Buy the Dip Sentiment Wanes But Altcoins Flashing Underbought Signal, Know More

Over the last few weeks, the broader cryptocurrency market has come under selling pressure with Bitcoin and some top altcoins heading lower. There’s a lot of uncertainty surrounding the macro developments and the ongoing US debt ceiling negotiations.

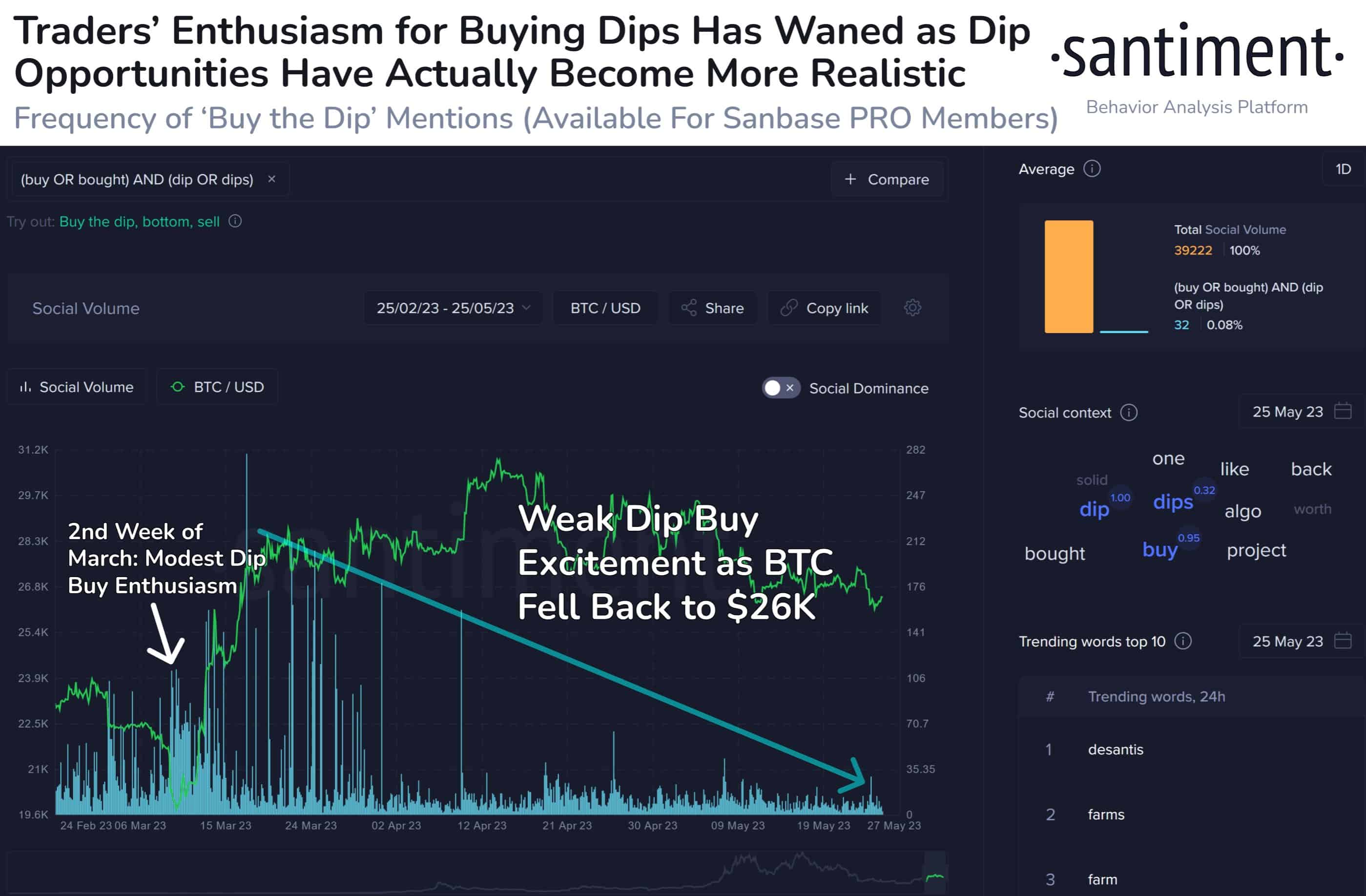

On-chain data provider Santiment shows that traders’ enthusiasm for Buy the Dips has waned amid dip opportunities becoming more realistic. It noted:

We are seeing the common paradox of traders buying short-term, small #crypto price dips, but scared to buy the longer-term bigger ones. Mentions of #buythedip or #boughtthedip are dormant. Historically, this kind of #FUD has been good to capitalize on.

Courtesy: Santiment

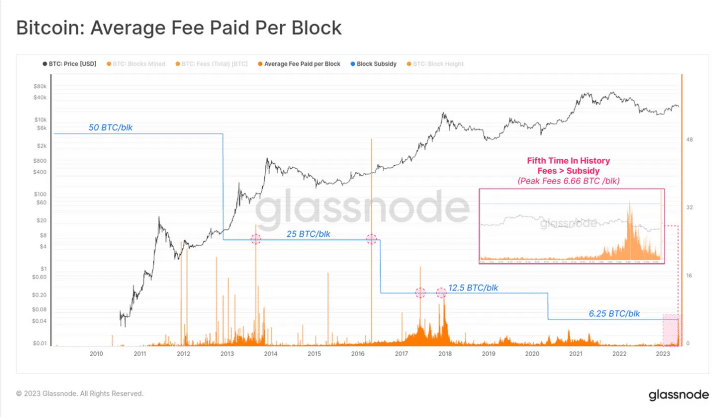

On the other hand, it seems that Bitcoin miners have continued to add throughout the month of May. Data from Glassnode shows that post the implosion of the FTX crypto exchange, miners have expanded their balance sheet by 8,200 Bitcoins with their total holdings now moving closer to 80K BTC.

Also, during the month of May, Bitcoin miners raked in a total of 12.9 BTC in mining rewards per block. Only for the fifth time in history, the Bitcoin miner fee revenue has surpassed the subsidies.

Courtesy: Glassnode

Altcoins Flash Underbought Signals

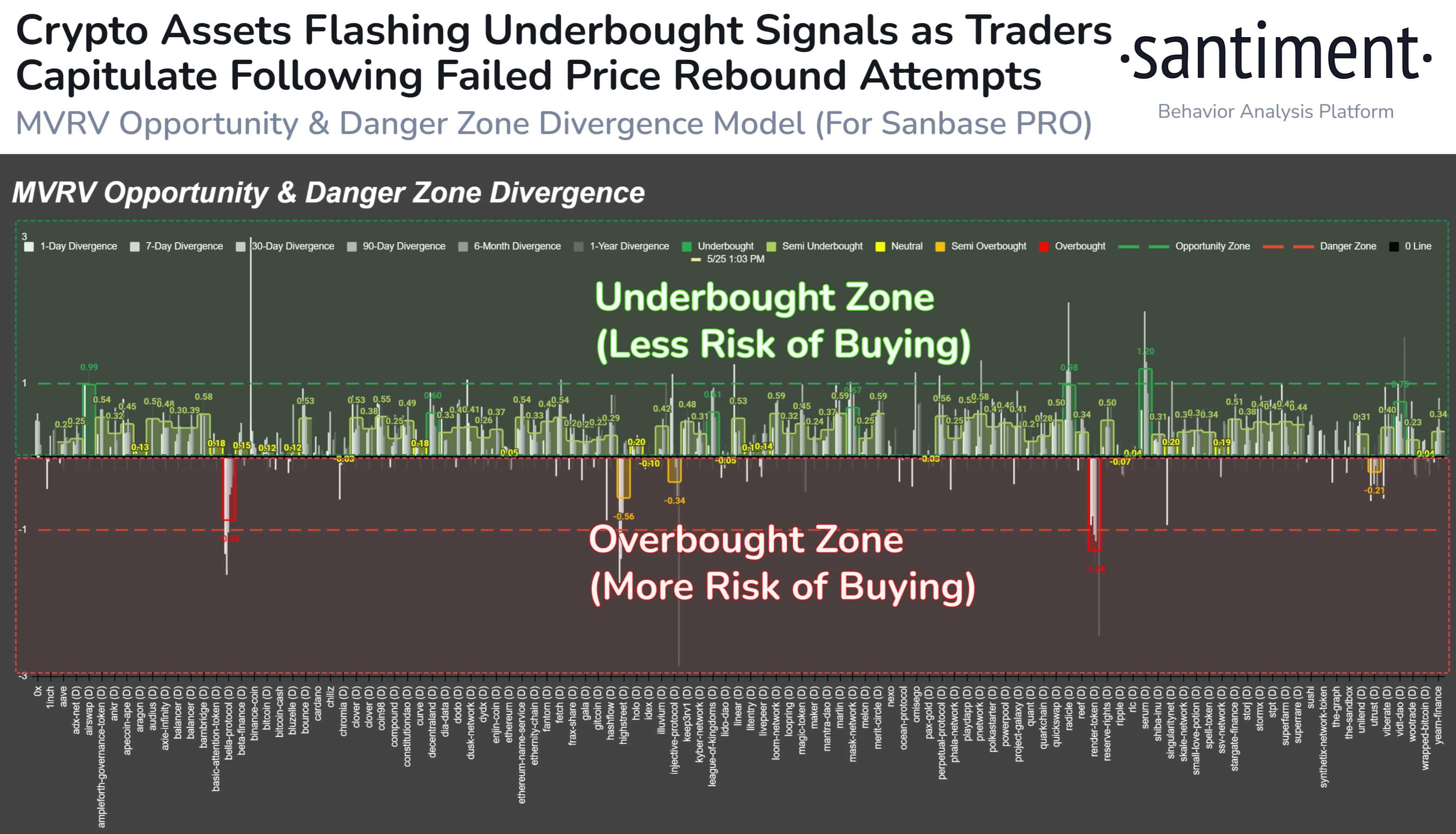

While the Bitcoin price continues to remain under selling pressure, traders’ attention has now shifted to altcoins. Santiment reported:

With markets seeming dull to traders, we’re continuing to see restless addresses emptying their wallets and selling at a loss. Our MVRV model, indicates the vast majority of #altcoins are flashing underbought signals across the sector.

Courtesy: Santiment

Some of the other popular crypto market traders are also stating that the time to buy altcoins is now. Popular crypto analyst and EightGlobal founder Michael Van De Poppe recently tweeted:

For altcoins, the time to accumulate them has come. One year before the halving -> time to buy those positions. Reached an important level here, which is also approx. 1 year before the halving.

Still a weekly bullish divergence on Others.Dominance chart.

This excludes $BTC and $ETH.

The previous time in the cycle, which was approx. 1 year before the halving of $BTC, altcoins also bottomed. pic.twitter.com/ths42Noyza

— Michaël van de Poppe (@CryptoMichNL) May 25, 2023

Some altcoins like Litecoin (LTC) are already showing strength. Before the current retracement, the LTC price surged above $90 in a bullish momentum driven by the upcoming halving event.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Zcash

Zcash  Decred

Decred  Dash

Dash  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Nano

Nano  Numeraire

Numeraire  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur