Crypto Crime Falls 15% Along With Bear Market: Chainalysis

Illicit activity involving cryptocurrency is down 15% in volume so far this year, according to a new report from blockchain intelligence firm Chainalysis. This compares to a 36% decline in legitimate transactions.

“If we dig into specific forms of cryptocurrency-based crime, we find that some have actually increased in 2022, while others have declined more than the market overall,” the firm reports.

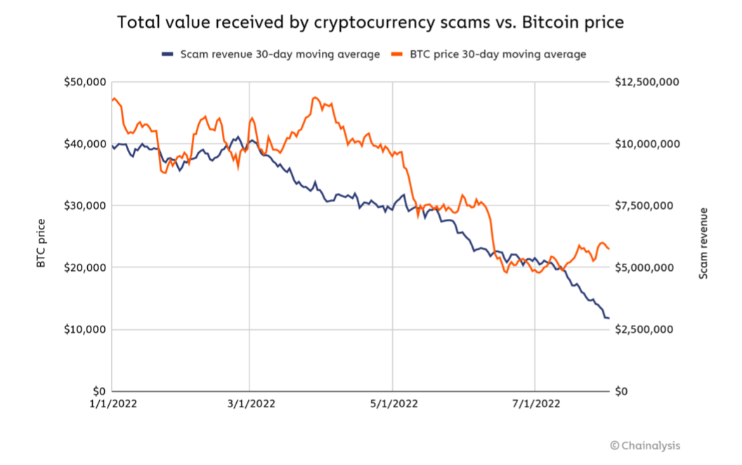

According to Chainalysis, total scam revenue for 2022 is 65% lower than it was through the end of July 2021 and currently sits at $1.6 billion, which it attributes to the declining overall crypto market.

“Since January 2022, scam revenue has fallen more or less in line with Bitcoin pricing,” the firm says. “The cumulative number of individual transfers to scams so far in 2022 is the lowest it’s been in the past four years.”

This change suggests fewer people are falling for cryptocurrency scams, Chainalysis says, because these scams are less enticing now that values are dropping in the bear market.

Another factor in the decline, the report notes, is that there has not yet been a single significant scam in 2022 compared to past years, when scammers behind PlusToken made off with over $2 billion in 2019 or when Finiko stole $1.5 billion in 2021.

CFTC Files Charges Against $12 Million ‘Bitcoin Ponzi Scheme’

Though the number of scams may be down, Chainalysis reports that as of July 2022, $1.9 billion in crypto was still stolen in hacks. These include the $190 million hack of the Nomad Token Bridge or the $5 million stolen from Solana wallets earlier this month, compared to just under $1.2 billion during the same period last year.

“We shouldn’t expect theft to drop based on cryptocurrency market movements the way scamming does,” the firm says. “As long as crypto assets held in DeFi protocol pools and other services have value and are vulnerable, bad actors will try to steal them.”

Founded in 2014, Chainalysis provides software tools for government agencies, financial institutions, and businesses to detect and prevent crypto-related crime.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur