Chainlink price analysis: Bullish pressure captures LINK market after a strong buying spree

Chainlink price analysis reveals the LINK market has experienced some buying activity, pushing the prices above $7.49 at the time of writing. The token is up by 3.27 percent in the last 24 hours and is trading in the $7.50 range. The support level for the LINK token is at $7.17, and if it fails to hold, this could be a sign of bearish momentum. On the upside, strong resistance is seen at $7.52, which should be broken for further bullish movement in the LINK market. The trading volume is also relatively high at $229 million, which may result in a further bullish trend. At the same time, the market capitalization of Chainlink has also increased to $3.87 billion, which suggests that buyers are still strong in the market.

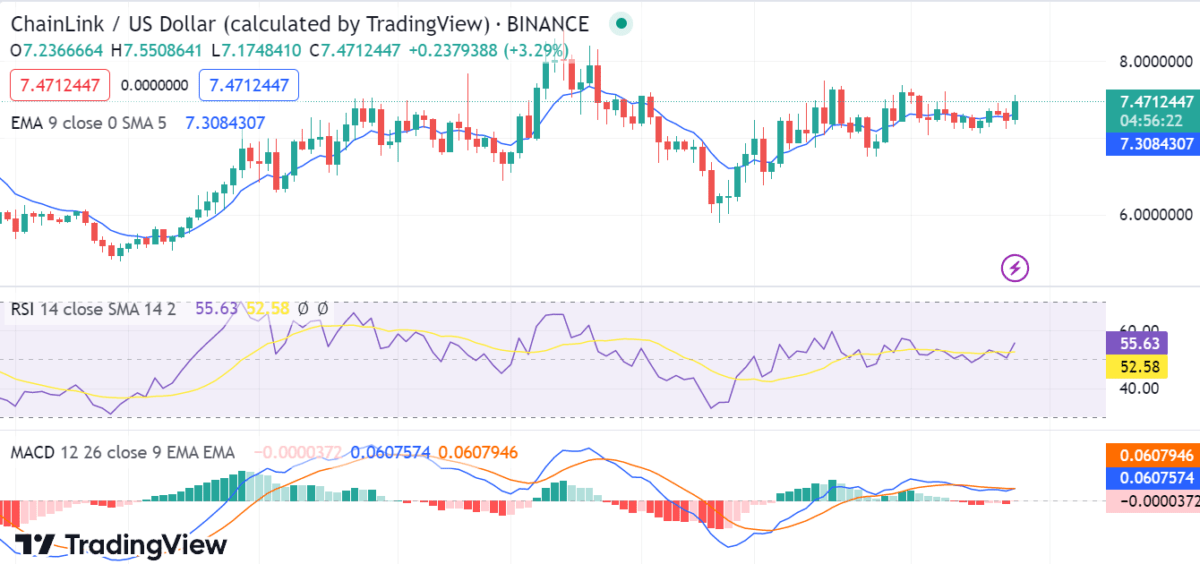

Chainlink price analysis 1-day chart: LINK follows a bullish movement at $7.49

The 1-day Chainlink price analysis indicates the token opened the daily trading charts on a bullish note, hitting an intra-day high of $7.49. The token’s price then bounced off the crucial $7.17 support to start a rally higher, and it is currently trading above the $7.49 handle with bullish momentum. The bulls are trying to push the price above the $7.52 resistance level, which could potentially ignite a new uptrend in the LINK market.

LINK/USD 1-day price chart, Source: TradingView

The technicals indicate the LINK token is trading above the 20-day EMA and 50-day EMA, which is a sign of bullish momentum. The token’s relative strength index (RSI) is trading at 55.63, which suggests that the token is neither in overbought nor oversold territory. The MACD line is trading above the signal line on the daily chart. The histogram further confirms the bullish sentiment in the market, as the bar is currently in the green color, which indicates an increase in buying pressure.

LINK/USD 4-hour price chart: Chainlink trades above the $7.49 level

The 4-hour Chainlink price analysis shows that the token has been trading in an ascending triangle pattern over the last week. If the bulls manage to break and sustain above the current resistance levels of $7.52, the LINK/USD pair could see further upward movement toward its next major resistance level at $7.62. The bulls are currently targeting a move above the $7.55 level to confirm a strong bullish trend in the near-term outlook.

LINK/USD 4-hour price chart, Source: TradingView

The MACD line is trading above the signal line, which is a sign of bullish momentum. The histogram bar is also green, which indicates that the buying pressure is increasing. The Relative Strength Index (RSI) is also bullish as it trades above the 60-level at $64.29 on the hourly chart. This suggests that there is still some buying pressure left in the market, and if this trend continues, then we could see further gains for Chainlink. The moving average is also bullish, as the 50-day and the 200-day are both trending above the current price.

Chainlink price analysis conclusion

In conclusion, Chainlink’s price analysis has seen an impressive price surge in recent hours, and it appears that the bulls are attempting to hold above $7.49 in order to push the price higher. The technical indicators are starting to show some bullish momentum, which could lead to further upside potential for the token in the near term.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Lisk

Lisk  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  HUSD

HUSD