential shifts in market sentiment.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Zcash

Zcash  Dash

Dash  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Nano

Nano  Status

Status  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur