Cardano price analysis: ADA falls flat to decline below $0.55 support

Cardano price analysis shows signs of bearish pressure coming into the market on the 24-hour price action, as price fell 4 percent to move as low as $0.5320. ADA fell below previous support at $0.55 after yesterday’s price action showed strong indication of a continuation of the current uptrend. While today’s price action saw ADA fall flat, price currently remains in technical uptrend and could break above the next resistance point at $0.60 soon. This will be greatly dependent on the release of the key US Retail Sales data for July, which if not disruptive could provide an upturn in sentiment for Cardano and push price upwards to $0.67-$0.69.

The larger cryptocurrency market remained largely in the hands of bears over the past 24 hours, as Bitcoin fell down to $23,500 and Ethereum moved below the $2,000 mark to settle at $1,800. Among leading Altcoins, Ripple showed some consolidation to move up to $0.37, whereas Dogecoin crashed 2 percent down to $0.082. Meanwhile, Solana dropped more than 3 percent to move as low as $41.6 and Polkadot declined down to $8.5 following a 3 percent downtrend.

Cardano price analysis: Cryptocurrency heat map. Source: Coin360

Cardano price analysis: Price falls below 50EMA on 24-hour chart

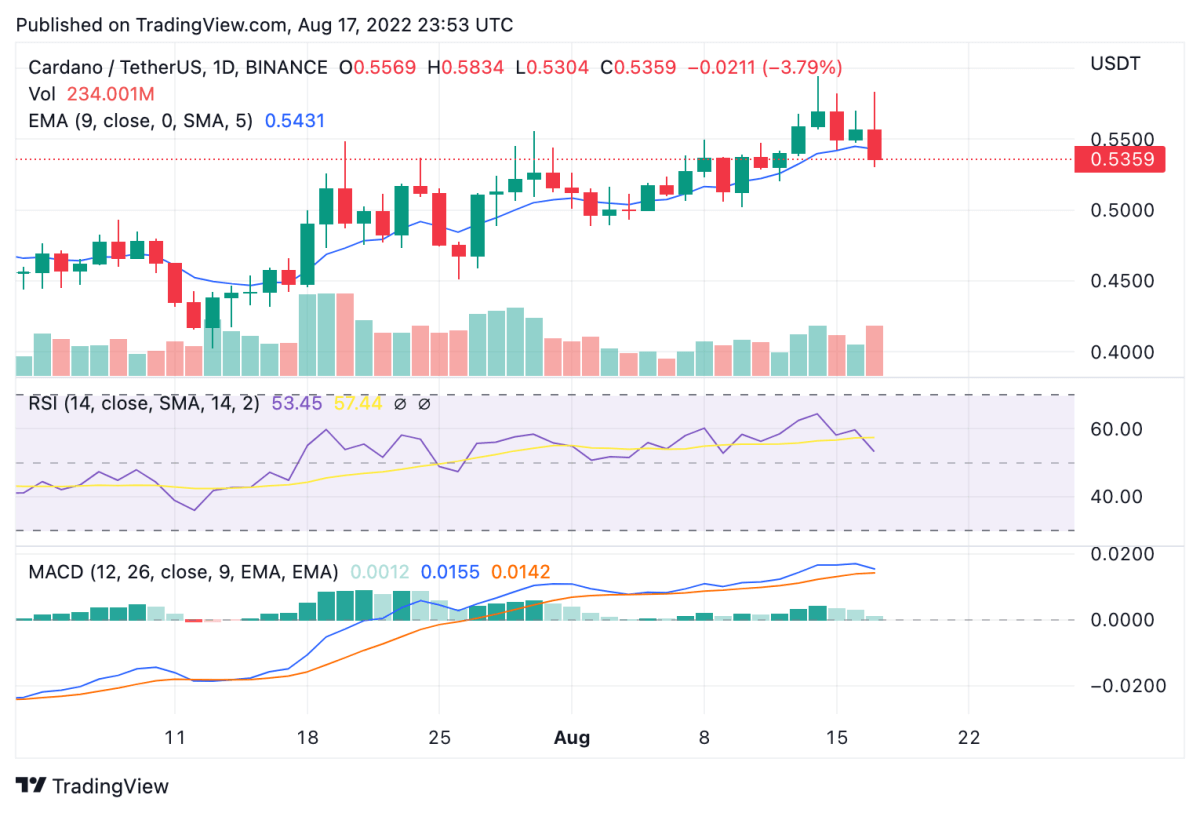

On the 24-hour candlestick chart for Cardano price analysis, price can be seen turning bearish once again after recovery yesterday to move back above $0.55. ADA lowered down to $0.53 over the past 24 hours with greater volatility coming into the market. Price breached the 9 and 21 day moving averages, along with the crucial 50-day exponential moving average (EMA) for the first time since initially crossing the then resistance at $0.55.

Cardano price analysis: 24-hour chart. Source: Trading View

The 24-hour relative strength index (RSI) also shows a downward trend for ADA market valuation, as it slipped from over 60 to move down to 53.45 today. Meanwhile trading volume went up by 35 percent over the past 24 hours, suggesting major price action was with sellers. Meanwhile, the moving average convergence divergence (MACD) curve is shaping to form a bearish divergence for the first time since August 14, 2022. If price breaks below $0.53 over the daily chart, it could quickly tumble further down to test the 50DMA at $0.50, which would open the door for a potential return to $0.40.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur