Crypto Analyst Identifies Major Pattern on NEO Price Chart

A cryptocurrency analyst with the Twitter name Ali has made public his price expectations for NEO, the cryptocurrency for the open-source, decentralized application blockchain that goes by the same name, Neo. Ali expressed his NEO price expectations using a Head and Shoulders pattern identified on the 4-hour chart of the cryptocurrency.

$NEO appears to be shaping an H&S patttern on 4hr chart! A break above $14 = bullish?, target $18.

Keep an eye on $12 support as losing this level could spoil the party for #NEO. pic.twitter.com/vHi3ONiz51

— Ali (@ali_charts) March 27, 2023

Based on the chart displayed and Ali’s analysis, the Head and Shoulders pattern has left strong support and resistance at the $12 and $14 price levels, respectively. He notes that a break above the $14 region could see the cryptocurrency under analysis rally up to the $18 mark. On the contrary, breaking below $12 could change the scenario and lead NEO to lower price levels.

At the time of Ali’s analysis, NEO’s price was $12.58, right in the middle of an established sideways trend that ranged between $11 and $13.

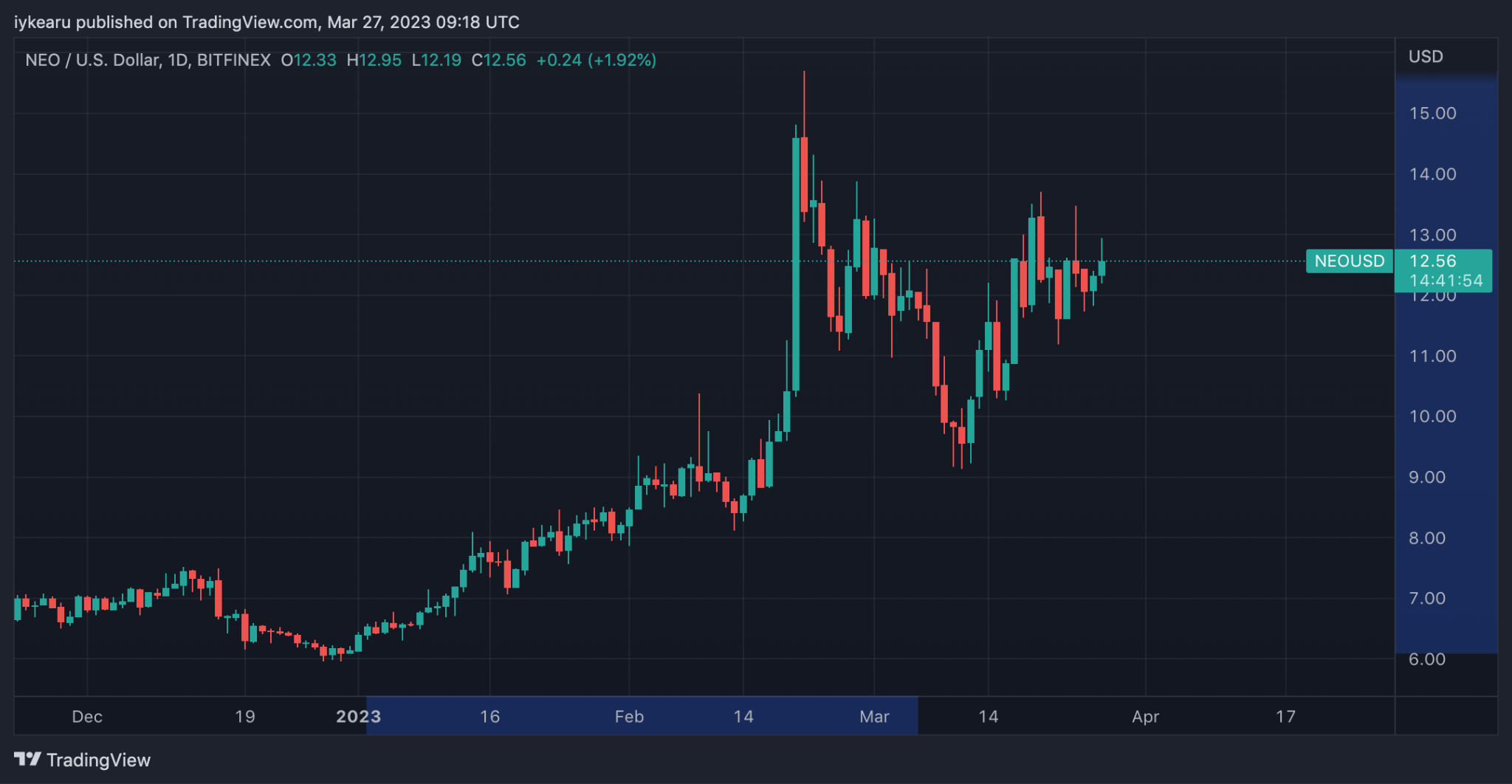

TradingView shows that NEO rose from $6.13 on January 1, 2023, to a yearly high of $15.70 on February 21, 2023. The rally coincided with the general surge of the cryptocurrency market and reflected a profit of 157.82%. A pullback saw the price of NEO fall to $9.13 before picking up again to reach $12.56 as of the time of writing.

Source: TradingView

Data from CoinmarketCap shows that NEO is the 57th-ranked cryptocurrency in the world. Its market capitalization at the time of writing was $891.9 million, with a daily trading volume of $93.7 million.

Neo developers consider the protocol as an ecosystem to become the foundation for the next generation of the internet. Neo aims to provide an environment where digitized payments, identities, and assets can merge efficiently.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Lisk

Lisk  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD