Can Elrond (EGLD) Break Long-Term Resistance to Turn Profitable?

Elrond is a sharding architecture decentralized blockchain protocol that runs on a Secure Proof of Stake (SPoS) consensus. It breaks into several shards depending on how much work is being done. It was started in 2017 by Lucian Mincu and Benjamin. In 2019, Elrond (EGLD) was launched on the Binance launchpad, and in 2020, it went live. This project is backed by an investment company called MetaChain Capital.

Other popular cryptocurrencies are facing issues with scalability and bandwidth. Elrond comes with a solution with the architecture to offer a lot more decentralization, security, and bandwidth to handle more requests on the network. In the white paper, the founder outlined that the developers should make sure the system is decentralized and free from any malicious attacks.

This solution aims to cut down the amount of computing and data costs by developing an innovative smart contract platform for the whole process. The developers claim that the network can handle 260,000 transactions per second, which is far better than Bitcoin and Ethereum.

The Secure Proof of Stake consensus is used to prepare the blocks for processing transactions by the validator nodes. The validators stake their coins on the network to get the right, and their work is also rated depending on how long they work. If the indicators fall below a level, the node is taking off from finding a new block.

On the other hand, if the validators break the network, the node is also disabled from the network. In this way, SPoS makes the network strongly decentralized and more secure in the crypto industry.

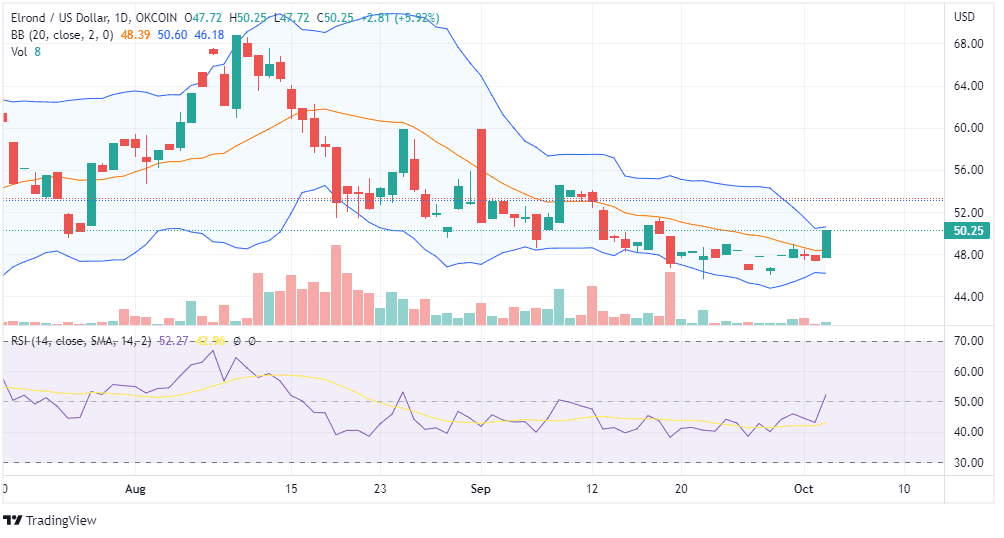

At the time of writing this post, EGLD was trading around $50.25. Elrond has taken support of around $47. The recent daily candlestick is forming around the upper half of the Bollinger Bands, and RSI is over 50, suggesting bullishness for the short term. But before investing in the coin, read our EGLD predictions for the next few years!

EGLD may face initial resistance around $53, and the price may consolidate within this range. Though the volume is less so, we do not think it will be sustainable for the long term. If you are interested in short-term investing, then you can invest, but be careful with a long-term investment in this token.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD