Cardano price analysis: ADA ready to take off after stabilising around $0.50

Cardano price analysis is expected to turn bullish once again, as price can be seen consolidating above the $0.50 support zone. ADA price rose more than 3 percent over the past 24 hours to move as high as $0.52. Cardano is expected to form a similar pattern as seen last month which could entice buyers for an easy setup to capitalize on.

This pattern was first seen on June 13, 2022 at a low of $0.435, which was followed up by a 25 percent uptrend to $0.550 in the next week. Cardano price recorded a similar downtrend to $0.488 over the past few days, and price could be ready to form a rally soon. ADA could rise a further 8 percent from the current price at $0.51 before exhausting the uptrend.

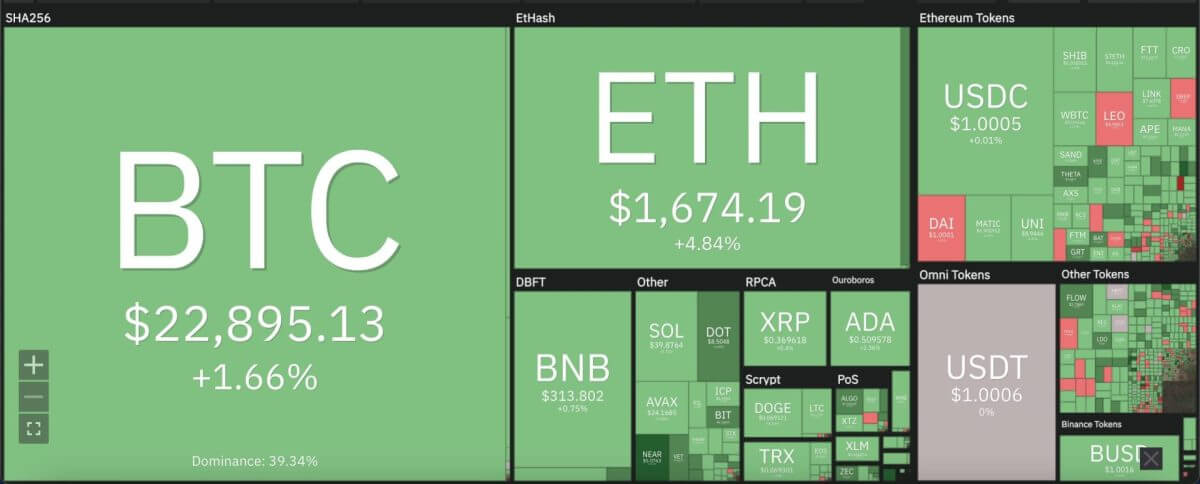

The larger cryptocurrency market showed positive signs over the past 24 hours, as Bitcoin made a 2 percent jump to move into touching distance of the $23,000 mark. Ethereum rose 5 percent to move up to $1,700, while major Altcoins also showed similar uptrends. Ripple rose up to $0.37 while Dogecoin ascended 4 percent to rise up to $0.07. Solana and Polkadot made bigger strides than most cryptocurrencies over the past 24 hours, with the former rising 5 percent up to $39.87, and the latter soaring up 7 percent to move as high as $8.50.

Cardano price analysis: Cryptocurrency heat map. Source: Coin360

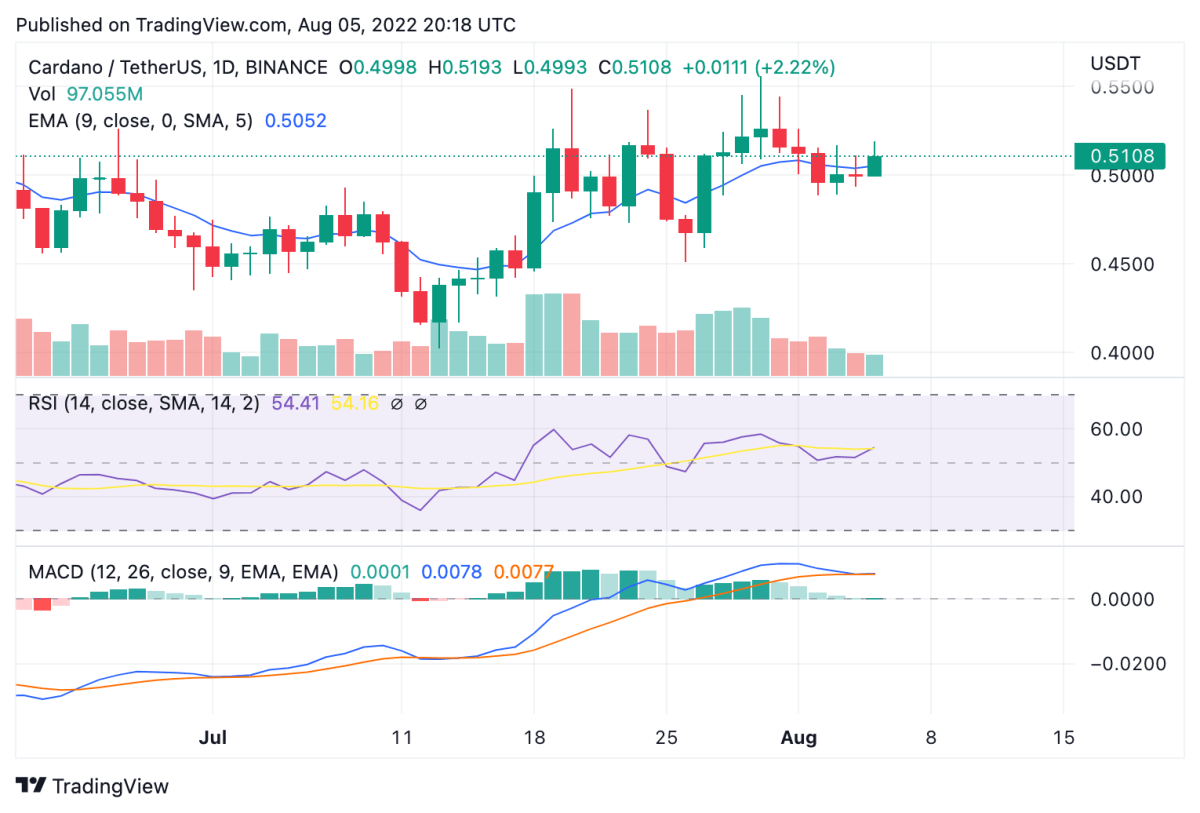

Cardano price analysis: 24-hour RSI shows increasing market valuation for ADA

On the 24-hour candlestick chart for Cardano price analysis, price can be seen attempting to rise above the $0.50 support region after surpassing seller pressure over the past week. ADA looked to be heading downwards beyond second support channel at $0.45 before withstanding bearish pressure around current price at $0.51. Cardano price has crucially remained in touch with the 9 and 21-day moving averages, along with the crucial 50-day exponential moving average (EMA) at $0.504.

Cardano price analysis: 24-hour chart. Source: Trading View

The 24-hour relative strength index (RSI) has also moved up to above 50 over the past 24 hours, representing healthy market valuation for ADA. Price could be tested further as the RSI approaches the over bought region above 60. Meanwhile, the moving average convergence divergence (MACD) curve remains unchanged from yesterday and shows a potential bearish divergence in place on the daily chart. A daily close below $0.45 would invalidate the bullish thesis for ADA with price also potentially visiting the next support level at $0.38 in such a scenario.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Dash

Dash  Ontology

Ontology  Zcash

Zcash  NEM

NEM  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur