Can Polygon (MATIC) Price Hit a New All-Time High Against Bitcoin (BTC)?

The Polygon (MATIC) price has created a short-term bullish pattern but is still trading below a critical resistance level.

Polygon is a Layer 2 scaling solution for the Ethereum blockchain. It effectively makes the Ethereum network an internet of blockchains. The platform focuses on decentralized applications and smart contracts. The native token for the Polygon network is MATIC.

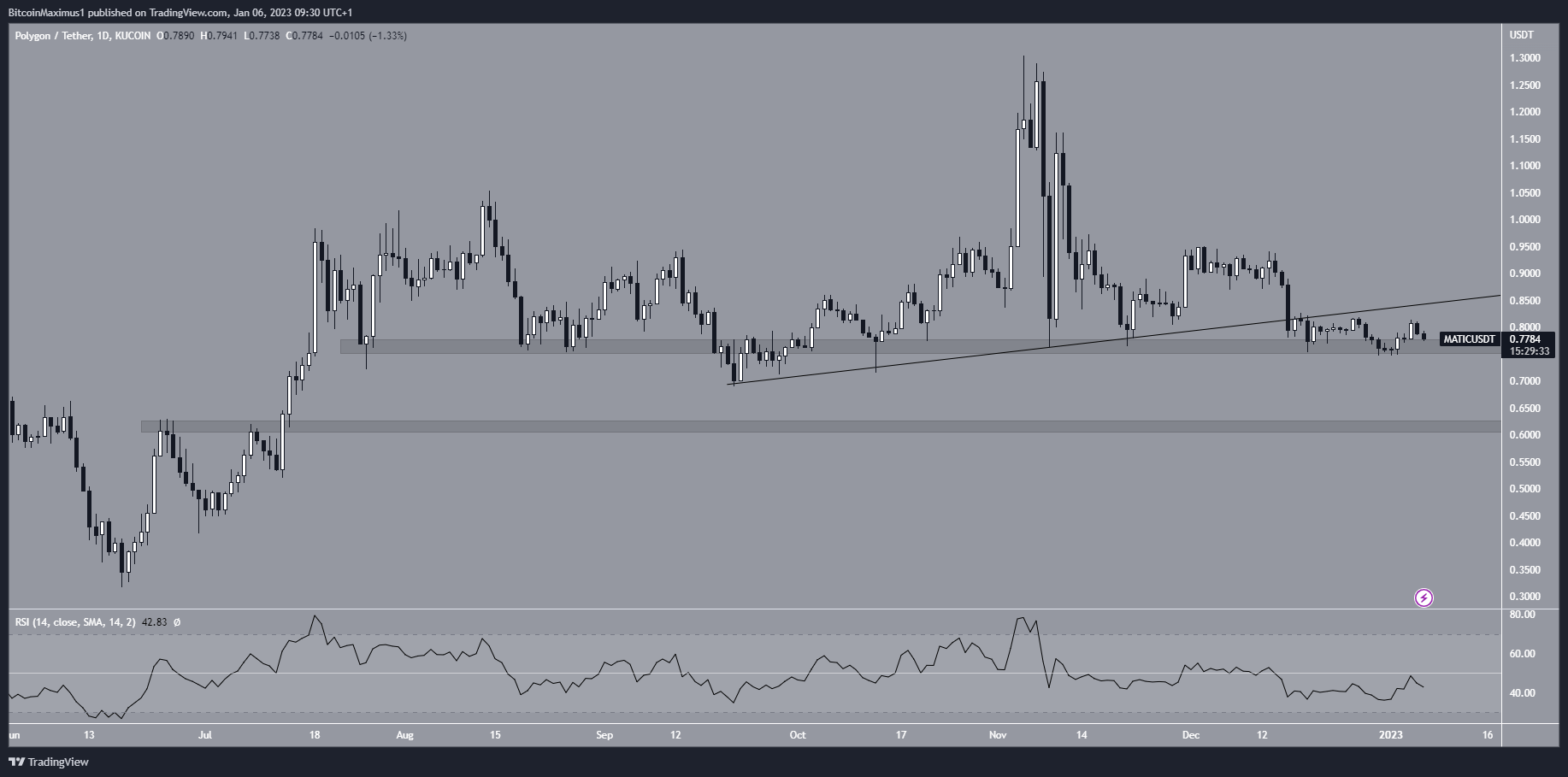

The Polygon price has fallen since reaching a high of $1.30 on Nov. 5. On Dec. 17, the downward movement caused a breakdown from an ascending support line in place since Sept. 19. This is a bearish sign that suggests the upward trend might have come to an end.

However, the downward movement was not sharp because the MATIC price bounced at the $0.77 horizontal support area.

The daily RSI is neutral. While the indicator is increasing, it has not generated bullish divergence and is still below 50. As a result, the direction of the future trend is unclear.

A breakdown below $0.77 would likely lead to a fall toward the next support area at $0.62 while reclaiming the ascending support line could take the MATIC price above $1.

MATIC/USDT Daily Chart. Source: TradingView

Will Short-Term Polygon Bounce Occur?

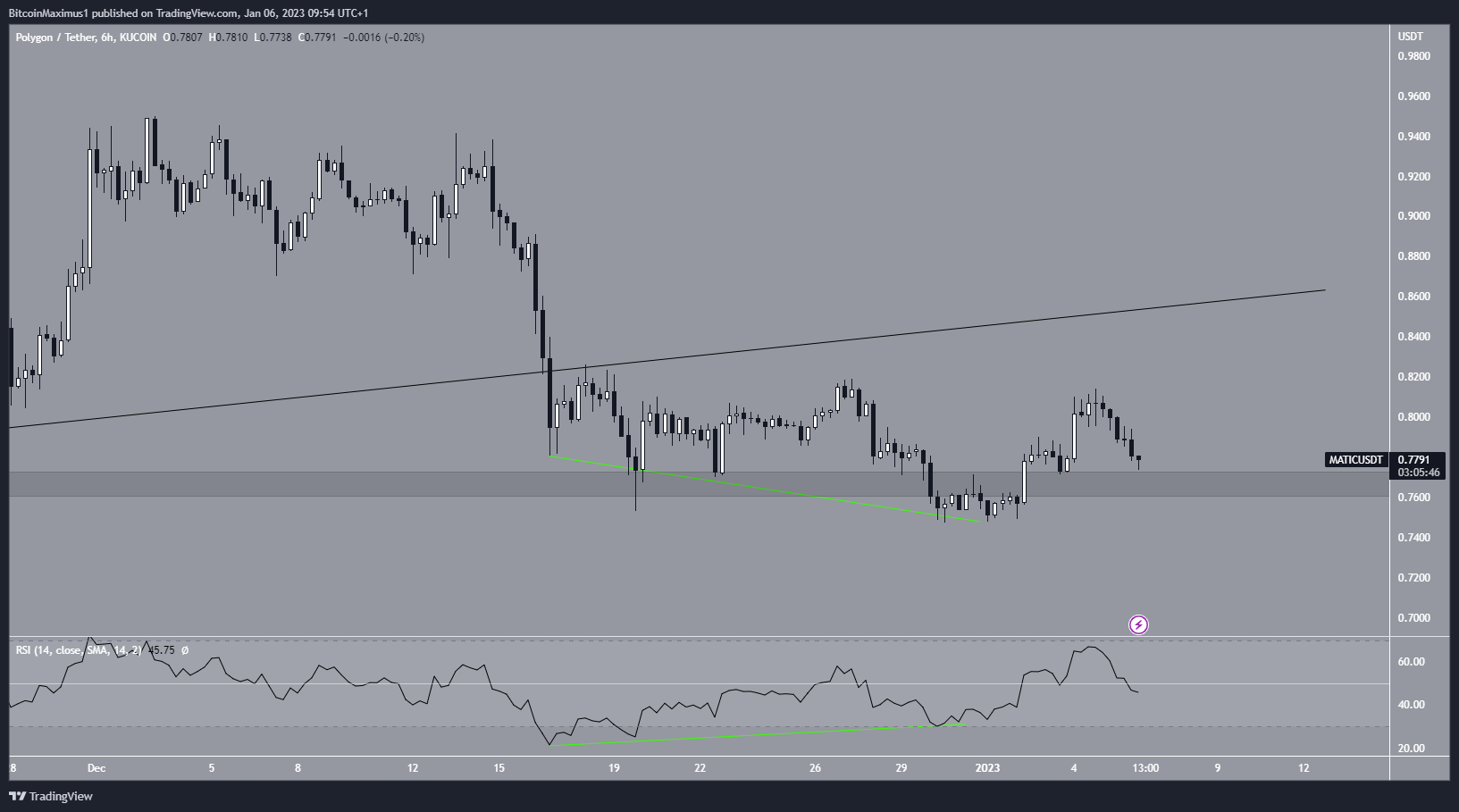

The technical analysis from the six-hour time frame is more bullish, offering hope for a potential relief rally. The main reason for this is the double bottom pattern that has been combined with bullish divergence. The fact that the pattern is developing inside a support area further increases its legitimacy.

So, it is possible that an increase toward $0.86 will occur. However, the trend cannot be considered bullish until this line is reclaimed.

As outlined previously, a close below the $0.77 support area could catalyze a sharp fall toward $0.62.

MATIC/USDT Six-Hour Chart. Source: TradingView

MATIC/BTC Barely Fails to Reach New All-Time High

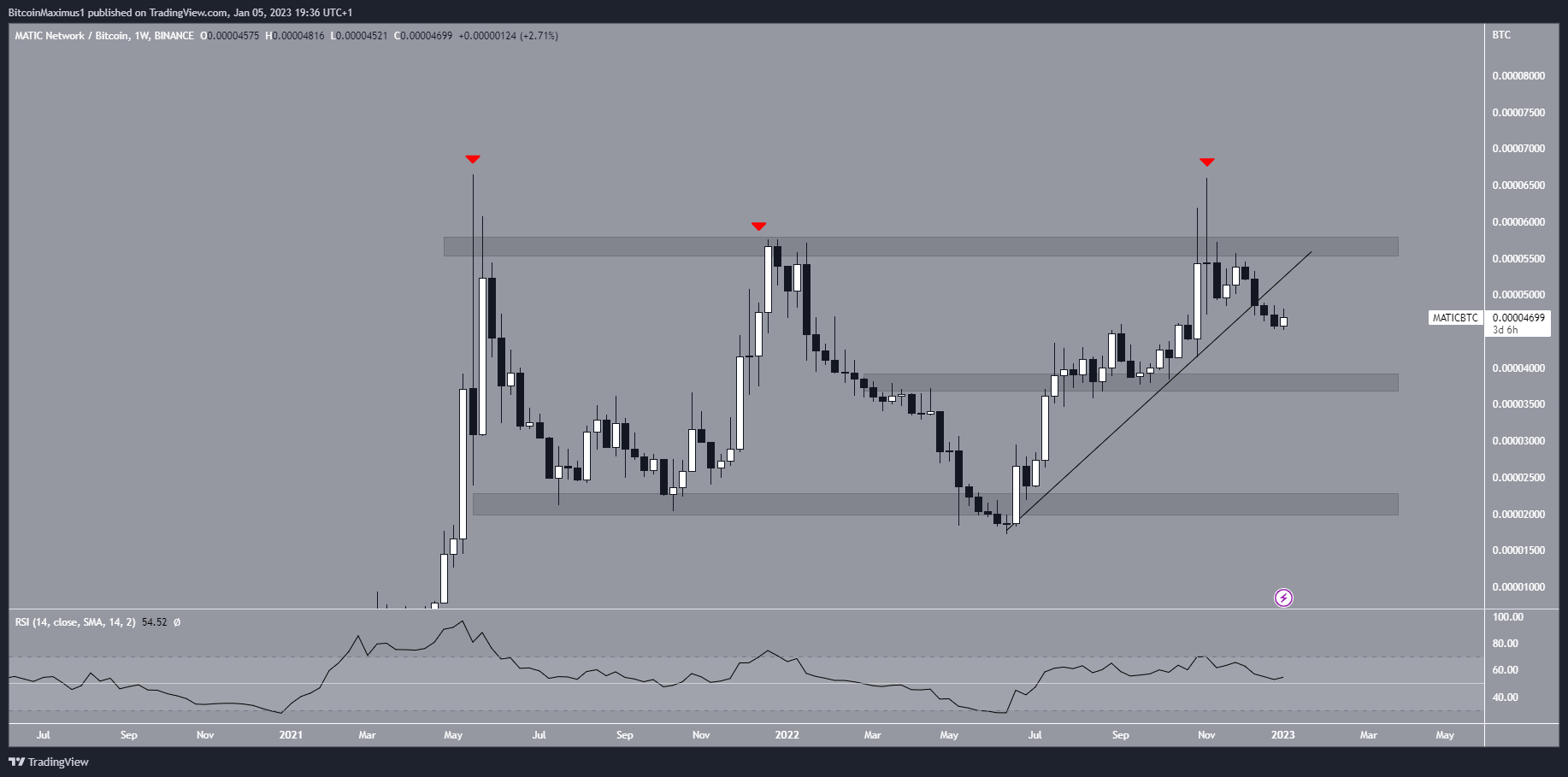

The MATIC/BTC price has increased since June 2022, and barely failed to reach a new all-time high in November. The price reached a high of 66,060 Satoshis, slightly below the all-time high of 66,651 Satoshis. However, it reversed trend shortly after and has been falling since.

The downward movement validated the 57,000 Satoshi area as resistance and created a triple top (red icons) pattern in the weekly time frame. The triple top is considered a bearish pattern.

Moreover, the MATIC price broke down from an ascending support line that had been in place since the upward movement began in June. As a result, the most likely MATIC price analysis is the continuation of the downward movement toward the 38,000 and possibly 20,000 Satoshi support levels.

A weekly RSI decrease below 50 would confirm the validity of the breakdown and downward movement.

On the other hand, a weekly close above the 57,000 Satoshi resistance area would be expected to send the MATIC price to a new all-time high. Due to the outlined bearish readings, this seems unlikely.

MATIC/BTC Weekly Chart. Source: TradingView

To conclude, the MATIC/USDT chart is considered bearish until the MATIC price reclaims the ascending support line from which it broke down. A close below the $0.77 area could trigger a rapid sharp fall.

Due to the creation of a bearish pattern, the MATIC/BTC chart is also considered bearish unless the 57,000 Satoshi area is reclaimed.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Algorand

Algorand  Cosmos Hub

Cosmos Hub  Gate

Gate  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur